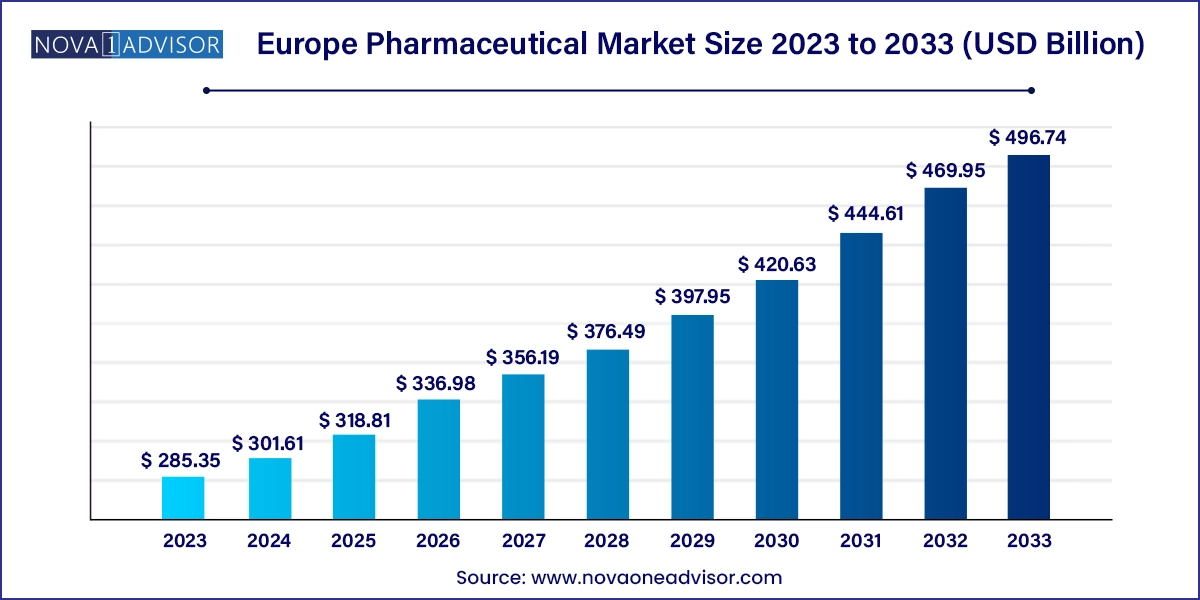

The Europe pharmaceutical market size was exhibited at USD 285.35 billion in 2023 and is projected to hit around USD 496.74 billion by 2033, growing at a CAGR of 5.7% during the forecast period 2024 to 2033.

The Europe pharmaceutical market represents one of the most mature, competitive, and research-intensive healthcare sectors in the world. It comprises a vast array of therapeutic products ranging from branded and generic medications to over-the-counter (OTC) and prescription drugs. With a robust infrastructure of healthcare systems, strong academic research, advanced biotechnology capabilities, and favorable reimbursement policies, Europe continues to be at the forefront of drug innovation, clinical development, and pharmaceutical exports.

Countries such as Germany, France, the United Kingdom, and Switzerland are home to several of the world’s leading pharmaceutical giants and research hubs. The region benefits from harmonized regulatory systems like the European Medicines Agency (EMA), which facilitate streamlined drug approvals across member countries. Additionally, Europe is a key battleground for global pharmaceutical companies owing to its lucrative patient base, aging population, and focus on chronic disease management.

Despite regulatory complexity and pricing pressures, the market is continuously evolving with innovations in biologics, biosimilars, personalized medicine, and digital therapeutics. The COVID-19 pandemic further highlighted the significance of rapid pharmaceutical innovation and supply chain resilience. The sector is now actively investing in digitalization, sustainability, and greater collaboration between public and private stakeholders to address emerging health challenges and support long-term market sustainability.

| Report Coverage | Details |

| Market Size in 2024 | USD 301.61 Billion |

| Market Size by 2033 | USD 496.74 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Type, Therapeutic Category, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd.; Bristol-Myers Squibb Company; AstraZeneca plc; Novartis AG; Johnson & Johnson Services, Inc.; Gilead Sciences, Inc.; GlaxoSmithKline plc.; Merck & Co., Inc.; Pfizer Inc.; Sanofi; Boehringer Ingelheim GmbH |

One of the most potent drivers of the European pharmaceutical market is its rapidly aging population and the associated rise in chronic diseases. According to Eurostat, more than 20% of the EU population is aged 65 and over, a figure that continues to rise. This demographic shift is closely linked with increased incidences of conditions such as cardiovascular disease, cancer, diabetes, and neurodegenerative disorders. These long-term conditions require continuous pharmaceutical intervention, creating sustained demand for medications. For example, the use of anti-coagulants and biologics in the elderly has become more widespread in Western Europe, spurring innovation and higher revenue streams for manufacturers.

Europe’s well-established healthcare systems, while a strength in access and equity, also impose stringent pricing and reimbursement controls that pose challenges for pharmaceutical companies. Governments in many EU countries apply external reference pricing, value-based assessments, and centralized negotiations to regulate drug costs. This environment limits the profitability of new drugs, particularly high-cost therapies like gene treatments or specialty biologics. Additionally, variations in pricing and reimbursement policies across countries create market access hurdles. In some cases, pharmaceutical firms delay product launches or opt out of certain markets altogether due to unfavorable pricing dynamics, thus restraining overall growth potential.

The advancement of personalized and precision medicine represents a substantial opportunity for the European pharmaceutical industry. Leveraging genomic data, artificial intelligence, and real-world evidence, companies can now develop therapies tailored to individual patient profiles. This trend is particularly impactful in oncology, where targeted therapies based on biomarker analysis are transforming cancer treatment protocols. For example, companion diagnostics are being integrated into drug development pipelines in countries like Germany and Sweden. As national healthcare systems invest in genomic sequencing initiatives and expand digital health records, the infrastructure for personalized care is strengthening. This opens new doors for niche therapies, improving outcomes while fostering innovation.

Branded pharmaceutical products have traditionally dominated the European market, driven by innovation, patent-protected revenues, and extensive physician loyalty. These include blockbuster drugs in therapeutic areas like oncology, cardiovascular care, and autoimmune diseases. Companies such as Roche, Novartis, and Sanofi continue to lead with high-value treatments that address unmet medical needs. Despite increasing scrutiny on prices, branded drugs hold a significant market share due to their clinical efficacy, regulatory backing, and marketing strategies. Moreover, novel therapies such as CAR-T cell treatments and monoclonal antibodies are extending the life cycles of branded portfolios.

However, generic drugs are witnessing the fastest growth, spurred by patent expirations, cost-containment policies, and the need for budget-friendly alternatives. Governments across Europe have implemented incentives to promote generic drug use, including substitution mandates and reimbursement prioritization. Eastern and Central European countries, in particular, are heavily relying on generics to enhance healthcare access. Companies like Teva, Sandoz (a Novartis division), and STADA are expanding their portfolios and increasing production capacities. The post-COVID fiscal environment further underscores the importance of generics in ensuring affordability and sustainability within national healthcare budgets.

Oncology remains the leading therapeutic category in Europe’s pharmaceutical market. With rising cancer prevalence and continuous breakthroughs in treatment, including immunotherapies and precision oncology, this segment commands significant investment. Governments and private health insurers alike prioritize oncology funding, and reimbursement frameworks for cancer drugs are generally more favorable. Countries like France and Germany have led several pan-European initiatives to fast-track access to innovative cancer treatments. The emergence of biosimilars and companion diagnostics is also strengthening oncology’s commercial viability while offering cost relief.

Meanwhile, central nervous system (CNS) disorders represent the fastest-growing therapeutic category. The increasing burden of Alzheimer’s, Parkinson’s, epilepsy, and depression across Europe’s aging population has heightened focus on CNS drug development. Advances in neuroimaging, digital therapeutics, and gene-based interventions are catalyzing growth in this area. European firms are collaborating with academic institutions to decode the underlying biology of neurodegenerative disorders and create novel interventions. The EU’s Horizon Europe program has also allocated substantial funding to brain health, underscoring long-term support for CNS research.

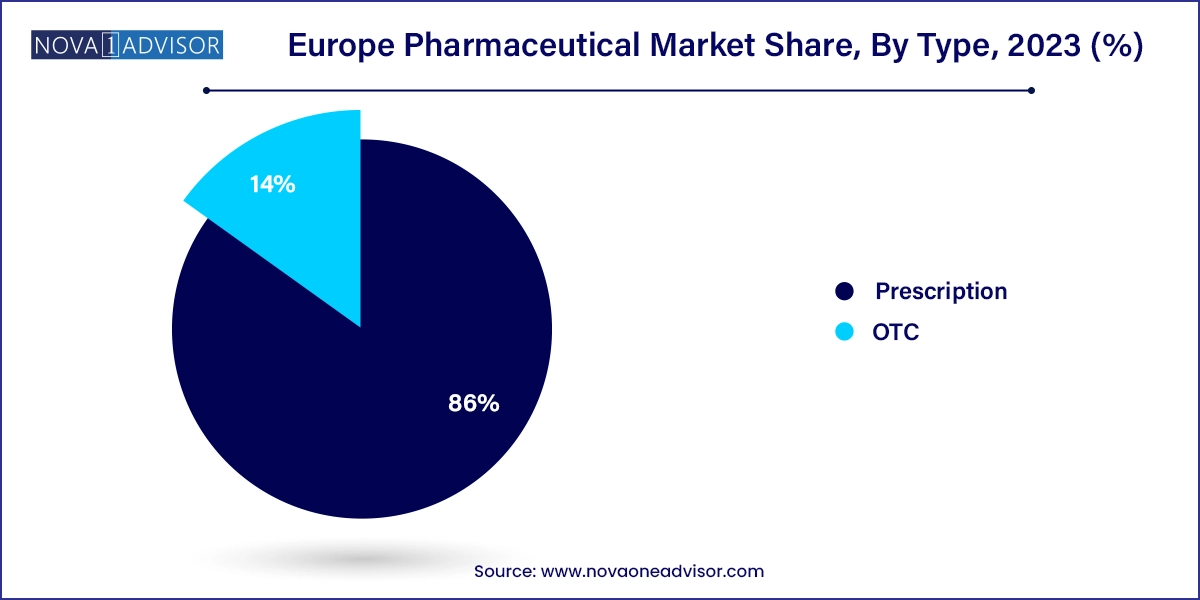

Prescription medications dominate the European pharmaceutical market due to their relevance in treating serious, chronic, and complex conditions. These include cancer therapies, cardiovascular agents, immunosuppressants, and neurological drugs. Hospitals and specialist care providers account for a significant portion of these sales, supported by robust public health insurance schemes. The regulatory rigor surrounding prescription drug approvals and usage also reinforces their dominance. Furthermore, clinical trials, academic research, and hospital-based diagnostics in Europe facilitate the expansion of prescription therapies into targeted patient populations.

On the other hand, over-the-counter (OTC) medications are experiencing steady growth, particularly in segments like cold and flu treatments, dermatology, digestive health, and women’s wellness. The expansion of self-care trends, driven by an informed and health-conscious population, is fueling demand for OTC products. Pharmacies and online platforms are increasingly marketing these solutions directly to consumers. In Nordic countries, e-pharmacy growth is particularly robust, and regulatory flexibility around non-prescription medicines has encouraged innovation. Additionally, the COVID-19 pandemic increased interest in immunity-boosting OTC supplements, a trend that has carried forward.

Western Europe, including countries like Germany, France, Italy, and the United Kingdom, is the largest regional contributor to the European pharmaceutical market. This dominance is attributed to strong healthcare systems, widespread insurance coverage, and significant R&D investment. Germany alone is Europe’s pharmaceutical powerhouse, known for its vast clinical trial infrastructure and domestic manufacturing excellence. France has maintained its status as a key market for both branded and biosimilar drugs, while the UK continues to lead in regulatory innovation post-Brexit through the Medicines and Healthcare products Regulatory Agency (MHRA). Western Europe also houses major industry clusters and is a hub for international headquarters and clinical research organizations.

Central and Eastern Europe (CEE) is witnessing the fastest growth within the broader European pharmaceutical market. Countries such as Poland, Hungary, and the Czech Republic are investing heavily in healthcare modernization and domestic drug production. The region offers cost advantages, an educated workforce, and increasing demand for affordable generic medications. EU funding programs and public-private partnerships are enabling infrastructure upgrades and improved access to medicines. Additionally, CEE countries are becoming attractive locations for clinical trials, regulatory outsourcing, and pharmacovigilance operations. The rising healthcare expenditure per capita is a testament to the region's trajectory as a key growth engine.

April 2025 – Novartis announced plans to launch a new gene therapy treatment for retinal disorders in Germany under accelerated access guidelines.

March 2025 – Sanofi entered a strategic partnership with the University of Cambridge to advance AI-driven drug discovery for metabolic disorders.

February 2025 – GSK launched its long-anticipated RSV vaccine for elderly populations across multiple European markets.

January 2025 – Bayer announced a €1 billion investment in upgrading its pharmaceutical manufacturing facility in Leverkusen, Germany.

December 2024 – AstraZeneca expanded its clinical trial footprint in Eastern Europe for oncology and cardiovascular drug pipelines.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe pharmaceutical market

Product

Type

Therapeutic Category

Regional