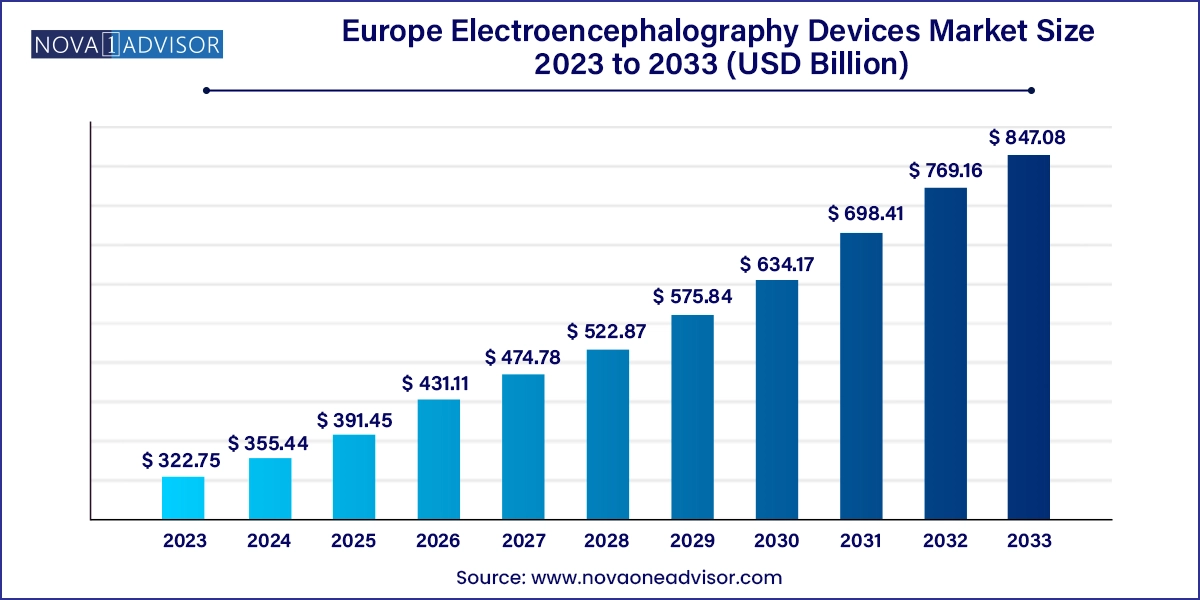

The Europe electroencephalography devices market size was exhibited at USD 322.75 Million in 2023 and is projected to hit around USD 847.08 Million by 2033, growing at a CAGR of 10.13% during the forecast period 2024 to 2033.

The electroencephalography (EEG) devices market in Europe represents a critical and evolving segment within the broader neurodiagnostics and brain monitoring landscape. Electroencephalography is a non-invasive technique used to record electrical activity in the brain, playing a pivotal role in diagnosing and monitoring neurological disorders such as epilepsy, brain injuries, sleep disorders, and even psychiatric conditions. In Europe, the growing neurological disease burden, aging population, technological advancements, and rising demand for personalized medicine are propelling the market forward.

Europe’s healthcare infrastructure is well-established, characterized by sophisticated hospital systems, national reimbursement frameworks, and strong academic-clinical collaboration. This environment has created fertile ground for the adoption of EEG technology, both in clinical practice and research settings. According to the European Brain Council, neurological conditions such as epilepsy, dementia, and Parkinson's disease affect over 220 million people in Europe annually. EEG devices are increasingly employed not only for diagnostics but also for treatment planning, surgical monitoring, and sleep research.

Further fueling the market is the surge in portable and wearable EEG systems, which offer patients mobility and enable remote neurological assessments. As healthcare systems across Europe increasingly lean into home-based care and telehealth services, the integration of EEG in remote diagnostics is witnessing exponential growth. In parallel, the medical community is showing growing interest in the applications of EEG beyond conventional neurology such as in anesthesia depth monitoring, cognitive neuroscience, and neurofeedback therapies.

As of 2024, EEG devices have become a mainstay in neurology clinics and diagnostic labs, with startups and tech companies introducing new generations of wearable EEG headsets capable of real-time data streaming, AI integration, and cloud-based analytics. Countries such as Germany, the UK, and France are leading in both adoption and innovation, while Nordic nations like Sweden and Norway are investing heavily in advanced tele-neurology infrastructure. Despite these gains, challenges persist—especially in standardizing protocols, securing reimbursement for newer devices, and addressing patient privacy concerns in cloud-linked systems.

Adoption of Wearable EEG Devices: Lightweight, patient-friendly wearable headsets are transforming brain monitoring, especially in ambulatory care and mental health tracking.

Integration of Artificial Intelligence (AI): AI is increasingly used to analyze EEG signals, detect anomalies, and predict neurological events like seizures or sleep apnea.

Growth in Tele-Neurology and Remote Monitoring: Portable EEG devices are being adopted in home-care setups, especially in rural areas and aging populations.

Use of EEG in Cognitive and Behavioral Research: Research labs across Europe are using EEG to study learning patterns, emotional responses, and attention deficits.

Hybrid EEG-fMRI and EEG-TMS Technologies: Hospitals and research institutions are investing in multimodal imaging systems for comprehensive brain mapping.

Consumer EEG Applications: Though still niche, consumer-grade EEG devices for meditation, mental wellness, and sleep enhancement are entering the European market.

Cloud-Based EEG Data Storage and Sharing: EEG data platforms are enabling collaboration between neurologists, researchers, and AI developers for longitudinal studies.

| Report Coverage | Details |

| Market Size in 2024 | USD 355.44 Million |

| Market Size by 2033 | USD 847.08 Million |

| Growth Rate From 2024 to 2033 | CAGR of 10.13% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Type, Application, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway |

| Key Companies Profiled | Natus Medical, Inc.; Medtronic; Nihon Kohden America, Inc.; Brain Products GmbH; Neurosoft; Compumedics Ltd.; ANT Neuro; Lifelines neuro; Emotiv |

A major catalyst for the growth of the EEG devices market in Europe is the alarming rise in neurological disorders, particularly among the elderly population. According to Eurostat, nearly 21% of the EU’s population is aged 65 and older a demographic highly susceptible to Alzheimer’s disease, Parkinson’s, stroke, and dementia. EEG technology is a critical diagnostic modality for early detection, classification, and management of such disorders.

Epilepsy, one of the most studied conditions using EEG, affects over 6 million people across Europe, with the highest prevalence observed in Eastern and Southern Europe. Early and accurate diagnosis of epilepsy significantly improves treatment outcomes, and EEG remains the gold standard for evaluating seizure patterns and cortical abnormalities. As a result, hospitals and diagnostics centers are expanding EEG service availability and incorporating multichannel systems to enhance diagnostic precision.

Additionally, brain injuries from trauma or stroke often require EEG assessments for coma monitoring and cognitive rehabilitation. As surgical techniques evolve and become more targeted, EEG has found new applications in intraoperative monitoring during neurosurgeries. The cumulative effect of these factors is the steady growth in EEG device procurement, particularly in high-volume neurological centers.

Despite increasing demand, a significant barrier to market expansion is the high cost associated with advanced EEG systems, especially multichannel and wearable variants. While traditional EEG setups may be relatively affordable, cutting-edge systems equipped with AI algorithms, wireless connectivity, and real-time monitoring features are expensive, sometimes costing tens of thousands of euros. This pricing makes it difficult for smaller clinics, independent neurologists, and underfunded public hospitals to invest in modern solutions.

Moreover, the effectiveness of EEG as a diagnostic tool is contingent on proper electrode placement, signal acquisition, and interpretation—all of which require skilled technicians and trained neurologists. Europe is currently facing a shortage of EEG technologists, particularly in countries like Spain and Italy, where neurodiagnostic education is still evolving. This human resource gap can lead to delayed diagnostics, increased error rates, and underutilization of equipment, thus undermining the return on investment in high-end EEG systems.

One of the most promising opportunities lies in the expansion of home-based EEG monitoring, especially for sleep disorders and epilepsy management. Obstructive sleep apnea, insomnia, and narcolepsy are common across Europe and often underdiagnosed due to limited access to sleep labs. Portable EEG systems integrated with sleep sensors offer a compelling alternative by enabling at-home polysomnography or ambulatory EEG assessments.

The proliferation of wearable EEG headbands designed for sleep tracking, such as those developed by companies like Dreem and Muse, is changing the way clinicians and consumers view brain wave monitoring. These devices, when used in conjunction with smartphone apps and cloud analytics, are creating a new paradigm in sleep science. Clinics can now offer subscription-based models for sleep monitoring, and neurologists can monitor epileptic episodes remotely without requiring repeated hospital visits. As regulatory frameworks evolve and telemedicine gains momentum in Europe, this segment is poised for exponential growth.

Multichannel EEG devices dominated the European market in 2024, owing to their superior diagnostic accuracy, flexibility, and integration capabilities with other monitoring systems. These devices are favored in hospitals and academic research settings, where capturing complex neurological data from multiple cortical areas is essential. Multichannel EEGs, typically with 64 or more electrodes, are critical in epilepsy surgery planning, brain-computer interface research, and sleep disorder diagnostics. As neurological diseases become more nuanced in their manifestations, these high-resolution EEG systems are increasingly seen as indispensable tools.

Among the fastest growing subsegments is the 32-channel EEG segment, striking a balance between cost and diagnostic utility. These systems are widely adopted in mid-sized hospitals and diagnostic centers, particularly in countries like France and Italy, where public health systems are looking for cost-effective yet comprehensive solutions. They offer enough granularity to monitor most standard neurology cases without the complexity and resource demands of multichannel systems. Companies offering modular 32-channel EEGs with upgrade capabilities are seeing increased traction across both western and central Europe.

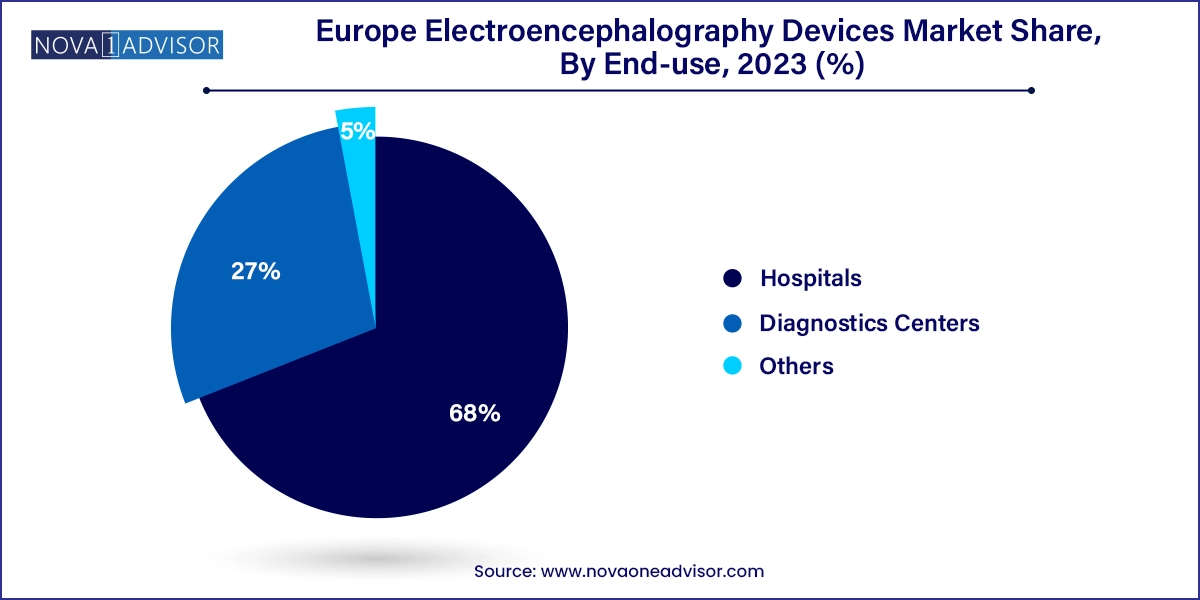

Hospitals dominated the EEG devices market by end-use in 2023, owing to the availability of multidisciplinary care teams and the requirement for complex diagnostics. Hospitals across Europe not only conduct routine EEGs but also deploy long-term monitoring in neurology wards and surgical theaters. Public hospitals, particularly in Scandinavia, are known for integrating EEG into broader neuroimaging protocols, often combining it with MRI or PET scans for comprehensive brain mapping.

On the other hand, diagnostic centers are the fastest-growing end-use environment, especially in urban and suburban regions. These centers offer specialized EEG services, reducing patient load in hospitals and offering quicker turnaround for tests. The affordability and scalability of 21- and 25-channel systems make them ideal for standalone diagnostic labs. In countries like Italy and Spain, diagnostic chains are emerging as key players in outpatient EEG services, often catering to both adults and pediatric populations.

Standalone devices captured the largest share in the EEG devices market across Europe, particularly due to their long-standing use in hospitals and diagnostic labs. These systems are robust, highly customizable, and provide uninterrupted power supply—making them suitable for in-patient and acute care settings. Neurosurgical departments and ICUs often rely on standalone EEG systems for continuous monitoring in conditions such as seizures, coma, or anesthesia depth.

However, wearable EEG devices are the fastest-growing subsegment, driven by rising consumer interest, outpatient monitoring needs, and technological advancements. These lightweight systems are equipped with wireless capabilities, dry electrodes, and mobile app interfaces, allowing for real-time data transfer. Germany and the UK are at the forefront of adopting wearable EEGs in both clinical and non-clinical settings, with companies like Emotiv and Neuroelectrics leading the innovation curve. Wearable devices are especially impactful in pediatric neurology, home-based seizure tracking, and mental health monitoring, offering both scalability and personalization.

Disease diagnosis is the leading application of EEG devices in Europe, supported by the growing neurological disease burden. EEG plays a central role in diagnosing epilepsy, dementia, encephalopathy, and brain tumors, among others. Most hospitals maintain dedicated EEG suites within neurology departments, and the demand for accurate, multi-signal diagnosis has led to increased procurement of high-end EEG systems. Germany and France, with their strong diagnostic infrastructure, are leading contributors to this application segment.

Meanwhile, sleep monitoring has emerged as the fastest-growing application area, propelled by increasing public awareness, lifestyle-induced sleep disorders, and rising research activity in sleep sciences. Nations such as Sweden and the UK are investing in sleep centers and ambulatory services where EEG is an essential tool for REM analysis and circadian rhythm assessment. Furthermore, collaborations between sleep device manufacturers and academic research institutes are leading to product innovations, boosting this subsegment's future growth prospects.

Germany is the largest contributor to the European EEG devices market, backed by robust hospital infrastructure, government-funded research, and high healthcare spending. German hospitals are pioneers in EEG integration with multimodal imaging, especially in academic and teaching institutions.

The UK is witnessing rapid adoption of wearable EEGs, especially for sleep monitoring and mental health applications. NHS-led pilot projects are promoting remote EEG monitoring for epilepsy patients.

France is focusing on mid-tier EEG systems like 25- and 32-channel devices for regional hospitals and outpatient clinics. Government subsidies and telehealth platforms are driving access in rural areas.

Italy is seeing an expansion in independent diagnostics centers and neurology-focused clinics. The growing geriatric population is pushing the need for EEG in dementia diagnosis.

Spain has seen investments in pediatric neurology and autism-related research using EEG tools. EEG services in private clinics are expanding due to increased health tourism.

These countries are leading in tele-neurology innovations. Public healthcare systems are integrating cloud-based EEG monitoring to deliver services across remote regions. Research funding for neurotechnology is also significantly high in Sweden and Norway.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe electroencephalography devices market

Product

Type

Application

End Use Channel

Country