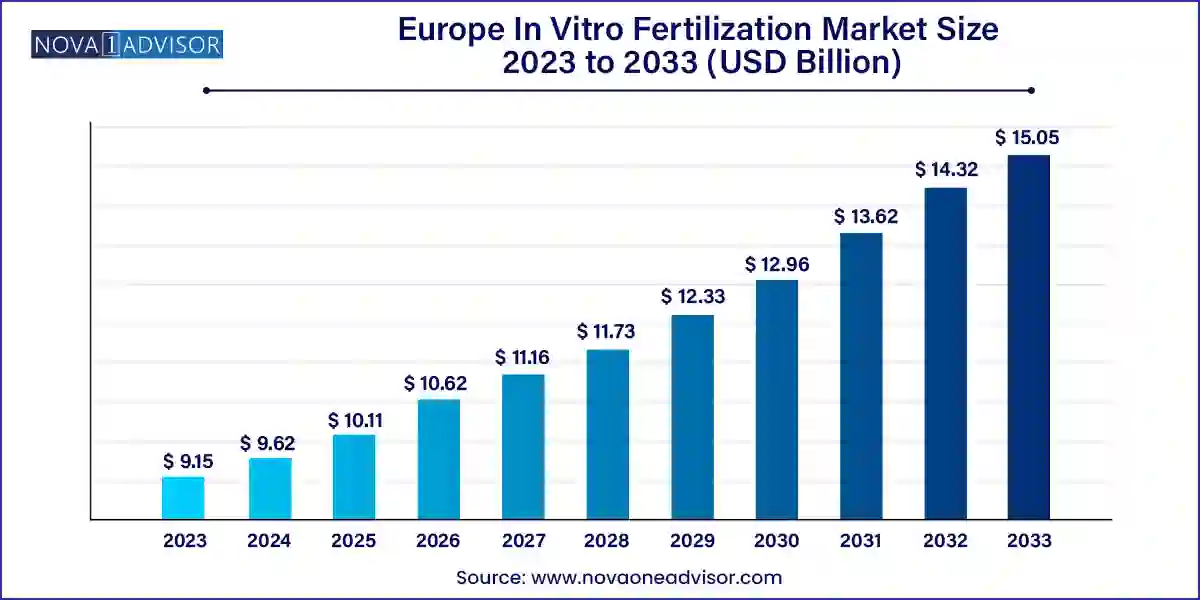

The Europe in vitro fertilization market size was exhibited at USD 9.15 billion in 2023 and is projected to hit around USD 15.05 billion by 2033, growing at a CAGR of 5.1% during the forecast period 2024 to 2033.

The Europe In Vitro Fertilization (IVF) market has emerged as a cornerstone of the global assisted reproductive technology (ART) ecosystem. With declining fertility rates, changing societal norms, and delayed family planning, IVF has transitioned from being a specialized intervention to a widely accepted reproductive choice across Europe. IVF is a process of fertilizing an egg with sperm outside the human body, often involving a series of complex steps such as ovum retrieval, fertilization, embryo culture, and embryo transfer.

Europe has long held a leadership position in ART, not only due to its early regulatory support and pioneering scientific developments but also because of a broad societal acceptance of fertility treatments. Countries like Spain, Belgium, and the UK are major hubs for IVF tourism due to progressive legislation, high clinical success rates, and a wide array of advanced treatment offerings. As of recent years, Europe accounts for a significant portion of the global IVF cycles performed annually, with both public and private providers scaling capacity to meet rising demand.

Technological innovations, such as time-lapse imaging, advanced sperm sorting devices, and AI-integrated embryo selection tools, are reshaping clinical workflows. Moreover, expanded insurance coverage in countries like France and Germany, alongside growing investments in fertility-focused startups and medical device firms, have led to enhanced accessibility and quality of services. With demographic pressures and continuous advancements in embryology, the Europe IVF market is positioned for sustainable growth over the next decade.

Rising age of first-time parents and age-related infertility: Women increasingly seek IVF due to delayed motherhood and age-related decline in fertility.

Surge in cross-border reproductive care (fertility tourism): Countries with liberal IVF laws attract patients from stricter regulatory environments.

Advancements in embryo selection using AI and time-lapse imaging: Clinics are integrating digital technologies to improve implantation success rates.

Growth in egg freezing and social fertility preservation: Demand from career-focused women and patients undergoing medical treatments is increasing.

Increasing demand for donor gametes and surrogacy support services: Broader acceptance of donor-assisted pregnancies is creating new service opportunities.

Integration of automation in lab workflows: Automated cryopreservation, media exchange, and culture monitoring systems are enhancing lab efficiency.

Supportive policy measures and expanded reimbursement: Countries such as France and Germany are expanding state support for fertility treatments.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.62 Billion |

| Market Size by 2033 | USD 15.05 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.1% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Procedure, Providers, Instruments, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | Germany; France; Spain; Italy; UK; Belgium; Netherlands; Switzerland |

| Key Companies Profiled | Vitrolife; Bayer AG; Ferring B.V.; Thermo Fisher Scientific Inc.; LG Chem; Merck KGaA |

A key driver of the IVF market in Europe is the persistent decline in fertility rates across the region. The average total fertility rate in the European Union has remained below the population replacement level of 2.1 children per woman for decades. According to Eurostat, several countries including Italy, Spain, and Portugal have some of the lowest fertility rates globally, hovering around 1.3–1.4 births per woman.

This demographic trend is attributed to various factors, including delayed childbearing, economic uncertainty, urban lifestyle changes, and increased participation of women in higher education and the workforce. As biological fertility naturally declines with age, many couples in their late 30s and early 40s find themselves turning to IVF and other ART procedures to conceive. IVF clinics are responding by offering tailored hormonal stimulation protocols, embryo banking, and preimplantation genetic testing (PGT) to improve outcomes in older patients. The combination of socio-economic shifts and biological necessity has created a sustained and growing demand for IVF services in the region.

Despite its growing popularity and clinical success, IVF remains financially inaccessible for many prospective parents across Europe. The high cost of IVF treatment often ranging from €4,000 to €10,000 per cycle poses a significant barrier to widespread utilization, particularly in countries with limited or no public funding. While nations like France and Belgium offer generous reimbursement for multiple IVF cycles under national health insurance, others like Ireland and parts of Eastern Europe provide minimal or no support.

Moreover, indirect expenses such as travel, accommodation (especially for fertility tourism), egg/sperm donor costs, and medication further elevate the financial burden. In countries without standardized pricing or regulation, the cost discrepancy between clinics can also affect patient decision-making. This cost barrier can lead to socioeconomic disparities in fertility care access, pushing patients to delay or forgo treatment altogether. Without consistent funding mechanisms or broader coverage mandates, the full potential of IVF adoption in Europe remains constrained.

One of the most promising opportunities in the Europe IVF market lies in the integration of advanced technologies and lab automation to enhance success rates, reduce human error, and increase efficiency. IVF success is closely linked to the precision of lab procedures, embryo handling, and culture environments. Innovations such as AI-based embryo selection, time-lapse monitoring (e.g., Vitrolife's EmbryoScope+), automated cryopreservation systems, and digital witness systems are transforming lab operations across European fertility clinics.

In March 2024, Vitrolife launched the EmbryoScope+ in select European markets, introducing high-resolution time-lapse imaging with AI integration to assess embryo viability and improve implantation predictions. Clinics adopting such technologies are reporting improvements in clinical pregnancy rates and workflow standardization. Additionally, automated media exchange and embryo handling tools reduce reliance on manual processes, leading to higher throughput and consistency. As the regulatory environment in Europe supports evidence-based innovation, clinics that embrace digital and automated systems are positioned to differentiate their services and improve patient outcomes.

Culture media dominated the instrument segment, accounting for the largest revenue share due to its essential role in every stage of the IVF process from sperm and ovum processing to embryo culture and cryopreservation. IVF success heavily depends on maintaining optimal pH, temperature, and nutrient composition in culture media. Leading providers such as CooperSurgical, Vitrolife, and Origio offer a wide range of specialized media formulations tailored to specific embryology protocols. Cryopreservation media, in particular, is witnessing strong growth with the rise in egg and embryo freezing for both medical and social reasons.

Equipment is the fastest-growing segment, driven by the increasing adoption of advanced embryology devices that support automation, precision, and safety. This includes sperm analyzers, micromanipulators, anti-vibration tables, and AI-integrated imaging systems. Clinics are investing in integrated IVF cabinets, cleanroom setups, and gas-controlled incubators to maintain stable environments for embryo development. Equipment innovations are also aligned with patient preferences for minimal stimulation cycles, embryo banking, and elective freezing, which demand higher-quality instrumentation to ensure viability.

Fertility clinics dominate the provider segment, contributing the majority of IVF cycles across Europe. These clinics often offer specialized services, advanced lab equipment, and individualized care models, making them the preferred choice for ART procedures. Major cities like London, Barcelona, Brussels, and Prague have become centers of excellence, attracting both domestic and international patients. Fertility clinics are also at the forefront of adopting AI tools, personalized stimulation protocols, and fertility preservation techniques.

Hospitals and other settings are growing faster, particularly as public hospitals in countries like France and Germany expand IVF offerings under national health systems. Additionally, some multi-specialty hospitals are developing dedicated reproductive medicine departments to tap into the growing demand for ART. These settings often cater to medically complex cases or patients seeking publicly funded IVF options, thereby increasing patient accessibility and equity in care.

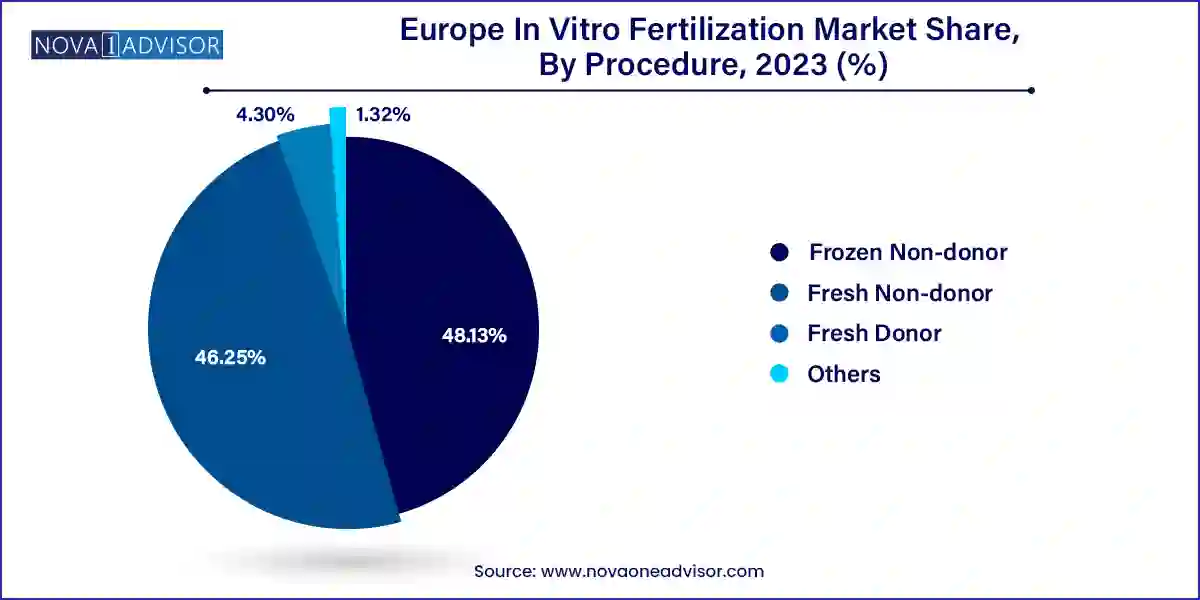

Fresh non-donor procedures remain the most common, as many couples prefer to use their own eggs and sperm for fertilization. These procedures typically have slightly higher success rates compared to frozen cycles and are favored in countries with fewer regulatory restrictions and higher public reimbursement. Clinics in Germany, France, and Italy primarily offer fresh cycles as the first-line treatment unless medical conditions warrant freezing.

Frozen donor cycles are the fastest-growing procedure type, fueled by increased acceptance of donor gametes, expanded cryopreservation capabilities, and changes in social dynamics. Patients with low ovarian reserve, single parents, same-sex couples, and older women are increasingly opting for donor egg or sperm cycles. Countries like Spain and Belgium, where gamete donation is anonymous and widely accepted, have become key destinations for donor-based IVF services. The growing demand for donor databases, genetic screening, and embryo matching is expected to further drive this segment.

Spain leads the Europe IVF market due to its liberal reproductive laws, high clinical success rates, and role as a major fertility tourism hub. Spain allows anonymous gamete donation, same-sex couple access to IVF, and has no legal age limit (though clinical cutoffs exist), making it attractive for international patients. With more than 400 fertility centers, the country has one of the highest numbers of IVF cycles performed annually. Spanish clinics such as IVI-RMA have built global reputations for excellence, supported by robust training programs, research output, and partnerships with leading IVF device manufacturers.

France is experiencing the fastest growth in IVF procedures following its 2021 healthcare law reform, which expanded access to ART for single women and lesbian couples under the national health insurance scheme. The government funds up to four full IVF cycles, which has led to a significant uptick in domestic demand. In addition to traditional public fertility centers, private clinics are scaling operations to meet the increased patient load. Companies like Ferring Pharmaceuticals and Igenomix have increased their footprint in France to support the rising need for reproductive drugs, genetic screening, and fertility diagnostics.

March 2024 – Vitrolife launched its next-generation EmbryoScope+ in Europe, integrating AI-driven embryo grading and enhanced time-lapse imaging capabilities to improve IVF success rates and lab standardization.

January 2024 – CooperSurgical expanded its IVF lab equipment portfolio with the launch of a modular automated cryopreservation platform for vitrification and thawing processes, targeting clinics in Germany and the UK.

February 2024 – Merck Group announced a €50 million investment in upgrading its fertility innovation and manufacturing facility in Darmstadt, Germany, focusing on injectable hormone development and supply chain scalability.

December 2023 – Gedeon Richter partnered with a chain of fertility clinics in Italy to co-develop a digital IVF tracking solution, offering real-time patient engagement, medication reminders, and embryo development updates.

November 2023 – Medicover Fertility announced a multi-clinic expansion in Poland and Romania, aimed at serving increasing cross-border IVF demand in Eastern Europe under EU directives on reproductive rights.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe in vitro fertilization market

Instrument

Procedure

Providers

Country