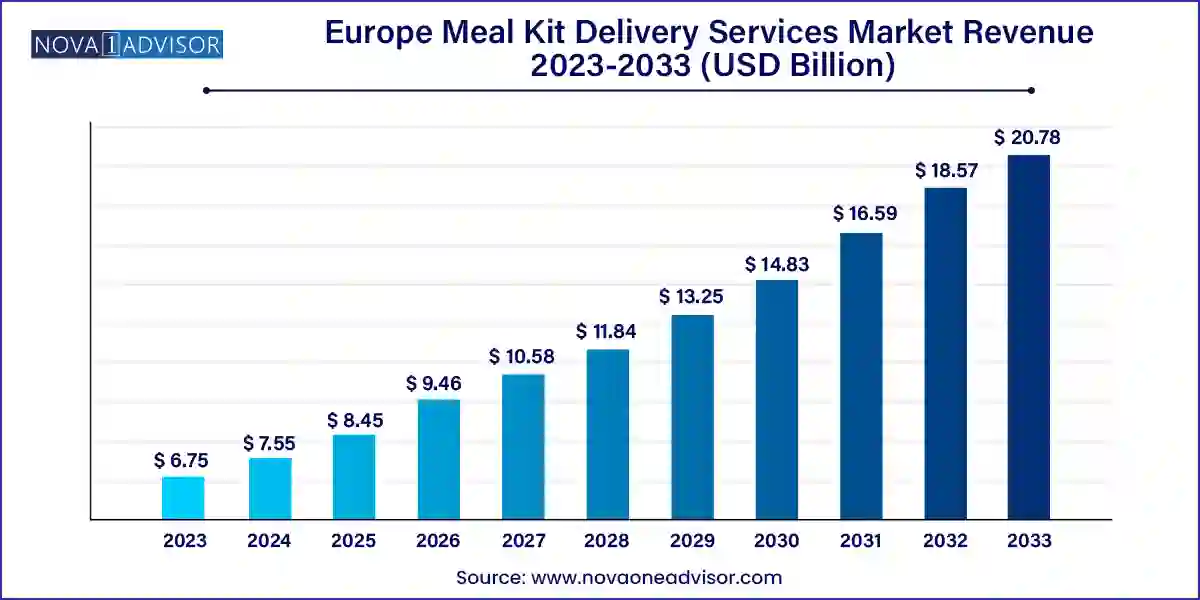

The Europe meal kit delivery services market size was exhibited at USD 6.75 billion in 2023 and is projected to hit around USD 20.78 billion by 2033, growing at a CAGR of 11.9% during the forecast period 2024 to 2033.

The Europe meal kit delivery services market has emerged as a dynamic and rapidly evolving space, characterized by consumer-driven innovation, the rise of health-conscious lifestyles, and a growing preference for convenience without compromising food quality. Across major economies like Germany, the UK, France, Italy, and Spain, busy urban consumers are embracing meal kits as a practical and enjoyable alternative to traditional cooking and dining out.

At its core, a meal kit service delivers pre-measured ingredients and recipes directly to consumers' doorsteps. These services bridge the gap between grocery shopping and ready-to-eat meals by allowing consumers to prepare fresh meals at home with minimal waste, planning, or effort. The increasing popularity of meal kits in Europe is closely linked to shifting demographic and social trends, including urbanization, smaller household sizes, dual-income families, and a generational shift toward sustainability and personalized nutrition.

What makes the European market especially distinctive is the deep-rooted food culture across different countries. This presents both a challenge and an opportunity—brands must cater to traditional tastes while introducing innovative formats. For instance, German consumers favor balanced and seasonal ingredients; the French market leans toward gourmet kits; British consumers appreciate flexibility and global flavors, while Italians value simplicity and authenticity.

The COVID-19 pandemic gave the market a significant boost, with home-cooking gaining renewed importance. Though the pandemic is now in the rearview mirror, the behavioral shift it triggered remains. The market continues to benefit from increased digitalization, enhanced cold-chain logistics, and a more health-oriented consumer mindset. The future of meal kit delivery in Europe lies in hyper-local customization, sustainability leadership, and integration with broader food-tech ecosystems.

Health-Driven Customization: Meal kits tailored for specific health goals (e.g., keto, gluten-free, low-carb, diabetic-friendly) are rapidly gaining market share.

Sustainable Packaging and Sourcing: Eco-conscious European consumers are demanding recyclable, biodegradable, and minimalistic packaging, along with sustainably sourced ingredients.

Technology-Driven Experience: Integration with apps, AI-driven personalization, and subscription management tools enhance user experience and retention.

Localization of Global Brands: International players like HelloFresh and Marley Spoon are adapting their menus and delivery models to local preferences in markets like France, Germany, and Italy.

Retail Convergence: Offline channels, including pop-up stores and meal kit placements in supermarkets such as Tesco (UK) and Carrefour (France), are blending with online platforms to increase visibility and consumer reach.

Premiumization and Gourmet Experiences: A growing segment of consumers is willing to pay more for gourmet-style meal kits featuring chef-designed recipes, premium meats, organic vegetables, and wine pairings.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.55 Billion |

| Market Size by 2033 | USD 20.78 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Offering, Service, Platform, Meal Type, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Germany; UK; France; Italy; Spain |

| Key Companies Profiled | HelloFresh; Marley Spoon Inc.; Quitoque; Kochhaus; Middagsfrid ; Allerhandebox ; Chefmarket; Kochzauber; Fresh Fitness Food ; Mindful Chef |

A key driver propelling the growth of meal kit delivery services in Europe is the increasing demand for convenient, home-cooked meals without the hassle of meal planning and grocery shopping. Time-pressed consumers, especially urban millennials and Gen Z, are looking for solutions that simplify their food routines while maintaining quality and nutrition. Meal kits fulfill this demand by offering flexibility, portion control, and variety in an affordable, accessible manner.

With the rise in dual-income households and single-person homes across Europe, particularly in countries like Germany and the UK, meal kits provide a perfect middle ground between eating out and cooking from scratch. Consumers also enjoy the educational aspect—learning new recipes and culinary skills while preparing their own meals. This appeal to both convenience and experience has led to widespread adoption, especially among younger demographics.

Despite rising popularity, cost remains a significant barrier for meal kit adoption in Europe, especially during periods of economic slowdown or inflationary pressure. Many consumers perceive meal kits as more expensive than traditional grocery shopping, particularly for larger households or budget-conscious consumers.

Additionally, the European market—unlike North America—has a deep-seated tradition of shopping at local markets or preparing meals from fresh produce at home. This cultural norm, combined with the recent rise in food inflation, has pushed some consumers to revert to cost-effective alternatives. Subscription fatigue is another challenge, with some users canceling services after initial trials due to monotony, pricing concerns, or changes in lifestyle.

A promising opportunity lies in the integration of meal kits with wellness and functional nutrition, especially targeting specific dietary needs and health conditions. As the European population ages and consumers become more proactive about their health, there's rising demand for functional meals that support immunity, gut health, cardiovascular health, and energy balance.

Meal kit services can collaborate with dietitians, fitness brands, and wellness startups to develop curated programs that go beyond calorie counting—incorporating ingredients with proven health benefits, detailed nutritional labeling, and meal scheduling aligned with users' health objectives. For instance, a diabetic-friendly meal plan or a menopause-supporting diet could open up new high-value customer segments. Countries like the UK and Germany are already witnessing this trend, with several startups positioning themselves as health-tech platforms rather than mere food delivery services.

The Cook & Eat segment dominated the European market, owing to its appeal among consumers who value the process of cooking as part of the overall dining experience. Across the UK, France, and Germany, consumers in the mid- to premium-income brackets enjoy the experience of preparing high-quality meals at home without the hassle of grocery shopping. Cook & Eat kits often come with seasonal, locally sourced ingredients and easy-to-follow recipes, enabling users to experiment with new cuisines and recreate restaurant-style dishes at home. HelloFresh and Gousto have capitalized on this trend, offering extensive menus with regional and international options.

However, Heat & Eat is the fastest-growing segment, particularly in densely populated urban centers and among older demographics. With improvements in food preservation, vacuum packaging, and sous-vide cooking, Heat & Eat kits now offer taste and texture that rivals freshly cooked meals. This format is gaining popularity among busy professionals and seniors seeking quick, healthy meals that require minimal effort. In Spain and Italy, where lunch breaks are often short, Heat & Eat kits are becoming common in office canteens and home deliveries alike.

Multiple-meal subscriptions dominate the service segment, offering users weekly meal plans that streamline meal preparation throughout the week. Consumers who prefer structure, especially families or working couples, find value in the consistent scheduling, variety, and cost efficiency these plans offer. Brands such as Marley Spoon and Foodly provide subscription tiers based on servings per week and dietary preferences. In Germany and the UK, subscription models with integrated delivery scheduling and ingredient swaps are particularly popular.

Nevertheless, single-meal orders are gaining popularity among younger, on-the-go consumers and trial users. This format is especially attractive to those who prefer flexibility and do not wish to commit to recurring deliveries. Single-meal kits are increasingly available through retail placements or delivery aggregators like Deliveroo or Uber Eats, giving consumers the option to try meal kits as one-off experiences. This model also appeals to consumers with dynamic schedules or specific cravings, expanding the market to impulse buyers and occasional users.

Non-vegetarian meal kits remain the dominant segment due to Europe’s culinary heritage, which includes meat, poultry, and seafood as staple components of many traditional dishes. Consumers generally prefer diverse options that include chicken curry, beef stroganoff, or salmon teriyaki, offered by players like Gousto or Marley Spoon. These kits also provide better protein density, making them popular among fitness enthusiasts and families.

On the other hand, vegan kits are showing the fastest growth, spurred by the rise of plant-based diets and environmental awareness. Particularly in the UK and Germany, demand for meat alternatives and dairy-free recipes has exploded. Companies are innovating with chickpea stews, tofu stir-fries, and lentil-based curries to cater to this trend. Partnerships with vegan brands like Beyond Meat and Oatly are also becoming common to enhance product credibility.

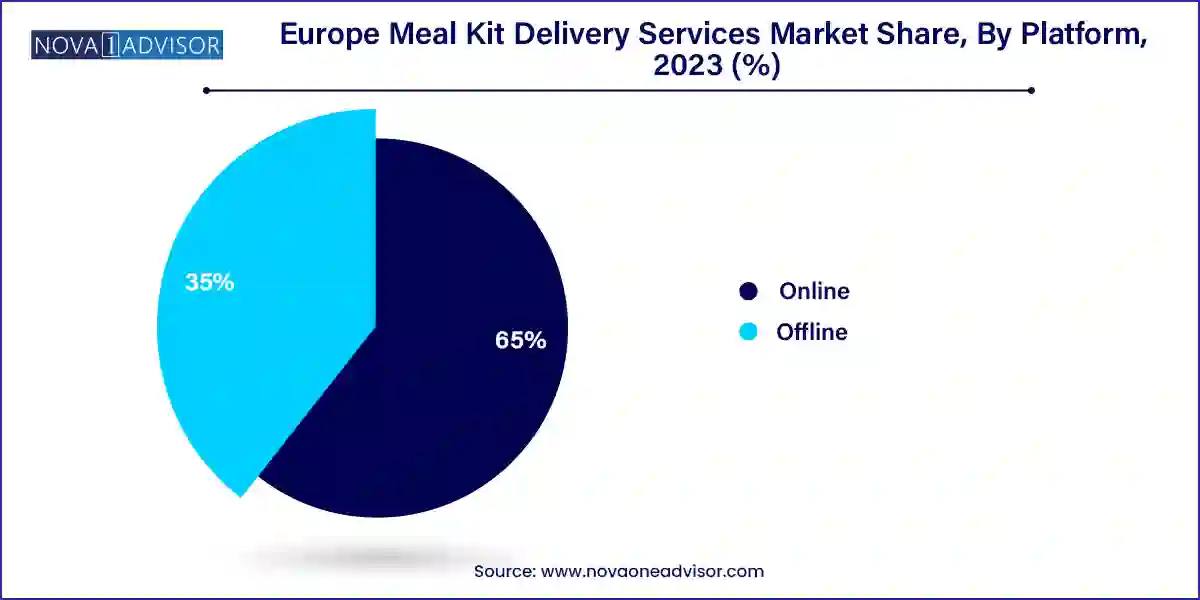

The online platform is the primary driver of meal kit sales in Europe, enabled by the high internet penetration, mobile-first ordering, and app-based ecosystem. Subscription management, customer reviews, personalized menus, and interactive recipe videos enhance the online experience. Brands like HelloFresh, Mindful Chef, and Gousto have built their entire business models on direct-to-consumer platforms, utilizing sophisticated CRM tools and AI to track and respond to consumer behavior in real time.

Meanwhile, offline platforms are witnessing renewed interest as part of omnichannel expansion strategies. Meal kits are being introduced in physical retail outlets like Waitrose (UK), Edeka (Germany), and Carrefour (France), allowing brands to reach a broader audience including those who prefer in-person shopping. These retail touchpoints serve as entry points for consumers to sample kits before subscribing, and they help build brand trust in regions where digital adoption is slower or older consumers dominate.

Germany leads the European meal kit delivery services market, supported by its large urban population, tech-savvy consumers, and environmental consciousness. Berlin and Hamburg are hubs for startups experimenting with organic and sustainable meal kits. HelloFresh, headquartered in Berlin, is the market leader and a global trendsetter in recipe innovation and logistics optimization.

The UK boasts one of the highest meal kit penetration rates in Europe. Busy urban lifestyles, high levels of digital literacy, and strong demand for international cuisines have made services like Gousto and Mindful Chef household names. The UK market also stands out for its emphasis on personalized nutrition and subscription flexibility.

France’s market is driven by culinary sophistication and consumer desire for gourmet experiences at home. Quitoque and other local startups are innovating with region-specific recipes and high-end ingredients. The market is also characterized by a higher willingness to pay for quality, aiding the growth of premium kits.

In Italy, traditional cooking remains deeply rooted in culture. However, meal kits offering regional favorites such as risottos, pasta sauces, and antipasti are slowly gaining popularity, especially among young professionals in Rome and Milan. Italian consumers value freshness, which is prompting providers to work with local suppliers.

Spain is an emerging market for meal kits, with startups focusing on Mediterranean diets and health-centric recipes. The increasing adoption of e-commerce and shift toward home-cooked meals post-pandemic is expected to accelerate growth. Barcelona is becoming a hub for culinary innovation, and meal kits are part of this transformation.

HelloFresh (Germany) announced in February 2025 the launch of a new AI-powered meal customization engine to enhance user experience and retention across European markets.

Gousto (UK) raised additional funding in November 2024 to expand its manufacturing capacity and introduce eco-friendly packaging options.

Quitoque (France) partnered with Carrefour in December 2024 to distribute its meal kits through select hypermarkets across France, expanding its offline footprint.

Marley Spoon rolled out a sustainability initiative in January 2025, promising to achieve 100% recyclable packaging by 2026 in all EU markets.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe meal kit delivery services market

Offering

Service

Platform

Meal Type

Country