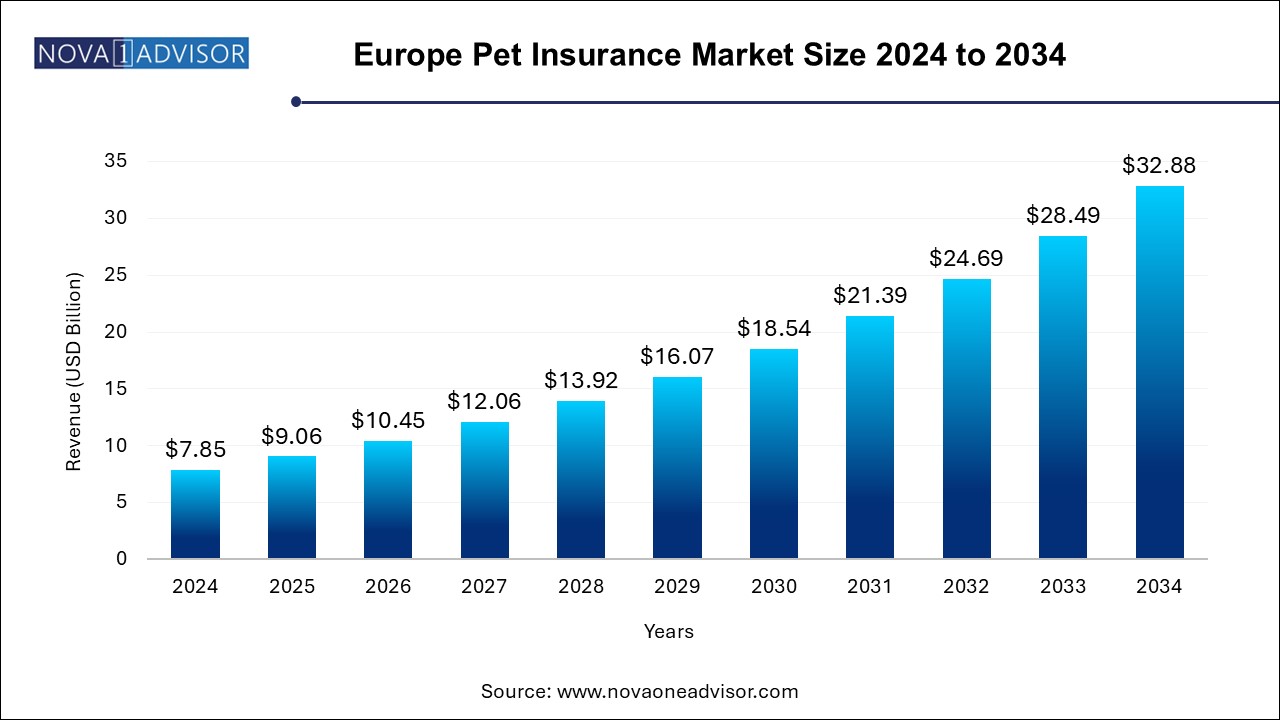

The Europe pet insurance market size was exhibited at USD 7.85 billion in 2024 and is projected to hit around USD 32.88 billion by 2034, growing at a CAGR of 15.4% during the forecast period 2025 to 2034.

The Europe pet insurance market has experienced significant transformation over the last decade, spurred by a cultural shift in how pets are perceived—no longer as just animals, but as cherished family members. This emotional shift has translated into rising expenditures on pet healthcare, nutrition, grooming, and overall wellbeing. Among these, pet insurance has emerged as a critical pillar of responsible pet ownership, offering financial coverage against unforeseen medical emergencies, accidents, and chronic illnesses.

Across Europe, governments, veterinarians, and insurance companies are recognizing the role of insurance in enhancing animal welfare and ensuring access to quality veterinary services. Countries such as the United Kingdom, Sweden, Germany, and France are leading the way, with a growing number of pet parents subscribing to insurance plans. The rise of premium veterinary treatments such as CT scans, chemotherapy, orthopedic surgeries, and dental procedures—many of which can cost hundreds to thousands of euros—makes insurance a practical necessity.

In 2024, Europe witnessed a notable expansion in pet insurance policies driven by increased pet adoption during the post-COVID years, rising veterinary inflation, and the digitization of insurance services. Mobile apps, telehealth for pets, and AI-based claims processing have simplified the customer journey, making pet insurance more accessible and attractive. Moreover, insurers are expanding their product portfolios with flexible, customizable plans that cater to the diverse needs of pet owners—ranging from comprehensive coverage to accident-only policies for senior animals.

As the pet population continues to grow and veterinary costs climb, the European pet insurance market is poised for sustained growth, offering lucrative opportunities to both traditional insurers and insurtech startups.

Humanization of Pets Driving Insurance Uptake

More pet owners in Europe now treat pets as family, leading to increased spending on their health and wellbeing, including insurance.

Growth of Digital-First Insurance Platforms

Tech-savvy consumers are turning to mobile apps and online platforms for policy purchase, management, and claims processing, reducing reliance on traditional agents.

Rising Veterinary Inflation Necessitating Coverage

The increasing cost of advanced veterinary treatments is pushing consumers to seek insurance as a cost-management tool.

Customizable and Tiered Plans

Insurers are offering plans based on pet age, breed, pre-existing conditions, and lifestyle, enhancing personalization and customer retention.

Integration of Wellness and Preventive Care

Policies that include preventive services like annual checkups, vaccinations, and wellness programs are gaining popularity.

Entry of Non-Traditional Players and Startups

New players like Bought By Many (now ManyPets) and Lassie are disrupting the market with transparent pricing and tech-enabled services.

Multi-Pet Discounts and Loyalty Benefits

Insurers are encouraging multi-pet households to opt for bundled insurance plans through attractive discounts and add-on services.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.06 Billion |

| Market Size by 2033 | USD 32.88 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.4% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Animal, Coverage, Sales Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | Europe |

| Key Companies Profiled | Trupanion; DFV; Petplan (Allianz); PetPartners, Inc.; GETSAFE; Direct Line (UK Insurance Limited); Embrace Pet Insurance Agency; LLC (JAB Holding Company); Waggel Limited; Perfect Pet Insurance; Deutsche Familienversicherung AG (DFV);Petplan (Allianz); EQT AB; ProtectaPet; Perfect Pet Insurance; Feather Insurance (Popsure Deutschland GmbH); Agria Pet Insurance Ltd |

A prominent driver accelerating the Europe pet insurance market is the rising rate of pet ownership, particularly among urban households. A shift in family structures—such as fewer children, delayed marriages, and increased single-person households—has led to a spike in companion animal adoption. According to the European Pet Food Industry Federation (FEDIAF), over 90 million households in Europe now own at least one pet.

In cities like Berlin, Paris, and London, pet ownership has become more than a trend—it is a lifestyle. This demographic shift has brought with it a willingness to invest in premium services, including health insurance for pets. As pets become emotionally integral to households, pet parents are increasingly prioritizing financial protection against veterinary emergencies, hereditary conditions, and accidents. This sentiment, combined with heightened awareness campaigns by animal welfare organizations, is significantly driving insurance uptake.

Despite impressive growth, the limited penetration in price-sensitive regions remains a critical restraint. In Eastern and Southern European countries—such as Romania, Bulgaria, Portugal, and Greece—pet insurance remains a low-priority expenditure due to limited awareness, lower disposable income, and cultural practices where pets are kept more for utility than companionship.

In these regions, the concept of insuring pets is relatively new, and pet owners often rely on out-of-pocket payments or avoid advanced veterinary treatments due to cost. Additionally, a fragmented veterinary service infrastructure with varying treatment quality and cost transparency has made insurers wary of expanding aggressively. These factors create a challenging environment for both incumbents and new entrants to gain traction, slowing the overall regional market expansion.

One of the most compelling opportunities lies in integrating pet insurance with broader insurance products or retail ecosystems. Insurance providers are exploring bundling pet coverage with home insurance, life insurance, or wellness subscriptions. For instance, some companies in the UK and Scandinavia now allow users to manage pet, health, and property policies through a single digital portal, improving user engagement and reducing churn.

In addition, partnerships with veterinary clinics, pet food retailers, and grooming services allow insurers to offer holistic value-added services that go beyond reimbursement. Loyalty rewards, cashback programs, and monthly pet health tracking have made bundled offerings more attractive. As e-commerce players like Amazon and Zooplus expand into the pet wellness space, collaborations with insurers to offer embedded pet protection at checkout may become a future growth driver.

Based on animal, the market is segmented into dogs, cats, and others. In 2024, the dogs segment dominated the market with a substantial share of 50.35%. In regions like the UK, France, and Germany, dogs are the most commonly insured pets, often enrolled from puppyhood. Their susceptibility to breed-specific conditions such as hip dysplasia, cardiac issues, and dermatitis makes dog owners more proactive in purchasing comprehensive insurance plans. Moreover, premium veterinary care—ranging from orthopedic surgeries to behavioral therapies—is more commonly availed for dogs, further boosting their dominance in the insurance sector.

The other animals segment such as horses, small mammals, reptiles, and others are expected grow at the fastest CAGR 17.04% during the forecast period. While traditionally considered low-maintenance pets, the growing urban cat population—especially among young professionals and apartment dwellers—has led to a surge in veterinary visits and associated costs. As feline diseases like urinary tract infections, diabetes, and dental conditions become more prevalent, cat owners are recognizing the value of insurance. Insurers have responded by introducing specialized plans for cats that include indoor-only coverage and chronic disease management, contributing to rapid growth in this segment.

In 2024, the accident and illness segment dominated the European pet insurance market, accounting for over 84.07% of the total share. These policies typically cover a wide range of treatments, including surgeries, diagnostic imaging, chronic conditions, and medications, providing peace of mind to pet owners. Most established insurers and digital startups promote this coverage type as the “all-inclusive” option, especially for young pets with a long coverage horizon. Dog owners in particular favor this plan, given the unpredictability of injuries and illness during outdoor activities or aging.

The other insurance type such as liability insurance policies, lifetime insurance, and surgery are expected grow at the fastest CAGR of 16.84% during the forecast period. These plans offer basic protection against injuries resulting from incidents like road accidents, falls, or bites at a lower premium. They serve as an entry point into pet insurance and are increasingly popular among younger consumers who may be cost-conscious. Some providers also offer accident-only plans with add-ons, allowing gradual upgrades and personalization, which enhances their appeal in newer markets and among budget-conscious pet parents.

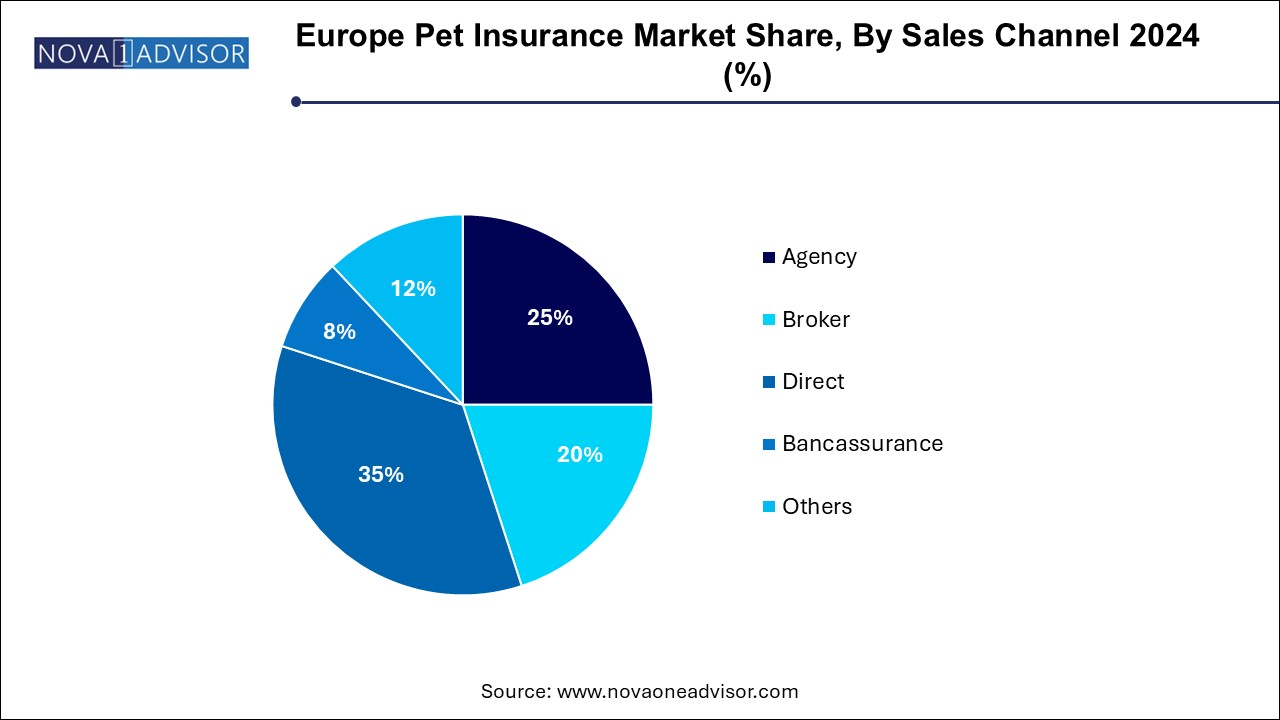

Based on sales channel, the direct channel segment held the largest share of 35.0% in 2024. Consumers increasingly prefer purchasing policies through insurer websites, mobile apps, or dedicated customer service centers. The convenience, speed, and transparency offered by direct sales platforms have reduced dependency on traditional intermediaries. Additionally, digital-native pet insurance providers like ManyPets and Lassie have revolutionized user experience with instant quotes, paperless claims, and 24/7 support, making direct channels the most efficient and widely adopted option.

Bancassurance is the fastest-growing channel in Europe’s pet insurance market. As banks seek to diversify their product portfolios, they are forming strategic alliances with insurance companies to cross-sell pet coverage alongside home or auto insurance policies. Bancassurance benefits from a trusted relationship between the customer and the bank, as well as an extensive distribution network. For example, in countries like Sweden and the Netherlands, large retail banks are bundling pet insurance products with digital banking services, reaching a wider audience and encouraging pet policy adoption through existing financial infrastructure.

The United Kingdom is the undisputed leader in Europe’s pet insurance market, accounting for the largest share in terms of policy volume, gross written premium, and insurer presence. Pet insurance in the UK has a long-established history, with some policies dating back to the early 20th century. Today, more than 40% of pet dogs and 30% of cats in the UK are insured, making it one of the most mature markets globally. Veterinary care in the UK is expensive, and with providers like the Royal Veterinary College offering high-end treatment, insurance becomes essential.

UK-based insurers like Petplan, Agria, and Bought By Many dominate the landscape, offering tailored plans and seamless digital onboarding. Regulatory frameworks under the Financial Conduct Authority (FCA) ensure transparency and policyholder protection. Additionally, British consumers are highly informed and digitally active, which has contributed to high penetration. The market continues to expand as insurers innovate with lifetime coverage, wellness benefits, and behavior training reimbursements, making the UK a benchmark for the rest of Europe.

February 2025: ManyPets (formerly Bought By Many) expanded its operations in Germany and France with AI-powered claims processing and multi-language support to streamline onboarding and customer service.

November 2024: Agria Pet Insurance announced a partnership with Pets at Home, the UK’s largest pet retailer, to offer in-store insurance sign-ups and exclusive coverage for customers.

September 2024: Lassie, the Swedish digital pet insurance startup, raised €25 million in Series B funding to expand across Europe and enhance its preventive pet health platform.

June 2024: Petplan UK launched a new policy tier that includes dental cleaning and wellness exams, a move to promote preventive care as part of long-term pet health management.

March 2024: Helvetia Insurance introduced a fully paperless mobile claims feature for pet insurance customers in Switzerland and Austria, reducing claims processing time by 60%.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe pet insurance market

Animal

Coverage

Sales Channel

Regional