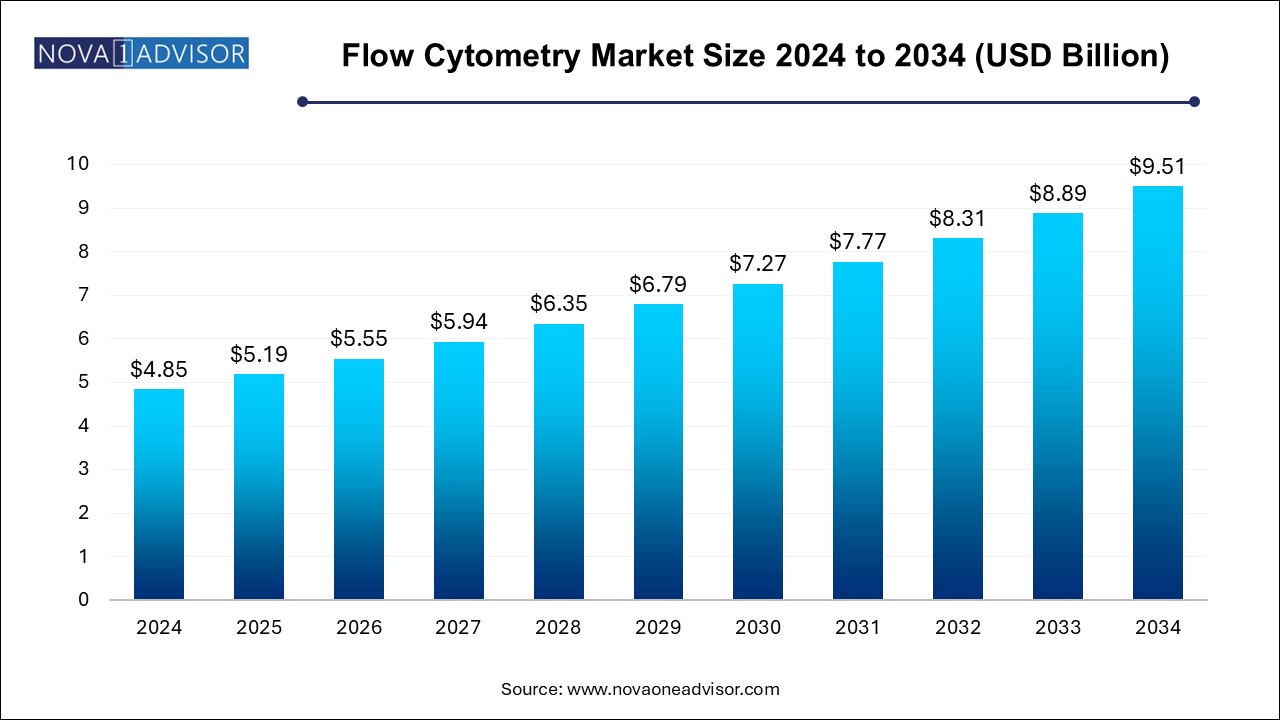

The flow cytometry market size was exhibited at USD 4.85 billion in 2024 and is projected to hit around USD 9.51 billion by 2034, growing at a CAGR of 6.97% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.19 Billion |

| Market Size by 2034 | USD 9.51 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 6.97% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Technology, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Danaher; BD; Sysmex Corp.; Agilent Technologies, Inc.; Apogee Flow Systems Ltd.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Stratedigm, Inc.; Miltenyi Biotec; Cytek Biosciences; Sony Group Corporation (Sony Biotechnology Inc.) |

The increasing incidence of cancer, immunodeficiency disorders, and infectious diseases is a key factor propelling market growth. Additionally, extensive research and development investments in biotechnology, life science, and biopharmaceutical research have contributed to a leveraged demand for flow cytometry instruments. For instance, in February 2024, Cytek Biosciences announced its plan to acquire the imaging and flow cytometry business from DiaSorin to expand its market share.

Flow cytometry is commonly used for the diagnosis of cancer and immunodeficiency diseases. The increasing prevalence of these diseases is one of the factors expected to drive the market over the forecast period. In addition, the adverse effects of chemotherapy & radiation therapy in cancer treatment have increased physicians' preference for autologous and allogeneic stem cell therapies, thereby positively impacting the growth of this market. According to data published by the American Cancer Society, in 2022, an estimated 1.9 million cancer cases were newly diagnosed in the U.S. Moreover, it also stated that around 0.60 million people died because of cancer.

Furthermore, key players are undertaking extensive strategic initiatives to new and advanced product developments. For instance, in January 2024, IDEX Health & Science introduced the new Semrock Nanopede Optical Filters tailored for flow cytometry applications. These filters cover the near UV and visible spectrum in 20 nm Full-Width, Half-Max (FWHM) increments, with the FWHM increasing to 30 nm in the near-infrared range. The Nanopede family includes 26 filters designed to meet specific application needs. This launch marks the initial step in expanding its product line to align with the dynamic market.

In addition, BD Biosciences has unveiled a significant technological advancement in Fluorescent Activated Cell Sorting (FACS), with the upcoming 50th anniversary of FACS in 2024. The BD FACSDiscover S8 Cell Sorter represents a milestone as the first spectral flow cytometer with sort-capable image analysis, offering the Canadian research community unprecedented insights and the ability to tackle previously unanswerable questions. Microfluidic miniature flow cytometry is expected to aid of adopting point-of-care diagnostics products, which is likely to be a key factor augmenting market growth. The introduction of multiplex reagents and probes for specific applications in drug discovery & diagnostics is expected to further create growth opportunities by catering to users in research laboratories and small peripheral laboratories. Moreover, digital signal processing has revolutionized the field of flow cytometry.

The instrument segment dominated the market with a revenue share of 35.40% in 2024 owing to higher penetration driven by technological developments. For instance, in June 2024, BD announced the launch of an automated instrument that is designed to prepare samples for clinical diagnostics through flow cytometry, enabling smoother processing and workflow. The progress in technology, leading to cost-effectiveness, improved accuracy, and portability, is expected to pave the way for future growth opportunities. In addition, the focus of companies on the development and manufacturing of instruments with rapid turnaround time is also estimated to have a positive impact on the segment’s growth during the forecast period.

The software segment is expected to witness significant CAGR from 2024 to 2034. Software plays a crucial role in controlling and acquiring data from cytometers, analyzing information, and offering statistical insights. In research applications, the software is employed for cell acquisition and data analysis, while in clinical diagnosis, it aids in disease diagnosis through the analysis of patients' samples. The broad spectrum of applications is anticipated to propel the market in coming years. Additionally, the introduction of new products by key companies is identified as a significant factor that is expected to fuel the growth of this segment. For instance, in February 2024, Agilent announced the launch of NovoCyte Flow Cytometer System Software which encompasses updated regulatory compliances for biopharmaceutical and pharmaceutical manufacturing.

Cell-based flow cytometry held the largest revenue share in 2024 and is expected to grow at a CAGR of 6.41% from 2024 to 2034. The cell-based assays are used in drug discovery for assessing the physiological characteristics of cells and studying the information obtained. In addition, technological advancements, such as multi-parameter flow cytometry used in rare cell analysis, are expected to impel segment demand over the coming years. This technology is used in clinical studies of various cells, tumor cells in peripheral blood, endothelial cells in the blood, tumor stem cells, and hematopoietic progenitor cells. It is also used in the study of disease mechanisms and target identification.

The bead-based assays segment is predicted to grow at an exponential CAGR from 2024 to 2034. . This growth can be attributed to advancements in molecular engineering and monoclonal antibody production, coupled with associated benefits such as cost-efficiency, minimal sample requirements, and rapid turnaround times. These assays, employing indirect or sandwich immunoassay formats, are specifically designed for assessing antibody levels in biological fluids. Moreover, these assays have been developed for the study of infectious diseases, and their demand is anticipated to experience substantial growth during the forecast period.

The clinical segment accounted for a major revenue share of 46.0% in 2024. This can be attributed to the growing research and development activities focused on cancer and infectious diseases, including the ongoing efforts related to COVID-19. Moreover, the increasing research and development investments in the biotechnology and pharmaceutical industry are expected to offer a favorable environment for market expansion. Additionally, the continuous growth strategies implemented by key market players and the introduction of innovative solutions for clinical applications are anticipated to play a significant role in supporting the growth of this segment. For instance, in July 2024, Discovery Life Sciences announced the launch of novel flow cytometry clinical trial services. The new instrument is expected to provide services in genomics, proteomics, and molecular pathology.

The industrial segment is expected to be the fastest-growing segment from 2024 to 2034 due to the increasing applications in activities such as microbiology, tissue culturing, the food industry, and plant tissue culture. In food microbiology, flow cytometry is used to check food safety. It also has applications in cellular measurements in food microbiology, viability assessment & cell counting, detection of food-borne pathogens, antimicrobial susceptibility testing, and biopreservation. Thus, the growth of the food industry in developed and developing economies is anticipated to create lucrative opportunities for flow cytometry solutions.

The academic institutes segment captured the highest revenue share in 2024. Flow cytometry is employed in studies related to cell biology and molecular diagnostics to assess various cell parameters, including the physical properties of cells and the identification of biomarkers using specific antibodies. It is utilized for determining cell type, cell lineage, and maturation stage. The technology finds applications across various educational fields such as molecular biology, immunology, pathology, plant biology, and marine biology. In January 2024, the Columbia Stem Cell Initiative (CSCI) at Columbia University used flow cytometry technology in its trailblazing stem cell research. This facility provides access to the technology for stem cell research and other research activities in various fields of life sciences.

The clinical testing labs segment is anticipated to be the fastest-growing segment from 2024 to 2034 due to the growing need for cost-effective diagnosis of target diseases such as cancer.It is a widely used tool in the diagnosis and treatment of cancers and immunodeficiency diseases. Furthermore, a growing number of industrial developments such as partnerships and collaborations are also projected to have a positive impact on the segment growth. For instance, in May 2024, BD India entered into a strategic partnership with Sehgal Path Lab to launch a clinical flow cytometry center in Mumbai.

North America dominated the overall market with a revenue share of 41.20% in 2024. This large share can be attributed to the presence of well-established healthcare system and pharmaceutical industry in the U.S., which has created a significant demand for flow cytometry solutions for clinical and research purposes. Extensive R&D initiatives being undertaken for developing therapeutics and increasing public-private investments in the field of cancer research have also fueled the need for instruments or products in the country, thus leading to high market growth. For instance, in December 2024, AlleSense was commissioned to enhance cancer diagnostics with the help of advanced technologies. The initial investment for the company was around USD 2.5 million.

U.S. Flow Cytometry Market Trends

The U.S. flow cytometry market is expected to grow from 2024 to 2034 attributed to the high prevalence of cancer and extensive R&D activities by regional players to develop novel therapies Government support and funding to facilitate the development of novel solutions in the country is anticipated to create lucrative growth opportunities

Europe Flow Cytometry Market Trends

The flow cytometry market in Europe can primarily be attributed to the increasing demand for products in countries with well-established biotechnology industries such as Germany, the UK, and Italy.Furthermore, a large number of COVID-19 cases in countries such as Italy, France, the UK, & Germany and extensive R&D initiatives by European pharmaceutical players to develop vaccines for the disease are anticipated to create high demand for various solutions.

The UK flow cytometry market is growing primarily due to collaborations between key market players and the launch of novel products. Commercial partnerships between the government and key players for the use of these products in the country are propelling the market growth.

The flow cytometry in France is expected to grow from 2024 to 2040 attributed to increased acceptance rate of these technologies in research & academia and increasing use of Artificial Intelligence (AI) technologies in flow cytometry workflows.

The Germany flow cytometry market in is expected to witness substantial growth owing to strong presence of key players and continuous strategic initiatives being undertaken by them. Furthermore, a high number of COVID-19 cases and extensive R&D activities by regional players to develop novel vaccines for the disease are anticipated to create significant demand for flow cytometry solutions for research and clinical applications.

Asia Pacific Flow Cytometry Market Trends

The Asia Pacific flow cytometry market is anticipated to witness a significant CAGR from 2024 to 2034 as a result of the growing pharmaceutical and biotechnology industries in emerging economies, such as China and India. The market growth is propelled by the rising prevalence of chronic diseases and the increasing utilization of cytometry devices across various applications in the region. Furthermore, continuous innovations in fields of cancer and infectious diseases are anticipated to contribute significantly to the market growth in the region. Additionally, extensive research activities conducted by regional players aiming to enhance or create innovative flow cytometry solutions are expected to bolster market growth in Asia Pacific throughout the projected timeframe.

The flow cytometry market in China is expected to grow from 2024 to 2034, owing to key players are undertaking both organic and inorganic growth strategies to gain a competitive edge. Increasing R&D initiatives are anticipated to significantly boost the demand for products in the country, thus supporting market growth.

The Japan flow cytometry market dominated the Asia Pacific market attributed to increased focus on R&D or introduction of new technologies for flow cytometry solutions for research purposes.

Latin America Flow Cytometry Market Trends

Latin America flow cytometry market is estimated to grow at a significant CAGR from 2024 to 2034. The rise in private-public partnerships to promote research on effective diagnostics is expected to drive the regional market. In addition, the demographic phenomenon of population aging is a significant trend driving market growth in the region.

The flow cytometry market in Brazil is influenced by the public-private investments in pharmaceutical & biotechnology sectors.

Middle East And Africa Flow Cytometry Market Trends

MEA flow cytometry market is anticipated to exhibit steady growth from 2024 to 2034. This steady growth can be attributed to various factors such as limited investments in the biotechnology sector, low affordability of expensive systems, and fewer R&D activities in pharmaceutical & biotechnology sectors.

The flow cytometry market in Saudi Arabia is expected to grow over the forecast period attributed to increase in consumer demand due to the growing prevalence of chronic illnesses, a higher need for localized testing, and decreasing sequencing prices.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the flow cytometry market

By Product

By Technology

By Application

By End-use

By Regional

Chapter 1 Methodology and Scope

1.1 Market Segmentation

1.1.1 Regional Scope

1.1.2 Market Definitions

1.1.3 Estimates And Forecast Timeline

1.2 Objectives

1.2.1 Objective - 1

1.2.2 Objective - 2

1.2.3 Objective - 3

1.3 Research Methodology

1.4 Information Procurement

1.4.1 Purchased Database

1.4.2 Internal Database

1.4.3 Secondary Sources

1.4.4 Primary Research

1.4.5 Details Of Primary Research

1.5 Information or Data Analysis

1.5.1 Data Analysis Models

1.6 Market Formulation & Validation

1.7 Model Details

1.7.1 Commodity Flow Analysis

1.7.1.1 Approach 1: Commodity Flow Approach

1.7.1.2 Approach 2: Country wise market estimation using bottom-up approach

1.8 List of Secondary Sources

1.9 List of Abbreviations

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Product and Technology Segment Snapshot

2.3 Application and End-use Segment Snapshot

2.4 Competitive Landscape Snapshot

Chapter 3 Market Variables, Trends, and Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Ancillary Market Outlook

3.2 Market Dynamics

3.2.1 Market Driver Analysis

3.2.1.1 Growing prevalence of chronic and infectious diseases

3.2.1.2 High R&D investments in biotechnology, clinical, and life science research

3.2.1.3 Technological advancements in flow cytometry instruments and reagents

3.2.1.4 Increasing demand for point-of-care diagnostics

3.2.2 Market Restraint Analysis

3.2.2.1 High Cost Of Instruments

3.2.3 Industry Challenges

3.2.3.1 Low Cell Throughput Rate

3.3 Business Environment Analysis

3.3.1 Pestel Analysis

3.3.2 Porter’s Five Forces Analysis

3.4 COVID-19 Impact Analysis

Chapter 4 Flow Cytometry Market - Segment Analysis, by Product, 2021 - 2034 (USD Million)

4.1 Flow Cytometry Market: Product Movement Analysis

4.2 Flow Cytometry Market Estimates & Forecast by Product (USD Million)

4.2.1 Instruments

4.2.1.1 Cell Analyzers

4.2.1.2 Cell Sorters

4.2.2 Reagents & Consumables

4.2.3 Software

4.2.4 Accessories

4.2.5 Services

Chapter 5 Flow Cytometry Market - Segment Analysis, by Technology, 2021 - 2034 (USD Million)

5.1 Flow Cytometry Market: Technology Movement Analysis

5.2 Flow Cytometry Market Estimates & Forecast by Technology (USD Million)

5.2.1 Cell-Based

5.2.2 Bead-Based

Chapter 6 Flow Cytometry Market - Segment Analysis, by Application, 2021 - 2034 (USD Million)

6.1 Flow Cytometry Market: Application Movement Analysis

6.2 Flow Cytometry Market Estimates & Forecast by Application (USD Million)

6.2.1 Research

6.2.1.1 Pharmaceutical

6.2.1.1.1 Drug Discovery

6.2.1.1.2 Stem Cell

6.2.1.1.3 In Vitro Toxicity

6.2.1.2 Apoptosis

6.2.1.3 Cell Sorting

6.2.1.4 Cell Cycle Analysis

6.2.1.5 Immunology

6.2.1.6 Cell Viability

6.2.2 Industrial

6.2.3 Clinical

6.2.3.1 Cancer

6.2.3.2 Organ Transplantation

6.2.3.3 Immunodeficiency

6.2.3.4 Hematology

6.2.3.5 Autoimmune Disorders

Chapter 7 Flow Cytometry Market - Segment Analysis, by End Use, 2021 - 2034 (USD Million)

7.1 Flow Cytometry Market: End-use Movement Analysis

7.2 Flow Cytometry Market Estimates & Forecast by End Use (USD Million)

7.2.1 Commercial Organizations

7.2.1.1 Biotechnology Companies

7.2.1.2 Pharmaceutical Companies

7.2.1.3 Cros

7.2.2 Hospitals

7.2.3 Academic Institutes

7.2.4 Clinical Testing Labs

Chapter 8 Flow Cytometry Market: Regional Estimates and Trend Analysis, By Product, Technology, Application, and End Use

8.1 Flow Cytometry Market: Regional Outlook

8.2 North America

8.2.1 North America Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.2.2 U.S.

8.2.2.1 Key Country Dynamics

8.2.2.2 U.S. Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.2.2.3 Competitive/Market Scenario

8.2.2.4 Regulatory Framework

8.2.2.5 Reimbursement Scenario

8.2.3 Canada

8.2.3.1 Key Country Dynamics

8.2.3.2 Canada flow cytometry market estimates and forecasts, 2021 - 2034 (USD Million)

8.2.3.3 Competitive/Market Scenario

8.2.3.4 Regulatory Framework

8.2.3.5 Reimbursement Scenario

8.3 Europe

8.3.1 Europe Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.3.2 UK

8.3.2.1 Key Country Dynamics

8.3.2.2 UK Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.3.2.3 Competitive/Market Scenario

8.3.2.4 Regulatory Framework

8.3.2.5 Reimbursement Scenario

8.3.3 Germany

8.3.3.1 Key Country Dynamics

8.3.3.2 Germany Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.3.3.3 Competitive/Market Scenario

8.3.3.4 Regulatory Framework

8.3.3.5 Reimbursement Scenario

8.3.4 France

8.3.4.1 Key Country Dynamics

8.3.4.2 France Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.3.4.3 Competitive Scenario

8.3.4.4 Regulatory Framework

8.3.4.5 Reimbursement Scenario

8.3.5 Italy

8.3.5.1 Key Country Dynamics

8.3.5.2 Italy Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.3.5.3 Competitive/Market Scenario

8.3.5.4 Regulatory Framework

8.3.5.5 Reimbursement Scenario

8.3.6 Spain

8.3.6.1 Key Country Dynamics

8.3.6.2 Spain Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.3.6.3 Competitive/Market Scenario

8.3.6.4 Regulatory Framework

8.3.6.5 Reimbursement Scenario

8.3.7 Denmark

8.3.7.1 Key Country Dynamics

8.3.7.2 Denmark Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.3.7.3 Competitive/Market Scenario

8.3.7.4 Regulatory Framework

8.3.7.5 Reimbursement Scenario

8.3.8 Sweden

8.3.8.1 Key Country Dynamics

8.3.8.2 Sweden Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.3.8.3 Competitive/Market Scenario

8.3.8.4 Regulatory Framework

8.3.9 Norway

8.3.9.1 Key Country Dynamics

8.3.9.2 Norway Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.3.9.3 Competitive/Market Scenario

8.3.9.4 Regulatory Framework

8.3.9.5 Reimbursement Scenario

8.3.10 Rest Of Europe Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.4 Asia Pacific

8.4.1 Asia Pacific Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.4.2 Japan

8.4.2.1 Key Country Dynamics

8.4.2.2 Japan Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.4.2.3 Competitive/Market Scenario

8.4.2.4 Regulatory Framework

8.4.2.5 Reimbursement Scenario

8.4.3 China

8.4.3.1 Key Country Dynamics

8.4.3.2 China Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.4.3.3 Competitive/Market Scenario

8.4.3.4 Regulatory Framework

8.4.3.5 Reimbursement Scenario

8.4.4 India

8.4.4.1 Key Country Dynamics

8.4.4.2 India Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.4.4.3 Competitive/Market Scenario

8.4.4.4 Regulatory Framework

8.4.4.5 Reimbursement Scenario

8.4.5 Australia

8.4.5.1 Key Country Dynamics

8.4.5.2 Australia Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.4.5.3 Competitive/Market Scenario

8.4.5.4 Regulatory Framework

8.4.5.5 Reimbursement Scenario

8.4.6 Thailand

8.4.6.1 Key Country Dynamics

8.4.6.2 Thailand Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.4.6.3 Competitive/Market Scenario

8.4.6.4 Regulatory Framework

8.4.6.5 Reimbursement Scenario

8.4.7 South Korea

8.4.7.1 Key Country Dynamics

8.4.7.2 South Korea Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.4.7.3 Competitive/Market Scenario

8.4.7.4 Regulatory Framework

8.4.7.5 Reimbursement Scenario

8.4.8 Singapore

8.4.8.1 Key Country Dynamics

8.4.8.2 Singapore Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.4.8.3 Competitive Scenario

8.4.8.4 Regulatory Framework

8.4.8.5 Reimbursement Scenario

8.4.9 Rest Of Asia Pacific Flow Cytometry Market Estimates And Forecasts, 2021 - 2034 (USD Million)

8.5 Latin America

8.5.1 Latin America Flow Cytometry Market Estimates And Forecasts, 2021 - 2034, (USD Million)

8.5.2 Brazil

8.5.2.1 Key Country Dynamics

8.5.2.2 Brazil Flow Cytometry Market Estimates And Forecasts, 2021 - 2034, (USD Million)

8.5.2.3 Competitive/Market Scenario

8.5.2.4 Regulatory Framework

8.5.2.5 Reimbursement Scenario

8.5.3 Mexico

8.5.3.1 Key Country Dynamics

8.5.3.2 Mexico Flow Cytometry Market Estimates And Forecasts, 2021 - 2034, (USD Million)

8.5.3.3 Competitive/Market Scenario

8.5.3.4 Regulatory Framework

8.5.3.5 Reimbursement Scenario

8.5.4 Argentina

8.5.4.1 Key Country Dynamics

8.5.4.2 Argentina Flow Cytometry Market Estimates And Forecasts, 2021 - 2034, (USD Million)

8.5.4.3 Competitive/Market Scenario

8.5.4.4 Regulatory Framework

8.5.4.5 Rest of Latin America Flow Cytometry Market Estimates And Forecasts, 2021 - 2034, (USD Million)

8.6 MEA

8.6.1 MEA Flow Cytometry Market Estimates And Forecasts, 2021 - 2034, (USD Million)

8.6.2 South Africa

8.6.2.1 Key Country Dynamics

8.6.2.2 South Africa Flow Cytometry Market Estimates and Forecasts, 2021 - 2034, (USD Million)

8.6.2.3 Competitive Scenario

8.6.2.4 Regulatory Framework

8.6.2.5 Reimbursement Scenario

8.6.3 Saudi Arabia

8.6.3.1 Key Country Dynamics

8.6.3.2 Saudi Arabia Flow Cytometry Market Estimates and Forecasts, 2021 - 2034, (USD Million)

8.6.3.3 Competitive Scenario

8.6.3.4 Regulatory Framework

8.6.3.5 Reimbursement Scenario

8.6.4 UAE

8.6.4.1 Key Country Dynamics

8.6.4.2 UAE Flow Cytometry Market Estimates and Forecasts, 2021 - 2034, (USD Million)

8.6.4.3 Competitive Scenario

8.6.4.4 Regulatory Framework

8.6.4.5 Reimbursement Scenario

8.6.5 Kuwait

8.6.5.1 Key Country Dynamics

8.6.5.2 Kuwait Flow Cytometry Market Estimates and Forecasts, 2021 - 2034, (USD Million)

8.6.5.3 Competitive Scenario

8.6.5.4 Regulatory Framework

8.6.5.5 Reimbursement Scenario

8.6.6 Rest Of Mea Flow Cytometry Market Estimates And Forecasts, 2021-2034 (USD Million)

Chapter 9 Competitive Landscape

9.1 Company Profiles

9.7.1 DANAHER CORPORATION

9.7.1.1 Company overview

9.7.1.2 Beckman Coulter, Inc.

9.7.1.2.1 Company Overview

9.7.1.3 Cytiva

9.7.1.3.1 Company Overview

9.7.1.4 Financial performance

9.7.1.5 Product benchmarking

9.7.1.6 Strategic initiatives

9.7.2 BECTON, DICKINSON AND COMPANY (BD)

9.7.2.1 Company overview

9.7.2.2 Financial performance

9.7.2.3 Product benchmarking

9.7.2.4 Strategic initiatives

9.7.3 SYSMEX CORPORATION

9.7.3.1 Company overview

9.7.3.2 Financial performance

9.7.3.3 Product benchmarking

9.7.3.4 Strategic initiatives

9.7.4 AGILENT TECHNOLOGIES, INC.

9.7.4.1 Company overview

9.7.4.2 Financial performance

9.7.4.3 Product benchmarking

9.7.4.4 Strategic initiatives

9.7.5 APOGEE FLOW SYSTEMS LTD.

9.7.5.1 Company overview

9.7.5.2 Product benchmarking

9.7.5.3 Strategic initiatives

9.7.6 BIO-RAD LABORATORIES, INC.

9.7.6.1 Company overview

9.7.6.2 Financial performance

9.7.6.3 Product benchmarking

9.7.6.4 Strategic initiatives

9.7.7 THERMO FISHER SCIENTIFIC, INC.

9.7.7.1 Company overview

9.7.7.2 Financial performance

9.7.7.3 Product benchmarking

9.7.7.4 Strategic initiatives

9.7.8 STRATEDIGM, INC.

9.7.8.1 Company overview

9.7.8.2 Product benchmarking

9.2 Company Categorization

9.3 Flow cytometry Market Share Analysis, 2023

9.4 Strategy Mapping

9.4.1 Mergers & Acquisitions

9.4.2 Partnerships And Collaborations

9.4.3 New Product Launch

9.4.4 Others

Chapter 10 Conclusion