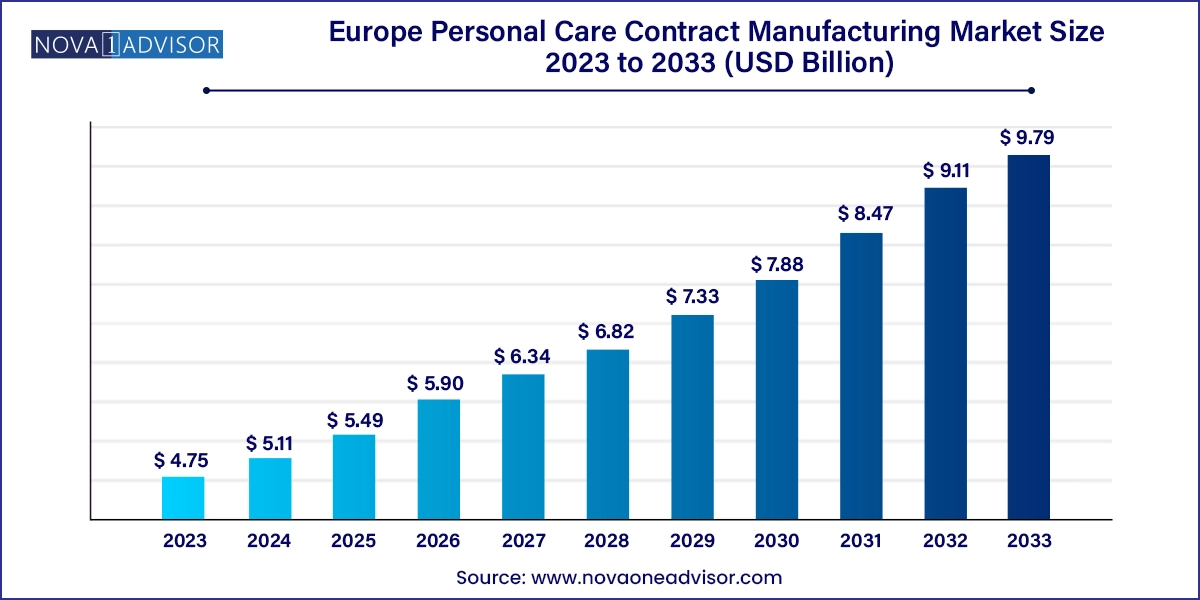

The Europe personal care contract manufacturing market size was exhibited at USD 4.75 billion in 2023 and is projected to hit around USD 9.79 billion by 2033, growing at a CAGR of 7.5% during the forecast period 2024 to 2033.

The Europe Personal Care Contract Manufacturing Market has witnessed significant transformation over the past decade, evolving from a support service to a strategic solution for both established and emerging personal care brands. Contract manufacturing allows companies to outsource various stages of product development, including formulation, manufacturing, and packaging, thereby enabling them to focus on branding, marketing, and consumer engagement. This model has proven especially advantageous in the dynamic personal care industry, where trends shift rapidly, and time-to-market is a crucial differentiator.

As consumer demand for innovative and personalized personal care products grows, many brands are opting to collaborate with specialized contract manufacturers. These manufacturers provide expertise, infrastructure, and regulatory compliance support, particularly vital in the European context, where strict cosmetic regulations such as the EU Cosmetics Regulation (EC) No. 1223/2009 are enforced. In addition, the market benefits from a robust ecosystem of research institutions, technological innovation, and a highly developed logistics network, making Europe an attractive hub for contract manufacturing activities.

The European market is also distinguished by its diversity in consumer preferences across countries. For instance, sustainability is a driving factor in countries like Germany and the UK, while premium skincare and fragrance innovations are rapidly gaining traction in France and Italy. Contract manufacturers are responding with tailored solutions, including eco-friendly packaging and green chemistry-based formulations. With increasing consumer awareness, clean-label and organic products have become a new norm, prompting contract manufacturers to shift towards more sustainable and compliant offerings.

Rising demand for clean-label and organic personal care products.

Increased partnerships between brands and contract manufacturers for R&D and innovation.

Growing inclination towards sustainable packaging solutions.

Higher demand for small-batch, customized personal care products.

Proliferation of indie brands leveraging third-party manufacturing expertise.

Digital transformation in formulation and product development (AI in R&D).

Regulatory compliance driving the need for specialized contract services.

Demand surge for male grooming and gender-neutral personal care lines.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.11 Billion |

| Market Size by 2033 | USD 9.79 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Product, Product Form, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Germany; France; UK; Italy; Spain |

| Key Companies Profiled | McBride Plc; RCP Ranstadt GmbH; Skinlys; Albea; Fareva; Intercos SpA; Wordsworth UK; UniGema Cosmetics & Pharmaceuticals |

A major driving force in the Europe Personal Care Contract Manufacturing Market is the increasing consumer preference for clean-label and organic products. Modern European consumers are highly informed, health-conscious, and environmentally aware. This shift has redefined product expectations consumers now scrutinize ingredient lists, expect transparency in sourcing, and demand proof of sustainability.

Contract manufacturers have responded by investing in green chemistry techniques, developing vegan, cruelty-free, and biodegradable formulations. For example, brands looking to launch preservative-free skincare lines often collaborate with contract manufacturers who possess the technical know-how to maintain product efficacy and shelf life without harmful additives. In countries like Germany and France, where organic certifications such as COSMOS and Ecocert carry strong value, contract manufacturers help clients meet stringent requirements while maintaining market readiness. This trend not only opens avenues for premium product offerings but also fuels innovation pipelines within the contract manufacturing domain.

While Europe’s stringent cosmetic regulations ensure high product quality and consumer safety, they also pose a significant barrier for companies—particularly startups and small brands looking to enter the market. Regulatory compliance in the European Union involves multiple layers, including ingredient safety assessments, product testing, labeling norms, and post-market surveillance.

This complex environment increases reliance on contract manufacturers, yet it also raises the cost and duration of product development cycles. For example, acquiring safety assessments from certified toxicologists or complying with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) guidelines can be both time-consuming and expensive. Contract manufacturers must continually invest in regulatory expertise and testing facilities to remain competitive. While large contract manufacturers can absorb these costs, smaller players may struggle to stay compliant while maintaining profitability, thereby limiting market expansion for newer entrants.

An exciting opportunity lies in the surge of indie and niche beauty brands across Europe. These brands typically emphasize storytelling, sustainability, inclusivity, and ethical values. However, they often lack the resources for in-house manufacturing and R&D. Contract manufacturers are capitalizing on this shift by offering flexible manufacturing volumes, rapid prototyping, and formulation customization services.

In markets like the UK and Italy, where indie skincare and cosmetics brands are flourishing on digital platforms, contract manufacturers are stepping in as innovation partners rather than just service providers. For instance, some offer white-label solutions for quick market launches, while others co-create bespoke product lines in collaboration with brand founders. This opportunity allows contract manufacturers to diversify their clientele and build long-term relationships with fast-growing D2C (Direct-to-Consumer) brands. Additionally, some are investing in incubator-style services, supporting startups from concept to commercialization.

Manufacturing services dominated the market in 2024, owing to the high outsourcing demand for scalable production facilities.

Contract manufacturing services form the backbone of the market, as many personal care brands prioritize speed and scalability. Europe has seen increased outsourcing of bulk production due to rising operational costs and the need for consistent product quality. Manufacturing contract services appeal to brands looking to scale up rapidly while maintaining stringent quality control. Larger contract manufacturers, equipped with automated production lines and advanced quality assurance protocols, cater to high-volume requirements without compromising efficiency. This has positioned manufacturing as the leading segment in terms of revenue and demand.

Custom formulation and R&D emerged as the fastest-growing segment, driven by the rise of personalization in skincare and beauty products.

With consumers seeking personalized skincare solutions and functional cosmetics, brands increasingly demand tailored formulations. This trend has accelerated the growth of the R&D segment. Contract manufacturers offer dedicated formulation labs, dermatological testing, and prototype development to ensure competitive advantage for client brands. For example, fragrance customization for niche brands in France and gender-neutral cosmetics in the UK are examples where R&D services provided by contract manufacturers have enabled innovation and market differentiation.

Liquids were the most dominant product form, accounting for a significant share due to their prevalence in skincare, haircare, and hygiene categories.

Liquid formulations such as shampoos, lotions, cleansers, and toners are easy to apply and have high consumer acceptance. They are also easier to manufacture and package in large volumes, making them the preferred choice for mass-market products. Contract manufacturers in Italy and Germany specialize in bulk liquid formulation and automated bottling solutions, providing scalability for brands targeting supermarkets, pharmacies, and online platforms.

Oils & serums are growing rapidly, particularly in premium and targeted treatment segments.

High-potency serums and plant-based facial oils have surged in popularity across Europe. Brands seeking to differentiate themselves often opt for complex oil blends enriched with active botanicals. This has increased demand for sophisticated emulsification and infusion techniques, often provided by specialized contract manufacturers. These products require precise formulation and stability testing, making R&D-focused manufacturers key partners in launching high-end skincare products.

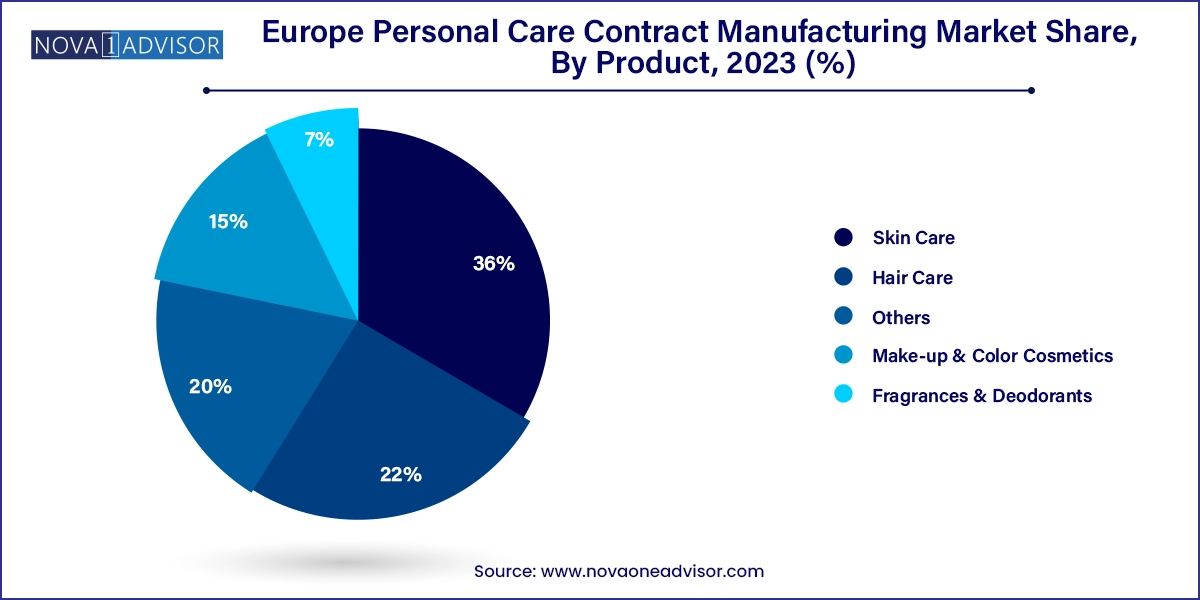

Skin care products led the market due to the widespread use of moisturizers, serums, and anti-aging solutions.

The skincare category has been a consistent revenue driver, driven by demand for facial creams, anti-aging serums, and acne treatments. Countries like Germany, France, and the UK are seeing rising adoption of natural and therapeutic skincare products. Contract manufacturers enable brands to deliver innovative product formats such as encapsulated serums or probiotic skincare, which require specialized production capabilities. The aging population in Europe and growing male skincare lines have further fueled the segment.

Make-up & color cosmetics is the fastest-growing segment, particularly among younger demographics and social media influencers.

The increasing influence of social platforms like TikTok and Instagram has amplified the demand for vibrant and creative makeup lines. Independent beauty brands launching online are turning to contract manufacturers for unique product textures, long-wear formulas, and eco-friendly colorants. The UK, in particular, has seen an explosion of indie color cosmetics brands, many of which rely heavily on third-party formulation and manufacturing to keep up with trend-driven consumer demand.

Germany

Germany represents one of the largest markets for personal care contract manufacturing in Europe. With a strong preference for natural and organic products, German brands collaborate with contract manufacturers that offer certified organic production lines. Moreover, Germany’s regulatory rigor has cultivated a mature manufacturing ecosystem with a strong focus on quality assurance and sustainability. Companies like Beiersdorf often partner with local and regional third-party manufacturers to fulfill evolving product demands.

France

France, known globally for its beauty and perfume legacy, is a hub for high-end and luxury personal care products. The country has a thriving ecosystem of boutique skincare and fragrance houses that rely on contract manufacturers for small-batch, premium production. These partnerships are often focused on maintaining artisanal quality while scaling to meet growing global demand. Custom fragrance development is a particularly active area of collaboration in France.

United Kingdom

The UK personal care market is driven by a diverse consumer base and a vibrant D2C brand ecosystem. The rise of male grooming and gender-neutral skincare has led to increased demand for innovation-centric contract manufacturers. Additionally, post-Brexit regulatory complexities have prompted UK brands to rely on manufacturers with pan-European compliance expertise. The UK market is agile, trend-responsive, and digitally driven—making speed and flexibility key attributes for contract manufacturing partnerships.

Italy

Italy’s rich heritage in skincare and spa cosmetics has fostered a niche market for natural and sensorial product development. Many Italian contract manufacturers specialize in botanical formulations, thermal spa treatments, and aromatherapy lines. The emphasis on product aesthetics—texture, scent, packaging—plays a crucial role in how Italian brands choose their manufacturing partners. Export-oriented growth has also made Italy a hotspot for contract production aimed at global markets.

Spain

Spain has emerged as a cost-effective manufacturing destination with a growing number of mid-sized contract manufacturers. Spanish firms are particularly strong in packaging and private-label production for export. The increasing popularity of sun-care products, body lotions, and budget-friendly skincare brands has contributed to rising contract manufacturing activity. Spain also supports sustainable and cruelty-free initiatives, which align with broader EU market values.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe personal care contract manufacturing market

Service

Product

Product Form

Country