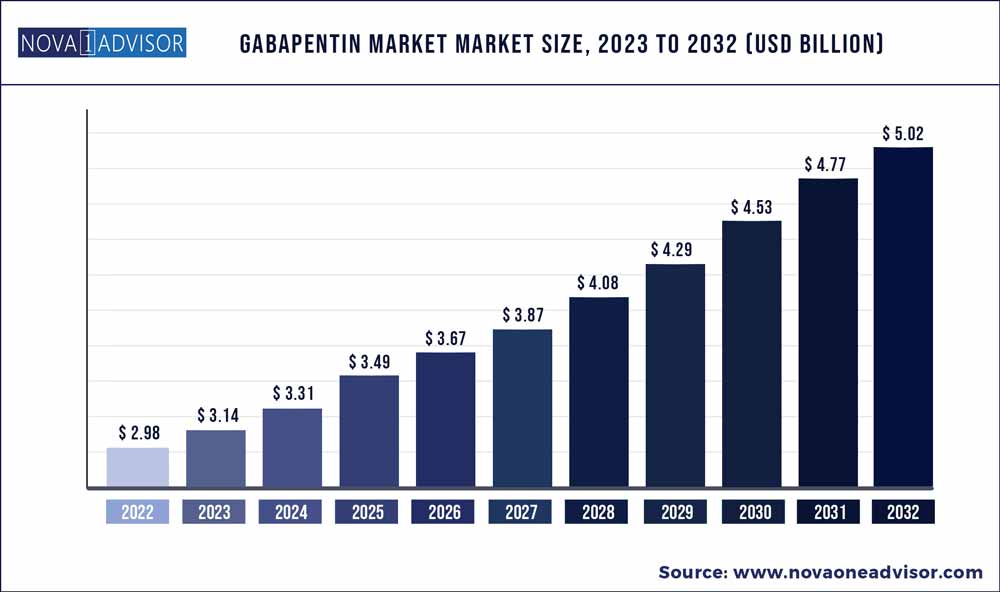

The global gabapentin market size was exhibited at USD 2.98 billion in 2022 and is projected to hit around USD 5.02 billion by 2032, growing at a CAGR of 5.36% during the forecast period 2023 to 2032.

Key Pointers:

Gabapentin Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 3.14 Billion |

| Market Size by 2032 | USD 5.02 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.36% |

| Base year | 2022 |

| Forecast period | 2023 to 2032 |

| Segments covered | Dosage form, Type, Application, Distribution channel |

| Regional scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key companies profiled | Zydus Pharmaceuticals, Inc; Glenmark Pharmaceuticals Limited; Sun Pharmaceutical Industries Ltd.; Ascend Laboratories, LLC; Apotex Inc.; Teva Pharmaceutical Industries Ltd.; Aurobindo Pharma.; Amneal Pharmaceuticals LLC.; Cipla USA, Inc.; BP Pharmaceuticals Laboratories Company; Assertio Holdings, Inc.; Arbor Pharmaceuticals, Inc.; Pfizer Inc. |

The growth can be attributed to the rising usage of gabapentin for neuropathic pain and the increasing incidence of associated diseases such as epilepsy globally. The other key growth driver is the rising geriatric population which is more to epilepsy and conditions such as neuropathic pain.

The growing demand for generics in the market is creating an opportunity for major generic players, however, the opportunity is more lucrative in the lower and middle-income nations due to the high preference for these drugs. Moreover, developed regions such as North America and Europe are further making policy changes to reduce the burden on the healthcare system by promoting the use of generics such as gabapentin.

Gabapentin is majorly available in three dosage forms, namely, tablet, capsule, and oral solution. The capsules segment held the largest market share in 2022, owing to the presence of major branded products and the ease of availability. Due to the discovery that gabapentin carries a risk of addiction and overdose, some nations have scrutinized its usage and placed limitations on it. Long-term growth for gabapentin may be impacted by such discoveries, which may push drugmakers to concentrate on creating safer and more potent painkillers.

North America is expected to dominate the market over the forecast period, due to a developed healthcare system that facilitates the adoption of drugs such as gabapentin. However, other regions such as Asia Pacific are growing at a faster rate attributable to the presence of key generic players and the rising awareness about the adoption of pharmaceutical treatments for diseases over traditional therapies, majorly used in Asian countries.

Some of the key competitors in the gabapentin industry include Sun Pharmaceutical Industries Ltd.; Ascend Laboratories, LLC; Apotex Inc.; Teva Pharmaceutical Industries Ltd.; Arbor Pharmaceuticals, Inc.; and Pfizer Inc. The downfall of branded products is leading to the shift of competition toward generic products. This is increasing the competitive rivalry due to increased marketplace saturation of players and products.

Gabapentin Market Segmentation

| By Dosage Form | By Type | By Application | By Distribution Channel |

|

|

|

|