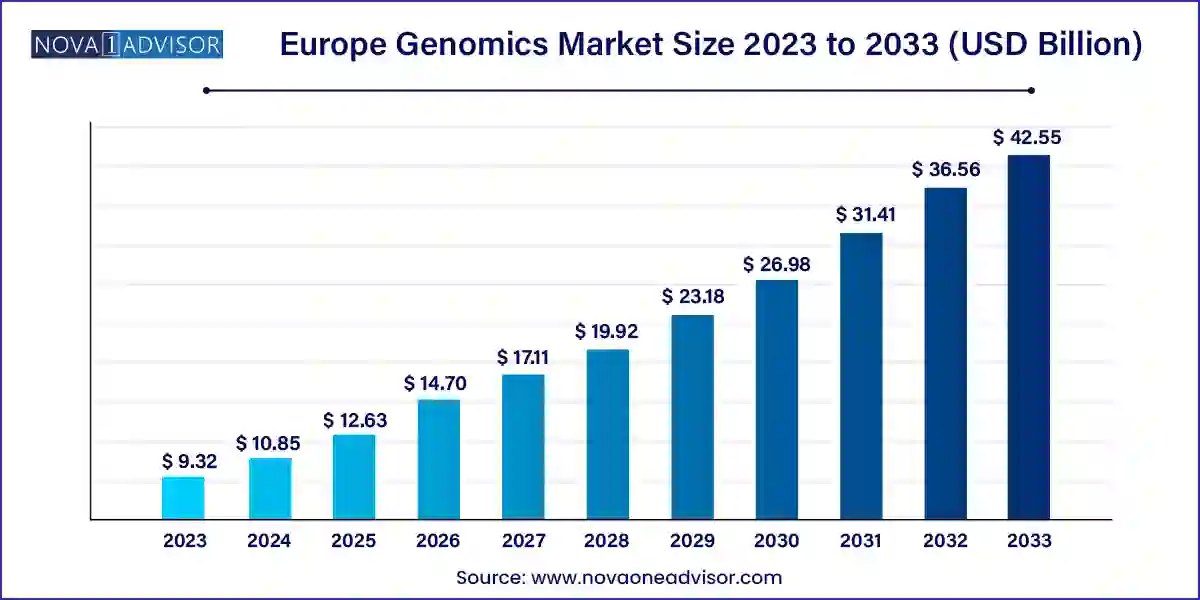

The Europe genomics market size was exhibited at USD 9.32 billion in 2023 and is projected to hit around USD 42.55 billion by 2033, growing at a CAGR of 16.4% during the forecast period 2024 to 2033.

The Europe Genomics Market is evolving rapidly as genomics transforms from a niche scientific field into a foundational element across medicine, research, and biopharmaceutical innovation. Genomics, the study of genes and their functions, has increasingly become central to drug discovery, disease diagnosis, predictive healthcare, agricultural biotechnology, and personalized medicine. Europe, as a continent with a mature healthcare infrastructure and a strong research base, has become a fertile ground for both academic genomics research and commercial translation.

The introduction of high-throughput sequencing technologies and the decreasing cost of genome sequencing have democratized genomics, making it accessible to more institutions, researchers, and healthcare providers. European countries have invested heavily in national genomics initiatives, public-private partnerships, and digital health infrastructure to advance personalized healthcare. For example, the UK's Genomics England project and France’s Plan France Médecine Génomique 2025 are landmark programs supporting population-wide sequencing and genomic diagnostics.

Europe’s genomics landscape is unique in its multi-country approach, with innovation being driven not only by national policies but also by collaborative EU initiatives such as Horizon Europe, the European Genomic Data Infrastructure (GDI), and the European Bioinformatics Institute. The interplay of advanced clinical genetics, AI-powered bioinformatics, precision oncology programs, and public health genomics initiatives has made Europe a leader in this domain.

Additionally, the pandemic accelerated the use of genomics in pathogen surveillance and vaccine development. Institutions across Germany, Spain, and Denmark employed sequencing-based tools to track COVID-19 variants in real time. This experience has strengthened infrastructure and demonstrated the role of genomics in addressing public health challenges. Moving forward, the market is expected to expand further with increasing integration of genomics into routine clinical practice, reimbursement reforms, and cross-border data-sharing frameworks.

Rise of Population-Scale Genomic Projects: Countries like the UK and France are sequencing hundreds of thousands of genomes for national precision health initiatives.

Adoption of AI & Machine Learning in Genomics: Algorithms are used for pattern recognition, variant prioritization, and multi-omics integration.

Clinical Integration of Whole Genome Sequencing (WGS): WGS is being implemented in oncology, rare disease diagnosis, and neonatal intensive care.

Cloud-based Bioinformatics Platforms: Increased use of scalable, cloud-native solutions for data analysis and interpretation across multiple endpoints.

Increasing Demand for NGS Services: Next-generation sequencing (NGS)-based services are growing due to their role in diagnostics and drug development.

Expansion of Genomic Biomarker Discovery: Biomarkers for immuno-oncology, neurodegeneration, and metabolic diseases are driving demand.

Epigenomics and Transcriptomics Boom: Multi-omics approaches are emerging, combining methylation, RNA-seq, and proteomic datasets.

Surge in Direct-to-Consumer Genomics: In select regions, consumer demand for ancestry and health predisposition testing is influencing the market, though regulated differently across countries.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.85 Billion |

| Market Size by 2033 | USD 42.55 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 16.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application & Technology, Deliverable, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | Germany; France; Italy; Spain; Denmark; Sweden; Norway; UK |

| Key Companies Profiled | Oxford Nanopore Technologies; Qiagen; Creative Biogene; Thermo Fisher Scientific; Illumina; Bio-Rad Laboratories; Danaher Corporation; Agilent Technologies; F. Hoffmann-La Roche Ltd.; Eurofins Scientific Group |

A major driver of the Europe genomics market is the rising demand for precision medicine, which aims to tailor medical treatment to individual genetic, environmental, and lifestyle factors. Precision medicine initiatives across Europe are heavily reliant on genomics to stratify patients, predict disease risk, and guide treatment decisions. In oncology, for instance, genomic profiling helps determine which patients are eligible for targeted therapies or immunotherapies based on actionable mutations.

Projects like Genomics England and France Médecine Génomique are actively sequencing thousands of patients to integrate genomic information into electronic health records (EHRs) and clinical decision-making workflows. Precision medicine has gained widespread institutional support in Europe due to its potential to improve outcomes, reduce adverse events, and lower overall treatment costs. As more healthcare providers adopt genomic testing for rare diseases, pharmacogenomics, and hereditary conditions, demand for products and services across the genomics value chain is increasing rapidly.

Despite strong momentum, the Europe genomics market is constrained by ethical, legal, and privacy-related challenges. The European Union's stringent data protection regulations, particularly under the General Data Protection Regulation (GDPR), impose strict controls on genomic data usage, storage, and sharing. While GDPR enhances trust and security, it complicates cross-border research and multi-center clinical trials where genomics data sharing is essential.

Moreover, ethical concerns around incidental findings, data ownership, informed consent, and potential misuse of genetic information remain unresolved in many countries. For instance, the extent to which employers or insurers can access genetic data varies across jurisdictions, and public apprehension can slow down adoption of DTC genomic testing. These regulatory and societal constraints require companies and research institutions to adopt highly transparent, compliant, and patient-centric data governance frameworks often adding operational complexity and cost.

A transformative opportunity in the Europe genomics market lies in the integration of multi-omics approaches combining genomics with transcriptomics, epigenomics, proteomics, and metabolomics to generate holistic biological insights. As diseases like cancer, Alzheimer’s, and autoimmune disorders are increasingly understood as complex, multifactorial conditions, researchers are turning to multi-omics to unravel pathophysiological mechanisms and discover new therapeutic targets.

European institutions and biotech companies are at the forefront of multi-omics innovation. For instance, EMBL-EBI, one of the world’s leading bioinformatics centers, supports multi-omics data warehousing and processing at scale. Companies are developing platforms to align genomic data with phenotypic and proteomic information using AI-based systems biology tools. The ability to integrate and interpret multi-dimensional datasets is opening new frontiers in diagnostics, drug response prediction, and personalized interventions—creating high-value opportunities for players that can support multi-omics assay development, computational services, and clinical applications.

Functional genomics dominated the European genomics market due to its widespread use in elucidating gene expression, gene-protein interactions, and regulatory mechanisms. Technologies under this segment, including real-time PCR, RNA interference (RNAi), transfection, SNP analysis, and microarrays, form the backbone of genomics research and diagnostics. Academic institutes, pharmaceutical R&D labs, and clinical research organizations (CROs) across Europe rely heavily on these tools for target validation, mechanistic studies, and assay development.

Biomarker discovery, however, is the fastest-growing segment. Driven by the surge in personalized medicine, biomarker research is central to developing diagnostic tests, companion diagnostics, and drug efficacy markers. Tools like mass spectrometry, bioinformatics, microarrays, and statistical analysis are increasingly applied in identifying disease-specific genomic signatures, particularly in cancer, cardiovascular diseases, and neurodegeneration. Europe’s rich clinical trial landscape and national biobank programs provide researchers with access to vast patient datasets, accelerating biomarker validation and commercialization.

Services form the dominant share of the Europe genomics market, reflecting the growing trend toward outsourcing and contract-based operations. Within this category, NGS-based services and computational services are in high demand. Pharmaceutical and biotechnology companies often outsource sequencing, bioinformatics, and data interpretation to specialized providers to reduce costs and enhance expertise access. Academic institutions also rely on service providers for large-scale sequencing, data warehousing, and omics integration.

That said, products especially consumables and reagents represent the fastest-growing deliverables. The increasing frequency of genomic workflows across laboratories has led to a steady demand for high-throughput reagents, sample prep kits, amplification enzymes, and sequencing reagents. Instrumentation sales are also strong, especially for NGS platforms, PCR systems, and microarray scanners. Companies are developing automation-friendly consumables tailored to specific instruments, enabling reproducible workflows for diagnostics and research labs alike.

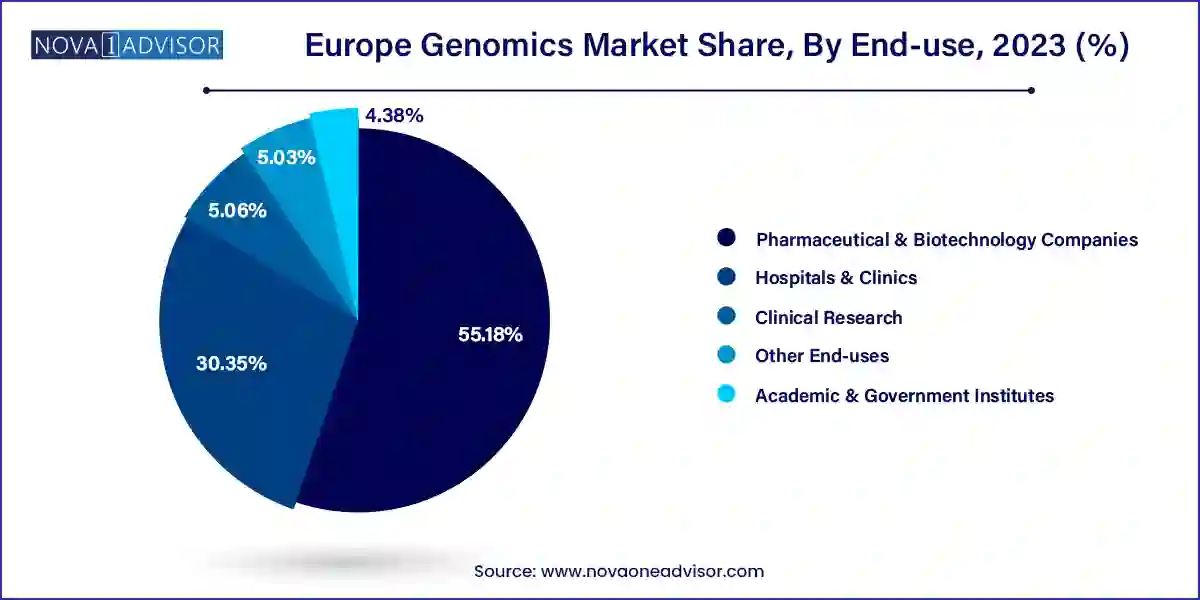

Academic and government institutes currently dominate the Europe genomics market as key contributors to basic research and translational genomics. Europe boasts a vast network of universities, publicly funded health systems, and research councils that fund genomics research in rare diseases, cancer, and population health. Public consortia such as the European Bioinformatics Institute (EBI) and the European Molecular Biology Laboratory (EMBL) provide critical infrastructure for shared data and collaborative research.

On the other hand, pharmaceutical and biotechnology companies are the fastest-growing end-use segment, fueled by the need for target discovery, pharmacogenomics, and biomarker development. Pharma companies increasingly use genomic data to stratify patient populations, monitor treatment responses, and develop companion diagnostics. Biotechs, particularly those in oncology and gene therapy, are deeply involved in genomic R&D. Startups across Germany, the UK, and Switzerland are leveraging CRISPR, single-cell genomics, and synthetic biology to revolutionize disease modeling and therapy development.

Within the Europe genomics market, Germany leads the pack in terms of investment, research output, and industry presence. The country hosts some of Europe’s largest biopharma clusters (e.g., Berlin, Munich, Heidelberg), world-class genomics research institutions (e.g., Max Planck Institutes, DKFZ), and is home to a rapidly growing healthtech startup ecosystem. Germany’s federal and regional governments have consistently funded genomics infrastructure and data-sharing platforms.

The United Kingdom is the fastest-growing country in the market, thanks to pioneering projects like Genomics England, the 100,000 Genomes Project, and NHS Genomic Medicine Service. These initiatives have enabled the integration of WGS into routine clinical practice, particularly in oncology, cardiology, and rare disease diagnostics. Furthermore, the UK’s regulatory framework, AI innovation hubs, and strength in computational biology give it a competitive edge. The post-Brexit landscape, while introducing new regulatory considerations, has also enabled faster domestic decision-making and strategic focus on genomics leadership.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe genomics market

Application & Technology

Deliverables

End-use

Country