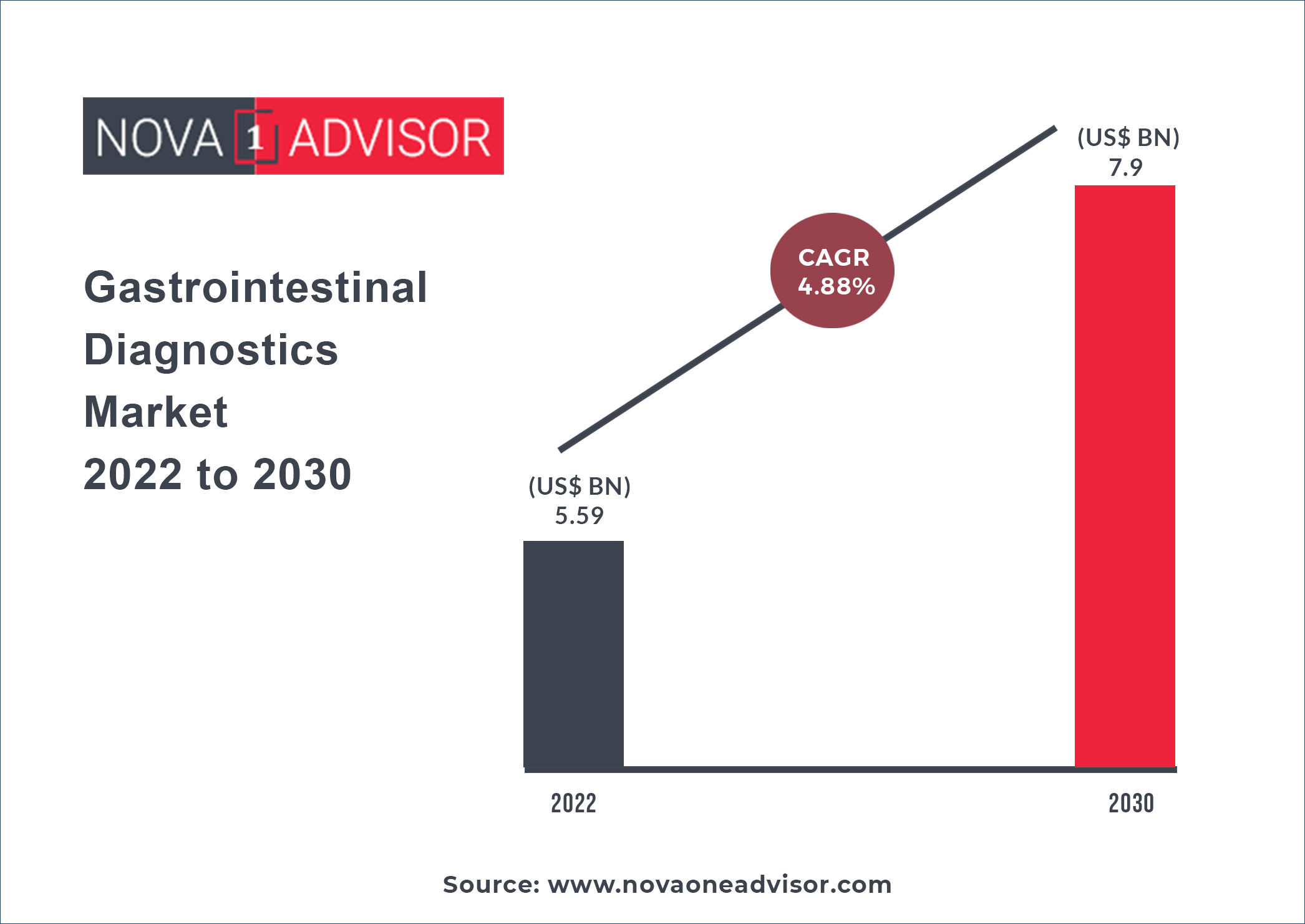

According to Nova one advisor, the global Gastrointestinal Diagnostics market size was valued at USD 5.59 billion in 2022 and is predicted to hit USD 7.9 billion by 2030 with a registered CAGR of 4.88% during the forecast period 2022 to 2030.

Key Takeaways:

Rising awareness about gastrointestinal disorders and a surge in gastrointestinal disorder testing are the major factors driving the market. Moreover, technological advancements in gastrointestinal infection testing are expected to cater to the market demand. For instance, in May 2022, QIAGEN launched QIAstat-Dx Rise, which is capable of providing results in a span of one hour for multiple diseases.

The increasing trend of a sedentary lifestyle, lack of exercise, unhealthy eating habits, and a higher prevalence of obesity are anticipated to fuel GI diagnostics market growth. According to the CDC, the prevalence of obesity among people in the U.S. is between 30-40%. States such as Alabama, Alaska, and Arizona have the highest prevalence of obesity in the U.S. Obesity is associated with GI diseases such as gastroesophageal reflux disease, diarrhea, gastric cancer, and others. Hence, it is expected to impetus market growth.

Technological advancements associated with gastrointestinal diagnostics for early diagnosis and efficient testing are expected to augment market growth during the forecast period. For instance, in March 2022, Luminex Corporation obtained a CE mark for its NxTAGxMAP GI Pathogen Panel. This test is a detailed multiplex test that detects nucleic acids from the 16 most clinically relevant viral, parasitic, and bacterial pathogens in stool samples. Moreover, the test is capable of providing results on the same day and can run 96 samples at a time.

Moreover, the presence of organizations involved in increasing awareness regarding gastrointestinal disorders is expected to facilitate market expansion. For instance, organizations such as the Gastrointestinal Society (Canadian Society of Intestinal Research) and the International Foundation for Gastrointestinal Disorders are actively involved in promoting gastrointestinal health and broadening the understanding of GI disorders, thereby augmenting market growth.

Furthermore, various strategic initiatives undertaken by market players to strengthen their product portfolio and expand global footprints are likely to provide lucrative growth opportunities for the market. For instance, in November 2021, The Life Raft Group and Bayer Pharmaceuticals announced a research collaboration for broadening access to genomic testing for GI stromal tumor patients. The aim of this collaboration is to advance precision medicine and improve genetic testing to identify patients in the U.S.

In addition, in June 2021, Prometheus Laboratories, Inc. announced an agreement with MultiPlan for accessing specialized gastrointestinal testing. Prometheus offered its breakthrough testing solutions to improve the outcome of GI disorders. This agreement has allowed the testing service of Prometheus to reach the maximum number of customers.

Report Scope of the Gastrointestinal Diagnostics Market

|

Report Coverage |

Details |

|

Market Size |

USD 7.9 Billion by 2030 |

|

Growth Rate |

CAGR of 4.88% from 2022 to 2030 |

|

Largest Market |

North America |

|

Fastest Growing Market |

Asia Pacific |

|

Base Year |

2021 |

|

Forecast Period |

2022 to 2030 |

|

Segments Covered |

Test type, technology, application, test location and Region, |

|

Companies Mentioned |

BIOMERIEUX; F. Hoffmann-La Roche Ltd.; Abbott; Beckman Coulter, Inc.; DiaSorin S.p.A; Siemens Healthineers AG; QIAGEN; Meridian Bioscience; Hologic, Inc. |

Test Type Insights

The endoscopy segment held the largest share of over 25.0% in 2021. The increased demand for non-invasive procedures, the high preference given by medical professionals to endoscopy procedures, and technological advancements are some of the factors contributing to the expansion of the endoscopy segment. Moreover, the surge in product launches for bringing innovative products with high precision is anticipated to support market growth. For instance, in October 2021, Fujifilm launched its El-740D/S dual-channel endoscope. This is the first dual-channel endoscope approved by the U.S. FDA for use in lower as well as upper gastrointestinal applications.

The blood test segment is anticipated to register the fastest growth rate over the forecast period. Increasing approval of molecular tests and other blood-based tests for the detection of gastrointestinal diseases is driving the segment over the forecast period.

Technology Insights

The others segment held the largest share of over 41.0% in 2021. The PCR segment held the second-largest share in 2021. The rising application of PCR in diagnostic procedures and the increasing development of precise, easy-to-use, point-of-care tests have fueled segment growth. Moreover, the presence of strong market players offering GI panel tests for multiple gastrointestinal diseases has increased segment growth. For instance, BioFire FilmArray Gastrointestinal Panel of BIOMERIEUX is a multiplex PCR system that enables accurate, rapid automated testing for common GI pathogens including bacteria, viruses, and parasites that cause infectious diarrhea.

The ELISA segment is projected to grow at the fastest rate during the forecast period. Increasing adoption of immunoassay tests such as Calprotectin ELISA test is supporting segment growth. Moreover, rapid detection and ease of procedure are some of the major advantages offered by this technique, which is increasing the adoption of these tests.

Test Location Insights

The central laboratories segment captured the largest share of over 66.0% in 2021 and is expected to maintain its dominance during the projected period. The presence of a large number of laboratories that perform GI diagnostic tests, quick results of tests, and betterment in healthcare infrastructure are the factors augmenting segment expansion. In addition, the laboratory-based tests offer high accuracy as compared to PoC tests, thus fueling segment growth.

The point-of-care segment is expected to exhibit a lucrative CAGR during the projected period. The rising demand for point-of-care testing, technological advancements, rapid turnaround time, and less complexity are some of the factors offering this segment a competitive edge in the market. Introduction of technologically advanced endoscope devices such as laser speckle contrast imaging (LSCI) to examine the gastrointestinal tracts is further expected to increase segment growth.

Application Insights

In 2021, the infection segment held the largest share of over 31.0%. The increasing incidence of gastrointestinal infections such as C. difficile, salmonella infection, shigella, and H.pylori infections, the surge in the diagnosis of GI infections, and increasing awareness are the major factors driving the segment. According to the CDC, C. difficile infection affects 1 in 6 people in the U.S.

The cancer segment is expected to grow at the fastest rate in the coming years. The increasing prevalence of colorectal cancers, government initiatives to manage cancer, and technological advancements in the diagnosis of gastrointestinal cancer are some of the key factors driving the segment over the forecast period. For instance, in 2020, there were more than 1.9 million cases of colorectal cancer reported across the globe.

Regional Insights

In 2021, North America held the largest share of over 41.0%. The growth of the North American region is attributed to the high prevalence of GI disorders, increasing awareness about gastrointestinal disorders, and the presence of advanced healthcare infrastructure. Moreover, the presence of leading market players and strategic initiatives undertaken by them are likely to fuel segment expansion in the coming years.

Asia Pacific is anticipated to be the fastest-growing region during the forecast period. The growth of the Asia Pacific region is augmented by the presence of untapped market potential and a surge in demand for cost-efficient diagnostic solutions. In addition, the large patient pool and rising geriatric population in the region are expected to spur regional growth. Furthermore, the increase in R&D activities related to gastrointestinal diseases will fuel segment growth. The number of GI-related clinical trials has increased by 138% over the past decade.

Some of the prominent players in the Gastrointestinal Diagnostics Market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Nova one advisor, Inc. has segmented the global Gastrointestinal Diagnostics market

By Geography

North America

Europe

Asia Pacific

Latin America

Middle East & Africa (MEA)

Key Benefits for Stakeholders