The Europe waste management market size was exhibited at USD 394.45 billion in 2023 and is projected to hit around USD 693.18 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2024 to 2033.

The waste management landscape in Europe has evolved dramatically over the past few decades. As environmental consciousness becomes deeply rooted across society and governments intensify efforts to mitigate climate change, the role of systematic waste handling is gaining unprecedented significance. Europe, being one of the most developed continents, produces millions of tonnes of waste annually spanning municipal, industrial, medical, and electronic origins. As a result, the continent has emerged as a global model in adopting sustainable waste treatment strategies.

Waste management in Europe now extends beyond mere collection and disposal; it incorporates a holistic approach that includes waste reduction, reuse, recycling, energy recovery, and environmentally sound disposal techniques. This transformation is driven by a combination of social activism, government regulations, technological progress, and economic opportunities. The market comprises various stakeholders from local municipalities managing residential waste to private firms handling industrial by-products.

In recent years, consumer behavior, urbanization, and commercial activity have pushed waste generation to new heights. Despite efforts toward minimizing waste at the source, cities are grappling with growing piles of refuse. In response, Europe is witnessing a renaissance in waste infrastructure, where smart bins, AI-powered sorting systems, and robotic waste pickers are becoming increasingly common. Moreover, waste is now seen as a resource a shift that underlines the circular economy movement flourishing across European cities and industrial clusters.

Overall, the European waste management market is not only expanding in size but also redefining its purpose. From a traditional utility function, it is now recognized as a critical pillar for environmental resilience and economic sustainability.

Surge in Zero-Waste Cities

European cities like Ljubljana, Milan, and Amsterdam are championing zero-waste initiatives, aiming to send no waste to landfills through aggressive recycling, composting, and policy enforcement.

Integration of Smart Technologies

From AI-powered waste sorters to IoT-enabled bins that signal when full, Europe is leading the adoption of smart waste tech to improve collection efficiency and recycling rates.

Rise of Decentralized Waste Systems

Communities and industries are investing in localized waste processing systems such as anaerobic digesters and modular incinerators reducing dependence on central facilities.

Compost Revolution in Urban Farming

Urban agriculture movements in cities like Berlin and Paris are embracing compostable packaging and food waste composting to sustain rooftop gardens and urban farms.

Combatting Fast Fashion Waste

With the fashion industry contributing significantly to landfill volumes, countries like France are implementing return-and-reuse programs for textiles and clothing resale platforms.

Growing Focus on Industrial Symbiosis

Waste products from one industry are being repurposed as inputs in another for instance, food waste fueling biogas plants that power breweries.

| Report Coverage | Details |

| Market Size in 2024 | USD 417.33 Billion |

| Market Size by 2033 | USD 693.18 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service Type, Waste Type, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | FCC Environmental Services, Suez, Veolia, Renewi, Biffa PLC, Saica Group, Coventa Holding Corporation, Indver, Viridor, Remondis se & co, Fortum |

Europe has built a robust regulatory framework that prioritizes environmental sustainability. From comprehensive EU directives to local ordinances, waste management is strictly governed with clear targets for landfill reduction, recycling rates, and hazardous waste control. The Waste Framework Directive, while not cited directly here, has inspired harmonized policies across member states focusing on prevention, reuse, recycling, recovery, and disposal in that order.

However, policies alone do not suffice. European citizens actively engage in waste segregation at the household level. In many regions, households sort their waste into as many as six separate streams. Public awareness campaigns and educational initiatives have created a culture of responsibility and pride in community-driven waste reduction efforts. This dual force of regulation and participation is a powerful growth engine for the waste management sector.

While many Western European countries boast state-of-the-art recycling plants and digitized waste logistics, parts of Southern and Eastern Europe continue to face infrastructure constraints. Inconsistent waste collection schedules, limited access to treatment facilities, and inadequate landfill monitoring can hamper the broader goal of harmonized waste handling across the continent.

Moreover, budget constraints in less affluent municipalities often lead to underinvestment in technology and workforce training. Illegal dumping remains a pressing concern in certain rural or economically distressed areas. Bridging this infrastructural divide is essential to realizing the continent-wide potential of sustainable waste management.

A thriving opportunity lies in startups and companies harnessing waste for value creation. Europe is increasingly fostering innovation hubs around the circular economy, particularly in cities like Copenhagen, Rotterdam, and Helsinki. These ecosystems promote businesses that turn waste into new products from construction materials made from industrial ash to bioplastics derived from food scraps.

Government funding programs, venture capital, and sustainability accelerators are catalyzing such ventures. Not only do these businesses provide economic returns, but they also align with Europe’s green agenda. As consumer and investor interest in sustainability surges, circular economy ventures are poised to inject fresh momentum into the waste management value chain.

Collection services form the backbone of the waste management system and represent the most extensive operational footprint across Europe. Every day, hundreds of thousands of waste collection trucks navigate urban and rural roads, gathering refuse from households, commercial properties, and industrial units. This segment’s dominance is underpinned by regulatory mandates for scheduled pickups, sanitation standards, and citizen expectations. Municipal contracts for waste collection continue to be major revenue generators, and in many regions, public-private partnerships optimize logistics through route digitization and community-level engagement.

The rise of "pay-as-you-throw" schemes, wherein users are charged based on waste quantity or type, is further fueling innovation in collection practices. These models incentivize segregation at source and increase recycling rates. Moreover, commercial properties including hotels, offices, and malls are increasingly subscribing to premium waste collection services offering real-time tracking and customized bins. This segment, although mature, remains vital and continuously evolving.

Disposal Services Exhibit the Fastest Growth

As environmental policies become stricter, the demand for eco-friendly disposal solutions is intensifying. Landfilling, once dominant, is being replaced by modern disposal methods like thermal treatment, pyrolysis, and bio-stabilization. This shift is causing the disposal services segment to grow faster than ever before.

Countries such as Sweden and the Netherlands are minimizing landfill use by emphasizing incineration with energy recovery. Others are investing in biodegradable waste decomposition systems, plasma gasification plants, and waste-to-fuel initiatives. The growing volume of hazardous and medical waste has also necessitated specialized disposal systems. Consequently, new revenue models are emerging for firms that handle final waste treatment in compliance with strict ecological standards.

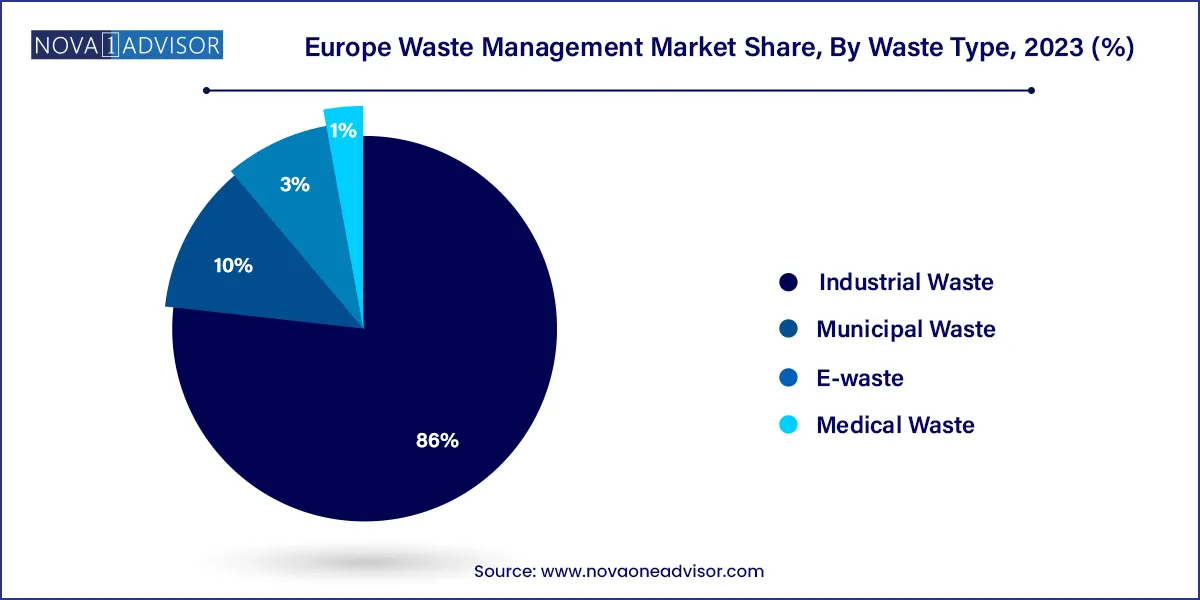

Municipal solid waste (MSW) is the most significant waste type by volume and frequency. Generated from households, schools, public parks, and local businesses, MSW includes everyday items such as food wrappers, packaging, paper, organics, and household chemicals. The high volume of this waste type necessitates continuous investment in its collection, segregation, and treatment.

Cities across Europe are diversifying their MSW strategies by investing in localized composting units, dual-stream recycling, and neighborhood sorting centers. Additionally, school programs and citizen reward systems are being used to instill best practices. The sheer scale of municipal waste guarantees its dominance for years to come, even as efforts are made to reduce per capita waste generation.

E-Waste Management Shows Explosive Growth

Europe is seeing a meteoric rise in electronic waste, driven by frequent device upgrades, planned obsolescence, and growing digital dependence. Items like smartphones, televisions, tablets, and appliances are discarded at increasing rates. E-waste poses unique challenges from toxic materials to intricate dismantling processes.

As a result, specialized recycling hubs for e-waste have gained prominence. These facilities retrieve rare earth elements and valuable metals like gold and lithium from discarded gadgets. Several countries are also mandating manufacturers to establish take-back schemes or pay recycling fees upfront. With digital penetration deepening, e-waste management will be one of the fastest-growing and most technologically demanding segments in this market.

The UK’s waste management market is undergoing a shift towards data-driven, decentralized models. London has piloted smart bin networks, while cities like Manchester have adopted food waste recovery schemes in collaboration with restaurants. Despite post-Brexit regulatory adjustments, the UK remains aligned with ambitious waste reduction goals. Recent innovations include blockchain-based traceability systems for construction waste and community composting incentives in rural areas.

Germany exemplifies best-in-class recycling with a multi-bin household system and mandatory packaging take-back for retailers. Its “Green Dot” initiative laid the foundation for producer responsibility, and it continues to lead in integrating digital tools in recycling centers. A growing number of German cities are investing in AI-driven waste sorters and optical sensors in materials recovery facilities to increase purity in recyclables.

France has adopted a zero-waste roadmap with bans on destroying unsold goods and mandates for organic waste segregation. In urban centers like Paris, startups are partnering with the government to deploy micro-composters and real-time waste level sensors. France is also focusing on textile and fashion industry waste, promoting second-hand retail and circular fashion platforms.

Italy presents a diverse picture. While northern regions like Lombardy and Emilia-Romagna boast high recycling rates and robust composting infrastructure, southern areas face illegal dumping and operational inefficiencies. National programs are injecting funds into modernizing facilities and enforcing waste tracking systems, especially for hazardous and medical waste.

Spain’s approach blends national regulations with regional autonomy. Catalonia, for example, is piloting waste credit systems for citizens. Organic waste collection is expanding, and more municipalities are converting landfills into biodiversity zones. Spain is also innovating with plastic alternatives in packaging through collaborative research centers funded by the government.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe waste management market

Service Type

Waste Type

Regional