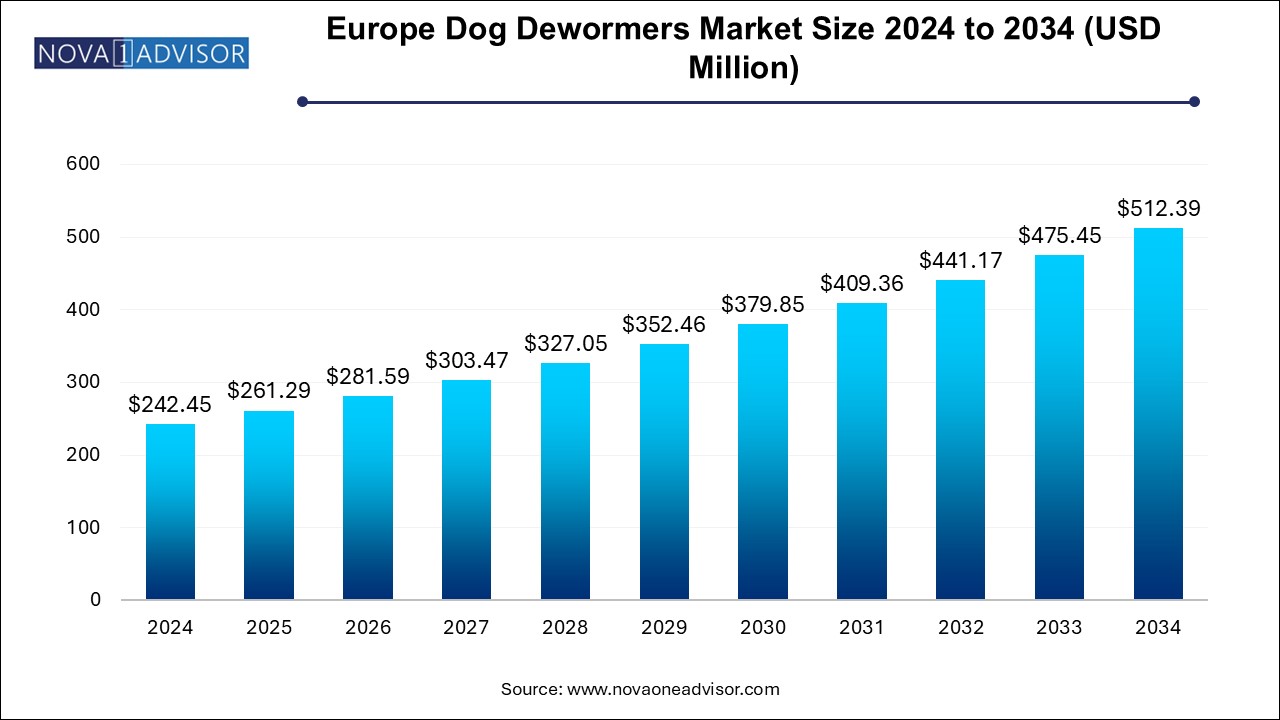

The Europe dog dewormers market size was exhibited at USD 242.45 million in 2024 and is projected to hit around USD 512.39 million by 2034, growing at a CAGR of 7.77% during the forecast period 2025 to 2034.

The Europe dog dewormers market has evolved into a dynamic and expanding segment of the pet healthcare industry, underpinned by rising awareness of pet health, increased pet ownership, and heightened emphasis on preventive care. Dewormers are pharmaceutical products used to eliminate internal parasites in dogs, such as roundworms, tapeworms, hookworms, and whipworms. These parasites not only compromise a dog's health but may also pose a zoonotic risk to humans. As pet owners increasingly treat their dogs as members of the family, the importance of regular deworming is becoming a standard part of responsible pet ownership.

Europe stands as one of the most developed markets in terms of veterinary healthcare infrastructure and regulatory frameworks that mandate routine parasite control. The demand for both over-the-counter (OTC) and prescription dewormers is seeing steady growth. Countries such as Germany, France, and the UK lead the market due to high pet penetration, advanced veterinary systems, and the presence of prominent market players. Emerging Eastern European nations, including Romania and Poland, are catching up rapidly due to improving pet healthcare access and growing awareness campaigns driven by non-profit and governmental bodies.

The market is segmented by route of administration, dosage form, type, and distribution channel, offering various options that cater to both pet owners' convenience and veterinarians’ preferences. The availability of palatable and easily administered products is further supporting widespread adoption. In addition, the rise of e-commerce and the digital pet care ecosystem is transforming distribution dynamics, making dewormers more accessible to rural and urban customers alike.

| Report Coverage | Details |

| Market Size in 2025 | USD 261.29 Million |

| Market Size by 2034 | USD 512.39 Million |

| Growth Rate From 2025 to 2034 | CAGR of 7.77% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Route of Administration, Dosage Form, Type, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Countries covered | Spain; Germany; Portugal; Romania; Slovakia; Czech; Hungary; Poland; Italy; Ireland; UK; France; Denmark; Sweden; Norway |

| Key Companies Profiled | Zoetis; Boehringer Ingelheim; Merck & Co. Inc.; Dechra Pharmaceuticals Plc.; Elanco Animal Health; Ceva Sante Animale; Virbac; Vetoquinol; Bioveta, a.s.; PetIQ, LLC |

Market Driver: Rising Pet Ownership and Humanization of Dogs

The most significant driver of the Europe dog dewormers market is the rising pet ownership and the growing humanization of dogs. Across Europe, the pet dog population has been steadily increasing, with countries like Germany, France, and the UK seeing millions of registered pet dogs. As pets increasingly assume roles akin to family members, owners are investing in high-quality healthcare, nutrition, and hygiene for their animals. Regular deworming is not only recommended but often considered essential for maintaining a dog's health.

This behavioral shift has changed how pet owners view and respond to preventive health products, such as dewormers. Regular vet visits, preventive screenings, and awareness about zoonotic parasites are now part of mainstream pet care culture. For example, the European Pet Food Industry Federation (FEDIAF) has observed a rising trend in pet-related expenditure over the last five years, with a significant portion allocated to health and wellness. This changing attitude fuels demand for easy-to-administer, broad-spectrum, and reliable deworming products.

Market Restraint: Resistance to Dewormers and Overuse Concerns

A key restraint in the market is the emergence of drug resistance and concerns regarding the overuse of anthelmintic products. Continuous and often unregulated usage of certain dewormers has led to a decline in their effectiveness due to parasitic resistance. This phenomenon is particularly notable with some prescription dewormers that have been widely used over extended periods.

Veterinarians are increasingly cautious, often requiring diagnostic confirmation before prescribing treatment. In addition, public concern around chemical ingredients and possible side effects has led some consumers to question the safety of frequently deworming their pets, especially when no symptoms are visible. Regulatory bodies are also promoting responsible use, which, while necessary, may slow down the over-the-counter segment. The need for alternative therapies, natural dewormers, or diagnostics to guide deworming schedules is gaining traction, adding complexity to market dynamics.

Market Opportunity: Growth in E-Commerce and Online Veterinary Platforms

One of the most promising opportunities lies in the rapid expansion of e-commerce and veterinary online platforms across Europe. As digital transformation accelerates across sectors, pet healthcare is no exception. Pet owners now have access to a wide array of veterinary products, including dewormers, through trusted online pharmacies and pet-focused e-commerce sites.

This opportunity is particularly significant in regions where access to brick-and-mortar veterinary services is limited, such as parts of Eastern Europe. E-commerce platforms not only allow easier access but also offer information on usage, dosage, and reviews that empower pet owners to make informed decisions. Companies are investing heavily in digital marketing, subscription-based deworming services, and direct-to-consumer models to expand their reach. With younger, tech-savvy pet owners emerging as a strong consumer group, the e-commerce channel represents a high-growth opportunity in the Europe dog dewormers market.

Oral dewormers dominated the Europe dog dewormers market by route of administration, accounting for a significant share due to their ease of administration, wide availability, and cost-effectiveness. Oral dewormers—especially in tablet and chewable forms—are highly preferred by both veterinarians and dog owners. These formulations often include flavors to improve palatability, making them easier to administer even to picky eaters. Furthermore, they allow for precise dosing and are effective against a broad spectrum of internal parasites. Oral dewormers are widely distributed across veterinary clinics, pet stores, and e-commerce platforms, making them the go-to choice for routine deworming.

However, injectable dewormers are emerging as the fastest-growing segment due to their efficacy and use in specific clinical situations, such as severe infestations or when oral administration is impractical. Veterinary professionals often prefer injectables in hospital settings where immediate action is required. This mode of administration ensures 100% compliance and is less prone to rejection or vomiting. Additionally, injectable dewormers are gaining popularity in rural areas, particularly among dog breeders and kennel operators who prefer more durable solutions with longer-lasting protection. The segment's growth is supported by innovations in injectable formulations that improve efficacy and reduce side effects.

Tablets lead the market in terms of dosage form, thanks to their convenience, long shelf-life, and broad availability. Tablet-based dewormers dominate both OTC and prescription categories. Their effectiveness across various weight groups and parasite types makes them a preferred format for general deworming schedules. In addition, tablets are easy to transport and store, allowing for wider distribution across Europe’s pet supply networks. Brands are also offering innovative designs like breakable tablets, which help customize dosage according to dog size.

In contrast, liquids are the fastest-growing segment, especially for puppies and small breeds where accurate dosing and ease of ingestion are critical. Liquid formulations are often used during early stages of life or when dogs have trouble chewing or swallowing pills. Pet owners also prefer liquid dewormers for their ease of administration using droppers or mixing into food. The growing adoption of natural and herbal dewormers is also contributing to this segment's expansion, as many of these products are formulated as liquids.

OTC dewormers dominate the market, largely due to their accessibility and the growing trend of proactive pet health management by pet owners themselves. Available through pet stores, online platforms, and even supermarkets, OTC dewormers enable pet parents to treat their animals without a vet visit. Brands have responded by offering easy-to-understand instructions and all-in-one formulations that target multiple parasites. This democratization of veterinary care is especially useful for managing routine treatments across a large pet population.

However, prescription dewormers are gaining traction as the fastest-growing segment, driven by rising veterinary awareness and diagnostic-based treatment approaches. In severe infestations or specific parasite types like heartworms or lungworms, prescription medications offer more targeted and effective outcomes. Prescription products are also seeing an uptick due to veterinary recommendations based on lab testing and resistance profiles. As telemedicine and online veterinary consultations grow in popularity, obtaining prescriptions remotely is also becoming easier, driving this segment forward.

Veterinary hospitals and clinics account for the largest share of distribution channels. These establishments are trusted sources for pet health advice and products. Most first-time deworming treatments and diagnostics occur under the supervision of a licensed veterinarian. These professionals play a pivotal role in educating pet owners, particularly about the importance of regular deworming. Their recommendations often influence product choice, making veterinary channels crucial in shaping market dynamics.

Nonetheless, e-commerce is the fastest-growing distribution channel. Online pet pharmacies and multi-brand e-commerce platforms offer a wide variety of dewormers, competitive pricing, home delivery, and subscription options. Consumers enjoy the convenience of automatic reminders and refill deliveries, ensuring timely deworming. Especially post-pandemic, a significant portion of pet owners prefer buying healthcare products online. This trend is likely to continue, with companies investing in improving their digital storefronts and customer experience.

Germany currently dominates the Europe dog dewormers market, with a robust veterinary infrastructure, high disposable income, and widespread pet ownership. The country’s regulatory framework supports regular parasite control, and the majority of dog owners are well-versed in preventive care. Germany is also home to leading pharmaceutical companies involved in veterinary product development, such as Bayer Animal Health (now part of Elanco) and Boehringer Ingelheim. The market benefits from widespread retail and veterinary clinic availability, in addition to rising adoption of online veterinary pharmacies. With over 10 million pet dogs and strong demand for high-quality pet healthcare, Germany sets the benchmark in market performance.

On the other hand, Poland is emerging as the fastest-growing market. The country has witnessed a surge in pet ownership, particularly among urban millennials and families. As disposable incomes rise and awareness about pet health grows, the market for preventive products like dewormers is expanding. Veterinary infrastructure is improving, and the government is encouraging responsible pet ownership through awareness campaigns and support for veterinary services. Polish pet owners are increasingly shopping online, and local as well as international players are capitalizing on this demand by offering affordable, effective, and accessible deworming products.

In March 2024, Elanco Animal Health launched a new combination dewormer in Europe, targeting roundworms and tapeworms with a single monthly chewable dose.

Virbac introduced a liquid natural dewormer for puppies and toy breeds in January 2024, catering to rising demand for herbal and mild formulations.

In February 2024, Zoetis expanded its European operations by opening a logistics hub in France to streamline distribution across Western and Central Europe.

Boehringer Ingelheim, in April 2024, announced a partnership with European e-commerce platforms to directly offer its prescription dewormers through online veterinary verification systems.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe dog dewormers market

By Route of Administration

By Dosage Form

By Type

By Distribution Channel

By Country