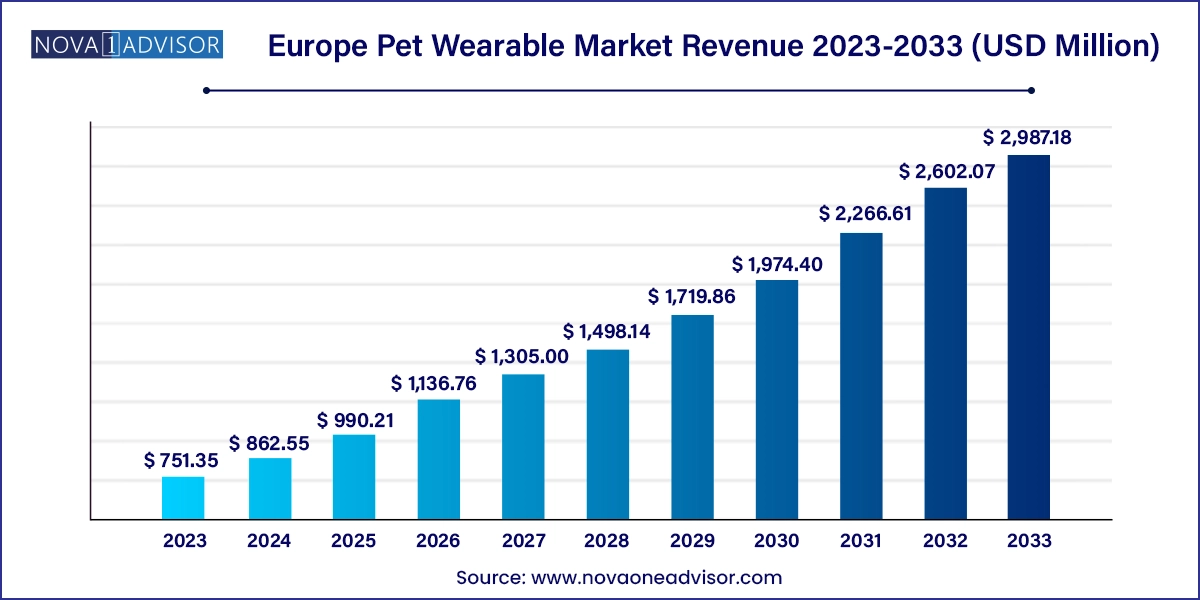

The Europe pet wearable market size was exhibited at USD 751.35 million in 2023 and is projected to hit around USD 2,987.18 million by 2033, growing at a CAGR of 14.8% during the forecast period 2024 to 2033.

The Europe pet wearable market is gaining considerable momentum, driven by a combination of increased pet ownership, heightened awareness of pet health and safety, and a growing inclination toward the use of smart technologies for animal care. Pet wearable devices—ranging from GPS-enabled collars to biometric harnesses—are redefining how European pet owners interact with and manage their pets. These devices provide real-time data on location, activity levels, health vitals, and even emotional states, enabling owners to monitor their animals with precision and convenience.

The market’s growth is supported by the region's tech-savvy consumer base, higher disposable incomes, and robust pet care infrastructure. According to FEDIAF (The European Pet Food Industry Federation), Europe is home to over 300 million companion animals, with dogs and cats being the most popular. Countries like the UK, Germany, and France are leading in terms of pet ownership and expenditure on pet care, which includes investments in digital pet health and tracking devices.

Further propelling the market is the rapid adoption of IoT-enabled products, improved connectivity standards, and the development of lightweight, energy-efficient components such as sensors and integrated chips. Pet wearables are no longer niche accessories but part of a broader ecosystem that aligns with wellness monitoring, smart home integration, and remote veterinary diagnostics. This evolution is reshaping traditional pet care into a data-centric, proactive domain.

Integration of Pet Wearables with Smartphone Apps: Most devices are now paired with user-friendly mobile applications that display pet data in real-time, enabling tracking, behavioral insights, and alert management.

Growth of Multi-Function Smart Collars: Collars embedded with GPS, accelerometers, temperature sensors, and even cameras are becoming mainstream.

Medical Monitoring Innovations: Devices are increasingly being used to monitor chronic conditions, detect early illness symptoms, and deliver vet-approved treatment alerts.

Increased Adoption of AI and Predictive Analytics: Smart wearables are incorporating AI algorithms to predict behavioral anomalies, track mood, or recommend activity routines.

Eco-Friendly and Lightweight Design Focus: Manufacturers are adopting recyclable materials and lightweight form factors to ensure pet comfort and sustainability.

Subscription-Based Models for Pet Monitoring Services: Companies are offering data services and location history subscriptions, creating recurring revenue streams beyond hardware sales.

Wearables for Cats and Exotic Animals: New product development is moving beyond dogs to accommodate feline and non-traditional pets with specialized tracking needs.

| Report Coverage | Details |

| Market Size in 2024 | USD 862.55 Million |

| Market Size by 2033 | USD 2,987.18 Million |

| Growth Rate From 2024 to 2033 | CAGR of 14.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Product, Animal, Component, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Germany; UK; France; Spain |

| Key Companies Profiled | Avid Identification Systems, Inc.; DOGTRA; Datamars; Felcana; Allflex Livestock Intelligence (a part of MSD Animal Health); Garmin Ltd.; GoPro Inc.; Latsen Technology Ltd.; Loc8tor Ltd.; Mars, Inc.; Petface by LeisureGrow Products Ltd; Tractive; Trovan Ltd. |

A key driver fueling the European pet wearable market is the increasing demand for real-time location tracking and enhanced safety features. As urban living environments become denser and pets often share public spaces with humans, the need for constant oversight has grown. GPS-enabled pet wearables allow owners to track their pets in real time, receive escape alerts, and define geo-fenced boundaries.

This is especially crucial in scenarios involving outdoor cats or working dogs. Devices like Tractive GPS trackers, popular in Germany and Austria, enable owners to monitor location, activity, and even resting behavior. The ability to retrieve a lost pet quickly through these tools provides immense peace of mind, particularly in cities where pet theft and straying are rising concerns.

Furthermore, safety-focused wearables are increasingly integrated with LEDs, buzzers, or vibrational cues, enhancing visibility during night walks and enabling communication with hearing-impaired pets. As consumer emphasis on pet welfare continues to intensify, real-time tracking remains a compelling and essential application driving adoption across Europe.

Despite the market’s potential, one of the key restraints impeding faster adoption is the high upfront and ongoing costs associated with pet wearable technologies. Premium smart collars can range from €80 to €300, with additional expenses incurred through subscription-based GPS data plans, device insurance, and app-based premium features.

This pricing can be prohibitive for budget-conscious pet owners or multi-pet households. Furthermore, wearables require periodic charging, firmware updates, and occasional hardware servicing, especially in rugged outdoor environments. These maintenance factors can deter users, especially those unfamiliar with tech-driven solutions or living in rural areas with limited connectivity.

As the market matures, there's an increasing need for affordable, entry-level wearables that maintain essential tracking and health monitoring functions without imposing high costs. Innovations in energy efficiency and open-source components may eventually address these constraints.

One of the most promising opportunities in the Europe pet wearable market lies in the integration of wearable data with veterinary health platforms and pet insurance schemes. Just as human health wearables feed into telemedicine services, pet wearables are poised to support remote diagnosis, post-operative monitoring, and long-term wellness tracking.

Companies are partnering with veterinary networks to create ecosystems where real-time health data can trigger alerts for early signs of infection, mobility issues, or behavioral abnormalities. For instance, Felcana (UK-based) is developing a data-rich analytics platform linking wearables to veterinary health records and cloud diagnostics.

Insurance providers across Europe are also exploring ways to offer discounts or dynamic premium adjustments for pets actively monitored through certified devices—mirroring telematics-based car insurance models. These integrations have the potential to reduce healthcare costs, improve pet outcomes, and unlock a new dimension of personalized, preventive veterinary care.

GPS technology dominates the European pet wearable market, largely due to its indispensable role in pet tracking. Dog owners, particularly in urban and suburban regions, prefer GPS-enabled collars that provide real-time mapping, activity logging, and geo-fencing capabilities. GPS is especially favored in countries like the UK and Germany, where leash laws and outdoor activities make location monitoring crucial. Brands like Tractive and Garmin have built entire ecosystems around GPS-enabled tracking with intuitive interfaces and reliable service coverage.

Sensor technology is growing at the fastest pace, as it expands the functionality of wearables beyond location. Sensors embedded in smart collars and harnesses can monitor biometric data such as heart rate, body temperature, respiration, and stress levels. These devices are increasingly adopted in France and Spain, where pet owners are proactive about pet wellness and early diagnosis. Combined with AI analytics, sensors enable predictive health monitoring, which is rapidly gaining favor among tech-forward pet owners.

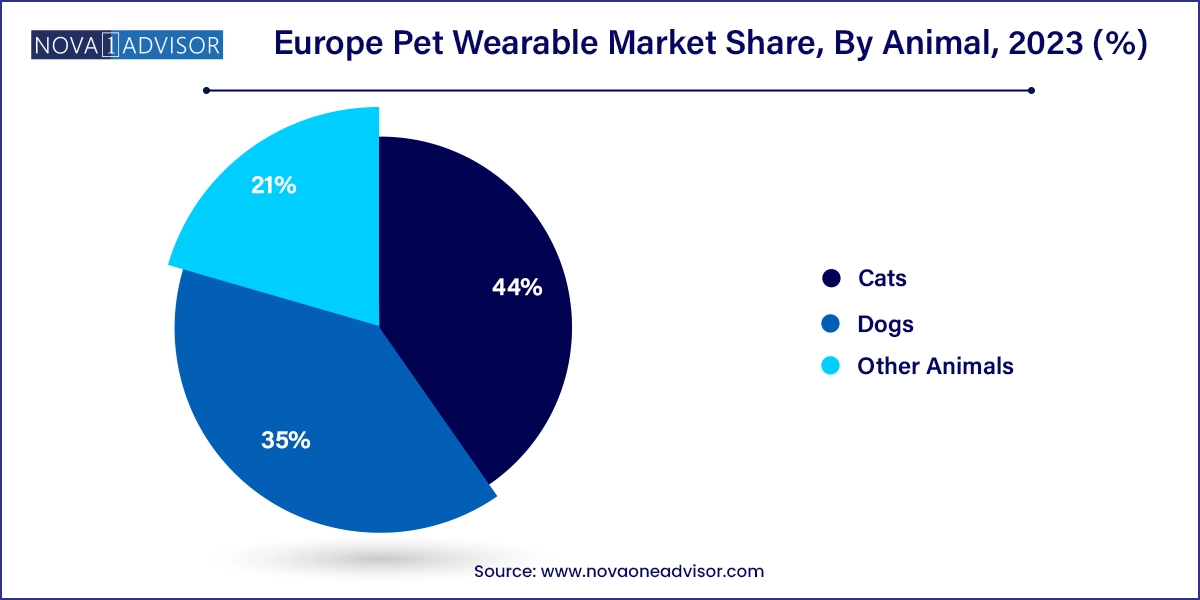

Dogs dominate the pet wearable segment, representing the largest user base in terms of volume and product development. The dog wearable market is well-established with tailored solutions ranging from training collars and smart trackers to behavioral monitors and medical alert devices. In countries like the UK, nearly 33% of households own a dog, making them the natural focus for innovation and sales efforts in the wearables space.

Cats are the fastest-growing segment, driven by a growing interest in feline behavioral understanding and location tracking. Traditionally seen as independent pets, cats now benefit from collar-based wearables that allow owners to track territory range, monitor eating habits, and detect health anomalies. In urban centers like Paris, Berlin, and Madrid, where indoor and partially outdoor cats are common, owners are adopting lightweight GPS collars and RFID-enabled trackers designed specifically for felines.

Smart collars hold the largest share of the product segment, due to their multipurpose functionality, ease of use, and widespread consumer familiarity. Collars equipped with GPS, accelerometers, and Bluetooth modules are now standard among pet wearables, offering activity tracking, safety alerts, and geolocation services. The UK and Germany, in particular, have high penetration rates for such products, driven by a strong culture of pet technology adoption and disposable income.

Smart harnesses and vests are the fastest-growing product type, especially in markets focused on high-performance breeds, service animals, or older pets requiring detailed health tracking. These wearables often incorporate more sensors and have a larger surface area, allowing for greater integration of components like ECG pads, LED indicators, and haptic feedback devices. Spain and France are seeing increasing adoption of smart harnesses for both pets and therapy animals, signaling a shift toward more advanced, multi-functional pet wearable formats.

GPS chips remain the most widely adopted component, owing to their fundamental importance in location-based tracking. Whether embedded in collars or vests, these chips enable pet owners to ensure pet safety during outdoor walks, hikes, or travel. European brands like Tractive have optimized GPS chip integration for precision in dense city environments and countryside alike.

Bluetooth and Wi-Fi chips are the fastest-growing connectivity components, as they support short-range data transfer, indoor navigation, and integration with home hubs. The increased penetration of smart homes in Europe has elevated demand for Bluetooth-enabled pet devices that can sync with home security systems, door sensors, or indoor pet cameras. These chips facilitate real-time status updates and control, especially useful in households with multiple pets or automated feeders.

Identification & tracking remains the dominant application, as safety and pet recovery continue to be top concerns for pet owners. RFID tags and GPS-based location services ensure that pets can be tracked, identified, and reunited with owners quickly. European countries with national pet ID registries, such as Germany and France, have built strong synergies between pet wearables and regulatory ID standards.

Medical diagnosis & treatment is the fastest-growing application, supported by rising awareness around preventive care and the digitalization of veterinary services. Smart devices that monitor body temperature, detect irregular heartbeats, or alert owners to sudden changes in motion are being adopted as tools for chronic illness management. PetPace, for example, offers medical-grade wearable collars for both dogs and cats that collect physiological data used by veterinarians for remote diagnostics.

The UK leads the European pet wearable market due to its tech-savvy pet owners, strong e-commerce infrastructure, and willingness to invest in premium pet care solutions. British brands and retailers actively promote smart collars, fitness monitors, and behavior tracking tools. Regulatory frameworks around pet identification and animal welfare also encourage pet owners to adopt wearables for tracking and safety.

Germany is another stronghold for pet technology, with a mature veterinary infrastructure and a cultural emphasis on animal welfare. German consumers appreciate utility-focused wearables, including GPS-enabled tracking collars and training systems. Demand for smart vests for service and therapy animals is also growing in Germany, aligned with the country's structured training programs and public safety norms.

France and Spain are experiencing strong growth in the adoption of smart pet accessories, with an increasing number of young, urban pet owners investing in fitness monitors and health diagnostics devices. The French market, in particular, is known for innovation in smart accessories and AI-based pet wellness tools.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe pet wearable market

Technology

Product

Animal

Component

Application

Country