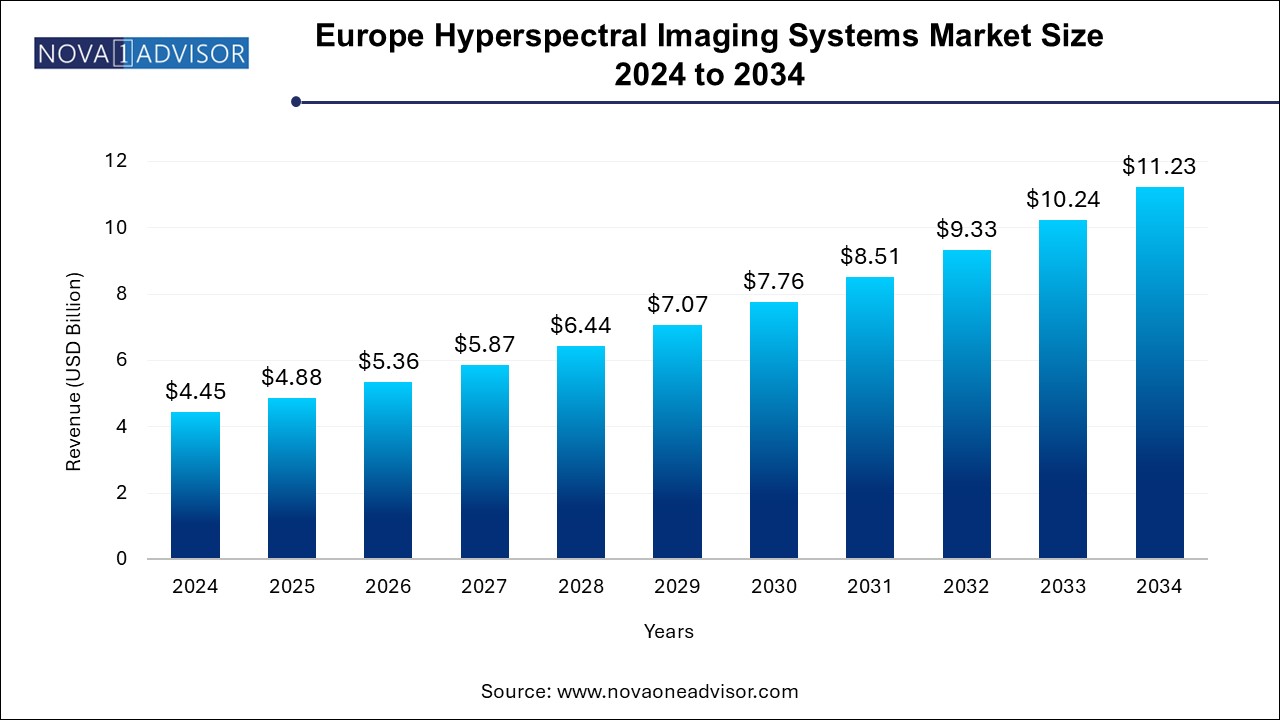

The Europe Hyperspectral Imaging Systems market size was exhibited at USD 4.45 billion in 2024 and is projected to hit around USD 11.23 billion by 2034, growing at a CAGR of 9.7% during the forecast period 2024 to 2034. The growing demand for high-resolution imaging in various applications such as military surveillance, medical diagnostics, and machine vision is driving the expansion of the hyperspectral imaging systems market in Europe.

The Europe Hyperspectral Imaging Systems Market is expanding as the need for advanced imaging technologies increases across various sectors. Hyperspectral imaging allows for the acquisition of high-dimensional data from objects, offering detailed insights into their chemical composition and material properties. This technology is widely used in industries ranging from military surveillance and remote sensing to medical diagnostics and machine vision. Hyperspectral imaging systems, which capture a large spectrum of light beyond the visible range, enable precise identification of materials, making them valuable for applications that require high levels of detail and accuracy. With ongoing technological advancements, the European market is poised to continue growing, driven by innovations and increasing demand for non-invasive diagnostic solutions.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.88 Billion |

| Market Size by 2034 | USD 11.23 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 9.7% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Technology, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Imec; XIMEA GmbH; Resonon, Inc.; Headwall Photonics, Inc.; Telops Inc.; Corning Incorporated; Norsk Elektro Optikk AS; Cubert GmbH; EVK DI Kerschhaggl GmbH; Inno-spec GmbH; SPECIM Spectral Imaging Ltd; Diaspective Vision GmbH |

Driver: Rising Demand for High-Resolution Imaging in Various Sectors

The growing need for high-resolution and non-invasive imaging across various sectors is a major driver for the hyperspectral imaging systems market in Europe. In industries such as medical diagnostics, military surveillance, and remote sensing, high-resolution imaging allows for better analysis and decision-making. For example, in medical diagnostics, hyperspectral imaging is used to detect early signs of diseases such as cancer by capturing subtle changes in tissue composition. Similarly, in defense and military applications, it enhances surveillance by detecting objects and materials that are otherwise invisible to traditional imaging technologies. The rise in demand for precision and accuracy across these industries directly supports the growth of the hyperspectral imaging systems market.

Restraint: High Cost of Hyperspectral Imaging Systems

One of the key restraints in the Europe Hyperspectral Imaging Systems Market is the high cost of these systems. Hyperspectral imaging requires advanced sensors, optics, and data processing software, which makes the overall setup costly. This high price can be a barrier to adoption, particularly for small to medium-sized enterprises or in regions with budget constraints. In medical applications, for instance, the cost of implementing hyperspectral imaging systems can be prohibitive for smaller clinics and healthcare providers. As a result, the cost remains a significant challenge for widespread adoption across various sectors, limiting market growth to some extent.

Opportunity: Technological Advancements in Hyperspectral Imaging

Technological advancements present significant opportunities for growth in the European hyperspectral imaging systems market. Innovations such as miniaturized devices, improved sensor capabilities, and enhanced data processing algorithms are making hyperspectral imaging more accessible and efficient. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) with hyperspectral imaging systems is improving data analysis, enabling faster and more accurate results. For instance, AI is being used to automate the interpretation of hyperspectral images, which can drastically reduce the time required for analysis in applications such as medical diagnostics and remote sensing. As these technologies evolve, they will expand the scope of hyperspectral imaging and make it more affordable for various industries.

The camera segment dominated the market in 2024 and is also expected to grow at the fastest CAGR of 10.5% over the forecast period. Cameras are the core component of hyperspectral imaging systems, responsible for capturing the spectral data that is then processed and analyzed for different applications. The increasing demand for high-performance cameras capable of capturing hyperspectral data at a high resolution is driving this segment's growth. Cameras are utilized in a wide range of sectors, including military surveillance, medical diagnostics, and remote sensing, contributing to their dominance in the market. Moreover, the continuous improvements in camera technology, such as increased sensitivity and faster data acquisition speeds, are further enhancing their appeal.

The accessories segment is the fastest-growing in the European market. This segment includes a wide range of complementary products such as lenses, lighting systems, and calibration tools, all of which are essential for enhancing the performance and functionality of hyperspectral imaging systems. As more industries adopt hyperspectral imaging, the demand for high-quality accessories to optimize the imaging process is on the rise. The expansion of applications in fields such as agriculture, machine vision, and medical diagnostics is fueling the growth of this segment. Accessories, although secondary to the cameras, are increasingly becoming a critical factor in the successful deployment and operation of hyperspectral imaging systems.

The snapshot technology segment held the largest market share of 52.5% in 2024 and is also expected to grow at the fastest rate over the forecast period. Snapshot imaging technology captures an entire image in a single exposure, making it particularly useful in applications where speed and efficiency are crucial. This technology is widely used in military surveillance, remote sensing, and other applications that require real-time imaging and analysis. Snapshot imaging enables quicker data acquisition, providing timely insights for critical decision-making. The ability to capture high-resolution images in a single snapshot makes this technology ideal for applications requiring continuous monitoring and instant analysis.

Push Broom Technology is the fastest-growing segment in the European market. This technology captures images line by line as the system is moved across the field of view, making it ideal for applications that require detailed spectral analysis over large areas. Push broom technology is particularly valuable in remote sensing, agriculture, and environmental monitoring, where large swathes of land or ocean need to be analyzed for specific spectral properties. As industries increasingly look for solutions to monitor and analyze vast areas, the push broom segment is seeing rapid growth, driven by the rising adoption of hyperspectral imaging in these applications.

The military surveillance segment held the largest market share of 33.0% in 2024, Hyperspectral imaging is widely used in defense and military applications for surveillance, reconnaissance, and target detection. The technology allows military personnel to detect and identify objects, even in challenging conditions such as low visibility or camouflage. It also enhances the ability to monitor large areas in real-time, making it an invaluable tool for defense forces across Europe. As security concerns continue to rise and the demand for advanced surveillance capabilities increases, military applications remain the dominant area of use for hyperspectral imaging systems.

Medical Diagnostics is the fastest-growing segment within the application outlook for hyperspectral imaging. The non-invasive nature of hyperspectral imaging, coupled with its ability to provide high-resolution, multi-dimensional data, is driving its adoption in the medical field. It is being increasingly used for early disease detection, particularly in oncology, where hyperspectral imaging is employed to detect cancerous tissues at an early stage. As healthcare providers in Europe continue to explore non-invasive diagnostic tools that offer precision and efficiency, the medical diagnostics application is expected to see significant growth in the coming years.

February 2025: Headwall Photonics announced the release of a new hyperspectral imaging system tailored for industrial applications, featuring improved real-time processing capabilities for machine vision and optical sorting.

January 2025: SPECIM introduced a compact hyperspectral imaging camera designed for use in remote sensing and medical diagnostics, offering higher resolution and faster data capture.

December 2024: Resonon partnered with a leading medical research institution in the UK to develop hyperspectral imaging solutions for cancer diagnosis, marking a significant step toward advancing non-invasive diagnostic tools.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe Hyperspectral Imaging Systems market

Product

Technology

Application

Country