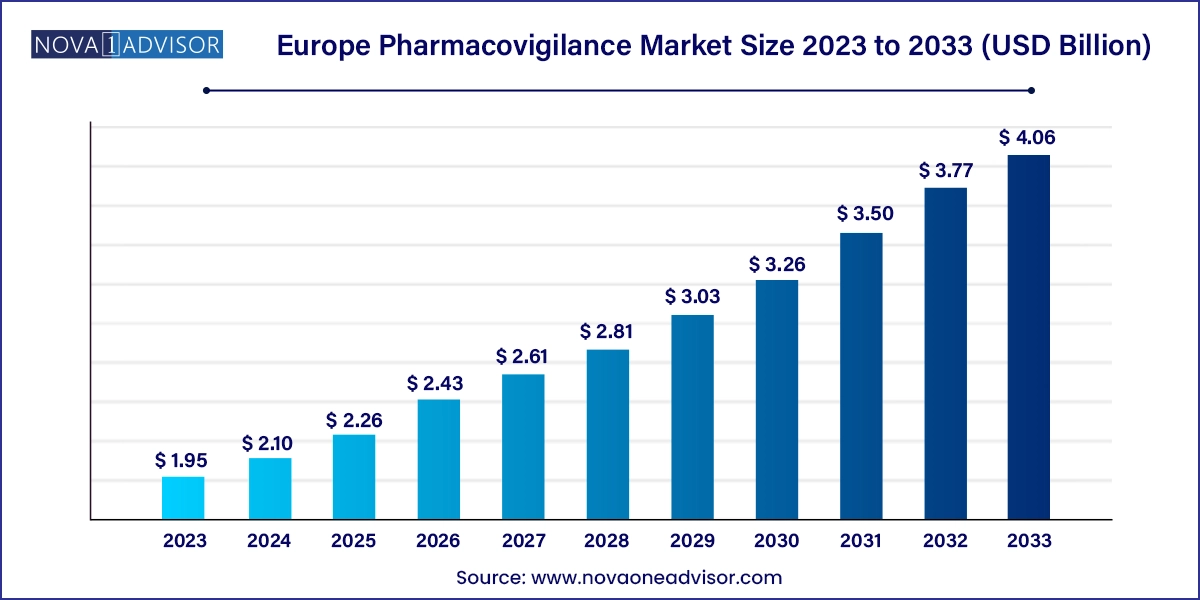

The Europe pharmacovigilance market size was exhibited at USD 1.95 billion in 2023 and is projected to hit around USD 4.06 billion by 2033, growing at a CAGR of 7.6% during the forecast period 2024 to 2033.

The Europe pharmacovigilance market is a cornerstone of the continent’s robust healthcare and pharmaceutical ecosystem, ensuring the safety, efficacy, and quality of drugs throughout their life cycles. Pharmacovigilance, often termed drug safety surveillance, involves the detection, assessment, understanding, and prevention of adverse effects or other drug-related problems. With an increasingly complex therapeutic landscape, stricter regulatory scrutiny, and public demand for transparency in drug safety, the importance of pharmacovigilance has grown exponentially across Europe.

The European Medicines Agency (EMA) and national regulatory authorities mandate stringent pharmacovigilance requirements for marketing authorization holders (MAHs). Companies are obligated to maintain safety databases, conduct risk assessments, submit individual case safety reports (ICSRs), and establish risk management plans (RMPs). The implementation of the EudraVigilance system—a centralized European database for adverse drug reaction (ADR) reporting—further strengthens cross-country collaboration in safety monitoring.

Rising clinical trial activity, particularly in oncology, neurology, and cardiology, has led to an expansion of pharmacovigilance services. European countries, especially Germany, the UK, France, and Italy, are investing in advanced pharmacovigilance platforms integrated with real-time signal detection, AI-based adverse event prediction, and automated case processing tools. The region’s pharmaceutical companies and contract research organizations (CROs) are increasingly outsourcing pharmacovigilance operations to improve scalability and cost-efficiency.

In response to the COVID-19 pandemic, the European pharmacovigilance infrastructure was stress-tested during rapid vaccine rollouts. The subsequent monitoring of vaccine safety using spontaneous reporting, cohort event monitoring, and real-world evidence (RWE) strategies became instrumental in shaping public health policies. As post-pandemic restructuring focuses on resilience, digitalization, and harmonization, Europe stands at the forefront of pharmacovigilance innovation.

AI and Automation in Pharmacovigilance: Increasing adoption of machine learning and natural language processing (NLP) for faster and more accurate case data management and signal detection.

Growing Role of Real-World Evidence (RWE): Leveraging EHRs, patient registries, and claims data for safety surveillance and decision-making.

Outsourcing to CROs and BPOs: Surge in contract outsourcing to specialized pharmacovigilance service providers for scalable and cost-effective operations.

Expansion of Risk Management Frameworks: Evolving risk management strategies including Risk Evaluation and Mitigation Strategies (REMS) and Risk Minimization Measures (RMMs).

Integration of EHR Mining and Big Data: Use of electronic health records and big data analytics to identify patterns in ADRs and improve pharmacovigilance precision.

Collaborative Cross-border Vigilance Systems: Strengthened cooperation among European countries through the EudraVigilance network and centralized safety databases.

Pediatric and Geriatric Pharmacovigilance: Rising attention to vulnerable populations in pharmacovigilance strategies, especially for age-specific safety profiling.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.10 Billion |

| Market Size by 2033 | USD 4.06 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product life cycle, Service Provider, Type, End use, Therapeutic Area, Process Flow, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Germany; France; UK; Italy; Russia; Spain; Sweden; Denmark; Norway |

| Key Companies Profiled | Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd.; Cipla Inc.; Aurobindo Pharma.; Asymchem Laboratories; Reyoung Pharmaceutical; CSPC Pharmaceutical Group Ltd.; Otsuka Pharmaceutical Australia Pty Ltd.; GC Biopharma Corp.; Chong Kun Dang Pharmaceutical Corp. |

Stringent Regulatory Mandates Driving Compliance and Market Growth

A major driver propelling the pharmacovigilance market in Europe is the continent’s comprehensive regulatory framework, which mandates robust safety monitoring mechanisms for pharmaceutical and biotechnology firms. The European Union (EU) has one of the most rigorous pharmacovigilance legislations globally, enforced through the EMA and supported by national authorities. Post-marketing surveillance is legally required under EU Regulation (EU) No 1235/2010 and Directive 2010/84/EU.

For instance, all MAHs must submit Periodic Safety Update Reports (PSURs), implement RMPs, and report ICSRs within strict timelines. Additionally, the EU Pharmacovigilance Risk Assessment Committee (PRAC) continuously evaluates safety signals. These measures ensure that companies invest in pharmacovigilance systems, driving market demand for case management, risk analysis, and compliance tools. As drug pipelines expand and regulatory complexity increases, particularly for biologics and gene therapies, pharmacovigilance becomes indispensable.

Operational Challenges in Managing Global Safety Databases

Despite its growth, the European pharmacovigilance market faces operational hurdles, particularly in managing the massive volume and diversity of safety data. Global safety databases must integrate multi-source information from clinical trials, spontaneous reports, literature, and social media in multiple languages and formats. Ensuring data consistency, completeness, and timeliness remains a complex task.

Moreover, the need for real-time adverse event detection increases the burden on pharmacovigilance teams. Manual data entry, quality control, and reconciliation across systems often result in inefficiencies and higher costs. Smaller companies and mid-sized biotech firms, in particular, struggle with scalability and compliance under these operational constraints. The resource-intensive nature of pharmacovigilance infrastructure especially when built in-house can hinder adoption or expansion.

Emergence of AI-driven Signal Detection and Predictive Analytics

One of the most promising opportunities in the European pharmacovigilance market is the deployment of AI and predictive analytics for signal detection and proactive risk management. Traditional pharmacovigilance processes are reactive, relying on the reporting of adverse events after they occur. AI transforms this approach by enabling early signal detection from structured and unstructured data sources, improving drug safety before risks escalate.

Companies like Oracle and ArisGlobal are developing platforms that apply NLP to extract adverse event data from social media, clinical notes, and medical journals. Predictive models assess patterns and risk profiles across therapeutic areas, allowing regulators and MAHs to respond faster. In 2023, the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) announced pilot projects using machine learning for pharmacovigilance signal evaluation. This shift to predictive pharmacovigilance represents a fundamental evolution of safety science and opens avenues for market expansion.

Spontaneous reporting remains the dominant type in the European market, largely due to regulatory reliance on individual case safety reports (ICSRs) from healthcare professionals and patients. EudraVigilance, the EU’s central ADR reporting database, receives thousands of spontaneous reports annually. This method remains a cornerstone of pharmacovigilance due to its simplicity, widespread use, and ability to capture unexpected adverse events. National authorities like the UK’s Yellow Card Scheme or France’s ANSM portal continue to strengthen spontaneous reporting mechanisms.

However, EHR mining is projected to be the fastest-growing segment, spurred by the digitalization of health records and real-world data (RWD) initiatives. Mining EHRs allows for comprehensive safety surveillance using longitudinal patient data, enabling early signal detection and patient subgroup analysis. For example, Sweden’s use of national EHR databases to monitor cardiovascular drug safety illustrates the potential of EHR mining. As interoperability and data analytics improve, EHR mining will become a core pharmacovigilance tool in the region.

Phase IV, or post-marketing surveillance, dominated the European pharmacovigilance market due to regulatory obligations requiring continuous monitoring of drugs after approval. Adverse drug reactions that emerge in real-world settings often differ from those seen in clinical trials due to larger and more diverse patient populations. Regulatory agencies emphasize Phase IV studies to ensure long-term safety, especially for chronic therapies, oncology drugs, and biological products. These post-marketing studies involve spontaneous reporting, cohort event monitoring, and EHR data mining. Pharmaceutical companies invest heavily in Phase IV pharmacovigilance systems to meet compliance, avoid litigation, and maintain public trust.

However, Phase III is witnessing the fastest growth due to the increasing number of global clinical trials and complex therapies advancing through late-stage development. During Phase III, pharmacovigilance is essential for trial monitoring, data integrity, and preparation for regulatory submission. With the EU Clinical Trials Regulation (CTR) mandating transparency and safety disclosure, Phase III pharmacovigilance is now integrated with clinical trial management systems (CTMS) and electronic data capture (EDC) tools. The convergence of clinical and safety operations in this phase fuels demand for integrated platforms and predictive monitoring capabilities.

Contract outsourcing emerged as the leading segment in the European pharmacovigilance market, driven by the need for cost-efficiency, scalability, and access to specialized expertise. Pharmaceutical and biotech companies increasingly rely on CROs and pharmacovigilance service providers to manage case processing, literature surveillance, and risk management planning. Outsourcing enables small and mid-sized companies to meet compliance requirements without investing in full-scale in-house teams. Leading providers offer end-to-end solutions, including medical writing, global reporting, and signal detection, often leveraging AI and cloud-based systems.

Nevertheless, in-house pharmacovigilance services are expected to grow steadily, particularly among large pharmaceutical enterprises with established pharmacovigilance infrastructure. These companies prefer internal control over safety data and invest in customized pharmacovigilance IT systems. In-house teams collaborate closely with regulatory affairs and R&D departments, ensuring seamless integration and faster decision-making. With increased regulatory scrutiny and the growth of complex biologics, maintaining robust internal pharmacovigilance capabilities becomes strategically important.

Pharmaceutical companies lead the pharmacovigilance market in Europe, accounting for the majority of ADR reports and post-marketing surveillance activities. These firms are subject to rigorous EMA guidelines and operate complex product portfolios requiring constant safety monitoring. Established companies maintain global safety databases, pharmacovigilance agreements (PVAs), and risk management frameworks, which create consistent demand for pharmacovigilance services and platforms.

Biotechnology companies, on the other hand, represent the fastest-growing end users. As innovation surges in gene therapies, monoclonal antibodies, and personalized medicines, biotechs are compelled to adopt sophisticated pharmacovigilance practices. With many EU-based biotechs advancing through clinical phases or receiving conditional approvals, safety surveillance becomes critical. The growth of cell and gene therapy trials in countries like France and the Netherlands accelerates this trend, pushing biotechs to partner with pharmacovigilance vendors or invest in AI-enabled systems.

Oncology was the dominant therapeutic area due to the high incidence of treatment-related adverse events and the complexity of cancer drug regimens. Immunotherapies, targeted treatments, and combination therapies often present unique safety challenges. EMA mandates extensive pharmacovigilance plans for oncology products, including real-world evidence collection and post-authorization safety studies (PASS). With increasing approvals for orphan oncology drugs, safety monitoring remains critical throughout their lifecycle.

Neurology, however, is growing at an accelerated pace. The expansion of clinical research in neurodegenerative diseases, such as Alzheimer’s, Parkinson’s, and multiple sclerosis, has driven pharmacovigilance efforts. Neurologic therapies often involve long-term use and can impact cognition or behavior, necessitating vigilant monitoring. EU Horizon programs and cross-border neurology research initiatives contribute to this growth, placing neurology in the spotlight for advanced safety assessments.

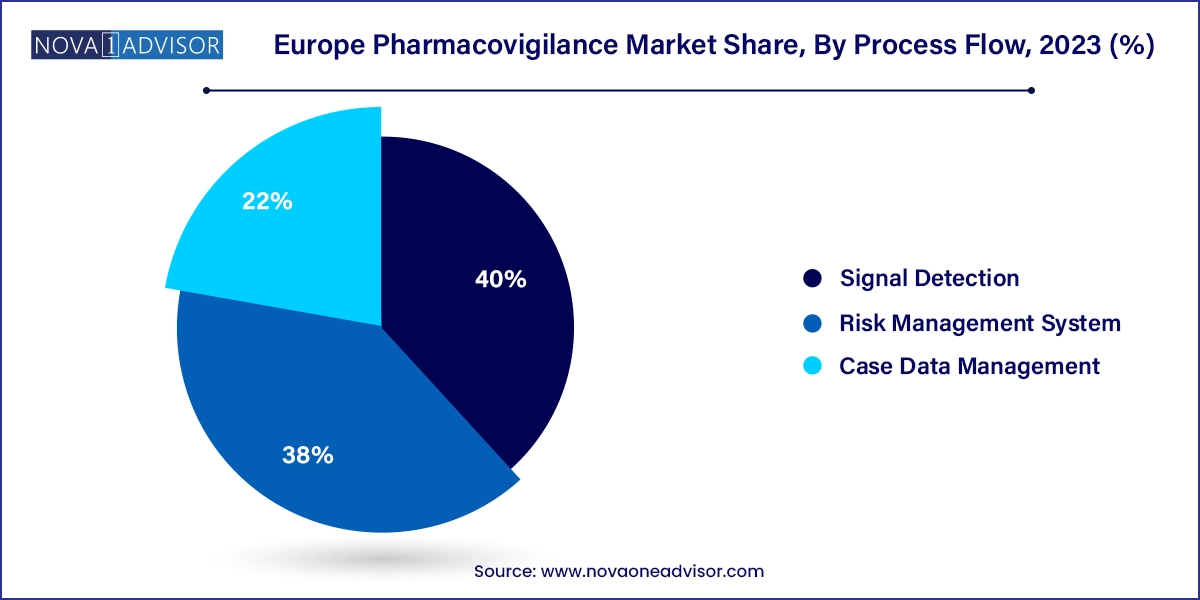

Case data management remains the largest segment due to the foundational role it plays in collecting, validating, coding, and submitting adverse event reports. Pharmacovigilance systems across Europe are built around efficient case intake and processing, especially with regulatory timelines for ICSR submission. Outsourced vendors and internal teams rely on specialized platforms like Oracle Argus Safety and ArisGlobal LifeSphere to manage high case volumes efficiently.

Yet, signal detection is quickly becoming the most dynamic process flow segment. Regulatory bodies now require proactive signal detection strategies to complement traditional reporting. AI tools that automate signal prioritization, duplicate case detection, and risk pattern identification are gaining traction. In April 2024, EMA released updated guidance on quantitative signal detection methodologies, further catalyzing investment in this segment.

Germany

Germany leads the European market due to its large pharmaceutical sector, robust regulatory compliance, and adoption of digital health technologies. The Federal Institute for Drugs and Medical Devices (BfArM) oversees national pharmacovigilance programs and collaborates with EMA on international initiatives.

United Kingdom

The UK remains a pharmacovigilance innovation hub even post-Brexit. The MHRA has established its own regulatory framework and emphasized AI in pharmacovigilance. Recent pilot programs have explored machine learning models for ADR detection and public health signal prioritization.

France

France’s ANSM is recognized for proactive pharmacovigilance. The country encourages patient-reported outcomes and maintains one of the highest spontaneous reporting rates in the EU. Partnerships with public hospitals enhance pharmacovigilance infrastructure.

Italy

Italy has made significant strides in pharmacovigilance digitization. The Italian Medicines Agency (AIFA) promotes the use of electronic reporting and integrates pharmacovigilance with national health records for comprehensive monitoring.

Spain, Sweden, Denmark, Norway

These countries have embraced EHR mining and real-world data initiatives. Sweden’s national EHR database, Denmark’s digital health infrastructure, and Norway’s data privacy regulations foster pharmacovigilance innovation and compliance.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe pharmacovigilance market

Product Life Cycle

Service Provider

Type

End Use

Therapeutic Area

Process Flow

Country