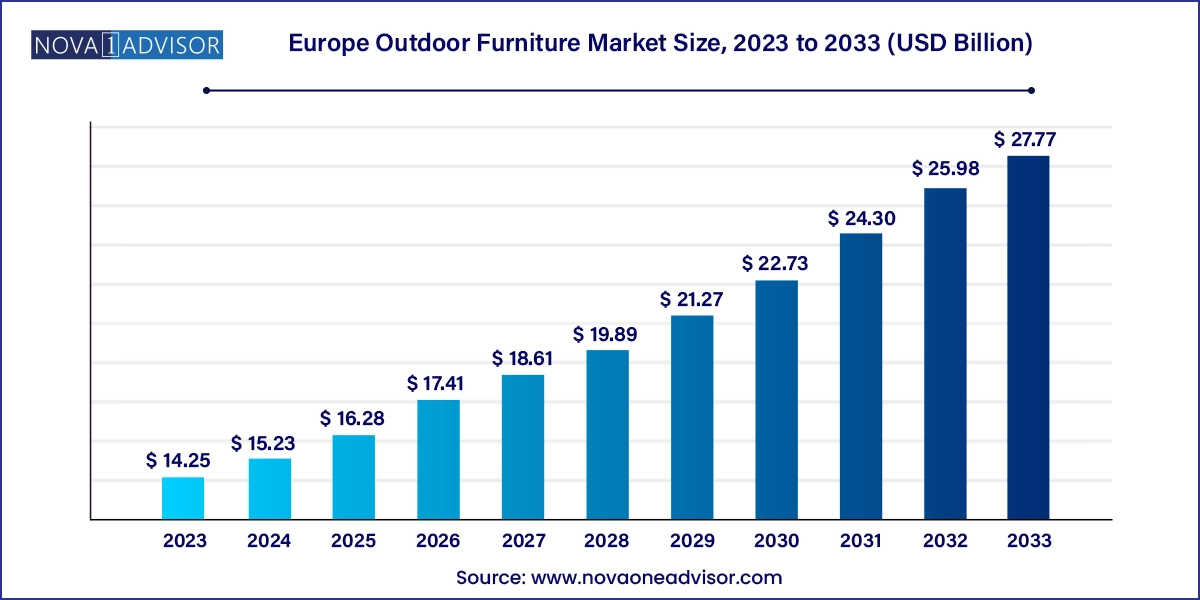

The Europe outdoor furniture market size was exhibited at USD 14.25 billion in 2023 and is projected to hit around USD 27.77 billion by 2033, growing at a CAGR of 6.9% during the forecast period 2024 to 2033.

The Europe outdoor furniture market is witnessing significant transformation, shaped by shifting consumer lifestyles, evolving home design preferences, and increasing investments in outdoor living spaces. As urban populations continue to seek balance between indoor comfort and outdoor relaxation, the role of outdoor furniture in enhancing leisure, aesthetics, and functionality has never been more prominent. Whether it’s terraces in city apartments, sprawling suburban gardens, rooftop lounges, or commercial outdoor dining setups, well-designed outdoor furniture is increasingly perceived as a core component of modern living.

Over the past decade, European consumers have redefined their relationship with their homes, placing greater emphasis on creating serene, recreational spaces that offer refuge from fast-paced digital lives. This sentiment has fueled demand for diverse types of outdoor furniture, including ergonomic loungers, durable dining sets, foldable chairs, and multifunctional seating systems. The boom in real estate refurbishments, especially post-COVID, has driven homeowners to invest in upgrading patios, decks, balconies, and courtyards—further stimulating the outdoor furniture industry.

Materials and design innovation are also central to the market’s momentum. The demand for weather-resistant, eco-friendly, and lightweight furniture has intensified, pushing manufacturers toward sustainable materials like FSC-certified wood, recyclable plastics, and powder-coated metals. Simultaneously, modular and contemporary aesthetics, often influenced by Scandinavian design principles, have become mainstream. Moreover, digital retailing, through e-commerce channels and virtual product visualization tools, has expanded accessibility, allowing consumers across Europe to explore and personalize furniture selections from global and local brands alike.

The commercial sector, particularly hospitality, is also a key market contributor. As hotels, cafes, resorts, and event venues emphasize ambiance and comfort in outdoor settings, the need for high-performance and stylish furniture continues to rise. This dual demand—from residential and commercial customers—ensures a strong foundation for consistent market growth across Europe.

Growing Popularity of Outdoor Living Concepts: Homeowners are treating patios and terraces as functional extensions of their indoor spaces, complete with dining, lounging, and entertaining setups.

Sustainability and Eco-Conscious Materials: There is a noticeable shift toward sustainably sourced wood, recycled plastic, and recyclable metal materials in both premium and mass-market furniture.

Smart Outdoor Furniture Innovations: Integration of technology—such as solar-powered tables, lighting-enabled furniture, and smart cushions—is gaining traction.

Rise of Modular and Multifunctional Designs: Furniture that offers flexible arrangements, easy storage, and multiple uses (e.g., seating doubling as storage units) is becoming increasingly popular.

Influence of Urban Gardening and Balcony Décor: The trend of decorating small outdoor spaces like balconies is driving demand for compact, foldable, and vertical furniture pieces.

Expansion of E-Commerce and Virtual Showrooms: Online platforms are enabling better product comparison, 3D visualization, and customization, enhancing consumer engagement.

Customization and Personalization Options: Brands are offering tailored designs, finishes, and cushions, especially in premium and luxury segments.

Premiumization of Outdoor Spaces: High-income households are increasingly investing in luxurious outdoor collections with designer aesthetics and comfort-forward features.

| Report Coverage | Details |

| Market Size in 2024 | USD 15.23 Billion |

| Market Size by 2033 | USD 27.77 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Material Type, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK, Germany, France, Italy, Spain |

| Key Companies Profiled | Inter IKEA Systems B.V.; Keter; Brown Jordan Inc.; Barbeques Galore; Ashley Furniture Industries, Inc.; Fermob; Hartman; Kettal; Gloster; Royal Botania |

Increasing Consumer Investment in Outdoor Living and Wellness

A key driver propelling the European outdoor furniture market is the growing consumer emphasis on outdoor living as an extension of personal wellness and relaxation. The demand for outdoor retreats within residential premises has grown exponentially, especially after the lifestyle shifts prompted by the COVID-19 pandemic. Europeans now prioritize spending time in fresh air, natural light, and tranquil outdoor settings—not only for leisure but also for mental well-being.

From urban rooftops in Milan and Paris to countryside patios in Spain, consumers are transforming their outdoor spaces into wellness zones that include yoga corners, open-air dining areas, and meditative lounges. This shift has fueled demand for ergonomic loungers, weatherproof dining sets, and cozy sectional sofas. Brands catering to this sentiment by offering comfort-enhancing designs—adjustable recliners, cushioned seats, and breathable fabric sets—are witnessing high engagement. The result is a robust market upliftment supported by rising expenditure on home enhancement, lifestyle alignment, and outdoor leisure pursuits.

Weather Dependency and Seasonality of Outdoor Furniture Usage

One of the primary restraints in the European outdoor furniture market is its inherent dependency on seasonal weather conditions. Outdoor furniture is largely used during spring, summer, and early autumn; prolonged cold or rainy months often limit usability and, consequently, consumer purchasing patterns. This seasonal limitation not only affects consumer spending cycles but also poses inventory management challenges for retailers.

For instance, Northern European countries like the UK and Germany experience extended winters, often necessitating the storage of furniture for several months—discouraging impulse buying or year-round investment. This cyclic nature also restricts frequent product innovation, as designers must cater to limited usage windows. Additionally, unless products are designed to be weather-resistant and low-maintenance, wear and tear caused by rain, frost, and UV exposure can deter consumers from investing in outdoor setups. Overcoming this barrier requires manufacturers to emphasize all-season durability, compact storage, and multifunctionality, but not all brands are equally equipped to meet these standards.

Expanding Demand from Commercial Outdoor Spaces in Hospitality and F&B Sectors

The growing commercial investment in outdoor ambiance by restaurants, hotels, resorts, and public spaces presents a significant opportunity in the European outdoor furniture market. As the hospitality industry shifts toward open-air dining and wellness-focused guest experiences, the need for sophisticated, weatherproof, and visually appealing furniture is intensifying.

In cities like Barcelona and Rome, sidewalk cafés are upgrading their outdoor arrangements to enhance customer comfort and aesthetics. Luxury hotels across the French Riviera, for instance, are investing in designer outdoor loungers and poolside cabanas to attract high-net-worth tourists. Moreover, outdoor weddings, garden events, and corporate gatherings are increasingly hosted in al fresco settings, creating new demand for stylish yet durable furnishings.

This opportunity extends to transit hubs and shopping centers that now feature public seating lounges, outdoor food courts, and pedestrian rest areas. Manufacturers that offer customizable, contract-grade furniture with brandable options and bulk supply capabilities are well-positioned to capitalize on this growing segment.

The outdoor seating seat furniture accounted for a revenue share of 27.2% in 2023. owing to their versatility, comfort, and aesthetic appeal across both residential and commercial applications. These sets—typically comprising sofas, sectional arrangements, and armchairs with coffee tables—have become a mainstay for patios, gardens, and terraces. Consumers favor them for hosting guests, relaxing outdoors, or enjoying meals in a casual setup. The rise of modular and lounge-style seating, often padded with weather-resistant upholstery, is reinforcing demand. Brands such as Kettler and Hartman have introduced collections combining metal and rattan textures, catering to diverse design tastes from rustic to contemporary.

The demand for the outdoor tables is projected to grow at a CAGR of 6.9% from 2024 to 2033. fueled by the popularity of outdoor meals, especially in warmer climates like southern France and Spain. With more families entertaining guests at home, garden dining has gained prominence. Dining sets now range from minimalist bistro tables for balconies to expansive 8-seater configurations for large backyards. Innovations include foldable options, extendable tables, and built-in storage, addressing space optimization needs. Additionally, the café and bistro boom in European cities is further accelerating demand for commercial-grade dining furniture that balances function with style.

The wooden outdoor furniture products accounted for a revenue share of 62.65% in 2023. owing to its timeless aesthetic, natural appeal, and cultural significance across Europe. Teak, acacia, eucalyptus, and oak are the most popular choices for crafting outdoor furniture. These woods are often treated to withstand weather damage while retaining their texture and charm. Wood appeals strongly to eco-conscious consumers and premium buyers alike, especially in Scandinavian and Alpine regions where craftsmanship and organic design principles are valued. Brands often pair wood with neutral-colored cushions to deliver classic, elegant looks suited for both countryside homes and city terraces.

Plastic is gaining traction as the fastest-growing material, driven by its affordability, weather resistance, and ease of maintenance. Modern-day plastic furniture is far removed from its outdated stereotypes, with innovations in HDPE wicker, molded polypropylene, and recycled plastics offering both durability and aesthetic value. These materials are especially appealing in coastal regions where salt air may damage wood or metal. Lightweight, stackable designs also make plastic furniture suitable for commercial use in beach cafés, pop-up venues, and events. Sustainability advancements, such as IKEA’s use of ocean-bound plastics, are making plastic an environmentally viable option too.

The residential outdoor furniture accounted for a revenue share of 54.0% in 2023. as European homeowners increasingly invest in personalized outdoor spaces that reflect their lifestyle, values, and design preferences. With the rise of remote work and staycations, home improvement projects have included transforming balconies, patios, and gardens into multipurpose leisure zones. Products like outdoor sofas, corner lounges, fire pit seating, and breakfast nooks have become must-haves for a growing segment of aspirational homeowners. Additionally, trends such as home gardening, outdoor movie nights, and open-air reading lounges have bolstered demand for durable and visually pleasing furniture.

The commercial outdoor furniture market is projected to grow at a CAGR of 6.6% over the forecast period of 2024-2033. From luxury hotels in Lake Como to boutique cafés in Berlin, the demand for outdoor furniture that offers comfort, brand consistency, and long-term durability is surging. Retailers are also investing in street-facing patios and rooftop lounges to increase customer footfall. Public spaces, including parks and plazas, are being upgraded with thoughtfully designed outdoor benches, picnic tables, and seating pods. The trend of outdoor coworking and networking zones is also creating new demand in urban commercial zones.

Germany is a leading market for outdoor furniture in Europe, known for its eco-conscious consumers and high-quality preferences. German buyers prioritize functionality, sustainability, and minimalist aesthetics, often leaning toward FSC-certified wood and modular metal frames. Domestic brands thrive by emphasizing durability and ergonomic design. Garden expos and home improvement fairs are key platforms driving awareness and product adoption.

In the UK, the market is driven by a blend of traditional garden furniture preferences and contemporary design trends. Compact outdoor furniture solutions—such as bistro sets and foldable chairs—are especially popular in urban settings. E-commerce penetration is particularly high, with British consumers relying heavily on online research and delivery services for furniture purchases.

France has a strong appreciation for design-led outdoor furniture that blends art with function. Outdoor living is deeply ingrained in French culture, with alfresco dining and terrace lounging common in both residential and commercial settings. French buyers often seek elegance in materials like wrought iron, sustainably sourced wood, and handwoven rattan.

Italy’s outdoor furniture market reflects its deep-rooted heritage in craftsmanship and aesthetics. Italian consumers often opt for luxury outdoor collections that incorporate marble tops, ceramic tabletops, and designer finishes. The integration of outdoor furniture into architectural landscaping is common, particularly in villas, vineyards, and resorts.

Spain’s favorable climate makes it a robust market for year-round outdoor furniture use. Spanish households and hospitality venues invest in UV-resistant, ventilated designs that support long hours of sun exposure. The local market also shows a strong preference for bright color palettes, Mediterranean styles, and rustic finishes.

January 2024: French outdoor furniture brand Fermob announced a partnership with Airbnb to furnish select European stays with its iconic bistro collection, enhancing user experience and brand visibility.

November 2023: IKEA introduced a new line of sustainable outdoor seating made from recycled fishing nets and plastics in Germany and the UK, aligning with its green initiative goals.

October 2023: Kettler launched a temperature-controlled smart lounger in Germany, allowing users to set personalized warmth settings via mobile app—a first in the premium outdoor relaxation segment.

September 2023: Hartman opened its flagship concept store in Amsterdam, showcasing modular patio setups with interactive AR tools for customers to visualize space planning.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe outdoor furniture market

By Product

By Material Type

ByEnd-use

By Country