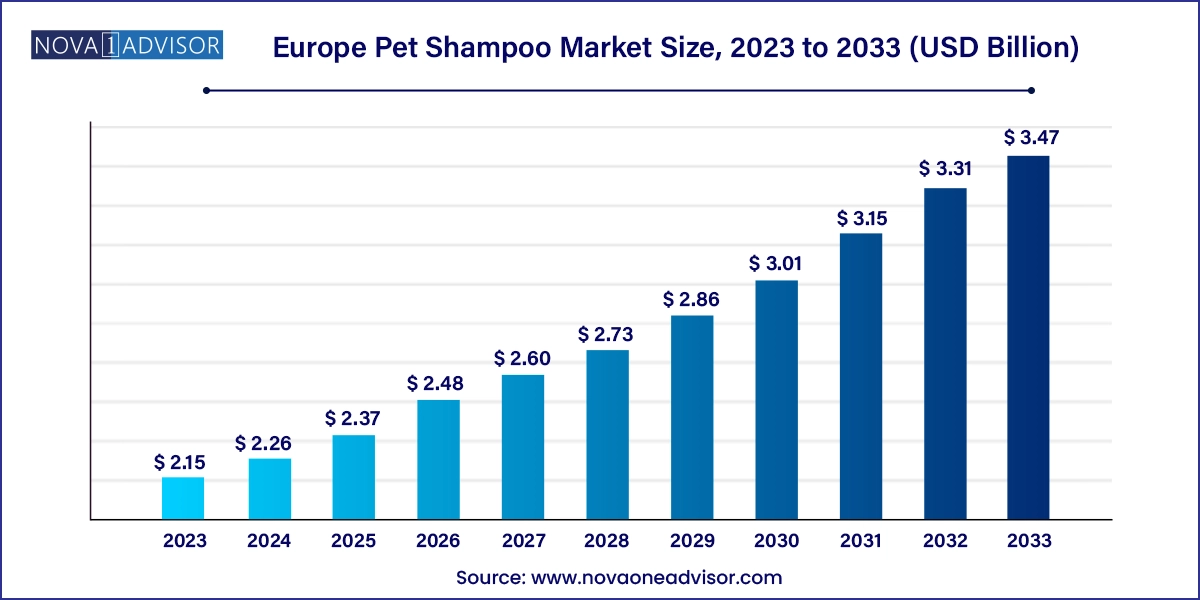

The Europe pet shampoo market size was exhibited at USD 2.15 billion in 2023 and is projected to hit around USD 3.47 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.26 Billion |

| Market Size by 2033 | USD 3.47 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Pet Type, Application, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK; Germany, France, Spain, Italy |

| Key Companies Profiled | Groomer's Choice; SynergyLabs; Vet's Best; Himalaya Herbal Healthcare; Petco Animal Supplies, Inc.; Logic Product Group LLC; Wahl Clipper Corporation; 4-Legger; Earthwhile Endeavors, Inc.; World For Pets |

More and more pet owners are looking for natural and organic products that are healthy for their animals, instead of the ones with harmful chemicals available in the market. Due to this, many companies are now selling natural and organic pet shampoos that not only clean and nourish the pet's skin and coat but also give further health advantages.

The Europe pet shampoo market accounted for a share of 35.3% of the global pet shampoo market revenue in 2023. Pet ownership has increased throughout Europe in recent years. The number of pets in homes throughout the continent is rising as more individuals decide to keep animals as companions. A number of causes, including evolving lifestyles, heightened consciousness regarding animal care, and the psychological and physical well-being advantages of owning pets, drives this trend. The European Pet Food Industry Federation (FEDIAF) estimates that 91 million families in Europe would have pets by 2022.

Premium pet food, medical care, grooming, accessories, and even opulent objects for companion animals are becoming more and more expensive to purchase for pet owners. Pet owners are integrating their pets more and more into their everyday lives, which is driving up demand for high-quality pet care supplies and services. In 2022, pet owners spent USD 26.5 billion on goods and services related to their animals, according to a report published by the FEDIAF.

Shampoos and other pet care products have been greatly helped by the spread of social media platforms. Influencers, writers, and specialists in pet care frequently endorse grooming products on social media platforms, impacting customer choices and increasing revenue. Animal influencers with social media followings have a significant influence on pet owners' purchasing decisions. Since many of these pet influencers are brand ambassadors, pet shampoo demand and awareness have increased.

The dog shampoo held the market share of 57% in 2023. The UK has one of the highest rates of dog ownership worldwide. Most dog owners consider their dog as a family member and are willing to spend more money on their health and hygiene. This factor is anticipated to fuel the market over the forecast period.

The demand for cat shampoo is expected to grow at a CAGR of 4.5% from 2024 to 2033. Cats are increasingly becoming popular as companion animals, contributing to the rise in cat ownership. Players are presenting novel products, especially for cats is also supporting the segment’s growth. Earthwhile Endeavors, Inc. offers a Hypoallergenic Cat Shampoo specially formulated for cats with allergies, sensitive skin, and cats living in a multi-cat household. This pH-balanced shampoo is exceptionally gentle for even highly sensitive cats.

The commercial pet shampoo market in Europe held a revenue share of 58.6% in 2023. The number of pet stores has grown dramatically in recent years. Similarly, in wealthy nations, there has been a notable surge in pet boarding and grooming services. Further fueling demand is the need for these organizations to purchase goods in bulk in order to feed a large number of animals.

The demand for pet shampoo in household applications in Europe is expected to grow at a CAGR of 5.6% from 2024 to 2033, owing to the increasing adoption of companion animals in Europe. The adoption rate in emerging economies in Europe has been rising significantly. In this market, rising pet grooming expenses has driven the demand for shampoos.

The sales of pet shampoo through offline distribution channel in Europe held a revenue share of 69.8% in 2023. Among the offline distribution channels, supermarkets and hypermarkets have been expanding significantly on a global scale. These retailers' extensive product selection will continue to be one of the main motivators. The makers have been using a hybrid business model for the past few years, combining online and physical retailing.

The online sales of pet shampoo in Europe is expected to grow at a CAGR of 5.6% from 2024 to 2033. The rapid growth of e-commerce in the home appliances industry is expected to boost product sales through online platforms.

UK Pet Shampoo Market Trends

The UK pet shampoo market held 24.5% of the European market revenue in 2023. Shampoos are among the many pet goods that are now easier for customers to obtain thanks to the advent of e-commerce. Numerous pet shampoo brands are available on internet retailers such as Amazon, Pets at Home, and Zooplus, which fuels the expansion of the pet shampoo industry in the UK. Because of health concerns, there is a growing tendency among pet owners to choose natural and organic pet care products. As more companies introduce natural and organic shampoos, this trend is having an impact on the pet shampoo market. James Wellbeloved, for example, sells natural pet shampoo lines in the UK.

Pet Shampoo Market Trends

The pet shampoo market in Germany is projected to grow at CAGR of 5.2% from 2024. This is mainly attributed to the reasons like rising disposable incomes, an increase in pet ownership, and changing consumer tastes. In order to satisfy the evolving demands of pet owners, the market continues to innovate and adapt with a wide selection of products accessible from numerous local and international brands. Dogs and cats are owned by a sizable fraction of families in Germany, which has a high pet ownership rate. Shampoos and other pet grooming supplies are in high demand as pet owners strive to provide their furry friends the best care possible. The increased demand for high-end pet care products like specialty shampoos is also driven by the trend of pet humanization, in which animals are seen as members of the family.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe pet shampoo market

Pet Type

Application

Distribution Channel

Country