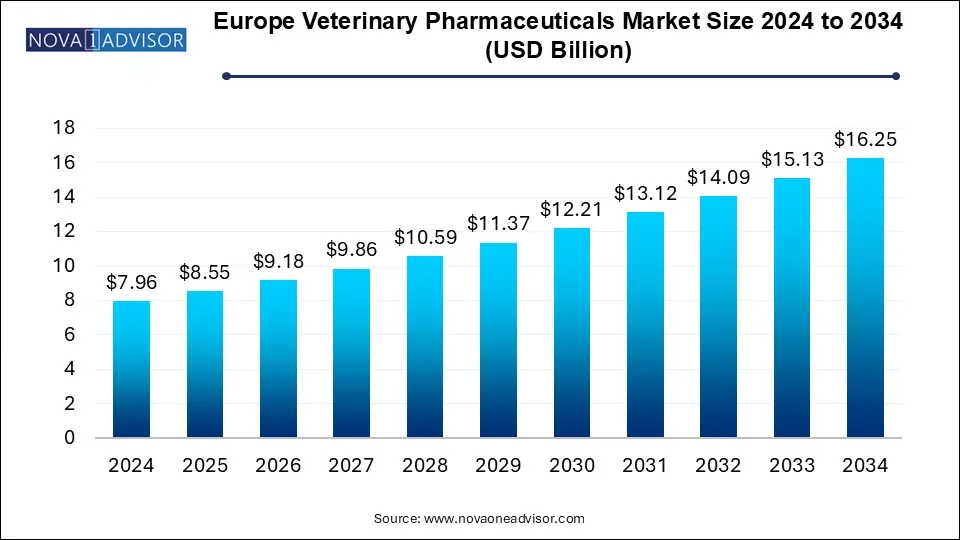

The Europe veterinary pharmaceuticals market size was exhibited at USD 7.96 billion in 2024 and is projected to hit around USD 16.25 billion by 2034, growing at a CAGR of 7.4% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.55 Billion |

| Market Size by 2034 | USD 16.25 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.4% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Animal Type, Product, Mode of Administration, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | Europe |

| Key Companies Profiled | Merck & Co., Inc.; Ceva; Vetoquinol; Zoetis Services LLC; Boehringer Ingelheim International GmbH; Elanco; Virbac; Calier; Bimeda Corporate; Prodivet pharmaceuticals sa/nv |

The growing awareness about zoonoses, the humanization of pets, the availability of pet insurance, and R&D initiatives by market players are the key factors anticipated to fuel market growth in the coming years. Boehringer Ingelheim, for instance, initiated over 450 clinical studies in 2020. The company received over 240 product authorizations that included approval for Aservo Equihaler in the EU for the alleviation of severe equine asthma.

Zoonoses, an infectious disease that can be transmitted between animals and humans, have played a significant role in driving the market growth. The spread of zoonotic diseases, such as avian influenza and bovine tuberculosis, has raised concerns about public health and animal welfare, prompting increased demand for veterinary medicines. According to the European Centre for Disease Prevention and Control (ECDC), in 2024 human contagions with influenza virus A(H1N2)v and A(H1N1)v of pig origin were detected in two European countries: Germany and Netherlands, respectively.

The impact of the COVID-19 pandemic on the European market was varied. The adverse effects included dampened demand, operational hurdles, and low sales. This was a result of movement restrictions, quarantine protocols implemented by governments, and deferred or canceled veterinary visits due to lockdowns. For instance, MSD’s (Merck) animal health division registered an estimated negative impact of approximately USD 100 million during 2020, whereas Elanco witnessed a 25% decline in revenue during Q2 2020. Elanco’s food animal products segment was the most affected due to pressured producer economics, processing plant closures, and reduced food service demand. Reduced demand for brands administered in veterinary clinics, notably vaccines, impacted the companion animal segment.

However, companies also recorded increased demand for pet medications and the adoption of telehealth. Boehringer Ingelheim, for instance, experienced a rise in product sales in the companion animal segment despite restricted access to veterinary clinics due to lockdown measures. However, the company reported a drastic decline in demand for its livestock products due to the closures of slaughterhouses and restaurants. In addition, the pandemic propelled the use of online channels, thus impacting customer buying patterns and promoting curb-side or virtual vet visits. As per Boehringer Ingelheim, therapeutic innovation is anticipated to boost the growth in the animal health business in the future.

Pharmaceutical drugs sold as prescription medications to treat pets may be needed for the short term or as lifelong medication to improve the quality of life. As per Animalhealth Europe, European households spent over EUR 2.7 billion on veterinary medicines in 2019. To help pet owners, offset the high costs of veterinary medications and treatment, insurance companies have started offering custom or tiered pet insurance plans. Pet insurance policies provide wide coverage including medication, tests, surgery, and diagnostics. For instance, Agria, the largest pet insurance provider in Sweden, provides coverage for several veterinary care procedures including prescription medicines as well as drugs purchased through online channels. The rising adoption of pet insurance is thus expected to fuel the market growth.

The government played a crucial role in fostering the growth of the market. Governments across Europe have implemented favorable regulatory frameworks, such as streamlining approval processes and ensuring compliance with safety and quality standards. In addition, they increased their expenditure on research and development of advanced veterinary medicines coupled with funding from other departments and organizations is estimated to boost the growth of the market over the forecast period. In 2020, the UK’s total expenditure on veterinary medicine was USD 15.3 million which increased to USD 29.6 million in 2024.

The availability and use of generic veterinary medicines are also growing as per the European Group for Generic Veterinary Products (EGGVP). This is owing to the expiry of patents and increasing R&D activities by small, medium, and large-sized market players to leverage the opportunity and increase their market share. The formulation patent for Draxxin (a product of Zoetis) containing the active ingredient tulathromycin expired in late 2020 in Europe and other key markets. Generic tulathromycin products are now marketed in several key markets such as Canada, Mexico, Europe, and Australia. Norbrook, based in the UK, follows a product model that mainly involves using molecules already established in the pharmaceutical industry. The company’s R&D strategy focuses on offering its customers a balanced portfolio of veterinary pharmaceutical products by being the first generic to the market wherever possible.

In terms of animal type, the companion animals segment held the largest revenue share in 2024. The dominance is attributed to the rising prevalence of infections in pets and the rising awareness among pet parents. As per a 2021 study published in the BMC Veterinary Research Journal, the prevalence of common disorders diagnosed in dogs in the UK was found to be 14.10% for dental disorders and 12.58% for skin disorders. Animalhealth Europe reported the overall sale of veterinary medicine for pets increased to 47.3% in 2024 compared to 42.4% in 2020.

The livestock animals segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is attributed to the increasing meat consumption and increasing standards for quality and safety. In May 2021, Inovet, headquartered in Belgium, invested in new facilities in France, in response to the continued high demand for livestock medicines as well as for an increase in its production capacity. The new facilities include a sterile solution plant and new QC and R&D microbiology laboratories. In October 2024, the Re-Livestock program was launched by Horizon Europe, to create integrated strategies for various dairy, beef, and pig systems, as well as for various geographical regions, considering climate change. It will bring together scientific knowledge and collaboration across diverse fields, including farm management, animal welfare, breeding, and nutrition, as well as environmental, socioeconomic assessment, and policy analysis.

In terms of mode of administration, the parenteral segment held the largest revenue share in 2024. Parenteral administration involves delivering drugs directly into the animals’ body through routes such as intravenous, intramuscular, or subcutaneous injections. The advantage of rapid and targeted drug delivery, enhanced bioavailability and better control over dosages resulted in market dominance. The market growth is driven by rapid product launch and development. For instance, in September 2024, Boehringer Ingelheim launched Fencovis, the first vaccine to stop E. coli F5- and bovine rotavirus-induced calf diarrhea and lessen the severity of coronavirus-induced calf diarrhea.

As per the MSD Vet manual, the oral route of administration is frequently used in companion and food animals. The dosage forms include tablets, powders, capsules, boluses, granules, solutions, pastes, and suspensions. The oral route is also the most widely used in cattle, pigs, and poultry to administer pharmaceuticals. New oral administration methods for flea and tick control products are further improving pet care as these can offer a simpler and more convenient form of administration for pet owners.

The use of modified-release delivery systems such as intraluminal boluses is also gaining traction in ruminants to deliver parasiticides, anti-bloat agents, production enhancers, and nutritional supplements. Dipping livestock animals is one of the most popular modes of administration amongst farmers. This is owing to the method’s efficiency in administering treatments such as those against ectoparasites. In addition, pour-on solutions and injectables help reduce the potential impact on the environment.

In terms of distribution channel, the veterinary hospitals and clinics segment held the largest revenue share in 2024. The dominance of the segment is attributed to the higher footfall in veterinary hospitals and clinics. In 2018, Mars Petcare- the largest operator of veterinary hospitals expanded into Europe with the acquisition of AniCura, a chain of 200+ veterinary clinics and hospitals with operations in Norway, Denmark, Sweden, Austria, Switzerland, Germany, Spain, Italy, the Netherlands, France, Portugal, and Belgium. In addition, the growth of the market can also be attributed to the increasing pet ownership and awareness regarding animal healthcare.

The digital or e-commerce segment is anticipated to grow at the fastest CAGR over the forecast period. This is owing to the rising digitalization in the animal health industry, changing customer preferences, adoption of veterinary telehealth, and usage of e-commerce platforms as the preferred platform for purchases. Elanco reported a shift in the purchasing behavior of veterinarians, farmers, and pet parents to online channels. The company has thus identified continuous digital ecosystem enhancement as a key growth driver. In September 2024, the European Union (EU) launched the standard logo for the selling of veterinary pharmaceuticals by online pharmacies and retailers in EU nations. The logo attests to the legitimacy of the websites and ensures the security of the products.

In terms of product, the anti-infective segment held the largest revenue share of 40.0% in 2024 and is also estimated to grow at the fastest CAGR over the forecast period. The growth can be attributed to the increasing product developments and initiatives by market players. The parasiticides segment held the second-largest share in 2024. This was attributed to the high incidence of ectoparasitic and endoparasitic infections in animals and the wide availability of products. According to the research published by BioMed Central Ltd for the Western European Region, 22.8% of dogs had an intestinal parasite, while Giardia was the most commonly detected parasite. In addition, in September 2024, Zoetis launched APOQUEL chewable tablets in the UK. These tablets provide fast and effective relief from canine dermatitis.

In 2020, the anti-infectives and parasiticides segments of Zoetis together accounted for 36% of the company’s revenue. This was followed by the company’s dermatology segment and other pharmaceutical products. However, growing initiatives by key public health and regulatory agencies to regulate and reduce the use of antimicrobials in animals may restrict the market growth for certain product segments. The Committee for Medicinal Products for Veterinary Use (CVMP) is tasked with taking forward the EU’s One Health Action Plan against antimicrobial resistance by implementing the provisions of the Veterinary Medicines Regulation.

The UK dominated the market in 2024 with the largest revenue share of 10.75%. In January 2021, the EU and the UK struck a provisional free-trade agreement. This ensured that the two sides could continue to trade goods without quotas or tariffs. Key details of the future relationship, however, remain uncertain, such as trade-in services. This prevented a “no-deal” Brexit, which could have significantly damaged the country’s economy. The British Veterinary Association (BVA) campaigned against a no-deal Brexit as it would leave the country with no time to transition and adjust. The BVA has also developed a set of key recommendations to secure the best possible outcome of Brexit for animal health that covers the following: animal welfare; veterinary medicines; veterinary workforce; food hygiene and safety; R&D; and trade.

The Netherlands is anticipated to grow at the fastest CAGR of 9.4% during the forecast period. Some key factors contributing to the growth of the Netherlands market include the high awareness among pet owners regarding their pet’s health, high standards for securing food sources by safeguarding the health of livestock animals, and the presence of key companies such as Norbrook, Chanelle Pharma, and Boehringer Ingelheim. According to a survey by GlobalPETS, from 2020 to 2024, 150,000 households in the Netherlands got a new pet. Among them 80,000 were dogs and 70,000 were cats.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe veterinary pharmaceuticals market

By Animal Type

By Product

By Mode of Administration

By Distribution Channel

By Country