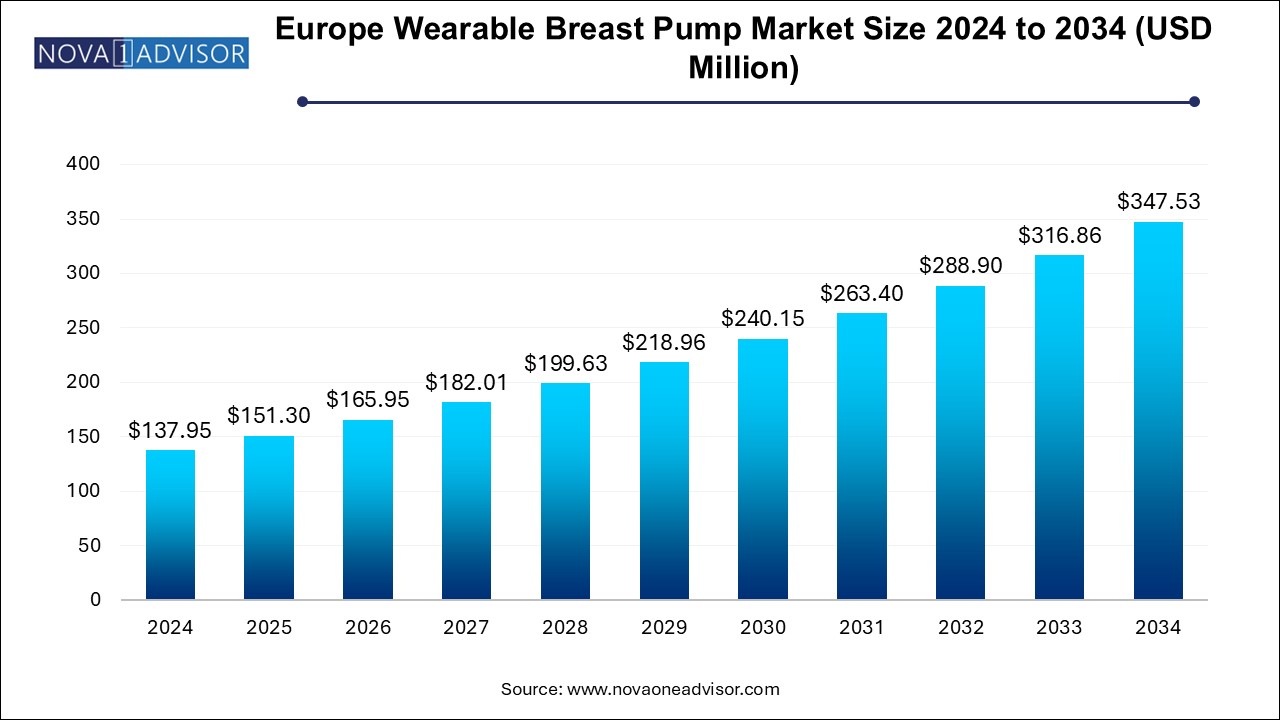

The Europe wearable breast pump market size was exhibited at USD 137.95 million in 2024 and is projected to hit around USD 347.53 million by 2034, growing at a CAGR of 9.68% during the forecast period 2025 to 2034.

The Europe wearable breast pump market is witnessing significant growth, driven by technological innovation, changing lifestyle patterns, increasing awareness of breastfeeding benefits, and supportive government initiatives that promote maternal and infant health. Wearable breast pumps have redefined convenience and privacy for nursing mothers by allowing hands-free milk expression, making them particularly appealing for modern, working mothers seeking flexibility.

Unlike traditional breast pumps, wearable variants are discreet, portable, and ergonomically designed to fit inside a bra, enabling mothers to pump milk on-the-go—be it at work, during travel, or while attending to household duties. This advancement has emerged as a game-changer, especially in European markets where maternal employment rates are high and public breastfeeding often faces societal limitations.

The demand for wearable breast pumps is also rising due to increasing healthcare expenditure, heightened consumer preference for technologically integrated healthcare products, and growing awareness about infant nutrition and postnatal health. Moreover, Europe’s established medical device regulation frameworks, emphasis on product safety, and presence of prominent global manufacturers contribute to steady market expansion.

The COVID-19 pandemic further spotlighted the importance of convenient and hygienic breast pumping solutions, driving sales of wearable devices that could be used in isolation, reducing reliance on shared hospital-grade pumps. As telehealth and remote monitoring services expand, smart wearable breast pumps are being integrated into maternal health platforms to support lactation tracking and milk volume analytics.

Growing preference for discreet, silent, and hands-free pumping solutions among working mothers in urban areas.

Rapid adoption of smart breast pumps integrated with Bluetooth and mobile applications for real-time tracking and analytics.

Expansion of e-commerce and direct-to-consumer sales channels for enhanced accessibility and brand engagement.

Collaborations between wearable tech companies and lactation consultants to personalize breastfeeding support.

Sustainability-focused product innovations, including BPA-free materials and rechargeable, energy-efficient designs.

Product diversification by global brands, introducing multi-size flanges, spill-proof containers, and adjustable suction technology.

Government programs and workplace lactation policies fostering a favorable environment for breast pump adoption.

Rising dual-income households and delayed motherhood, contributing to a growing target audience.

| Report Coverage | Details |

| Market Size in 2025 | USD 151.3 Million |

| Market Size by 2034 | USD 347.53 Million |

| Growth Rate From 2025 to 2034 | CAGR of 9.68% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Component, Technology, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | Europe |

| Key Companies Profiled | Medela AG, Willow Innovations, Inc. Philips, Elvie (Chiaro Component Ltd), BabyBuddha Products, LLC, Spectra, iAPOY, Lavie Mom, Pigeon Corporation |

One of the primary drivers fueling the growth of the Europe wearable breast pump market is the increasing participation of women in the workforce. According to Eurostat, female employment rates in Europe have been steadily rising, with many women returning to work shortly after childbirth. This demographic shift has prompted a surge in demand for portable, efficient, and discreet pumping solutions that can seamlessly blend into professional lifestyles.

Traditional breast pumps often restrict mobility and privacy, creating challenges for working mothers. Wearable breast pumps resolve these issues by offering silent operation, cordless use, and compatibility with standard nursing bras. This has enabled mothers to maintain their lactation routines without compromising productivity or privacy in the workplace.

Moreover, European labor policies and maternity leave standards vary by country, but often encourage early reintegration into work environments. The need for supportive lactation infrastructure, including home and workplace pumping devices, has become vital—making wearable breast pumps a critical investment in postnatal care.

Despite growing popularity, a significant restraint facing the Europe wearable breast pump market is the high initial cost of advanced wearable devices, especially smart variants. Compared to conventional manual or basic electric breast pumps, wearable models such as those by Elvie or Willow are priced at a premium, ranging between €250–€500 or more per unit. This price point may pose affordability challenges for low-income families or first-time mothers.

Additionally, limited reimbursement or insurance coverage for breast pumps in certain European countries curbs market penetration. While some national health systems (such as in France and the UK) provide partial support or rentals for traditional breast pumps, comprehensive reimbursement for wearable alternatives is often lacking. This disparity restricts access to technologically advanced pumps, especially among economically disadvantaged groups.

Affordability concerns are particularly pressing in Eastern European regions, where healthcare subsidies for maternal care are still evolving. To achieve inclusive market growth, manufacturers and healthcare policymakers must address the affordability and accessibility barriers surrounding premium wearable breast pumps.

An exciting opportunity in the Europe wearable breast pump market lies in the integration of smart technologies—such as app-based controls, real-time milk volume tracking, and cloud data storage—with digital maternal health platforms. As Europe increasingly embraces digital healthcare tools, wearable breast pumps with smart features are being positioned as vital components of postpartum care ecosystems.

Mothers can now access personalized insights about pumping duration, output trends, and nipple suction settings via connected mobile apps. This data can be shared with lactation consultants, pediatricians, or maternal health coaches to tailor breastfeeding advice, especially in cases involving low milk supply, mastitis, or irregular feeding patterns.

Moreover, smart pumps can sync with baby care apps, electronic health records, and wellness trackers—enabling holistic postpartum care. As remote care platforms expand in countries like Sweden, Germany, and the Netherlands, wearable breast pumps with integrated tech stand to revolutionize maternal health management.

The wearable pumps segment dominates the Europe wearable breast pump market, as they form the core innovation driving this industry’s evolution. These pumps offer mothers freedom, discretion, and mobility—key requirements in modern parenting routines. Brands like Elvie, Willow, and Medela have pioneered designs that eliminate external tubes, wires, and bulky motors, offering fully enclosed systems that fit directly into a bra. Such innovations have made pumping less intrusive and more aligned with the daily lives of modern women.

Wearable pumps are designed to be lightweight, quiet, and ergonomically optimized for maximum comfort and usability. The segment continues to grow as more mothers prioritize convenience, aesthetic design, and performance. While hospitals and lactation centers still rely on traditional electric pumps, the consumer segment increasingly demands wearable solutions for at-home and on-the-go use, reflecting a larger shift toward consumer-led healthcare technologies.

The accessories segment, although smaller, is growing rapidly. Accessories such as spare collection cups, flanges, valves, milk storage bags, and cleaning tools have become essential for daily usability. As wearable pumps become more mainstream, demand for compatible, hygienic, and brand-specific accessories rises concurrently. Subscription-based accessory models are also gaining traction, especially among tech-savvy European consumers who value continuous product support.

Battery-operated wearable breast pumps dominate the technology segment, offering a balanced mix of affordability, convenience, and efficiency. These pumps do not require manual effort and are designed with rechargeable batteries that allow usage in transit, at work, or during multitasking. Popular models by Philips Avent and Lansinoh fall under this category, catering to mothers who seek reliability without overly complex features.

Battery-operated pumps have found strong adoption in urban Europe, where the need for consistent and independent pumping outweighs the limitations of manual or corded devices. These products are especially favored in countries like Germany and France, where consumer trust in medical-grade device performance remains high.

However, smart wearable breast pumps represent the fastest-growing technology segment, thanks to their innovative integration with digital health ecosystems. These pumps offer Bluetooth connectivity, app-based controls, and real-time milk monitoring. Brands such as Elvie and Willow are leading the charge, offering pumps that not only express milk but also provide insights, reminders, and troubleshooting tips through smartphones.

Smart pumps are becoming the go-to choice for tech-savvy parents and healthcare-conscious millennials. As awareness of digital parenting grows, demand for pumps that blend physical functionality with data-driven insights is projected to soar.

Germany Dominates the Europe Wearable Breast Pump Market

Germany is the largest market for wearable breast pumps in Europe, driven by its robust healthcare infrastructure, high maternal employment rates, and strong consumer purchasing power. German mothers benefit from progressive parental leave policies and access to postnatal care services, including lactation support programs that encourage breastfeeding through advanced tools.

The country’s well-regulated medical device market also fosters trust in technologically advanced pumps. Major retail chains, pharmacies, and e-commerce platforms in Germany offer an extensive variety of wearable pumps from domestic and international brands. Moreover, a cultural emphasis on health-conscious parenting and access to maternity insurance contributes to steady product demand.

Sweden Emerges as the Fastest Growing Market

Sweden is the fastest-growing market, supported by its digitally advanced healthcare system, high female labor force participation, and openness to health technology adoption. The country is at the forefront of integrating maternal health platforms with wearable devices, making smart breast pumps an appealing addition to postpartum care plans.

Swedish parents are highly receptive to innovation, and government subsidies on maternal health products further ease adoption. Local hospitals often collaborate with tech firms to distribute wearable pumps through telehealth and home-visit programs. This synergy of public health policy and tech-driven parenting contributes to Sweden’s accelerated growth in this niche market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe wearable breast pump market

By Component

By Technology

By Regional