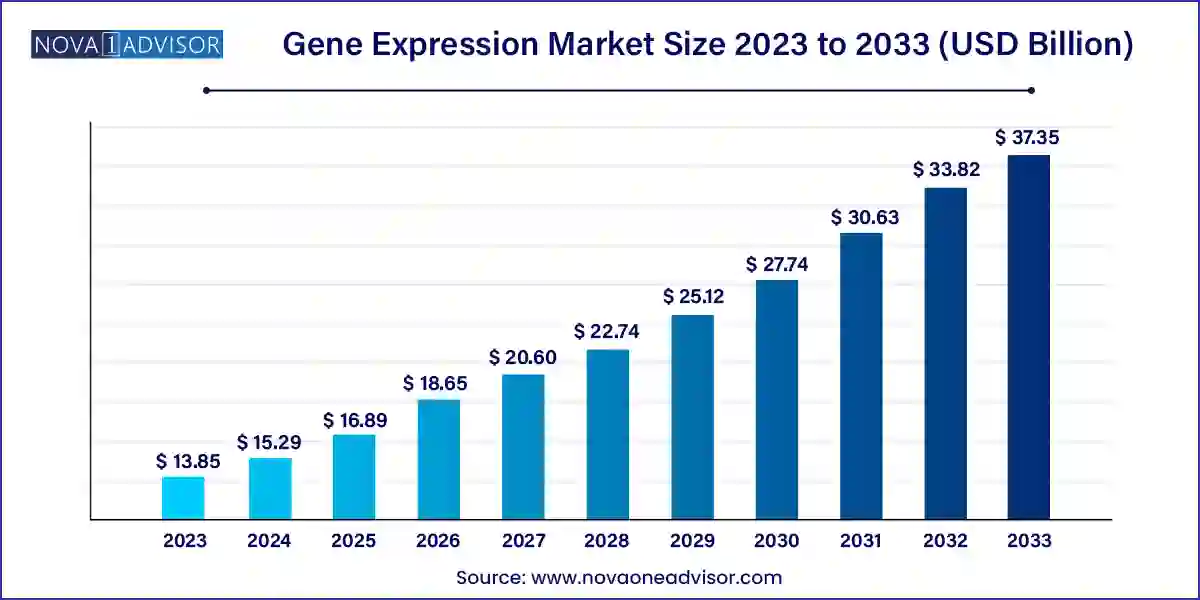

The global gene expression market size was estimated at USD 13.85 billion in 2023 and is projected to hit around USD 37.35 billion by 2033, growing at a CAGR of 37.35% during the forecast period from 2024 to 2033.

The Gene Expression Market plays a critical role in modern molecular biology, driving innovation in both academic and commercial life sciences sectors. Gene expression analysis involves the quantification of messenger RNA (mRNA) levels or proteins to understand when and how genes are turned on or off in different biological contexts. These insights are essential for a broad range of applications, including cancer research, drug discovery, biomarker identification, personalized medicine, and infectious disease studies.

Advancements in high-throughput sequencing, real-time PCR, microarrays, and single-cell analysis have transformed the scale and resolution at which gene expression can be assessed. These technologies allow researchers to decode complex transcriptional profiles and identify gene regulatory networks with unmatched precision. In the clinical domain, gene expression signatures are increasingly being adopted for disease diagnosis, prognosis, and therapeutic stratification—especially in oncology, cardiology, and neurology.

Major biotechnology and life sciences players such as Thermo Fisher Scientific, Illumina, Agilent Technologies, and Bio-Rad Laboratories have consistently introduced new products that improve the speed, accuracy, and affordability of gene expression studies. Furthermore, the expansion of genomic data repositories, coupled with advances in bioinformatics and cloud computing, is making it easier for researchers and clinicians to interpret large datasets. With increasing investments in precision medicine, growing demand for targeted drug development, and the emergence of multi-omics approaches, the gene expression market is expected to experience sustained growth across developed and emerging economies.

Integration of Multi-omics Platforms: Combining transcriptomics with proteomics, metabolomics, and epigenomics to obtain a holistic view of gene function and regulation.

Rise of Single-cell RNA Sequencing: Single-cell analysis is enabling the dissection of cellular heterogeneity and rare cell population characterization.

AI and Machine Learning in Data Interpretation: Artificial intelligence is being used to decode complex gene expression datasets for drug discovery and diagnostics.

Miniaturization and Automation of Workflows: Automated gene expression kits and portable systems are enabling point-of-care and decentralized research.

Clinical Validation of Expression Signatures: Commercialization of gene expression-based diagnostics for oncology and infectious disease management is expanding.

Expansion of Spatial Transcriptomics: New platforms allow for the visualization of gene expression within intact tissues, revealing spatial context in gene regulation.

Cloud-Based Data Analysis Platforms: Secure, scalable data processing systems are being adopted for collaborative gene expression studies.

Open-Access Databases and International Genomics Initiatives: Public efforts like The Cancer Genome Atlas (TCGA) and GTEx are enriching available datasets and fostering innovation.

| Report Attribute | Details |

| Market Size in 2024 | USD 15.29 Billion |

| Market Size by 2033 | USD 37.35 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 37.35% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Process, product, capacity, application, technique, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | QIAGEN; Quest Diagnostics, Inc.; F. Hoffmann-La Roche Ltd.; Illumina, Inc.; PerkinElmer, Inc.; Bio-Rad Laboratories; Thermo Fisher Scientific, Inc.; Agilent Technologies; GE Healthcare; Promega Corp.; Luminex Corp.; Takara Bio, Inc.; Danaher Corp.; ELITechGroup; AutoGenomics; Biocartis NV; IntegraGen; Interpace Biosciences, Inc.; Fluidigm Corp. |

A major driving force behind the growth of the gene expression market is its expanding application in drug discovery and personalized medicine. Pharmaceutical and biotech companies are increasingly using gene expression profiling to understand disease mechanisms, identify therapeutic targets, and stratify patients based on predicted drug responses. By comparing gene expression patterns in healthy versus diseased tissues, researchers can identify potential biomarkers or evaluate the effects of candidate compounds at the molecular level.

One prime example is the use of gene expression analysis to tailor cancer therapies. In breast cancer, for instance, assays such as Oncotype DX and MammaPrint analyze the expression of specific genes to determine a patient’s likelihood of recurrence and whether they will benefit from chemotherapy. This level of personalization not only improves outcomes but also reduces unnecessary treatment exposure. As the push toward individualized care intensifies, the demand for comprehensive gene expression tools continues to grow, making them indispensable in modern healthcare and R&D.

Despite its scientific promise, the gene expression market faces a significant restraint in the form of complex data interpretation and lack of standardized analytical pipelines. Technologies such as RNA sequencing and microarrays generate large and multidimensional datasets, which require sophisticated bioinformatics tools and statistical expertise to interpret accurately. Errors in normalization, batch effects, and data processing algorithms can lead to misleading results or reproducibility issues.

Moreover, the absence of standardized guidelines for data analysis across different platforms complicates result comparison. While databases and reference genomes are available, variations in sample preparation, library construction, and computational methods create inconsistencies. Clinical implementation of gene expression assays also faces regulatory scrutiny to ensure diagnostic reliability, which can slow product development and market entry. Overcoming these challenges will require further investment in bioinformatics infrastructure, workforce training, and regulatory harmonization.

An emerging opportunity in the gene expression market lies in its integration into clinical diagnostics and the development of companion biomarkers. As personalized medicine evolves, clinicians require tools that can predict disease progression, treatment response, and therapy resistance. Gene expression profiling is at the heart of this transformation, offering molecular insights that enable targeted treatment plans. For instance, the use of expression signatures to assess immunotherapy response in melanoma or lung cancer is gaining traction.

Additionally, pharmaceutical companies are collaborating with diagnostic developers to co-develop companion diagnostics that assess gene expression levels before initiating therapy. This approach ensures drug efficacy and improves trial success rates. The FDA’s supportive stance on molecular diagnostics and increasing reimbursement approvals in the U.S. and Europe are fostering market expansion. As more gene expression-based tests gain regulatory clearance, particularly in oncology and infectious diseases, the market stands poised for exponential clinical adoption.

PCR Analysis dominated the process segment, due to its widespread use in gene quantification workflows across both research and clinical settings. Quantitative PCR (qPCR) remains the gold standard for measuring gene expression levels due to its sensitivity, specificity, and speed. Platforms like Thermo Fisher's QuantStudio series and Bio-Rad’s CFX systems are extensively used for gene expression validation, especially in biomarker discovery and diagnostics. The relatively low cost, high throughput, and ability to multiplex make PCR an essential component of most laboratory protocols.

Data Analysis & Interpretation is the fastest-growing process, driven by the explosion of high-throughput sequencing datasets and increasing complexity of downstream analytics. The advent of single-cell RNA-seq and spatial transcriptomics has created the need for advanced computational frameworks that integrate biological pathways, machine learning, and visualization tools. Companies and startups are developing cloud-based platforms that offer secure, user-friendly interfaces for data mining, clustering, and differential gene expression analysis, making this a booming sub-sector.

Kits & Reagents led the product category, accounting for a significant share due to their recurring demand in daily research operations and diagnostics. From RNA extraction kits to cDNA synthesis and library preparation reagents, these consumables are integral to every step of the gene expression workflow. Vendors like Thermo Fisher, Qiagen, and Agilent offer comprehensive reagent portfolios that support a wide variety of platforms and applications.

DNA Chips are the fastest-growing product, especially for multiplex expression profiling in oncology, infectious disease diagnostics, and pharmacogenomics. DNA microarrays provide cost-effective, high-throughput solutions for analyzing hundreds to thousands of genes simultaneously. As clinical labs expand their offerings for personalized testing panels, the demand for robust, pre-validated DNA chips is on the rise.

Low- to Mid-Plex systems dominated, mainly due to their use in focused research questions, clinical panels, and validation experiments. These systems are popular in clinical diagnostics where a defined set of genes is assessed, such as hormone receptor panels in cancer or inflammation-related markers in autoimmune diseases. The lower cost, ease of interpretation, and faster turnaround times make them a practical choice for small and mid-sized labs.

High-Plex systems are rapidly gaining popularity, as transcriptome-wide studies become more accessible. Technologies like RNA-seq, NanoString’s nCounter system, and Illumina’s sequencing platforms enable the analysis of tens of thousands of transcripts in parallel. These systems are increasingly adopted in biomarker discovery, pathway analysis, and drug development programs, making high-plex analysis a key growth driver for the future.

Drug Discovery & Development held the largest share, reflecting the critical role of gene expression in understanding disease biology, identifying drug targets, and assessing drug efficacy. Pharmaceutical companies routinely profile gene expression in preclinical models and human tissues to evaluate therapeutic impact and adverse effects. Integration of gene expression data in clinical trials for patient stratification is also becoming common, particularly in oncology and immunology.

Clinical Diagnostics is the fastest-growing application, due to the increasing use of gene expression assays in hospital and reference laboratories. From cancer recurrence tests like Oncotype DX to infectious disease panels detecting respiratory pathogens, gene expression is being translated into actionable clinical information. Regulatory approvals and inclusion in clinical guidelines are further boosting this segment.

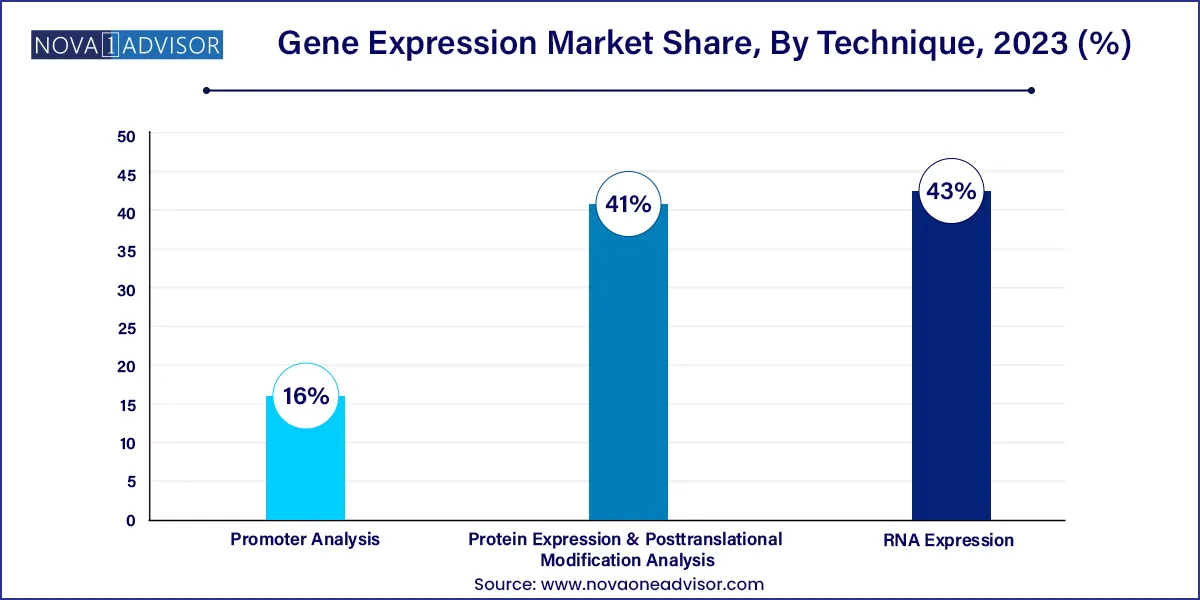

RNA Expression analysis dominated, being the primary technique for gene expression studies. mRNA quantification through real-time PCR, microarrays, or sequencing provides direct insights into gene activity. This technique is a staple in functional genomics, disease modeling, and therapeutic validation across academia and industry.

Promoter Analysis is the fastest-growing technique, especially in synthetic biology and gene therapy research. By evaluating promoter strength, tissue specificity, and transcription factor binding, researchers can optimize gene constructs for expression in target cells. This is particularly relevant for viral vector development and CRISPR-based modulation of gene expression.

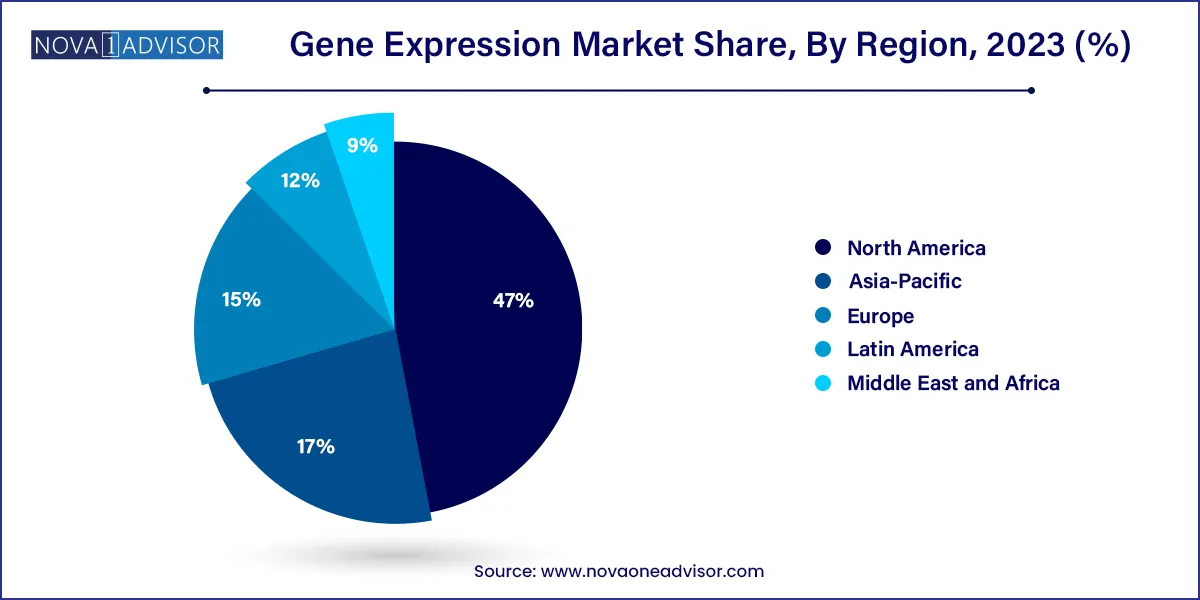

North America, led by the United States, dominates the global gene expression market. The region benefits from a mature research ecosystem, generous funding from bodies like the NIH, and early adoption of advanced genomic technologies. U.S.-based companies such as Illumina, Thermo Fisher, and Agilent have spearheaded innovation in expression profiling tools, making the region a hub for both academic and commercial R&D. Furthermore, strong regulatory pathways for molecular diagnostics and broad insurance coverage for genomic testing support the clinical translation of gene expression technologies.

Asia-Pacific is the fastest-growing region, driven by expanding biotechnology sectors in countries like China, India, South Korea, and Japan. Governments are heavily investing in genomic research, with national initiatives supporting disease genomics, personalized medicine, and agricultural biotechnology. Increased academic research funding, growing awareness of precision diagnostics, and a surge in biotech startups are accelerating regional growth. Additionally, the lower cost of clinical trials and genomic services in countries like India is attracting outsourcing from Western pharmaceutical firms, further boosting the market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Gene Expression market.

By Process

By Product

By Capacity

By Application

By Technique

By Region