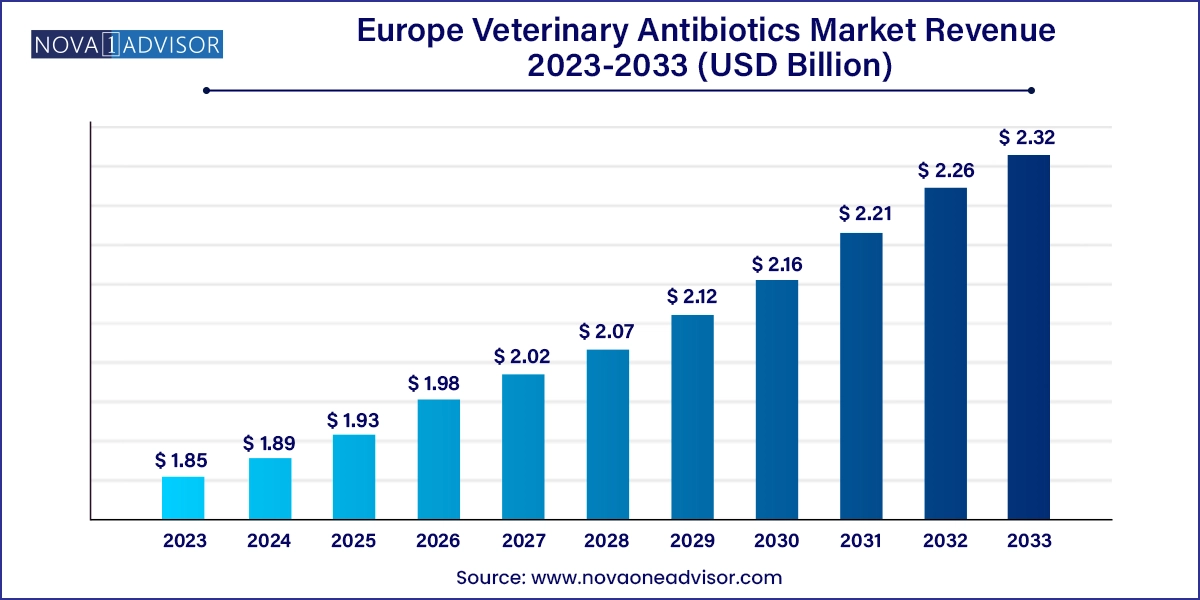

The Europe veterinary antibiotics market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 2.32 billion by 2033, growing at a CAGR of 2.27% during the forecast period 2024 to 2033.

The Europe veterinary antibiotics market occupies a central role in the continent's broader animal health and agricultural economy. As the demand for animal-derived food products grows and zoonotic disease threats intensify, veterinary antibiotics have become indispensable in maintaining livestock productivity, preventing disease outbreaks, and ensuring food safety. Europe, known for its stringent animal health regulations and advanced veterinary care practices, represents one of the most mature yet evolving markets for veterinary antibiotics globally.

Veterinary antibiotics are pharmaceutical agents used to treat bacterial infections in animals. These drugs are administered prophylactically, therapeutically, and metaphylactically to a wide range of species including pigs, cattle, poultry, and sheep. Their role extends from large-scale commercial livestock production to companion animal care. However, what makes the European market particularly distinctive is the growing emphasis on antimicrobial stewardship, a movement aimed at minimizing resistance risks through careful and regulated antibiotic use.

Over the past decade, European authorities have implemented a series of policy frameworks, such as the EU One Health Action Plan Against Antimicrobial Resistance and restrictions on the prophylactic use of antibiotics in farm animals. These actions have redefined market dynamics, pushing manufacturers toward innovation, surveillance, and transparency. In parallel, demand remains resilient—driven by disease prevalence, growing meat consumption in Eastern Europe, and an expanding companion animal sector in Western Europe.

With emerging technologies, including long-acting injectables, microbiome-enhancing alternatives, and digital animal health monitoring, veterinary antibiotic solutions are undergoing transformation. Furthermore, major European nations such as Germany, France, and Spain are witnessing strong public-private collaborations focused on advancing veterinary pharmaceuticals, while countries like Poland and Hungary are rapidly adopting modern antibiotic usage protocols to align with EU norms.

Shift Toward Targeted and Narrow-Spectrum Antibiotics: Driven by antimicrobial resistance (AMR) policies, there is growing adoption of precision-based and species-specific antibiotics.

Growth of Injectable Formulations: Longer-acting injectable antibiotics are gaining traction due to improved compliance, reduced dosing frequency, and lower stress for animals.

Digitalization of Veterinary Health Monitoring: AI-driven platforms and biosensors are increasingly used for early disease detection, minimizing broad-spectrum antibiotic usage.

Integration of Antimicrobial Stewardship Programs: Veterinary clinics and livestock producers are adopting EU-regulated antimicrobial usage protocols, impacting prescription behavior.

Rise in Combination Antibiotic Therapies: Combinations targeting multi-pathogenic infections are seeing increased use, particularly in swine and poultry production.

Expansion of Veterinary Antibiotics for Companion Animals: With pet ownership rising, especially post-pandemic, specialized antibiotics for dogs and cats are becoming a growth area.

Increased Manufacturer Investment in R&D and Compliance: Companies are investing in advanced manufacturing technologies and transparent residue monitoring to meet stringent EU standards.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.89 Billion |

| Market Size by 2033 | USD 2.32 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 2.27% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Animal Type, Drug Class, Dosage Form, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK, Germany, France, Italy, Spain, Denmark, Sweden, Netherlands, Belgium, Hungary, Poland, Portugal, Romania |

| Key Companies Profiled | Merck & Co., Inc; Ceva Sante Animale; Vetoquinol; Zoetis Services LLC; Boehringer Ingelheim International GmbH; Dechra Pharmaceuticals PLC; Elanco Animal Health Incorporated; Virbac S.A.; Calier; Bimeda, Inc.; Prodivet Pharmaceuticals SA/NV; Norbrook Laboratories |

Poultry emerged as the dominant animal type in the Europe veterinary antibiotics market, largely due to the high volume of broiler and layer production across countries like France, the Netherlands, and Poland. Poultry farming is intensive, with short production cycles and high stocking densities, making the flock highly susceptible to bacterial infections such as necrotic enteritis and colibacillosis. Antibiotics, especially in the early stages of disease, are crucial to maintain flock health and reduce mortality. Moreover, poultry contributes significantly to the European food chain, with increasing export demands necessitating tight health control protocols.

In contrast, the pig segment is the fastest-growing, particularly in countries like Spain and Denmark where pork is a major agricultural product. Pigs are prone to a wide range of bacterial infections including respiratory illnesses and enteric diseases. Newborn and weaned pigs are especially vulnerable, often requiring metaphylactic antibiotic interventions to prevent disease spread. Innovations in pig-specific antibiotic combinations, injectable therapies, and oral suspensions have further propelled this segment’s growth.

Tetracyclines dominate the veterinary antibiotics market by drug class, credited to their broad-spectrum activity, cost-effectiveness, and long-standing acceptance in veterinary protocols. They are widely used across multiple animal species for treating respiratory, urogenital, and systemic infections. Their continued inclusion in therapeutic guidelines and ease of oral and injectable formulation further solidify their position in the European market.

However, macrolides are the fastest-growing class, owing to their superior pharmacokinetics, tissue penetration, and effectiveness against respiratory pathogens. Macrolides such as tylosin and tilmicosin are extensively used in swine and cattle production to combat pneumonia and mycoplasmosis. Given their targeted action and reduced contribution to AMR, regulatory bodies are less restrictive with macrolide usage compared to other broad-spectrum classes supporting their uptake.

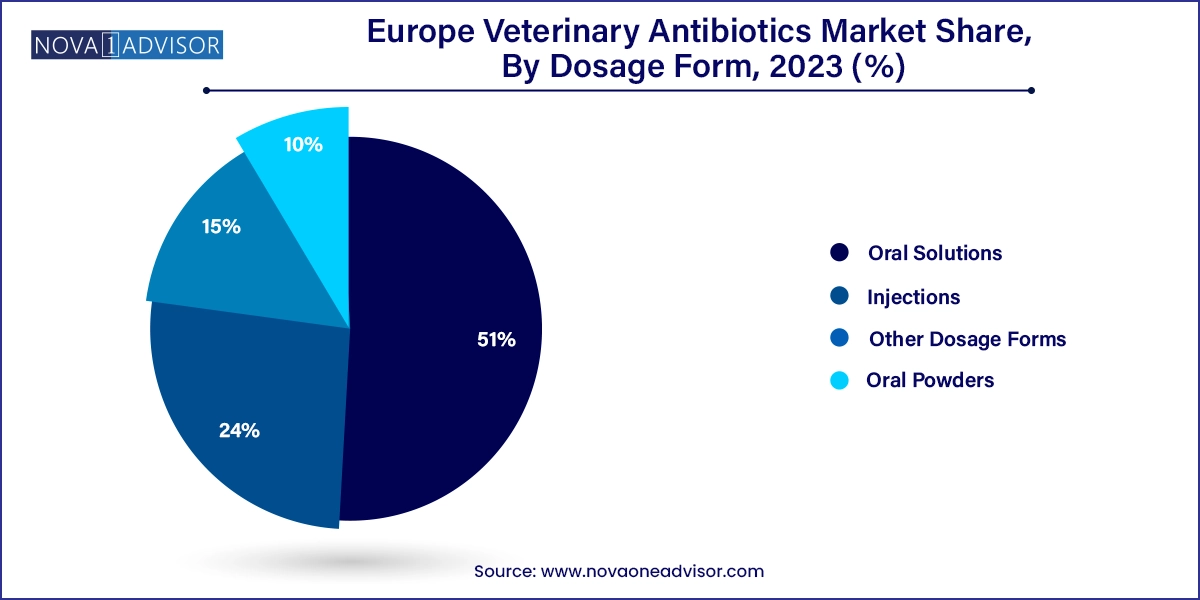

Injections dominate the dosage form segment, particularly in commercial livestock farms where immediate therapeutic action and high bioavailability are critical. Injectable antibiotics are preferred for severe infections requiring systemic treatment, and recent innovations in long-acting formulations have improved user experience and outcomes. Veterinarians often opt for injections when oral compliance is low or when gastrointestinal absorption is compromised.

Meanwhile, oral solutions are the fastest-growing segment, especially in poultry and pig farming. They offer a convenient route of administration through drinking water, making mass medication feasible. Recent advancements in taste masking, stability, and formulation quality have boosted the popularity of oral solutions in both preventive and therapeutic settings.

Germany: Leading the Veterinary Antibiotics Market

Germany leads the veterinary antibiotics market in Europe, supported by its large and diverse livestock industry, strong pharmaceutical infrastructure, and proactive antimicrobial stewardship efforts. With a mature cattle and pig farming sector, Germany witnesses consistent demand for therapeutic-grade antibiotics. German veterinary associations have integrated EU directives into national practice efficiently, supporting responsible antibiotic use while maintaining access. Additionally, pharmaceutical companies in Germany invest heavily in R&D and compliance, positioning the country as a hub for high-quality veterinary drug production and export.

Poland: Fastest-Growing Market

Poland has emerged as the fastest-growing veterinary antibiotics market, driven by rapid modernization of its livestock sector, growing meat exports, and alignment with EU health standards. Polish farms are investing in animal welfare, veterinary services, and record-keeping, which has increased antibiotic prescription rates—albeit with regulatory oversight. The government is also facilitating access to EU funding for livestock health programs, boosting market expansion. With veterinary education and diagnostics improving in rural areas, Poland’s antibiotic market is expanding in both volume and sophistication.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe veterinary antibiotics market

Animal type

Drug class

Dosage form

Country