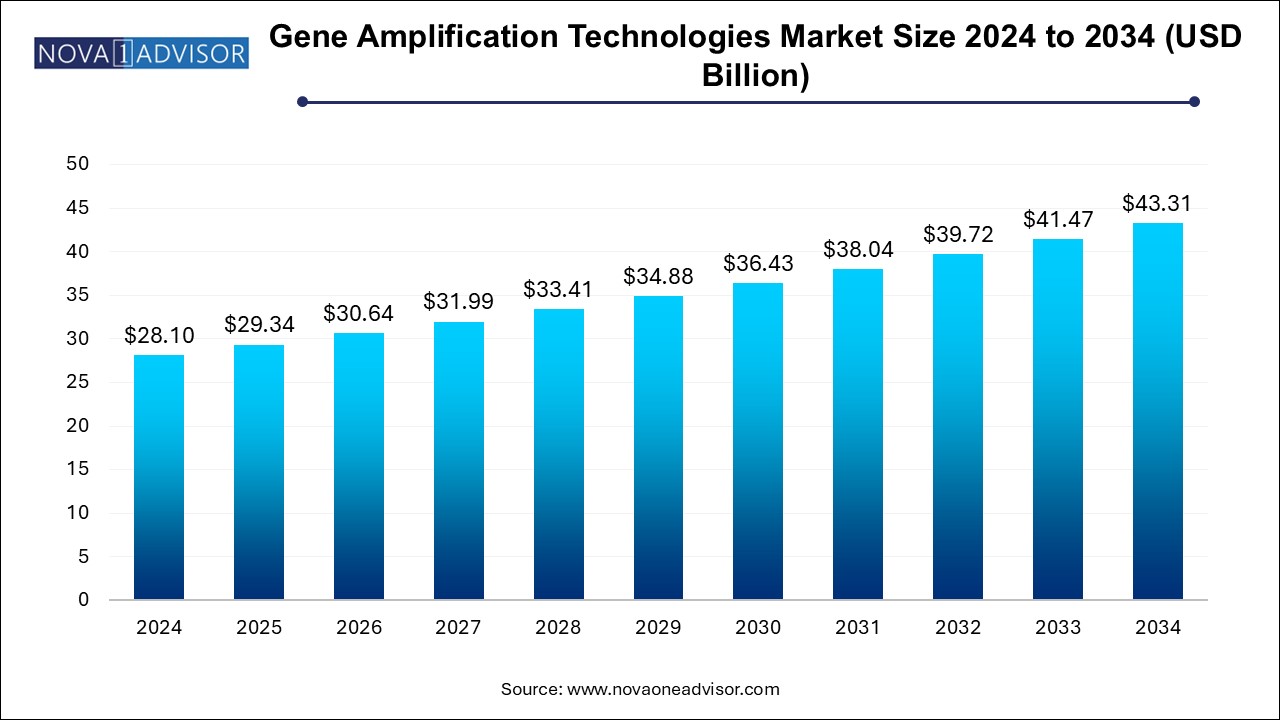

The gene amplification technologies market size was exhibited at USD 28.10 billion in 2024 and is projected to hit around USD 43.31 billion by 2034, growing at a CAGR of 4.42% during the forecast period 2024 to 2034.

The gene amplification technologies market is experiencing robust expansion, fueled by the growing demand for genetic diagnostics, precision medicine, and next-generation therapeutics. At its core, gene amplification refers to molecular techniques that increase the number of copies of a specific DNA or RNA sequence, enabling easier detection, analysis, and manipulation of genetic material. These technologies are essential tools in genomics, clinical diagnostics, pharmacogenomics, agricultural biotechnology, forensic analysis, and food safety testing.

The market has evolved from conventional PCR-based methods to highly sophisticated isothermal and rolling circle amplification techniques that offer higher specificity, sensitivity, and speed. This evolution has been pivotal in supporting critical applications such as infectious disease diagnosis (e.g., COVID-19, tuberculosis), cancer biomarker detection, prenatal screening, and rare genetic disorder identification.

Rapid advances in automation, AI-powered data interpretation, and integration with point-of-care platforms have further pushed the boundaries of gene amplification technology. Today, amplification tools are not only confined to high-tech laboratories but are also embedded in portable diagnostics used in rural healthcare and mobile testing units. Increasing investments in genomics, supportive regulatory frameworks, and the rise of personalized medicine are expected to propel market growth well into the next decade.

Expansion of isothermal amplification technologies: Techniques like LAMP and rolling circle amplification are gaining popularity due to their rapid turnaround times and minimal thermal cycling requirements.

Integration with digital platforms: AI and machine learning are being leveraged for automated analysis of gene amplification data, improving diagnostic accuracy.

Rising use of portable amplification devices: Point-of-care diagnostics equipped with amplification capabilities are transforming testing in remote and resource-limited settings.

Proliferation of CRISPR-based gene amplification: Innovative approaches combining CRISPR-Cas systems with amplification methods are enhancing target detection efficiency.

Customization of reagent kits: Manufacturers are offering tailor-made kits for specific applications, particularly in oncology, rare diseases, and microbial testing.

Consolidation of services and products: Companies are integrating amplification platforms with sample prep, detection systems, and software analytics for end-to-end solutions.

Regulatory approval acceleration: Streamlined FDA pathways and CE mark processes for amplification-based diagnostics are helping faster market entry.

Cross-sectoral applications on the rise: Beyond healthcare, gene amplification is finding applications in agriculture (GMO detection), food safety (pathogen identification), and forensic science (DNA profiling).

| Report Coverage | Details |

| Market Size in 2025 | USD 29.34 Billion |

| Market Size by 2034 | USD 43.31 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 4.42% |

| Base Year | 2024 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Application, Aample Type, Product, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | QIAGEN; New England Biolabs; Illumina Inc.; Yikang Gene; Bio-Rad Laboratories, Inc.; Menarini Silicon Biosystems; Merck KGaA; Promega Corporation; Takara Bio Inc.; Danaher Corporation; 4basebio; LGC Limited; Vazyme Biotech Co. Ltd.; MyBioSource.com. |

A significant driver of the gene amplification technologies market is the increasing adoption of genetic testing for clinical diagnostics. From detecting hereditary diseases to identifying somatic mutations in cancers, gene amplification lies at the heart of most molecular diagnostic workflows. Its ability to detect low-abundance DNA or RNA targets with high precision makes it indispensable for early diagnosis, treatment stratification, and monitoring.

For instance, in oncology, amplification technologies are used to detect EGFR mutations in non-small cell lung cancer and BRCA mutations in breast and ovarian cancers. In infectious diseases, real-time PCR remains the gold standard for detecting SARS-CoV-2, HIV, and Hepatitis viruses. The ongoing push for personalized medicine—where treatments are tailored to genetic profiles—demands robust amplification technologies capable of handling diverse sample types and genetic complexities.

According to WHO, the global burden of genetic disorders and chronic diseases with genetic predispositions continues to grow, which places gene amplification at the center of modern diagnostics and therapeutic development. As payers and regulators increasingly support genomics in clinical decision-making, the demand for precise and scalable amplification tools is expected to surge.

Despite its broad applications, gene amplification technologies face challenges related to technical complexity and the high risk of sample contamination. The high sensitivity of amplification techniques such as PCR and LAMP, while advantageous, makes them particularly vulnerable to false positives due to cross-contamination or primer-dimer formation.

Many laboratories, especially in emerging markets, lack the infrastructure or training to perform amplification-based assays under sterile and tightly controlled conditions. Even minor lapses in pipetting, reagent storage, or thermal cycling can lead to erroneous results. Additionally, setting up multiplexed or quantitative assays requires deep molecular biology expertise, which is not always readily available.

To address these concerns, manufacturers are investing in closed-system platforms, automated sample handling, and contamination-resistant reagents. However, the associated costs of implementing and maintaining these high-end systems remain a barrier, particularly for smaller labs, limiting the broader adoption of advanced amplification technologies.

An exciting opportunity for the gene amplification technologies market lies in the expanding scope of agricultural biotechnology and food safety testing. In agriculture, amplification methods are used to detect genetically modified organisms (GMOs), identify crop pathogens, and authenticate varietal purity in seeds. In food safety, these technologies play a critical role in detecting contaminants such as E. coli, Listeria, and Salmonella in meat, dairy, and produce.

With global concerns over food traceability and biosecurity, governments and international bodies are mandating stricter testing protocols. For instance, the European Union has implemented comprehensive labeling requirements for GMOs, necessitating reliable amplification-based assays. Similarly, outbreaks of foodborne illnesses in the U.S. have led to widespread adoption of real-time PCR for pathogen detection in food processing units.

Moreover, portable amplification platforms now allow farmers and food inspectors to perform on-site testing with rapid results. This has opened up new markets in rural regions and export-oriented industries. As climate change and population growth strain food systems, ensuring crop integrity and food safety through reliable genetic testing will become a critical priority—offering fertile ground for the growth of amplification technologies.

The kits and reagents segment accounted for the largest revenue share of 68.1% in 2024. Accounting for the largest market share due to their widespread use in routine lab workflows. These consumables are essential for every amplification assay and are often bundled with instrument platforms. The trend of customized, application-specific kits—such as cancer mutation panels or viral load quantification kits—has further boosted demand. Companies are also developing lyophilized and room-temperature stable reagents to support field-based testing.

Software & services is expected to register the fastest CAGR of 2.2% during the forecast period. Reflecting the market’s digital transformation. Advanced software platforms are being used for real-time data analysis, assay optimization, result visualization, and compliance documentation. Cloud-based services enable collaborative analysis and remote diagnostics, especially important for decentralized or multi-center trials. Moreover, bioinformatics support services are critical in interpreting complex amplification data, particularly in multi-omics studies.

The Polymerase Chain Reaction (PCR)-bases amplification segment accounted for the largest share of 72.0% in 2024. Maintaining its stronghold as the most widely used method in clinical diagnostics, academic research, and biotechnology. Its long-standing presence, ease of use, and robust validation across multiple applications make PCR a reliable standard. Variants such as quantitative real-time PCR (qPCR) and digital droplet PCR (ddPCR) are particularly valued for their accuracy, reproducibility, and capability for high-throughput analysis. PCR’s ability to detect minute quantities of nucleic acids with high specificity ensures its relevance in infectious disease detection, cancer diagnostics, and pharmacogenomics.

On the other hand, Loop-mediated Isothermal Amplification (LAMP) emerged as the fastest-growing segment, driven by its rapid reaction time, minimal equipment requirements, and high tolerance to sample inhibitors. Unlike PCR, LAMP does not require thermal cycling, making it ideal for point-of-care and resource-limited settings. During the COVID-19 pandemic, LAMP-based assays were widely adopted for field testing and rapid diagnostics. Recent innovations have enabled multiplexing in LAMP, opening avenues for broader diagnostic applications, including STDs, tropical diseases, and animal health. The technique's affordability and scalability make it a game-changer in decentralized testing environments.

The Diagnostics and Pharmaceutical segment captures the largest revenue share of 72.7% in 2024. As gene amplification is a critical component in molecular diagnostics, drug development, and biomarker validation. From detecting viral RNA to identifying oncogenes, amplification tools underpin nearly every stage of the diagnostic workflow. The pharmaceutical sector also leverages amplification in preclinical research, target validation, and drug response profiling. With the surge in companion diagnostics and targeted therapies, this segment is poised for sustained growth.

Meanwhile, agricultural and food safety applications are witnessing the fastest growth, especially in developing economies where food quality assurance is becoming a policy priority. Amplification-based techniques are enabling real-time pathogen detection and GMO screening in supply chains. Governments and regulatory bodies are investing in training and infrastructure to deploy these tools in border inspection, warehousing, and processing units. As global food exports increase, reliable gene testing will become a crucial pillar of food certification and compliance.

The cell lines segment held the largest revenue share of 39.8% in 2024. fueled by increased research activity in genomics, pharmacology, and biotechnology. Amplification techniques are extensively used in genetic engineering, CRISPR validation, and recombinant protein production. Biotech firms and academic labs are generating custom-engineered cell lines that require rigorous amplification-based validation to confirm gene insertions, deletions, or expression levels. As demand for cell-based therapies and biomanufacturing rises, the need for reliable gene amplification in cell culture workflows will intensify.

Agricultural & food sample is projected to grow at the fastest CAGR over the forecast period. particularly due to their use in non-invasive and minimally invasive diagnostic procedures. Blood, saliva, urine, and cerebrospinal fluid are commonly used in PCR-based tests for infectious diseases, metabolic disorders, and cancers. The ability to perform liquid biopsy using plasma or serum has revolutionized oncology diagnostics, offering an alternative to traditional tissue biopsies. Amplification methods can extract and amplify cell-free DNA (cfDNA) and circulating tumor DNA (ctDNA) from these fluids for early disease detection and monitoring.

Pharmaceutical and biotechnology companies held the lion’s share of the end-use segment, driven by their heavy reliance on amplification in research, drug development, and quality control. Amplification is used throughout the drug discovery pipeline—from target validation to clinical trial biomarker tracking. Biotech firms also utilize these technologies in gene editing, antibody development, and synthetic biology applications. These industries typically operate high-throughput environments, requiring scalable, automated amplification systems.

Hospitals and diagnostic laboratories are the fastest-growing end users, especially as molecular diagnostics becomes a standard component of personalized care. Hospitals are adopting amplification-based assays for infectious disease panels, cancer genomics, and genetic counseling. In diagnostic labs, automated platforms that integrate nucleic acid extraction, amplification, and result reporting are gaining traction. The COVID-19 crisis accelerated this trend, with many labs expanding their amplification testing capacity to meet surging demand.

North America continues to dominate the gene amplification technologies market, owing to its mature healthcare infrastructure, high R&D investments, and concentration of leading biotechnology firms. The U.S. is a global innovation hub, with companies such as Thermo Fisher Scientific, Bio-Rad Laboratories, and Illumina pioneering cutting-edge amplification platforms. Strong regulatory frameworks, reimbursement models, and clinical adoption rates support market growth. Furthermore, collaborations between academia, industry, and government (e.g., NIH’s Precision Medicine Initiative) provide a fertile ground for technology advancement.

Asia Pacific is the fastest-growing region, driven by expanding healthcare access, increasing genomic research, and rising awareness of molecular diagnostics. Countries like China, India, Japan, and South Korea are making significant strides in biotechnology innovation. Government initiatives such as China’s “Precision Medicine Initiative” and India’s “Genome India Project” are catalyzing demand for amplification technologies. Local manufacturers are also emerging, making these technologies more affordable and widely available. Additionally, the region's vast and genetically diverse population provides a strong base for clinical trials and population genomics studies.

January 2025: Bio-Rad Laboratories announced the launch of its new ddPCR Gene Expression Assay Kit, aimed at cancer and autoimmune disease research.

November 2024: Thermo Fisher Scientific unveiled a compact isothermal amplification system tailored for decentralized COVID-19 and flu diagnostics.

September 2024: Agilent Technologies acquired a startup specializing in AI-assisted gene amplification analytics to enhance its digital diagnostic platforms.

June 2024: QIAGEN launched a customizable LAMP kit series for rapid pathogen detection in agriculture and veterinary medicine.

April 2024: Roche Diagnostics entered a strategic partnership with a major Southeast Asian health ministry to deploy rolling circle amplification tools for TB screening.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the gene amplification technology market

Technology

Application

Sample Type

Product

End Use

Regional