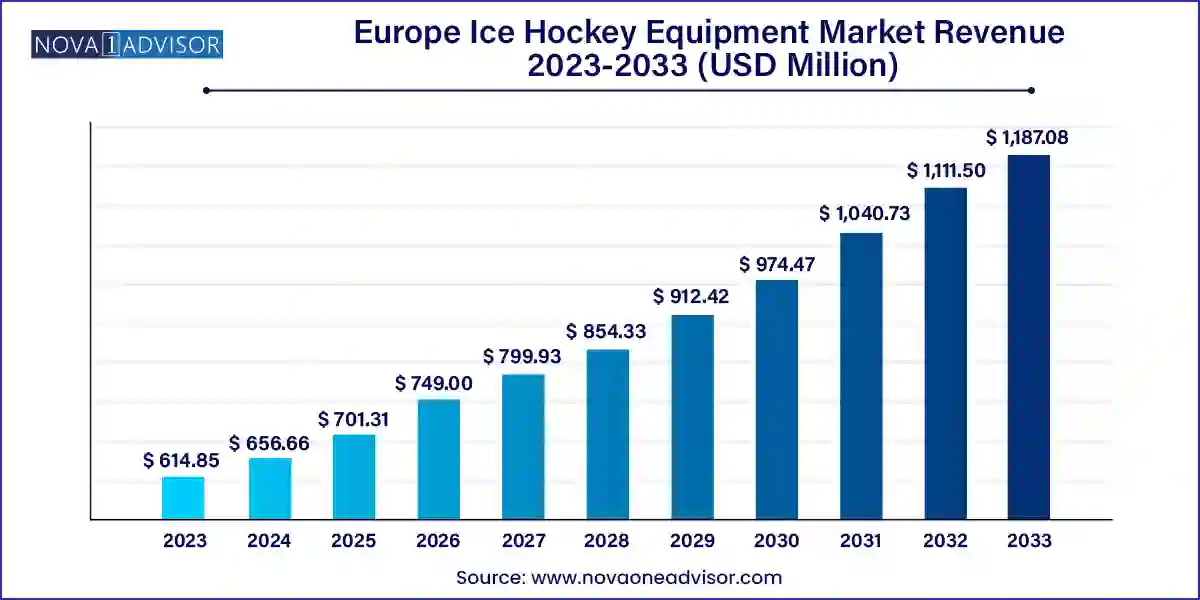

The Europe ice hockey equipment market size was exhibited at USD 614.85 million in 2023 and is projected to hit around USD 1,187.08 million by 2033, growing at a CAGR of 6.8% during the forecast period 2024 to 2033.

The Europe ice hockey equipment market is a highly specialized segment within the broader sporting goods industry, driven by deep-rooted cultural interest, professional league development, and active grassroots participation across several Northern and Central European countries. Ice hockey is not just a recreational activity in Europe—it is a national passion in countries like Sweden, Finland, and the Czech Republic, where local leagues garner massive followings and international competitions receive substantial viewership.

European ice hockey players, from elite professionals to youth league amateurs, rely heavily on purpose-built equipment for performance and safety. The market includes a broad spectrum of products such as skates, sticks, helmets, shoulder and elbow pads, shin guards, gloves, and accessories. The demand is shaped by a mix of professional clubs, national sports associations, recreational players, and emerging women's hockey leagues. High-quality manufacturing, often concentrated in Eastern and Central Europe, gives the region a unique competitive edge.

With the rise of digital retailing, cross-border e-commerce, and increasing exposure to NHL-style marketing and sponsorships, European consumers are becoming more brand-aware and technologically inclined in their gear preferences. Notably, the expansion of international leagues like the Champions Hockey League (CHL) and youth development academies have intensified the need for durable, high-performance, and certified protective gear. From club-level bulk orders to individual online purchases, the European ice hockey equipment market is poised for sustained growth over the next decade.

Surging Popularity of Women’s Ice Hockey: National and club-level investment in female participation is creating new consumer segments for gender-specific gear.

Technology-Driven Performance Enhancements: Lightweight carbon composite sticks, thermoregulated skates, and AI-fitted helmets are revolutionizing equipment functionality.

Custom Fit and Personalization: Demand for custom-molded skates, grip-optimized sticks, and individualized protective wear is growing among elite and amateur players alike.

Rise in Online Equipment Retail: Cross-border e-commerce is increasing in popularity, particularly among amateur players and parents purchasing junior equipment.

Eco-Conscious Manufacturing Practices: European brands and buyers are becoming more environmentally conscious, driving demand for recyclable and sustainably produced gear.

Youth Development Investment: Federations and clubs are ramping up junior hockey programs, leading to steady demand for beginner-level gear, especially in Finland and Germany.

Integration of Smart Sensors in Equipment: Performance analytics in sticks and helmets is becoming more prominent, particularly in training and elite performance environments.

| Report Coverage | Details |

| Market Size in 2024 | USD 656.66 Million |

| Market Size by 2033 | USD 1,187.08 Million |

| Growth Rate From 2024 to 2033 | CAGR of 6.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Czech Republic; Sweden; Finland; Germany; Austria |

| Key Companies Profiled | Bauer (Peak Achievement Athletics Inc.); CCM (Birch Hill Equity Partners); SherWood (Canadian Tire Corp); Warrior Sports (New Balance); True Temper Sports; STX; Grafskates AG; Winnwell; Vaughn Hockey; ROCES SPORT S.R.L |

A core driver of the European ice hockey equipment market is the strong institutional and cultural integration of the sport across several countries, particularly in the Nordic and Central European regions. Ice hockey is the national sport in Finland and enjoys massive grassroots participation in Sweden, the Czech Republic, and Austria. These nations have robust development systems where children start playing as early as age five and progress through well-established club pipelines.

Support from national hockey federations, government-backed sports funding, and widespread access to indoor and outdoor rinks ensures a consistent influx of new players into the sport. This high participation rate translates into continuous demand for beginner, intermediate, and professional-grade equipment. Tournaments like the Ice Hockey World Championship and Winter Olympics also drive merchandise sales and influence gear upgrades among fans and players. The passion and institutional framework surrounding ice hockey in Europe form the backbone of a stable and expanding market for equipment manufacturers and retailers.

While Europe boasts a loyal base of ice hockey players, the high cost of quality equipment and price sensitivity among amateur buyers remain critical market restraints. A full set of branded gear—including helmet, pads, gloves, skates, and stick—can easily exceed €1000, posing a financial challenge for families with multiple children or those in economically constrained regions.

This leads to a thriving secondhand market, especially for youth and entry-level players. Online resale platforms and club-based swap events have become common, thereby slowing down the sale of new equipment. Additionally, some parents opt for multi-use or rental gear for junior players who may outgrow their equipment within a single season. These practices reduce the frequency of new gear purchases, particularly in the mid-range segment, making it harder for manufacturers to consistently upsell premium products to cost-conscious buyers.

A transformative opportunity in the European ice hockey equipment market is the growing popularity and institutionalization of women’s hockey leagues. The European Women’s Hockey League (EWHL), national leagues in Sweden (SDHL), Finland (Naisten Liiga), and rising female participation in Germany and Austria have created new, underserved consumer bases. Historically, women used scaled-down versions of men’s gear, but today, demand for anatomically optimized equipment tailored to female athletes is rising.

This shift opens the door for product innovation in helmets, shoulder pads, jerseys, and skates designed for female-specific biomechanics and fit. Brands that invest in this segment with supportive marketing and sponsorships can capture loyalty among a rapidly growing demographic. Additionally, as women’s hockey gains visibility through Olympic success and media coverage, more girls are being introduced to the sport, boosting long-term demand across youth and adult segments.

Protective wear dominates the European ice hockey equipment market, accounting for the largest share of product revenue. This segment includes vital gear such as helmets, shoulder pads, elbow pads, shin guards, mouthguards, and gloves. Regulatory standards across European leagues mandate high levels of protection, especially for youth and amateur players. Helmets, in particular, are frequently updated for safety reasons, while pads and gloves are replaced due to wear and tear or sizing changes. Protective wear’s essential nature across all levels of play—combined with regular replacement needs—makes it the most consistent and recurring revenue contributor in the region.

Skates are the fastest-growing segment, propelled by advancements in material technology, ergonomic design, and customization capabilities. Elite players now demand thermoformable skates that provide personalized fit and improved energy transfer. Brands such as Bauer and CCM have launched skate lines with lightweight carbon outsoles, moisture-wicking linings, and precision blade holders. Demand is also growing among recreational and amateur players due to increased rink accessibility and year-round indoor play. As players upgrade for performance or comfort, and as beginner players invest in starter skates, this category is experiencing rapid sales momentum across price tiers.

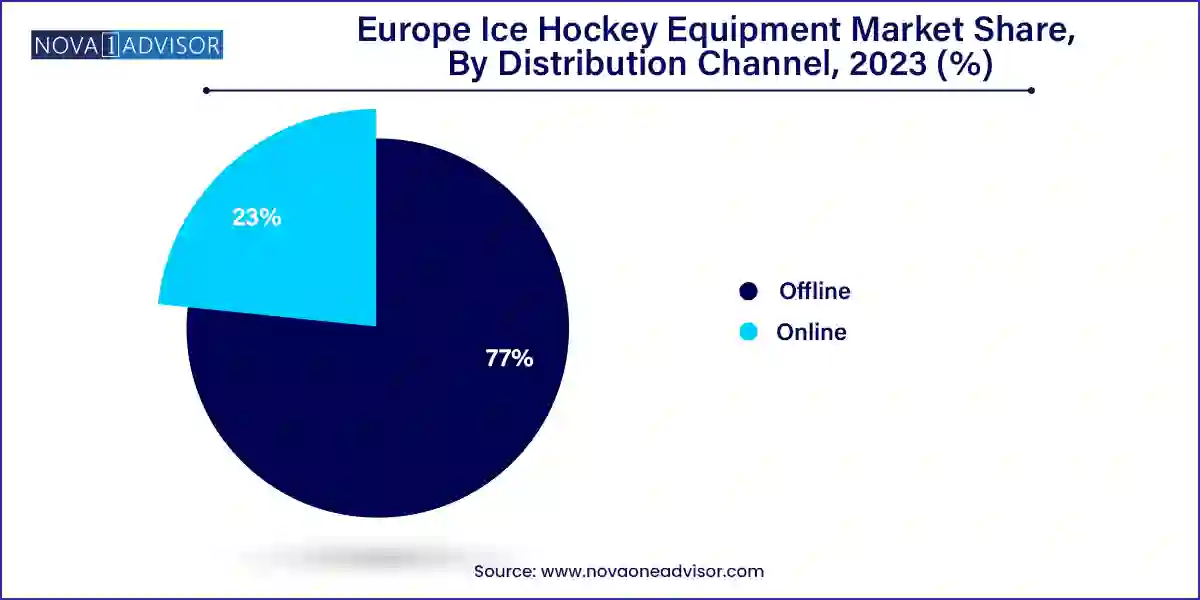

Offline retail continues to lead the distribution of ice hockey equipment in Europe, particularly in hockey-intensive countries like Sweden, Finland, and the Czech Republic. Specialty retailers and pro shops located within hockey arenas offer hands-on fittings, expert advice, and in-store services such as skate sharpening and repairs. Customers value being able to try on gear and compare brands side-by-side, especially for products requiring precise sizing. Clubs and schools also place bulk orders through established local retailers, reinforcing the dominance of the brick-and-mortar sales channel.

Online channels are growing at the fastest pace, driven by increasing digital literacy, cross-border e-commerce, and convenience for time-strapped consumers. Retailers like Hockey Point, HockeyMonkey Europe, and IceWarehouse are offering region-specific online storefronts with broad selections, virtual fitting guides, and home delivery. Online-exclusive discounts, custom engraving services, and the ability to compare products across brands have made this a preferred channel for younger, tech-savvy players. The pandemic also accelerated online buying behavior, and brands are investing in multilingual e-commerce platforms and localized distribution networks to capture this digital growth wave.

Sweden dominates the European ice hockey equipment market due to its strong domestic league (SHL), high participation rates, and structured youth development programs. Ice hockey is a mainstream sport, backed by public funding, school-linked clubs, and deep-rooted fan culture. Equipment demand is particularly strong in youth and teen segments, where club-mandated gear purchases are frequent. Sweden’s tech-savvy consumers also show high interest in smart hockey sticks and data-tracking accessories, adding a layer of innovation-driven growth.

Finland is the fastest-growing country in terms of equipment market expansion, thanks to its growing export of professional players, Olympic and World Championship success, and public investment in rink infrastructure. Ice hockey is the national sport, and the Finnish Ice Hockey Association’s emphasis on youth development has spurred equipment demand across age groups. Government-subsidized programs that provide starter kits to children have helped reduce entry barriers, while Finnish brands like Tackla continue to maintain a strong regional presence.

CCM Hockey (March 2024): Launched its Tacks AS-V Pro series across European retailers, introducing a full line of performance gear optimized for elite players, including smart stick technology with embedded sensors.

Bauer Hockey (January 2024): Announced a strategic retail partnership with a leading German sports distributor to expand access to custom-fit skates and helmets across Central Europe.

Warrior Hockey (December 2023): Debuted its latest Covert QR6 stick line with enhanced shot release technology, promoted through elite team sponsorships in the Swedish Hockey League (SHL).

Tackla (November 2023): Introduced an eco-friendly line of jerseys and protective wear manufactured with recycled polyester, targeting Finnish and German youth leagues.

Hockey Point Europe (October 2023): Expanded its online fulfillment center in the Czech Republic to speed up shipping across Eastern and Central Europe and handle increased seasonal demand.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe ice hockey equipment market

Product

Distribution Channel

Country