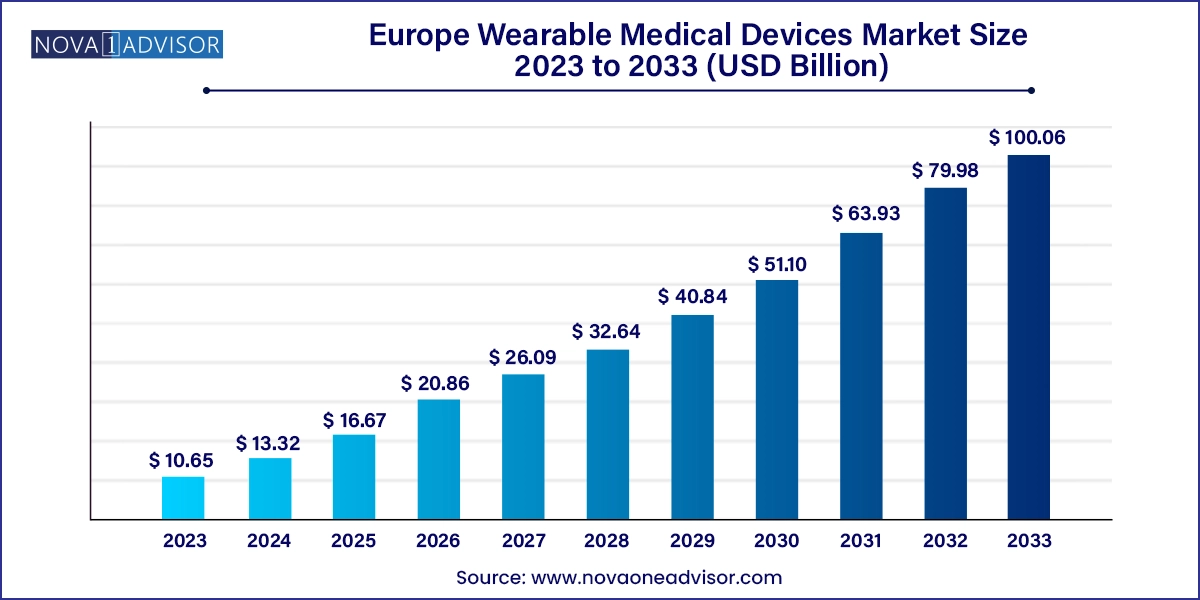

The Europe wearable medical devices market size was exhibited at USD 10.65 billion in 2023 and is projected to hit around USD 100.06 billion by 2033, growing at a CAGR of 25.11% during the forecast period 2024 to 2033.

The Europe wearable medical devices market is at the forefront of a paradigm shift in how healthcare is delivered, monitored, and consumed across the continent. With an aging population, rising incidence of chronic diseases, and growing demand for remote and preventive healthcare, wearable medical technologies have emerged as essential tools that enable real-time patient monitoring, chronic disease management, and lifestyle tracking. From wrist-worn heart rate monitors and smart glucose sensors to AI-powered rehabilitation devices and sleep trackers, wearable medical devices are becoming central to both clinical care and wellness routines across Europe.

The convergence of digital health and consumer electronics, along with favorable health policies and increasing investment in telemedicine infrastructure, is propelling the adoption of wearable medical devices in Europe. Countries like Germany, the UK, and Sweden are at the forefront of deploying these technologies in both public and private healthcare sectors. Moreover, the COVID-19 pandemic has further accelerated this trend, highlighting the importance of contactless monitoring, home healthcare, and digital patient engagement tools.

The market comprises both diagnostic and therapeutic devices, spanning a range of product categories from vital sign monitoring devices (such as pulse oximeters and ECG monitors) to advanced therapeutic equipment like neurostimulation devices, insulin pumps, and respiratory aids. These devices are increasingly being integrated into mobile health (mHealth) ecosystems that leverage smartphones, cloud platforms, and AI algorithms to provide actionable insights to patients and clinicians alike.

In a region that places strong emphasis on data privacy, healthcare quality, and technological innovation, the wearable medical device market is poised to see robust expansion. This is fueled by ongoing collaborations between medtech companies, healthcare providers, and digital startups, as well as by supportive regulatory pathways under frameworks such as the European Union Medical Device Regulation (EU MDR). As Europe continues to digitize its healthcare systems, wearable devices are expected to play a critical role in creating more proactive, personalized, and cost-effective healthcare experiences.

Integration with AI and Predictive Analytics: Wearables are increasingly paired with AI for early detection of anomalies and personalized health recommendations.

Shift Toward Clinical-Grade Devices: Devices with regulatory certification (CE-marked) are gaining prominence in hospital and remote patient monitoring settings.

Consumerization of Health Tech: Fitness wearables are evolving into multi-function health monitoring devices targeting both wellness and clinical applications.

Growth in Home Healthcare Demand: Europe’s aging population is fueling the need for wearables that support aging-in-place and chronic disease management at home.

Expansion of Telehealth Ecosystems: Wearables are becoming a key input in remote consultations, enhancing virtual care accuracy and continuity.

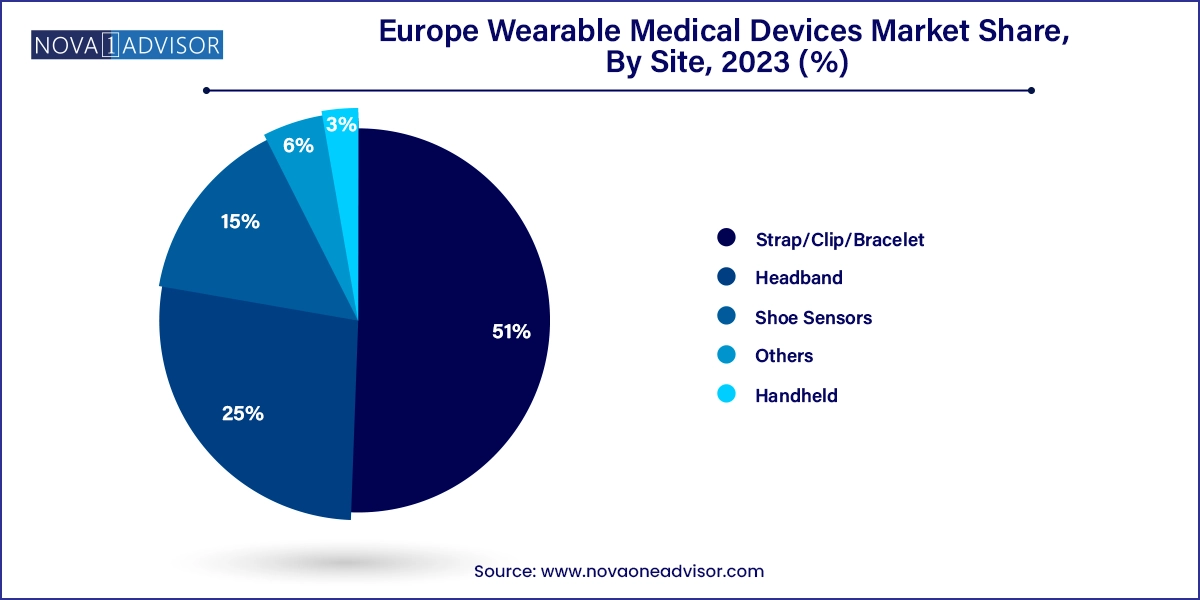

Focus on User Comfort and Aesthetics: Ergonomic, unobtrusive designs like headbands, shoe sensors, and bracelets are seeing higher adoption, especially among elderly patients.

Rising Importance of Data Privacy and Security: Compliance with GDPR and regional health data standards is driving secure cloud integration and encrypted communication.

| Report Coverage | Details |

| Market Size in 2024 | USD 13.32 Billion |

| Market Size by 2033 | USD 100.06 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 25.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Site, Grade Type, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Germany; France; Italy; Spain; Netherlands; Russia; Sweden; UK |

| Key Companies Profiled | Abbott Laboratories; Medtronic; Koninklijke Philips N.V; Omron Corporation; Samsung Electronics; Stryker Corporation; Sotera Digital Health; Polar Electro; Intelesense Ltd.; Withings |

A primary driver of the Europe wearable medical devices market is the increasing prevalence of chronic diseases and an aging demographic profile, which places a significant burden on healthcare systems. According to the European Commission, chronic diseases are responsible for over 77% of the disease burden in the region, with cardiovascular diseases, diabetes, respiratory illnesses, and neurodegenerative conditions leading the statistics.

Wearable medical devices are uniquely positioned to support early diagnosis, continuous monitoring, and personalized disease management all of which are critical for chronic care. Elderly populations, who often face mobility challenges and complex medication regimens, benefit immensely from devices that can track vital signs, remind patients of medication schedules, and transmit health data to caregivers or clinicians. These devices not only improve patient autonomy and quality of life but also reduce unnecessary hospital admissions and healthcare costs.

For example, wearable ECG monitors enable real-time detection of atrial fibrillation in elderly patients at home, while smart insulin pumps with Bluetooth connectivity help diabetics maintain optimal glucose levels. As European healthcare systems transition from episodic care to preventive and value-based care models, the role of wearable medical devices as a driver of patient-centric care continues to grow exponentially.

Despite a supportive innovation climate, the regulatory complexity and market fragmentation across European countries remains a notable restraint for the wearable medical devices market. While the European Union has implemented the Medical Device Regulation (EU MDR), which harmonizes product classification and approval processes, national-level requirements and reimbursement mechanisms still vary widely.

For instance, a wearable ECG device approved and reimbursed in Germany may face significant delays and compliance hurdles in France or Italy due to differing insurance frameworks or regional clinical guidelines. This lack of uniformity poses a challenge for manufacturers, especially startups and mid-size firms, seeking to scale quickly across Europe.

Moreover, the EU MDR imposes strict clinical evidence and post-market surveillance requirements, which can increase time-to-market and development costs for new wearable devices. The high standards are essential for ensuring safety and efficacy but can be a barrier for smaller innovators with limited resources. Navigating multiple healthcare systems, payer requirements, and data protection regulations (e.g., GDPR) adds layers of complexity that can slow down commercialization.

A compelling opportunity lies in the integration of wearable medical devices into national healthcare and remote patient monitoring (RPM) programs. European governments are increasingly investing in digital health transformation to reduce the burden on hospitals and enable decentralized care delivery. Wearables are critical enablers of such initiatives, offering real-time, passive data collection that informs clinical decisions without requiring frequent in-person visits.

For example, Germany’s “DiGA” (Digital Health Applications) framework, which reimburses approved digital health solutions, has opened the door for wearables to be used alongside certified mobile health apps. Similar developments are underway in France and the UK, where the NHS is piloting RPM programs for heart failure and COPD patients using wearable monitoring systems.

The scalability, affordability, and clinical value of wearables make them ideal for nationwide deployment, particularly in managing high-risk and elderly populations. Companies that can offer compliant, secure, and clinically validated wearable systems with integrated software will find significant growth opportunities through public-private partnerships and hospital collaborations.

Diagnostic wearable devices dominate the Europe market, particularly those used for vital sign monitoring such as ECGs, blood pressure monitors, and pulse oximeters. These devices are crucial in both acute care and chronic disease management, offering real-time data that supports early intervention. Heart rate monitors and portable ECGs, especially those with Bluetooth or 5G connectivity, are widely used in cardiology departments and for home-based cardiac monitoring. Wearable pulse oximeters gained major traction during the COVID-19 pandemic and continue to be essential tools for respiratory patients.

Therapeutic wearable devices are the fastest-growing segment, fueled by demand for pain management devices, insulin pumps, and rehabilitation wearables. Neuromodulation devices for migraine and chronic pain treatment are gaining popularity due to their non-invasive nature and patient comfort. Similarly, wearable insulin pumps are being increasingly adopted among Type 1 and insulin-dependent Type 2 diabetics, driven by technology integration and improved ease of use. Wearables that assist in motor function rehabilitation, including accelerometers and smart braces, are also expanding in stroke and orthopedic recovery settings.

Remote patient monitoring is the leading application, reflecting the broader healthcare shift toward decentralized care. Hospitals and clinics are deploying RPM platforms that integrate wearable devices for continuous monitoring of patients with hypertension, diabetes, COPD, and heart failure. These applications reduce hospital readmissions and enable early detection of deterioration, especially in post-discharge patients.

Home healthcare is the fastest-growing application, driven by the preference for aging-in-place and managing chronic diseases in familiar environments. Wearable devices that support 24/7 health tracking, medication reminders, and teleconsultation connectivity are central to this model. European families and caregivers are increasingly turning to wearable-enabled health solutions to ensure safety and continuity of care for elderly members.

Strap/clip/bracelet-based devices dominate in terms of wearability, as they are ergonomically suitable for extended use and offer easy integration with sensors and displays. These formats are commonly used in activity monitors, smartwatches, and glucose monitoring devices. The ease of removing and reattaching the device, along with user familiarity, contributes to their widespread acceptance in both consumer and clinical environments.

Headband and shoe sensor-based devices are gaining adoption quickly, especially in neurological monitoring and physical rehabilitation. Headband devices are increasingly used for sleep tracking and EEG monitoring in epilepsy and neurodegenerative conditions, while shoe sensors are utilized in gait analysis and fall detection among elderly populations. These innovative formats are part of the next wave of wearables that offer niche applications and highly specialized use cases.

In the United Kingdom, the NHS is actively integrating wearable technology into chronic care programs, including remote cardiac monitoring and digital diabetes management. Government pilot programs and national health apps support data integration from certified wearables.

Germany is leading in regulatory innovation through the DiGA framework, enabling reimbursement of digital health applications that incorporate wearable data. The German healthcare system’s strong support for RPM and EHR integration is driving clinical adoption.

France and Italy are scaling telehealth services post-pandemic, with regional health authorities investing in remote care infrastructure. Wearables that aid in pulmonary and cardiac rehabilitation are seeing increased usage.

Scandinavian countries, notably Sweden, are known for early tech adoption and strong public-private partnerships. The elderly population in these countries is supported through home monitoring programs leveraging wearables for fall detection, mobility tracking, and chronic disease monitoring.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe wearable medical devices market

Product

Site

Application

Grade Type

Distribution Channel

Country