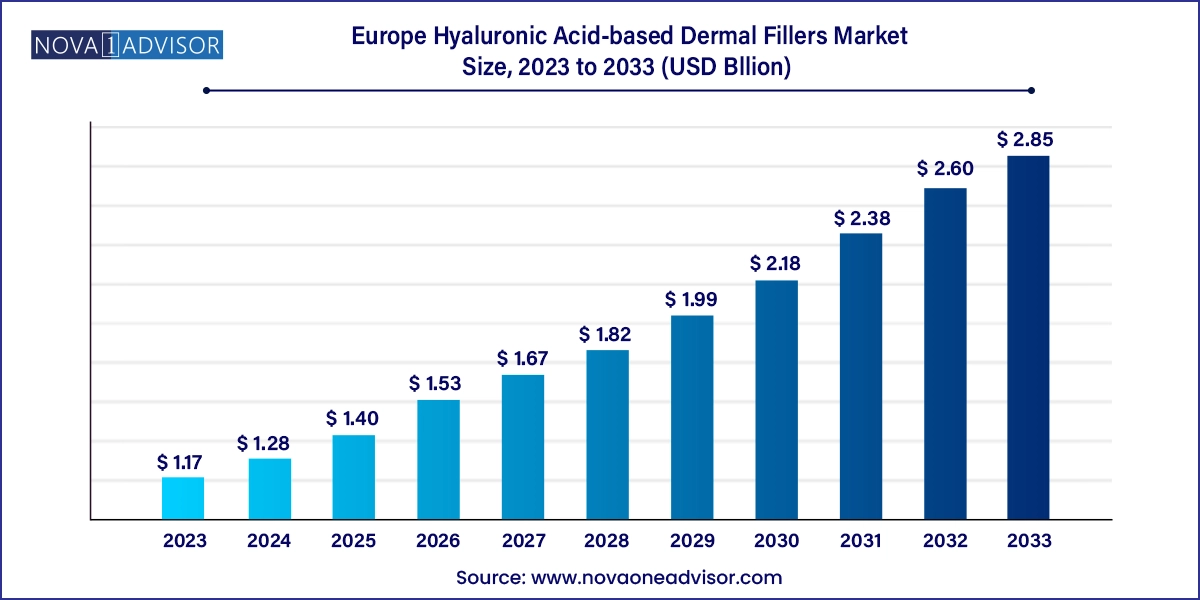

The Europe hyaluronic acid-based dermal fillers market size was exhibited at USD 1.17 billion in 2023 and is projected to hit around USD 2.85 billion by 2033, growing at a CAGR of 9.3% during the forecast period 2024 to 2033.

The Europe Hyaluronic Acid (HA)-based dermal fillers market has emerged as a dynamic and high-growth sector within the broader medical aesthetics and cosmetic dermatology space. Driven by a rising aging population, increasing consumer interest in non-surgical cosmetic procedures, and widespread accessibility to trained dermatologists and aesthetic practitioners, the demand for HA-based fillers has grown significantly across European countries. Unlike surgical interventions, hyaluronic acid-based dermal fillers offer minimally invasive options with lower downtime, immediate results, and customizable treatments, making them highly attractive to the aging yet appearance-conscious European demographic.

Hyaluronic acid is a naturally occurring polysaccharide found in the human skin and connective tissues. Its ability to retain moisture and add volume makes it ideal for facial rejuvenation treatments such as wrinkle correction, lip enhancement, and contouring. The growing emphasis on "preventive aesthetics" where younger individuals undergo cosmetic procedures to delay visible aging signs has expanded the market’s target base. Additionally, the normalization of aesthetic procedures among men and the influence of social media, beauty influencers, and the wellness economy are further pushing market penetration.

With dermatology clinics, med spas, and aesthetic practitioners proliferating across the continent, particularly in cities like Paris, Milan, and London, Europe has become a key global hub for cosmetic enhancements. Regulatory support through the European Medicines Agency (EMA) and country-specific cosmetic regulations has also ensured that the market maintains quality, safety, and efficacy, supporting long-term growth prospects.

Preventive Aesthetics Gaining Momentum: Younger demographics, especially millennials and Gen Z, are opting for early interventions to prevent wrinkle formation and volume loss.

Natural-Looking Results Drive Demand: There is a clear shift toward subtle enhancements and natural aesthetics, prompting innovation in filler technology that mimics skin’s natural texture.

Personalized Treatments and Layering Techniques: Dermatologists increasingly use a combination of HA-based products in layers to achieve bespoke facial contouring and rejuvenation.

Male Aesthetic Market is Expanding: A growing number of men are undergoing non-invasive procedures such as jawline contouring and wrinkle filling, contributing to market expansion.

Sustainable and Biocompatible Filler Development: Companies are investing in formulations that enhance skin health while ensuring biocompatibility and minimal immunogenic response.

Rising Popularity of Combination Therapies: Fillers are being used in combination with botulinum toxin, lasers, and skin boosters for holistic aesthetic outcomes.

Increased Adoption of Duplex Products: Duplex fillers offering combined effects (like lifting and hydration) are gaining traction for long-term results.

Social Media and Celebrity Influence: Platforms like Instagram and TikTok are playing a powerful role in promoting facial aesthetics and boosting consumer education.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.28 Billion |

| Market Size by 2033 | USD 2.85 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway |

| Key Companies Profiled | Allergan; Galderma Laboratories; Merz Pharma; Genzym corporation; Medicis Pharmaceutical (Bausch Health); Inamed Corporation; Laboratoires VIVACY; Bioxis Pharmaceuticals |

A primary driver propelling the Europe hyaluronic acid-based dermal fillers market is the increasing geriatric population coupled with strong demand for anti-aging cosmetic solutions. Europe is home to some of the world's oldest populations—Italy, Germany, and France have median ages exceeding 45 years. With aging comes concerns such as facial volume loss, wrinkles, sagging skin, and fine lines, all of which HA-based fillers can effectively address.

What sets this market apart is the cultural emphasis on graceful aging and the pursuit of natural-looking results. Unlike invasive surgeries, dermal fillers offer subtle enhancements, which align with European consumer preferences. The affordability, repeatability, and relatively short procedure times also make these treatments ideal for busy, urban, aging consumers. As a result, dermatology clinics and med spas across European capitals report a steady rise in clientele over 40, seeking facial rejuvenation without altering their natural expressions.

Despite the growth trajectory, the market faces a restraint in the form of high treatment costs and lack of reimbursement under national healthcare programs. Hyaluronic acid-based dermal fillers are typically classified as elective cosmetic procedures and are therefore not covered by insurance or public health systems in countries like the UK, France, or Germany. This makes the procedures accessible primarily to middle and high-income individuals, limiting penetration in broader population segments.

Additionally, high-end filler brands can cost hundreds of euros per syringe, and most patients require multiple syringes for a single procedure. Maintenance treatments every 6 to 12 months further escalate the cumulative expense. This cost burden, combined with inflationary pressures and income disparity across Europe, particularly in Southern and Eastern countries, continues to restrict adoption despite growing awareness and demand.

A compelling opportunity lies in expanding into emerging aesthetic demographics, including younger age groups, male clients, and previously underrepresented regions. Traditionally, the dermal fillers market catered to women over 40. However, there is a marked shift, with younger clients now viewing aesthetic procedures as a form of self-care and wellness enhancement.

In cities like Berlin, Madrid, and Copenhagen, younger professionals seek minimally invasive treatments to enhance facial symmetry, jawline sharpness, or correct minor imperfections. Similarly, the rise of male grooming culture and changing perceptions about masculinity have made HA-based dermal fillers popular among men. Clinics are increasingly offering male-specific packages, such as chin enhancement or under-eye correction.

Moreover, rural and Tier-2 cities in Europe are witnessing growing interest due to wider awareness and better access to certified practitioners. Clinics and manufacturers that tap into these underserved yet growing segments stand to gain significant market share.

Wrinkle removal remained the dominant application, fueled by the aging European population and the desire to reduce visible signs of aging. Crow’s feet, marionette lines, forehead lines, and nasolabial folds are among the most commonly treated areas. Given HA’s hydrating and volumizing properties, it is ideal for restoring youthful contours without surgery. Clinics report that wrinkle correction accounts for over 50% of their dermal filler bookings, often complemented with neuromodulators for dynamic wrinkle treatment. The availability of FDA- and EMA-approved fillers for this application further strengthens market confidence.

Meanwhile, lip augmentation is emerging as the fastest-growing application segment. The surge in demand is driven by beauty trends, social media influence, and the popularity of ‘selfie culture’ among millennials and Gen Z. Hyaluronic acid’s soft, moldable nature makes it perfect for enhancing lip volume, symmetry, and definition. The rise of lip-specific filler lines such as Juvederm Volbella and Teosyal Kiss has also fueled growth. Clinics across Paris, Stockholm, and London report a growing number of younger women and men seeking lip enhancement for aesthetic balance, indicating strong future momentum for this segment.

Single-phase products dominated the Europe HA-based dermal fillers market. These fillers, characterized by their smooth, monophasic gel structure, offer superior consistency, ease of injection, and natural integration into the skin tissue. They are highly popular among practitioners for applications like fine line correction, tear troughs, and lip augmentation. Brands like Juvederm (Allergan/AbbVie) and Belotero (Merz) offer best-in-class monophasic fillers that maintain results for up to 12 months. Moreover, single-phase products are perceived to cause less swelling and bruising, making them ideal for first-time patients and minor aesthetic corrections.

On the other hand, duplex products are the fastest-growing segment, due to their versatility and dual-layer structure, which allows deeper volumization and longer durability. Duplex fillers contain both cross-linked and non-cross-linked HA, enabling hydration and structure simultaneously. They are especially suited for applications like cheek augmentation, chin sculpting, and nasolabial fold correction. Patients increasingly demand longer-lasting results with fewer visits, which duplex fillers provide. Companies like Teoxane and Vivacy are leading innovation in this space, and their adoption is growing rapidly across dermatology clinics in France, Germany, and the UK.

The UK represents one of the largest and most mature dermal filler markets in Europe. High aesthetic awareness, a concentration of dermatology clinics in London, Manchester, and Birmingham, and a robust culture of self-enhancement fuel demand. Recent changes by the UK government to regulate non-medical aesthetic providers have brought more safety and credibility to the market. Brands like Juvederm, Restylane, and Teoxane dominate the scene, and consumer demand remains high for lip fillers and wrinkle correction treatments.

France, home to major players like Laboratoires Vivacy and Teoxane, is a hub of aesthetic innovation and a stronghold for dermal filler adoption. Paris alone houses hundreds of licensed aesthetic clinics offering a range of facial rejuvenation services. The French population generally favors natural-looking results, which aligns well with the performance of HA-based fillers. Regulatory rigor and consumer education further enhance market quality.

Germany’s strong medical infrastructure and wealthy population make it a highly profitable dermal filler market. Cities like Berlin, Munich, and Hamburg have flourishing dermatology clinics with advanced aesthetic technologies. The preference for preventive care and wellness-focused services drives HA-based filler uptake, especially in the 30–50 age group.

Southern European countries like Italy and Spain are catching up fast. With a deeply entrenched beauty culture and growing disposable incomes, the aesthetic market is booming. Lip augmentation, cheek sculpting, and smile line correction are among the most requested procedures. The Mediterranean climate and outdoor lifestyle also contribute to a culture of physical appearance maintenance.

Scandinavian countries are witnessing a surge in demand, particularly among younger professionals. Known for minimalism and natural beauty, Scandinavian consumers favor subtle enhancements. Clinics in Stockholm, Oslo, and Copenhagen offer advanced dermal filler treatments using both monophasic and duplex products. The male aesthetic market is notably stronger in this region compared to others.

March 2025: Teoxane launched its new “RHA 5” filler in Germany, a hybrid resilience HA product designed for facial contouring and volume restoration with enhanced elasticity.

January 2025: Allergan Aesthetics expanded its Juvederm training program in the UK to include AI-assisted facial mapping tools for precise injection guidance.

November 2024: Laboratoires Vivacy opened a new training and distribution center in Milan, Italy, aimed at expanding its footprint in Southern Europe.

October 2024: Merz Aesthetics announced a partnership with leading aesthetic chains in Scandinavia to launch its Belotero Lips portfolio across Sweden and Norway.

August 2024: Revance Therapeutics received CE mark approval for its RHA Collection in Spain, boosting competition in the duplex segment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe hyaluronic acid-based dermal fillers market

Product

Application

Country