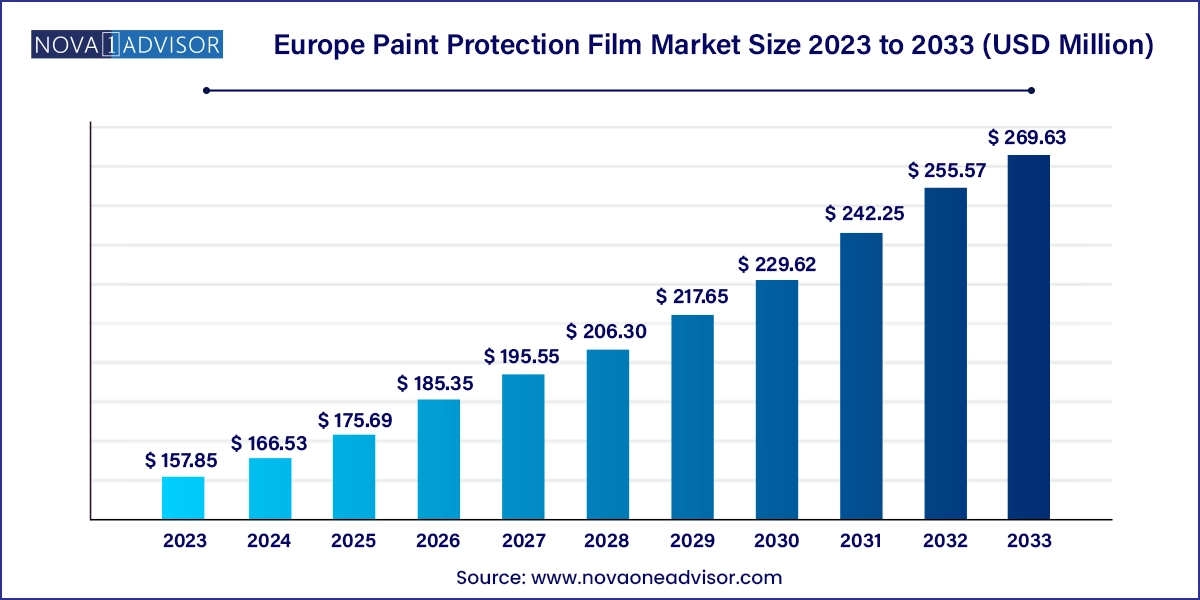

The Europe paint protection film market size was exhibited at USD 157.85 million in 2023 and is projected to hit around USD 269.63 million by 2033, growing at a CAGR of 5.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 166.53 Million |

| Market Size by 2033 | USD 269.63 Million |

| Growth Rate From 2024 to 2033 | CAGR of 5.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Application, country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Germany; UK; France |

| Key Companies Profiled | 3M; Eastman Chemical Company; Avery Dennison Corp.; Saint-Gobain Group; Renolit SE; DuPont de Nemours, Inc.; BASF SE; Imerys S.A.; XPEL Inc.; Hexis |

A key driver is the rising popularity of premium and luxury cars, which tend to have more delicate paint finishes that benefit from the protective film. The rising awareness of the advantages of paint protection films (PPFs) among car owners is also propelling the market growth. Furthermore, increasing disposable incomes allow consumers to invest more in car care, including paint protection.

The Europe paint protection film market accounted for a share of 31.6% of the the global paint protection film market revenue in 2023. The European Union (EU) has implemented regulations to ensure the safety, sustainability, and performance of PPFs and architectural paints available in the European market. These regulations include various directives and initiatives aimed at minimizing the environmental impact and enhancing consumer safety.

The thermoplastic polyurethane (TPU) segment dominated the market with a share of 83.5% in 2023. TPU is a versatile material known for its exceptional durability, flexibility, and resistance to abrasion, impact, and UV radiation. These properties make it an ideal choice for automotive paint protection films. As vehicles become more sophisticated and consumers seek long-lasting solutions, TPU-based films have gained traction.

The polyvinyl chloride (PVC) segment is projected to grow at a CAGR of 22.6% from 2024 to 2033. PVC films offer good chemical resistance, ease of installation, and cost-effectiveness. However, they may not match TPU’s self-healing capabilities or long-term durability. Despite this, advancements in PVC formulations and increased awareness about paint protection films are expected to drive demand for PVC-based solutions. As the automotive aftermarket continues to expand, PVC films will likely play a crucial role in meeting consumer needs for paint protection.

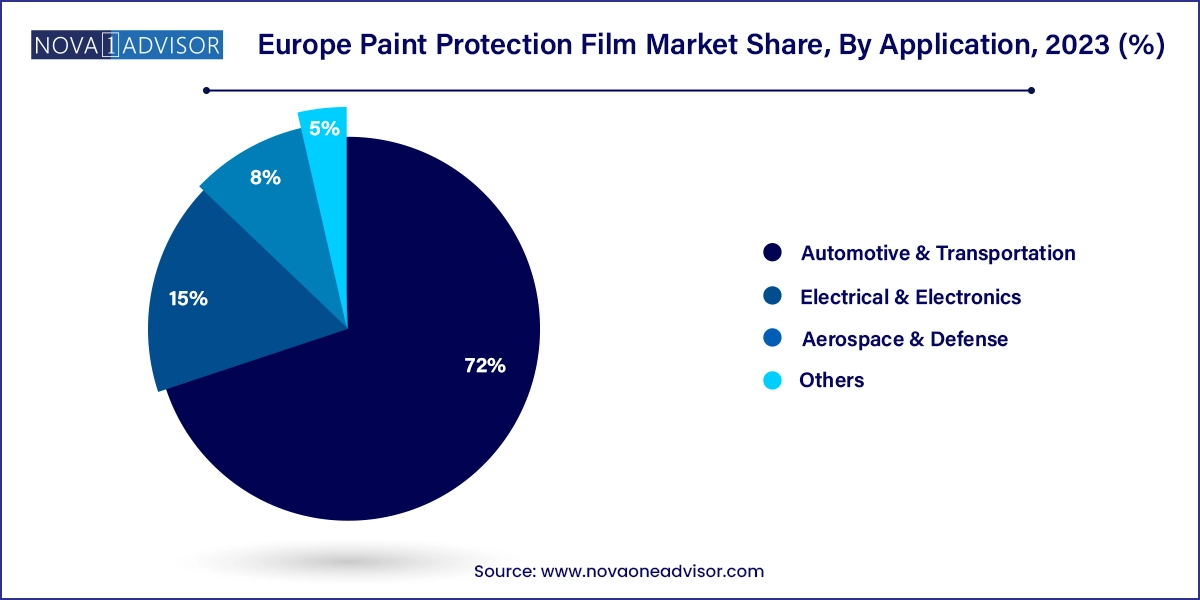

The automotive & transportation sector held the largest revenue share of 72.0% in 2023. This dominance is driven by the widespread adoption of paint protection films in the automotive industry. Vehicle owners increasingly recognize the value of protecting their investments by applying these films to their cars, trucks, and motorcycles. Paint protection films shield the vehicle’s exterior from scratches and environmental factors, preserving the original paint finish. As consumers become more conscious of aesthetics and long-term maintenance costs, the demand for high-quality paint protection films continues to rise. In addition, advancements in film technology, such as self-healing properties and enhanced clarity, contribute to the segment’s growth. Automotive manufacturers and aftermarket service providers play a pivotal role in driving this trend.

The electrical and electronics segment is projected to grow at a CAGR of 5.1% over the forecast period. Paint protection films are used to safeguard electronic devices, displays, touchscreens, and other sensitive surfaces in this segment. The adoption of paint protection films in the electrical and electronics industry aligns with the growing emphasis on product longevity and user experience.

Germany Paint Protection Film Market Trends

The Germany paint protection film market dominated the Europe regional market with a share of 25.5% in 2023. Germany has a robust automotive sector, with a high automobile demand, thereby driving product adoption. In addition, Germany hosts major paint protection film manufacturers and a network of skilled installers. These factors, coupled with rising awareness among consumers about the benefits of protective coatings, have fueled the product demand in Germany.

UK Paint Protection Film Market Trends

The UK paint protection film market is expected to grow at a CAGR of 5.2% from 2024 to 2033. The automotive industry in the UK, along with a growing preference for quality finishes, contributes to the market’s positive trajectory.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe paint protection film market

Material

Application

Country

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Paint Protection Film Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Distribution Channel Analysis

3.2.2. Raw Material Trends

3.2.3. Technological Overview

3.3. Regulatory Framework

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.4.4. Industry Opportunities

3.5. Industry Analysis Tools

3.5.1. Porter’s Five Forces Analysis

3.5.2. Macro-environmental Analysis

Chapter 4. Paint Protection Film Market: Material Estimates & Trend Analysis

4.1. Material Movement Analysis & Market Share, 2024 & 2030

4.2. Paint Protection Film Market Estimates & Forecast, By Material, 2018 to 2030 (Thousand Sq. Meter) (USD Million)

4.3. Thermoplastic Polyurethane (TPU)

4.3.1. Thermoplastic Polyurethane (TPU) Market Revenue Estimates and Forecasts, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

4.4. Polyvinyl chloride (PVC)

4.4.1. Polyvinyl chloride (PVC) Market Revenue Estimates and Forecasts, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

4.5. Others

4.5.1. Others Market Revenue Estimates and Forecasts, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

Chapter 5. Paint Protection Film Market: End-Use Estimates & Trend Analysis

5.1. End-Use Movement Analysis & Market Share, 2024 & 2030

5.2. Paint Protection Film Market Estimates & Forecast, By End-Use, 2018 to 2030 (Thousand Sq. Meter) (USD Million)

5.3. Automotive &Transportation

5.3.1. Automotive &Transportation Market Revenue Estimates and Forecasts, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

5.4. Electrical & Electronics

5.4.1. Electrical & Electronics Applications Market Revenue Estimates and Forecasts, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

5.5. Aerospace & Defense

5.5.1. Aerospace & Defense Applications Market Revenue Estimates and Forecasts, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

5.6. Other Applications

5.6.1. Others Applications Market Revenue Estimates and Forecasts, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

Chapter 6. Paint Protection Film Market: Regional Estimates & Trend Analysis

6.1. Regional Movement Analysis & Market Share, 2024 & 2030

6.2. North America

6.2.1. North America Paint Protection Film Market Estimates & Forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.2.2. U.S.

6.2.2.1. Key country dynamics

6.2.2.2. U.S. Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.2.3. Canada

6.2.3.1. Key country dynamics

6.2.3.2. Canada Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.2.4. Mexico

6.2.4.1. Key country dynamics

6.2.4.2. Mexico Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.3. Europe

6.3.1. Europe Paint Protection Film Market Estimates & Forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.3.2. Germany

6.3.2.1. Key country dynamics

6.3.2.2. Germany Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.3.3. UK

6.3.3.1. Key country dynamics

6.3.3.2. UK Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.3.4. France

6.3.4.1. Key country dynamics

6.3.4.2. France Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.3.5. Italy

6.3.5.1. Key country dynamics

6.3.5.2. Italy Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.3.6. Spain

6.3.6.1. Key country dynamics

6.3.6.2. Spain Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.3.7. Netherlands

6.3.7.1. Key country dynamics

6.3.7.2. Netherlands Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.3.8. Norway

6.3.8.1. Key country dynamics

6.3.8.2. Norway Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.3.9. Russia

6.3.9.1. Key country dynamics

6.3.9.2. Russia Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.4. Asia Pacific

6.4.1. Asia Pacific Paint Protection Film Market Estimates & Forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.4.2. China

6.4.2.1. Key country dynamics

6.4.2.2. China Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.4.3. Japan

6.4.3.1. Key country dynamics

6.4.3.2. Japan Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.4.4. India

6.4.4.1. Key country dynamics

6.4.4.2. India Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.4.5. Australia

6.4.5.1. Key country dynamics

6.4.5.2. Australia Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.4.6. South Korea

6.4.6.1. Key country dynamics

6.4.6.2. South Korea Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.4.7. Indonesia

6.4.7.1. Key country dynamics

6.4.7.2. Indonesia Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.4.8. Malaysia

6.4.8.1. Key country dynamics

6.4.8.2. Malaysia Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.4.9. Thailand

6.4.9.1. Key country dynamics

6.4.9.2. Thailand Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.5. Central & South America

6.5.1. Central & South America Paint Protection Film Market Estimates & Forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.5.2. Brazil

6.5.2.1. Key country dynamics

6.5.2.2. Brazil Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.5.3. Argentina

6.5.3.1. Key country dynamics

6.5.3.2. Argentina Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.6. Middle East & Africa

6.6.1. Middles East & Africa Paint Protection Film Market Estimates & Forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.6.2. Saudi Arabia

6.6.2.1. Key country dynamics

6.6.2.2. Saudi Arabia Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.6.3. UAE

6.6.3.1. Key country dynamics

6.6.3.2. UAE Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

6.6.4. South Africa

6.6.4.1. Key country dynamics

6.6.4.2. South Africa Paint Protection Film Market estimates & forecast, 2021 - 2033 (Thousand Sq. Meter) (USD Million)

Chapter 7. Paint Protection Film Market - Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Market Share/Position Analysis, 2024

7.4. Company Heat Map Analysis

7.5. Strategy Mapping

7.5.1. Expansion

7.5.2. Mergers & Acquisition

7.5.3. Partnerships & Collaborations

7.5.4. New Product Launches

7.5.5. Research And Development

7.6. Company Profiles

7.6.1. Kangde Xin Composite Material Co. Ltd

7.6.1.1. Participant’s overview

7.6.1.2. Financial performance

7.6.1.3. Product benchmarking

7.6.1.4. Recent developments

7.6.2. 3M

7.6.2.1. Participant’s overview

7.6.2.2. Financial performance

7.6.2.3. Product benchmarking

7.6.2.4. Recent developments

7.6.3. XPEL Inc.

7.6.3.1. Participant’s overview

7.6.3.2. Financial performance

7.6.3.3. Product benchmarking

7.6.3.4. Recent developments

7.6.4. Schweitzer-Mauduit International, Inc. (SWM, Inc.)

7.6.4.1. Participant’s overview

7.6.4.2. Financial performance

7.6.4.3. Product benchmarking

7.6.4.4. Recent developments

7.6.5. Premier Protective Films International

7.6.5.1. Participant’s overview

7.6.5.2. Financial performance

7.6.5.3. Product benchmarking

7.6.5.4. Recent developments

7.6.6. Eastman Chemical Company

7.6.6.1. Participant’s overview

7.6.6.2. Financial performance

7.6.6.3. Product benchmarking

7.6.6.4. Recent developments

7.6.7. Avery Dennison Corporation

7.6.7.1. Participant’s overview

7.6.7.2. Financial performance

7.6.7.3. Product benchmarking

7.6.7.4. Recent developments

7.6.8. Saint-Gobain S.A.

7.6.8.1. Participant’s overview

7.6.8.2. Financial performance

7.6.8.3. Product benchmarking

7.6.8.4. Recent developments

7.6.9. Matrix Films

7.6.9.1. Participant’s overview

7.6.9.2. Financial performance

7.6.9.3. Product benchmarking

7.6.9.4. Recent developments

7.6.10. RENOLIT SE

7.6.10.1. Participant’s overview

7.6.10.2. Financial performance

7.6.10.3. Product benchmarking

7.6.10.4. Recent developments

7.6.11. Ziebart International Corporation

7.6.11.1. Participant’s overview

7.6.11.2. Financial performance

7.6.11.3. Product benchmarking

7.6.11.4. Recent developments

7.6.12. Hexis S.A.S

7.6.12.1. Participant’s overview

7.6.12.2. Financial performance

7.6.12.3. Product benchmarking

7.6.12.4. Recent developments

7.6.13. Orafol Europe GmbH

7.6.13.1. Participant’s overview

7.6.13.2. Financial performance

7.6.13.3. Product benchmarking

7.6.13.4. Recent developments

7.6.14. Sharp line Converting Inc.

7.6.14.1. Participant’s overview

7.6.14.2. Financial performance

7.6.14.3. Product benchmarking

7.6.14.4. Recent developments

7.6.15. Madico Inc.

7.6.15.1. Participant’s overview

7.6.15.2. Financial performance

7.6.15.3. Product benchmarking

7.6.15.4. Recent developments

7.6.16. Garware Hi-Tech Films Ltd

7.6.16.1. Participant’s overview

7.6.16.2. Financial performance

7.6.16.3. Product benchmarking

7.6.16.4. Recent developments