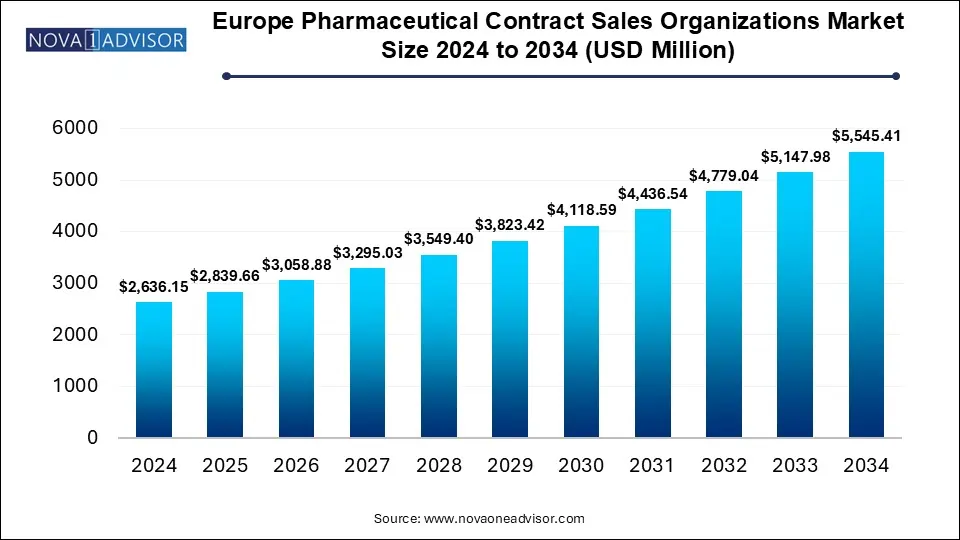

The Europe pharmaceutical contract sales outsourcing (CSO) market was valued at USD 2,839.66 million in 2024 and is projected to reach USD 5,545.41 million by 2034, registering a CAGR of 7.72% from 2025 to 2034. The global Europe pharmaceutical contract sales outsourcing (CSO) market growth is attributed to the strong developing pipeline with recent approvals of therapies in disease management.

Europe Pharmaceutical Contract Sales Outsourcing (CSO) market deals with the practice of pharmaceutical companies partnering with external organizations to handle various aspects of their marketing and sales efforts. This concept has gained popularity in the pharmaceutical business due to the availability of specialist knowledge, enhanced flexibility, and cost reductions. CSOs help secure financial viability and achieve brand success of emerging pharmaceutical companies. There are various major drivers propelling the market growth such as consumer demand for lower in-house sales costs, pharmaceutical R&D activities, and increased new drug launches.

In addition, increasing marketing strategies and increasing the need for cost-efficient sales reduced the burden of maintaining large in-house sales teams and encouraged pharmaceutical companies to engage CSOs. Furthermore, the growing regulatory requirements in Europe, increasing adoption of digital sales channels, and the complexity of modern pharmaceutical products such as personalized medicines and biologics are further expected to drive the growth of the Europe pharmaceutical Contract Sales Outsourcing (CSO) market.

| Report Coverage | Details |

| Market Size in 2025 | USD 2,839.66 Million |

| Market Size by 2034 | USD 5,545.41 Million |

| Growth Rate From 2025 to 2034 | CAGR of 7.72% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Service, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | PDI Health, Charles River Laboratories, ManpowerGroup Solutions, Celerion, QFR Solutions , MaBico ,Mednext Pharma Pvt. Ltd., Peak Pharma Solutions Inc., IQVIA, Inc., Syneous Health |

Market Opportunity

The market creates significant growth opportunities enhanced by shifting market demands and evolving pharmaceutical industry dynamics. The increasing adoption of outsourcing strategies among biopharmaceutical and pharmaceutical companies presents major opportunities. These companies can focus on core operations such as research and development, through promotional activities and outsourcing sales. In addition, the growing presence of digital engagement models such as remote medical science liaisons and virtual detailing are further anticipated to enhance the growth of the Europe pharmaceutical Contract Sales Outsourcing (CSO) market in the coming years.

Regulatory complexity may hamper market growth

The highly complex and diverse regulatory environment is one of the major challenges hindering market growth. Each European country has its own set of compliance and rules governing pharmaceutical marketing and sales. Navigating these regulatory frameworks needs resources and expertise which may increase operational challenges for CSOs, which are further expected to restrain the growth of the Europe pharmaceutical Contract Sales Outsourcing (CSO) market.

The personal promotion segment dominated the Europe pharmaceutical Contract Sales Outsourcing (CSO) market in 2024. The segment growth in the market is driven by factors such as increasing direct impact on sales performance. Vacancy management services are offering seamless salesforce coverage during staff shortages and gaining traction. Whereas the non-personal promotion segment is expected to grow fastest during the forecast period. The segment growth in the market is contributed to the increasing adoption of remote and digital engagement solutions and increasing preference toward hybrid sales models combining non-personal and personal promotions.

The pharmaceutical companies segment dominated the Europe pharmaceutical Contract Sales Outsourcing (CSO) market in 2024. The segment growth in the market is attributed to the increasing complexity of modern therapies. In addition, the biopharmaceutical companies segment is expected to grow fastest during the forecast period. The segment is witnessing major growth due to factors such as increasing focus on niche therapies, such as personalized medicine. These companies are heavily dependent on CSOs for compliance and expert sales capabilities with strict regulatory frameworks in Europe.

Europe Pharmaceutical Contract Sales Outsourcing (CSO) Market in 2024 Trends

The market in Europe is segmented into Spain, Italy, France, the UK, and the Rest of Europe. The market growth in the region is attributed to the increasing demand for new drug molecules for various therapeutic applications, the rising geriatric population, and the increasing demand for pharmaceutical products. Contract sales organizations (CSOs) in Germany provide their services to small-scale biotech companies and large pharmaceutical companies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe Pharmaceutical Contract Sales Outsourcing (CSO) Market

By Service

By End-use

By Region