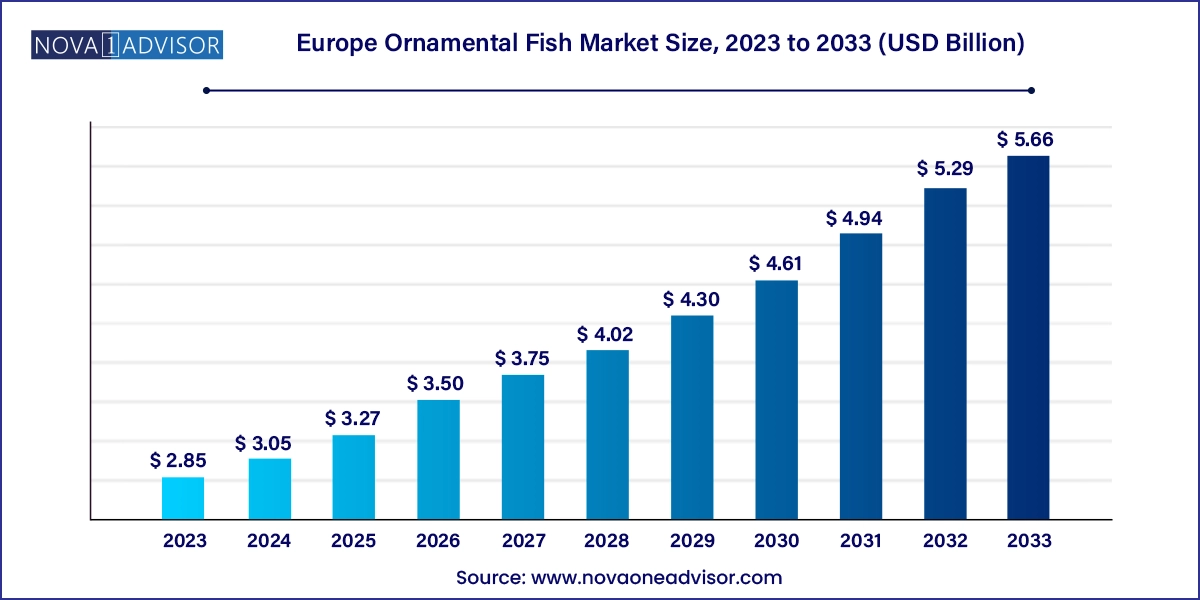

The Europe ornamental fish market size was exhibited at USD 2.85 billion in 2023 and is projected to hit around USD 5.66 billion by 2033, growing at a CAGR of 7.11% during the forecast period 2024 to 2033.

The ornamental fish market in Europe has evolved into a thriving industry supported by a growing community of hobbyists, expanding aquascaping trends, and increased consumer interest in pet companionship. What began as a niche hobbyist segment has now become a multi-million-euro market encompassing the breeding, trade, maintenance, and aesthetic presentation of a diverse range of exotic fish species. Ornamental fish are aquatic pets that are bred or caught for display in aquariums and water gardens, serving both recreational and decorative purposes. Their popularity spans across households, commercial lobbies, hotels, restaurants, and healthcare environments.

Europe stands out as one of the most influential regions in the global ornamental fish market due to its long-standing aquarium culture, robust import-export network, and high levels of discretionary spending. Countries like Germany, the UK, and France lead the charge in terms of both consumption and innovation, often setting global trends in aquascaping styles, fish wellness standards, and sustainable sourcing practices. The European market benefits from a strong infrastructure that includes specialist retail chains, aquarium design services, online distributors, and dedicated aquatic veterinarians.

The industry is deeply intertwined with ecological and regulatory aspects. There’s a growing emphasis on ethical breeding, sustainable harvesting, and biosecurity protocols to prevent invasive species or disease outbreaks. Moreover, advancements in aquarium technology such as automated feeding systems, pH monitoring sensors, and LED lighting have made ornamental fishkeeping more accessible to the average consumer, spurring market growth. Social media has also played a pivotal role, with platforms like YouTube and Instagram promoting elaborate aquascape designs and fish care tutorials, driving greater engagement and knowledge-sharing.

Despite its positive outlook, the market is not without challenges. Disease management, environmental concerns regarding overfishing of marine varieties, and tightening animal welfare regulations pose notable hurdles. Nonetheless, the trend toward personalized aquatic ecosystems, combined with high consumer willingness to invest in hobbyist-grade fish and accessories, positions the Europe ornamental fish market for sustained growth.

Surge in Aquascaping Culture: Enthusiasts across Europe are adopting aquascaping as an art form, designing intricate underwater landscapes with live plants and ornamental fish.

Premiumization of Fish Species: Demand is increasing for rare and premium varieties such as Flowerhorn cichlids, Arowanas, and imported Betta species.

Rise of Online Retail Platforms: E-commerce platforms are facilitating the direct purchase and home delivery of live fish, tanks, and accessories, enhancing accessibility.

Integration of Smart Aquarium Tech: Smart tanks with auto-regulators, Wi-Fi-enabled feeders, and environment monitors are making fishkeeping easier for beginners.

Sustainable and Ethical Sourcing: European consumers are increasingly opting for ethically bred, disease-free fish that are sourced through certified supply chains.

Educational and Therapeutic Applications: Aquariums are being installed in schools, healthcare settings, and therapy centers to promote relaxation and cognitive development.

Growing Preference for Freshwater Species: Due to lower maintenance costs, freshwater species are favored over marine fish among first-time fishkeepers.

Customization in Aquarium Design: Homeowners and interior designers are now requesting custom-built aquariums that align with their aesthetics, from minimalist designs to exotic reef-like structures.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.05 Billion |

| Market Size by 2033 | USD 5.66 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Product, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK, Germany, France, Italy, Spain |

| Key Companies Profiled | Aqua-Nautic Specialist PTE LTD; Oasis Fish Farm; Sanyo Aquarium (Pte) Ltd; AlgaeBarn LLC; bioAquatiX; Imperial Tropicals; LiveAquaria; SUNBEAM AQUARIUM PTE LTD; Qian Hu Corporation Limited; Tropical Fish International Pte Ltd |

Rising Popularity of Ornamental Fish as Companions in Urban Lifestyles

One of the most influential drivers behind the growth of the European ornamental fish market is the rising preference for low-maintenance pets, especially among urban dwellers with space and time constraints. Unlike traditional pets such as dogs or cats, ornamental fish require limited direct interaction, making them ideal for individuals with busy schedules or smaller living spaces. Their calming visual appeal also adds an aesthetic value to homes, offices, and public places.

For instance, a compact apartment in Paris or Berlin can be transformed by the simple addition of a nano aquarium with vibrant guppies and aquatic plants. Fishkeeping offers a therapeutic escape from digital fatigue, serving as a mindfulness activity for individuals across all age groups. Particularly during the COVID-19 pandemic, there was a noticeable surge in pet adoption, including ornamental fish, as people sought comfort during periods of isolation. This shift has continued post-pandemic, driving consistent demand for new species, better equipment, and high-quality feed.

High Mortality Rates and Disease Management Challenges

A significant barrier to ornamental fishkeeping is the vulnerability of fish to diseases, stress, and environmental fluctuations. Unlike land-based pets, early signs of fish illness can be difficult to detect, leading to sudden mortality. The ornamental fish supply chain often involves long transport durations and multiple handling stages, which increase the likelihood of stress-induced illness or parasite introduction.

For instance, marine species imported from Southeast Asia into Europe sometimes suffer during transit due to poor oxygenation or sudden temperature changes. Moreover, if not quarantined properly, a single infected fish can wipe out an entire tank. Inadequate knowledge among hobbyists about water chemistry, filtration, and fish compatibility further contributes to health issues. These challenges deter new entrants into the hobby and raise operational costs for breeders and retailers who must maintain strict biosecurity measures. Addressing this requires consumer education, improved supply chain handling, and better disease diagnosis technologies.

Expansion of Therapeutic and Educational Applications

A promising growth opportunity lies in leveraging ornamental fish for therapeutic and educational environments. Scientific studies have shown that observing fish in aquariums can lower blood pressure, reduce anxiety, and enhance mental clarity. As a result, aquariums are increasingly being adopted in mental health clinics, senior care homes, and rehabilitation centers across Europe.

Educational institutions are also integrating aquariums into their curriculum to teach students about ecosystems, biology, and environmental conservation. For example, some primary schools in the UK and Germany use classroom aquariums to foster curiosity and responsibility among children. This application not only opens up a new revenue stream for aquarium suppliers but also introduces fishkeeping to younger generations, cultivating lifelong customers. The growing recognition of aquariums as tools for mental wellness and education is likely to drive future demand and innovation.

The Europe topical freshwater fish market accounted for a revenue share of 50.0% in 2023. These species—such as Neon Tetras, Guppies, Angelfish, and Gouramis—are often considered beginner-friendly and are widely available through both physical and online pet stores. Their colorful patterns and diverse behavior make them ideal for both personal and decorative purposes. They also require less sophisticated equipment compared to marine species, which further enhances their popularity among first-time buyers. European breeders also favor these species due to ease of breeding and relatively lower mortality during shipment.

The Marine ornamental fish are witnessing the fastest growth, particularly among experienced aquarists and commercial buyers who are drawn to their exotic appeal. Marine species such as Clownfish, Blue Tang, and Mandarin Goby are popular for their striking appearance and compatibility with reef setups. Advances in saltwater tank technology, coupled with better knowledge sharing via online communities, have encouraged more hobbyists to transition into marine fishkeeping. This segment is also supported by public aquariums and high-end commercial setups, including luxury hotels and corporate offices that invest in elaborate reef displays for customer engagement and ambience enhancement.

The household ornamental fish market in Europe accounted for a revenue share of 71.93% in 2023. driven by the growing popularity of personal aquariums among pet lovers, families, and apartment residents. Ornamental fish offer a unique pet ownership experience that blends beauty, tranquility, and manageable care routines. Families with young children, for instance, often introduce aquariums as a first pet responsibility, creating a lasting bond with aquatic life. Homeowners also consider aquariums as an element of home décor, often placing them in living rooms, kitchens, or entryways to create visual interest. This segment benefits from steady product innovations, including compact nano tanks, desktop aquariums, and customizable stands.

The commercial application segment is growing rapidly, especially as more businesses in hospitality, healthcare, and corporate sectors invest in aquariums for ambiance and branding. Upscale hotels in Italy and Spain use large aquariums in lobbies to attract and calm guests. Dental and medical clinics across Germany and France install aquariums in waiting rooms to reduce patient anxiety. In such settings, fish tanks are not merely decorative but serve a functional role in enhancing customer experience. The growing influence of wellness-centric architecture and biophilic design is expected to further fuel demand in the commercial segment.

Germany is one of the largest markets for ornamental fish in Europe, with a long-standing aquarium culture and a mature distribution network. German consumers show a high level of awareness regarding fish welfare, leading to a preference for ethically bred and well-documented species. The country is home to several aquarium product manufacturers and wholesalers that set industry standards across the region.

The UK ornamental fish market is driven by a strong pet ownership culture and a growing interest in aquascaping among millennials. The rise of online specialty shops and aquarium YouTube influencers has created a vibrant community of hobbyists. The post-Brexit regulatory changes have introduced some complexity in fish imports, but the domestic breeding sector is adapting quickly.

France’s market is characterized by stylish and modern aquarium setups that emphasize aesthetics. French consumers often favor designer aquariums that serve as art installations. The demand for premium tropical fish and live aquatic plants is growing, particularly in urban centers like Paris and Lyon.

Italy is emerging as a hotspot for marine ornamental fish, with coastal cities showing particular interest in reef tank setups. Aquarium cafés and themed restaurants are also adopting elaborate fish displays, contributing to the commercial growth of the segment. Local breeders in Italy are increasingly collaborating with environmental agencies to ensure sustainable practices.

In Spain, ornamental fish are becoming a fixture in both households and public spaces. The favorable climate supports breeding facilities, especially in southern regions. Spanish hobbyists are increasingly exploring native aquatic species for aquariums, promoting biodiversity and conservation awareness within the industry.

February 2024: Tropica Aquarium Plants, a leading supplier in Europe, launched a new range of aquascaping plants with sustainable packaging, targeting eco-conscious consumers across France and Germany.

December 2023: German brand EHEIM introduced a Wi-Fi-enabled filter system that allows users to monitor tank parameters remotely via a mobile app, appealing to tech-savvy hobbyists.

October 2023: UK-based Maidenhead Aquatics partnered with schools to launch educational aquarium programs, aiming to promote fish care and aquatic biology among students.

August 2023: Italian startup AquaSymbio announced a collaboration with marine research institutes to breed exotic marine fish species domestically, reducing import dependency.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe ornamental fish market

Product

Application

Regional