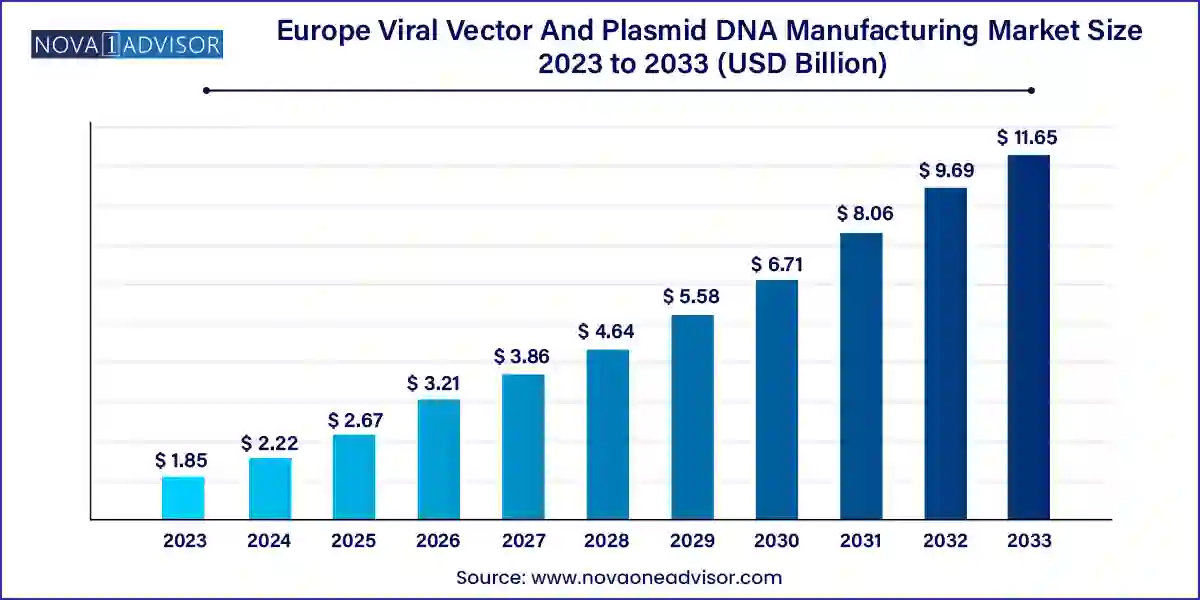

The europe viral vector and plasmid DNA manufacturing market size was USD 1.85 billion in 2023, calculated at USD 2.22 billion in 2024 and is expected to reach around USD 11.65 billion by 2033, expanding at a CAGR of 20.2% from 2024 to 2033.

The Europe viral vector and plasmid DNA manufacturing market is poised for substantial growth over the coming decade, driven by the surging demand for advanced gene and cell therapy solutions, next-generation vaccines, and cutting-edge genetic research. Viral vectors and plasmids are crucial components in delivering genetic material into cells, acting as foundational elements in the development of genetic medicines, such as those used in treating inherited disorders, cancer, and infectious diseases. With Europe positioning itself as a key global player in biotechnology innovation and biomanufacturing infrastructure, the region’s market is entering a phase of accelerated expansion.

Viral vectors—such as adeno-associated viruses (AAV), lentiviruses, and adenoviruses—have become integral to the success of therapeutic modalities like CAR-T therapy, in vivo gene editing, and RNA-based treatments. Similarly, plasmid DNA plays a vital role in genetic engineering, vaccine development, and the production of viral vectors themselves. As biopharmaceutical pipelines increasingly focus on personalized medicine and complex biologics, the need for scalable, compliant, and high-purity vector production has never been greater.

Europe’s regulatory rigor, presence of academic research centers, and a growing ecosystem of Contract Development and Manufacturing Organizations (CDMOs) are fueling the development of regional manufacturing capabilities. Germany, the UK, France, and the Netherlands are particularly active in establishing facilities that support clinical- to commercial-scale production. The COVID-19 pandemic, which significantly raised the profile of vector-based vaccines, has further elevated awareness and investment in this niche but rapidly expanding market.

Surging Gene Therapy Approvals: European regulators are approving more gene therapy candidates, increasing demand for clinical and commercial vector supply.

Shift Toward In-House Manufacturing: Larger biopharma companies are reducing reliance on CDMOs by investing in internal vector manufacturing capacity.

Modular and Continuous Manufacturing Systems: Facilities are transitioning from batch-based to continuous or modular platforms to improve speed and yield.

Emphasis on Plasmid DNA Quality Control: High demand for antibiotic-free, endotoxin-free, and high-yield plasmids used in vaccine and cell therapy manufacturing.

CDMO Consolidation and Expansion: Mergers, acquisitions, and greenfield facility investments are reshaping the landscape of service providers across Europe.

Digital Biomanufacturing and Automation: Smart manufacturing tools and AI-driven process optimization are being adopted to streamline vector production workflows.

Focus on Rare and Orphan Diseases: Orphan drug designations are incentivizing vector-based therapy development for genetic disorders.

| Report Attribute | Details |

| Market Size in 2025 | USD 2.67 Billion |

| Market Size by 2033 | USD 11.65 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 20.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Vector type, workflow, application, end-use, disease |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Merck KGaA; Lonza; BioMarin; Batavia Biosciences; BioNTech IMFS; Miltenyi Biotec; Charles River Laboratories (Cobra Biologics); FUJIFILM Holdings Corporation; Thermo Fisher Scientific, Inc. |

The principal driver of the European viral vector and plasmid DNA manufacturing market is the escalating demand for gene and cell therapies, especially in the areas of oncology, hematology, and rare genetic disorders. As of 2024, over 2,000 gene therapy clinical trials are active globally, with a significant proportion occurring across leading European biopharmaceutical hubs. These therapies require complex delivery mechanisms—primarily viral vectors such as AAV or lentiviruses—to effectively introduce therapeutic genes into target cells.

Cell-based immunotherapies like CAR-T (Chimeric Antigen Receptor T-cell) treatments depend heavily on high-purity, GMP-grade viral vectors. Additionally, plasmid DNA is a necessary precursor in viral vector production and plays a direct role in the formulation of DNA vaccines. With more gene therapies advancing from clinical to commercial stages, the demand for scalable, regulatory-compliant manufacturing solutions for these critical biological tools continues to intensify.

A major restraint facing the market is the technological complexity and cost-intensiveness of viral vector and plasmid DNA production. Manufacturing these biologics is far more intricate than producing traditional small molecule drugs, involving multiple steps of fermentation, purification, filtration, and validation under stringent regulatory conditions. The yield, quality, and consistency of vectors can be highly variable depending on the cell line, promoter systems, and downstream processing methods used.

Furthermore, cleanroom facilities that adhere to Good Manufacturing Practices (GMP) are required, leading to significant capital expenditure. The scarcity of skilled labor, long setup times for batch production, and high process failure rates pose additional challenges. For emerging biotech firms with limited funding, the cost of outsourcing or establishing in-house vector production can become a critical bottleneck, delaying drug development timelines.

A major market opportunity lies in the expanding use of viral vectors and plasmid DNA in next-generation vaccine development. Beyond COVID-19, vector-based vaccines are being explored for diseases like HIV, Zika, influenza, and certain cancers. Adenovirus and AAV vectors are proving particularly effective in stimulating robust immune responses in both prophylactic and therapeutic vaccines.

Plasmid DNA is also being leveraged in the development of synthetic mRNA and DNA vaccines, offering faster design and scalability compared to traditional platforms. The success of DNA vaccines for veterinary use and the growing body of human trials indicate a clear path toward wider medical use. Europe, with its strong regulatory framework and investment in public health, is well-positioned to support vaccine biomanufacturing initiatives that require advanced vector and plasmid production capabilities.

Adeno-associated virus (AAV) vectors dominate the Europe viral vector market, owing to their favorable safety profile, long-term gene expression, and compatibility with non-dividing cells. AAV is currently the most commonly used vector for in vivo gene therapy, especially in the treatment of retinal diseases, hemophilia, and neurodegenerative disorders. Multiple gene therapies approved in the EU rely on AAV vectors, solidifying their commercial viability. The vector’s low immunogenicity and capacity to deliver genes without integrating into the host genome make it ideal for applications demanding safety and long-term benefit.

However, plasmids represent the fastest-growing segment, driven by their dual function as therapeutic agents and as DNA templates for viral vector production. The demand for high-quality plasmid DNA for mRNA vaccines, CAR-T therapy, and genome editing applications is rising exponentially. Manufacturers are focusing on antibiotic-free and high-yield plasmid production processes to meet GMP standards. Startups and established biopharma companies alike are investing in dedicated plasmid facilities in countries such as Germany and the Netherlands, capitalizing on regulatory clarity and funding initiatives.

Downstream manufacturing currently dominates the vector production landscape in Europe, largely because of the emphasis placed on purification, concentration, and fill-finish steps that determine the final product’s quality and safety. Techniques such as affinity chromatography, ultrafiltration, and sterile filtration are critical in meeting regulatory requirements for endotoxin levels, DNA residuals, and viral particle concentration. Many CDMOs in Europe are focused on strengthening their downstream capabilities, especially for commercial-scale viral vector production.

Meanwhile, upstream manufacturing is expanding at the fastest pace, particularly in the sub-segment of vector amplification and recovery. Efficient transfection protocols, bioreactor scaling, and transient expression systems are receiving increased investment. Companies are leveraging HEK293 and Sf9 cell lines to maximize productivity, reduce cost, and simplify scale-up from bench to bioreactor. Vector amplification strategies using suspension cultures and fed-batch techniques are being adopted to meet demand for clinical trial material and commercial supply.

Gene therapy remains the dominant application for viral vectors and plasmid DNA in Europe, given the number of clinical candidates and the volume of funding directed toward correcting genetic mutations at the source. Diseases such as spinal muscular atrophy (SMA), cystic fibrosis, and various forms of inherited blindness are being addressed using vector-based therapies. With multiple gene therapies approved or under conditional marketing authorization in the EU, the demand for GMP-grade vectors and plasmids tailored to specific gene payloads continues to rise.

Conversely, vaccinology is the fastest-growing application, spurred by the success of vector-based COVID-19 vaccines like AstraZeneca’s ChAdOx1 and Janssen’s Ad26.COV2.S. The proof of concept for rapid vaccine development and global distribution has encouraged further exploration of viral vectors and plasmids for infectious disease prevention. Research into cancer vaccines and universal flu vaccines using AAV and adenoviral platforms is gaining traction, particularly in immuno-oncology circles. The success of mRNA vaccines has also driven increased demand for high-quality plasmid templates.

Pharmaceutical and biopharmaceutical companies are the dominant end-users, utilizing viral vectors and plasmid DNA for therapeutic development, preclinical studies, and commercial drug manufacturing. These companies either develop in-house manufacturing capacity or collaborate with CDMOs for scalability. The strategic importance of securing vector supply for CAR-T therapies and monoclonal antibody production places this user segment at the center of the market’s revenue stream.

Meanwhile, research institutes and academic centers are rapidly increasing their use of vectors and plasmids for basic research, translational medicine, and early-phase clinical trials. Institutions across Germany, France, and Sweden are leveraging government grants and EU funding to develop platform technologies in gene editing, cell reprogramming, and viral vector optimization. These players also serve as early adopters of novel vector formats and play a critical role in training the next generation of manufacturing scientists.

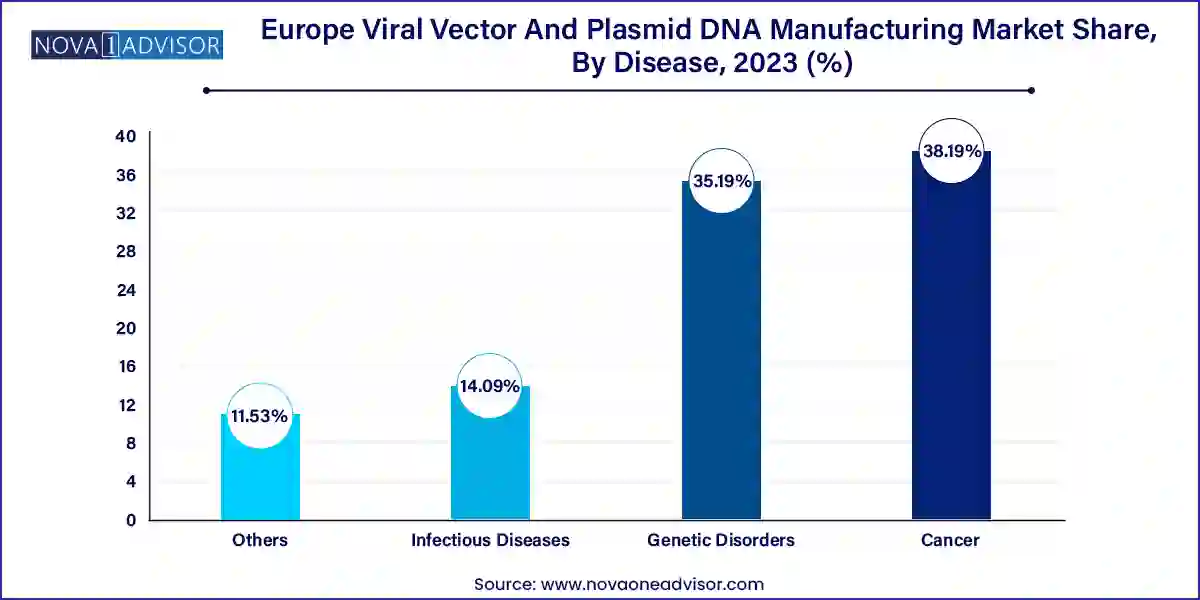

Cancer is currently the leading disease area in terms of application, especially in relation to cell and gene therapies like CAR-T and oncolytic viruses. Viral vectors and plasmid DNA are used in therapies that target hematological malignancies and solid tumors, either through immune cell modification or targeted gene delivery. The rise in cancer incidence across Europe, combined with regulatory momentum for advanced therapy medicinal products (ATMPs), is keeping oncology as the top disease focus.

Genetic disorders are growing the fastest, as therapies for monogenic diseases like hemophilia, Duchenne muscular dystrophy, and spinal muscular atrophy move through late-stage trials and commercialization. These diseases are ideal candidates for gene therapy due to their single-gene origin and severe clinical burden. EU incentives for orphan drug development and patient advocacy movements have created a favorable climate for investments in viral vector and plasmid infrastructure focused on genetic disorders.

Germany leads the Europe viral vector and plasmid DNA manufacturing market with robust infrastructure, world-class research institutions, and a thriving biotech ecosystem. The country houses several CDMOs and pharma giants with vector manufacturing capabilities, such as Bayer and BioNTech. Regulatory support, funding programs from the Federal Ministry of Education and Research (BMBF), and strong collaboration between academia and industry position Germany as a manufacturing hub for clinical-grade and commercial vector supply.

France and the United Kingdom are emerging as innovation centers, with growing investments in advanced therapy facilities. The UK’s Cell and Gene Therapy Catapult and France’s Genethon and Yposkesi are expanding vector production capacity with public-private support. These countries also benefit from strong clinical trial infrastructure, making them ideal for early-phase gene therapy development.

Yposkesi (France, March 2024): Announced the expansion of its AAV and lentivirus GMP manufacturing facility to increase capacity by 50% to meet growing gene therapy demand in Europe.

Oxford Biomedica (UK, February 2024): Partnered with Novartis to provide commercial lentiviral vector supply for global CAR-T therapy programs under an extended agreement.

PlasmidFactory GmbH (Germany, January 2024): Opened a new GMP-compliant plasmid DNA manufacturing suite in Bielefeld, targeting vaccine and gene therapy clients.

Aldevron (January 2024): Expanded its European client base for high-purity plasmid DNA, establishing a distribution partnership with a Germany-based biopharma services company.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe Viral Vector And Plasmid DNA Manufacturing market.

By Vector Type

By Workflow

By Application

By End-use

By Disease