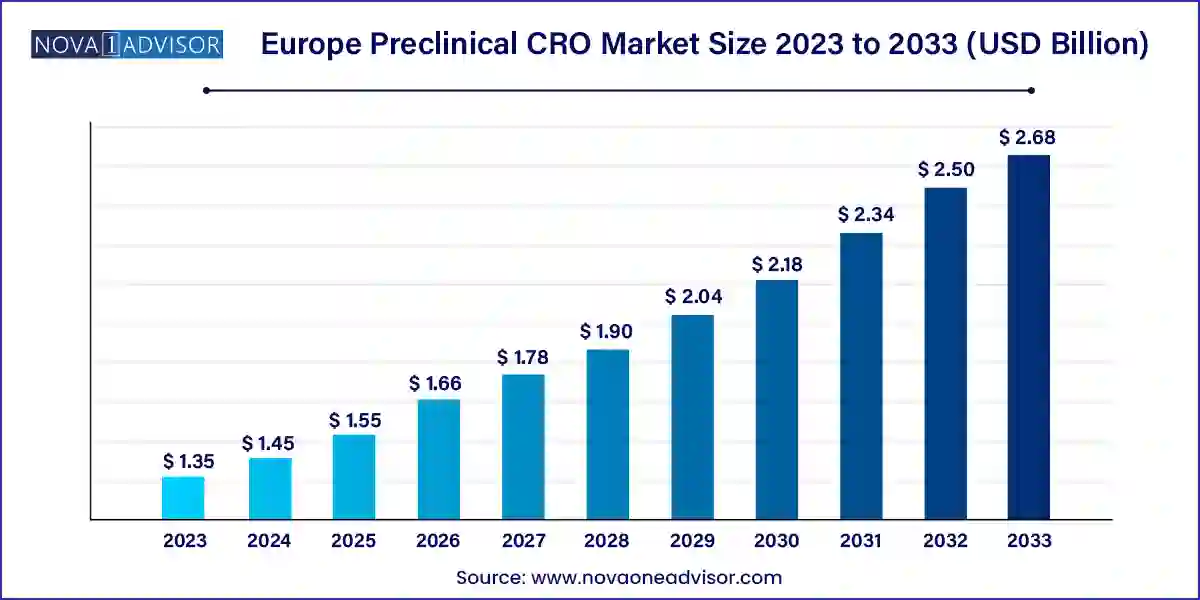

The Europe preclinical CRO market size was exhibited at USD 1.35 billion in 2023 and is projected to hit around USD 2.68 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2024 to 2033.

The Europe Preclinical Contract Research Organization (CRO) market plays a crucial role in the early-stage drug development pipeline, enabling pharmaceutical and biotechnology companies to accelerate investigational drug candidates from discovery to clinical testing. Preclinical CROs provide a suite of essential services such as toxicology testing, bioanalysis, pharmacokinetics, safety pharmacology, and compound management all designed to assess the safety, efficacy, and pharmacological profile of drug compounds before they enter human trials.

Europe stands as a significant hub for preclinical research due to its highly developed regulatory environment, strong academic research institutions, and presence of global pharmaceutical leaders. The region’s harmonized regulatory standards, under the European Medicines Agency (EMA), provide a conducive framework for companies to conduct GLP-compliant studies. Nations like Germany, France, and the UK are especially dominant due to their robust infrastructure, cutting-edge research facilities, and close collaborations between academia and industry.

Furthermore, the market is driven by increased drug development activities, rising demand for outsourcing, and growing R&D investments in biopharmaceuticals and medical devices. With a significant portion of drug pipelines globally targeting rare diseases, oncology, and autoimmune disorders, preclinical CROs in Europe are scaling their capabilities to support complex and customized testing needs. CROs are also responding to the growing preference for patient-relevant models, digitalized study designs, and regulatory-compliant data management systems, setting the stage for accelerated growth and innovation.

Expansion of patient-relevant models (PDOs and PDX): Preclinical CROs are investing heavily in developing and validating models that mimic human biology more closely.

Rise in AI-driven drug discovery platforms: Integration of artificial intelligence and machine learning in early-phase research is helping optimize compound screening and toxicology predictions.

Increased outsourcing by European biotech startups: Small and medium-sized enterprises (SMEs) across Europe are relying on CRO partnerships to support preclinical R&D and regulatory submissions.

Surge in oncology-focused preclinical studies: The rise of targeted therapies and immuno-oncology has led to a spike in demand for tumor-specific in vivo and in vitro models.

Cross-border academic and commercial collaborations: Joint research projects between EU universities, national institutes, and CROs are boosting model development and data standardization.

Focus on sustainability and animal welfare: Preclinical labs in Europe are prioritizing the 3Rs (Replace, Reduce, Refine) in animal research and exploring alternatives like organ-on-chip and 3D culture models.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.45 Billion |

| Market Size by 2033 | USD 2.68 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.1% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Model Type, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | Europe |

| Key Companies Profiled | Eurofins Scientific; Atlant Clinical; ASSAY Clinical Research; ALS Food and Pharmaceutical; Davids Biotechnologie GmbH; ABX-CRO advanced pharmaceutical services GmbH; ERBC Group.; Diag2Tec. |

One of the most significant drivers of the European preclinical CRO market is the rise in biopharmaceutical R&D expenditure, particularly in the development of therapies for rare, orphan, and complex diseases. Europe has been at the forefront of rare disease drug development, supported by incentives from the EMA and national governments. For instance, EU-funded programs such as Horizon Europe have contributed millions toward collaborative drug research focused on neurological, oncological, and genetic disorders.

Preclinical CROs are vital in these projects, offering specialized in vivo and in vitro models, pharmacogenomic profiling, and biomarker identification. For example, testing for Duchenne muscular dystrophy or advanced glioblastomas requires CROs to design custom-tailored efficacy and safety studies that comply with stringent ethical regulations. These services allow biotech firms to reduce development time and cost while optimizing clinical outcomes. As the number of orphan drugs in the European pipeline continues to grow, the demand for high-precision, scalable, and compliant preclinical testing will rise in tandem.

While Europe's harmonized regulatory framework is often seen as a strength, it also presents a unique set of challenges. Navigating the continent's diverse ethical review systems, language barriers, and variations in animal welfare legislation across countries can complicate the operations of preclinical CROs. For instance, although the EU Directive 2010/63/EU sets a baseline for animal research, countries like Germany and the UK enforce stricter national laws, increasing compliance complexity.

Moreover, the approval process for preclinical animal studies can be slow, often involving multiple institutional and governmental review bodies. These bureaucratic hurdles can extend project timelines, increase costs, and reduce flexibility in study execution. Ethical concerns about animal testing are also more pronounced in Europe than in other regions, leading to heightened public scrutiny and increased pressure on CROs to shift toward alternative models, which may require costly infrastructure upgrades. These regulatory intricacies remain a critical constraint for both local and foreign sponsors seeking to streamline preclinical studies in the region.

The shift toward personalized medicine in Europe presents a valuable opportunity for preclinical CROs, especially those that specialize in pharmacogenomics, molecular pathology, and companion diagnostics. Personalized therapies often target subpopulations defined by genetic biomarkers, requiring highly specific preclinical testing to demonstrate efficacy and safety across genotypes. The development of companion diagnostics tests designed to identify patients who will benefit from a specific therapy also depends heavily on robust preclinical data.

CROs are increasingly playing a pivotal role in these efforts by providing biomarker validation, in silico modeling, and genotype-phenotype analysis before clinical trials. For example, PDX and PDO models derived from European patient tumor banks are being used to simulate treatment responses in colorectal and breast cancers. With the EU investing in initiatives like the “1+ Million Genomes” project, which aims to build a cross-border genomics database, CROs with capabilities in bioinformatics, omics-based screening, and personalized preclinical assessments are uniquely positioned to capture new growth opportunities.

Patient-Derived Xenograft (PDX) models dominate the model type segment, largely due to their enhanced predictability in oncology drug development. European CROs benefit from well-established hospital networks and biobanks that supply tumor tissues for creating PDX models tailored to local genetic backgrounds. Germany and France, in particular, have seen a surge in the application of PDX models in immune-oncology studies. These models are especially valuable in evaluating the efficacy of monoclonal antibodies, checkpoint inhibitors, and combination therapies. CROs offering cryopreserved PDX libraries or custom model generation enjoy a competitive edge, as demand grows for more translationally relevant efficacy studies.

Patient-Derived Organoid (PDO) models are the fastest-growing model type, especially in countries like the UK and the Netherlands, which are leading innovation in 3D culture and regenerative medicine. PDOs offer a non-animal alternative that replicates organ-specific architecture and function, making them suitable for both efficacy screening and mechanistic studies. These models are being increasingly used in respiratory, gastrointestinal, and hepatic drug research. As regulatory agencies push for alternatives to animal testing and personalized therapy demands rise, PDOs are rapidly gaining acceptance. Several EU-funded consortia are also supporting the development and validation of PDO-based preclinical platforms.

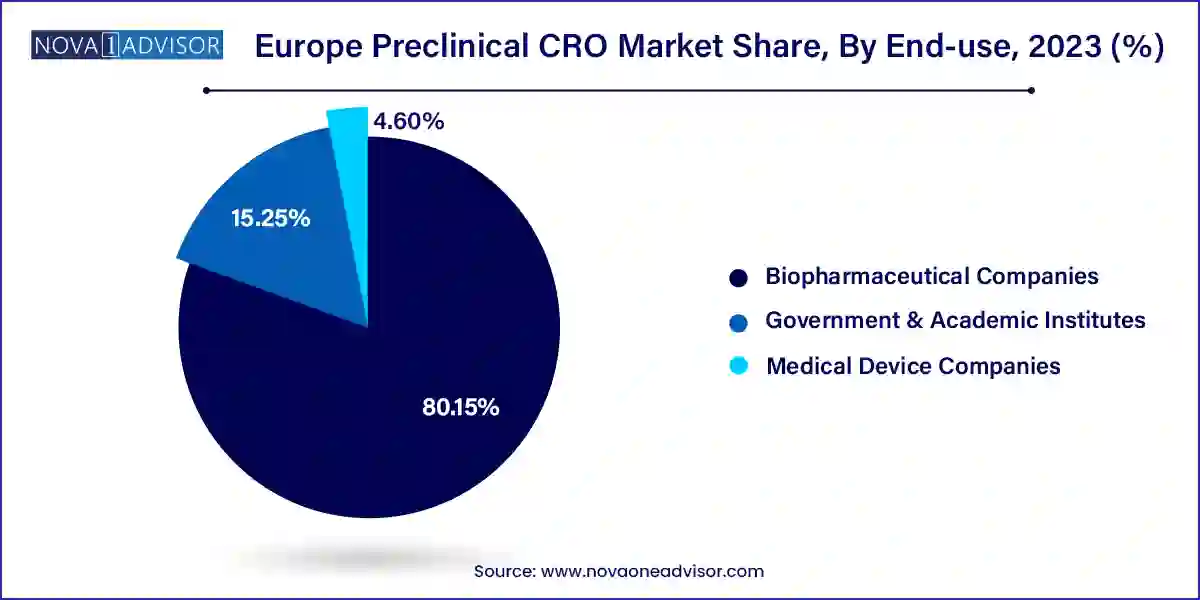

Biopharmaceutical companies remain the largest end-users of preclinical CRO services in Europe. Both global pharma giants and regional biotech firms rely heavily on outsourcing to streamline early-stage development, reduce time-to-market, and meet regulatory demands. The trend toward virtual biotech companies particularly in Scandinavia and Belgium has further accelerated the need for comprehensive preclinical support. CROs offering integrated IND-enabling packages are especially popular among these firms, enabling smoother transitions to clinical trials. Large players like Bayer and Roche often maintain long-term partnerships with European CROs to leverage their local regulatory knowledge and scientific expertise.

Government and academic institutes are rapidly emerging as a high-growth end-user segment, spurred by increased public funding for translational research and rare disease initiatives. Institutions such as the UK’s Medical Research Council (MRC), Germany’s Max Planck Institutes, and France’s INSERM are collaborating with CROs to execute large-scale preclinical studies. These organizations require expertise in model development, advanced imaging, and molecular biology, making them ideal partners for CROs that emphasize innovation. Public-private partnerships are also becoming common, creating fertile ground for CROs to co-develop new testing platforms and accelerate research outcomes.

Toxicology testing is the dominant service segment in the Europe preclinical CRO market, owing to its indispensable role in determining drug safety profiles prior to clinical trials. CROs across the UK, Germany, and France are renowned for their expertise in acute, sub-chronic, and chronic toxicity studies in accordance with OECD and EMA standards. Additionally, rising demand for environmental and reproductive toxicity assessments in line with REACH regulations is expanding the toxicology testing scope beyond pharmaceuticals to include chemicals and cosmetics. CROs such as Charles River and Eurofins offer comprehensive GLP-compliant toxicology services, backed by decades of experience and state-of-the-art facilities.

Bioanalysis and DMPK studies are the fastest-growing service segment, driven by the increasing complexity of drug formulations and delivery mechanisms. These services are crucial for evaluating a compound’s ADME (Absorption, Distribution, Metabolism, Excretion) characteristics and optimizing pharmacokinetic profiles. As novel modalities like mRNA therapeutics and cell-based therapies gain traction, the demand for customized bioanalytical assays and PK modeling is surging. European CROs are investing in high-resolution mass spectrometry, advanced LC-MS/MS systems, and integrated bioinformatics platforms to support high-throughput bioanalysis. Companies like Evotec and Sygnature Discovery are at the forefront of this transition, helping sponsors make data-driven decisions early in the pipeline.

The UK boasts a highly developed CRO landscape, supported by world-class academic institutions and a progressive regulatory environment. The post-Brexit emphasis on attracting life sciences investment has led to new government-backed innovation hubs and tax incentives for R&D. CROs in Cambridge, Oxford, and Manchester are seeing robust demand for preclinical oncology and neurology services.

Germany is Europe’s largest pharmaceutical market and a leading hub for GLP-certified preclinical testing. With a strong industrial base and strict regulatory standards, German CROs are trusted for their quality, reliability, and compliance with global standards. Berlin and Munich house several top-tier CRO facilities offering toxicology and PK/PD services.

France is a growing center for preclinical innovation, particularly in immunology and rare disease research. Paris and Lyon are home to CROs that specialize in PDO model development and AI-based preclinical screening. Government agencies like ANSM ensure strong oversight and promote collaboration between public and private research entities.

Italy is rapidly catching up in terms of biotech investment and CRO capabilities. Milan and Rome are emerging as centers for medical device and small-molecule preclinical studies. Regulatory reform and university-industry collaboration are helping Italian CROs scale their operations to compete globally.

Spain offers a cost-effective yet high-quality environment for preclinical testing. Barcelona and Madrid are notable for their strong academic support, hospital networks, and growing presence of early-stage biotech companies. Spanish CROs are expanding their offerings in regenerative medicine and gene therapy platforms.

April 2024 – Evotec SE and Bayer AG extended their women's health drug discovery collaboration based in Europe, emphasizing integrated discovery-to-preclinical development workflows that benefit CRO partners.

February 2024 – Charles River Laboratories announced an expansion of its French facility to enhance its capabilities in GLP toxicology and DMPK studies, targeting small and mid-sized biotech clients.

January 2024 – Eurofins Scientific launched a new bioanalytical center of excellence in Germany to provide advanced LC-MS/MS-based assays for biologics and biosimilars.

March 2024 – Sygnature Discovery (UK) partnered with the University of Nottingham to develop new PDO models for neurological diseases, aiming to reduce reliance on traditional animal models.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe preclinical CRO market

Service

Others

Model Type

End-use

Country