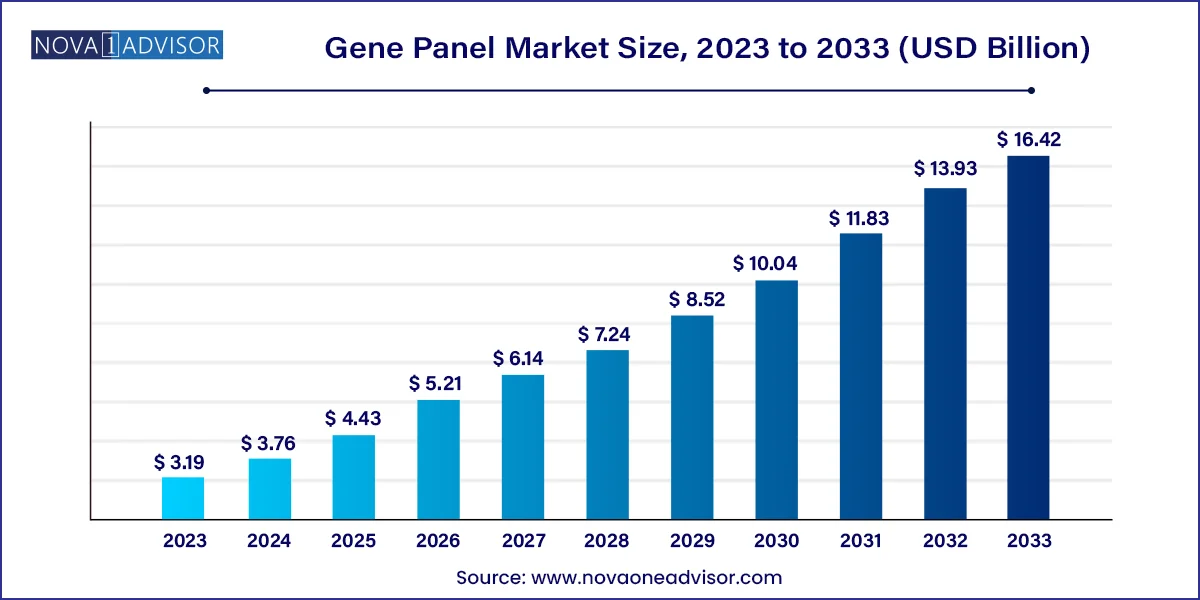

The global gene panel market size was USD 3.19 billion in 2023, calculated at USD 3.76 billion in 2024 and is expected to reach around USD 16.42 billion by 2033, expanding at a CAGR of 17.8% from 2024 to 2033.

The market is experiencing rapid expansion due to factors such as the rising prevalence of hereditary disorders and cancer, increasing need for genetic screening, and changing guidelines for genetic screening to proactively reduce mortality rates from genetic disorders. Moreover, identifying the genetic predisposition for various types of cancer or other genetic disorders has become the primary approach for clinicians to advance disease prognosis and treatment.

The increasing adoption of gene panels in cancer-focused treatments is the primary driver of market growth. In line with market expansion and developments, the market shows substantial promise in meeting the unmet diagnostic and therapeutic requirements for chronic illnesses, especially in the realm of cancer. As the number of deaths related to cardiovascular diseases, diabetes, and arthritis rises among adults with various chronic ailments, there is a critical need for advanced diagnostic services. These services integrate clinically significant target sequences into NGS tests, providing a hopeful resolution.

According to the National Institutes of Health, approximately 7,000 rare diseases affect around 25-30 million people in the U.S. Many gene panels are specifically designed to identify genetic conditions at birth, facilitating early diagnosis and treatment strategies. Moreover, genetic testing allows for the detection of altered genes linked to different illnesses, opening doors for the creation of specific treatments.

Various medical fields, such as oncology, pharmacology, and cardiology, are expected to be impacted by the progress in genetics. The increasing funding in R&D from pharmaceutical firms highlights the market's promising future. To sum up, the industry is set to transform the diagnostic field by delivering precise and prompt data, ultimately enhancing patient results.

| Report Attribute | Details |

| Market Size in 2025 | USD 4.43 Billion |

| Market Size by 2033 | USD 16.42 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 17.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product & services, technique, design, application, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | BGI, Illumina, Inc., Agilent Technologies, Inc, Eurofins Scientific, QIAGEN, OriGene Technologies, Inc., Bioneer Corporation, GenScript, Eurogentec, Twist Bioscience., BioCat GmbH, Thermo Fisher Scientific Inc, Novogene Co., Ltd, GENEWIZ, Inc., Integrated DNA Technologies, Inc, F. Hoffmann-La Roche Ltd, ArcherDX, Inc. and GATC Biotech AG |

Test kits dominated the market and accounted for revenue share of 60.19% in 2023. Genetic testing kits are ideal for identifying genetic mutations in genes, chromosomes, or proteins. To meet consumer demand for at-home testing, key competitors introduced Direct-to-Consumer test kits, driving segment growth. Regulatory approvals and increasing clinical trials also contributed to the segment's dominance.

Testing services are expected to witness the fastest growth at a CAGR of 18.0% over the forecast period, driven by the increasing demand for comprehensive genetic analysis and diagnosis of rare and complex disorders. Genetic testing services provide a customized approach, allowing clinicians to investigate specific genes or genomic regions of interest, driven by research and development activities, personalized medicine, and improving disease understanding.

Amplicon-based approach dominated the market and accounted for a share of 79.12% in 2023. The continued product launches by the key players using this technology are expected to drive the segment growth. Amplicon-based gene panels are favored due to their reliability, reproducibility, and ability to analyze a large number of genes, making them a preferred technique in the gene panel market.

The hybridization-based approach is expected to grow at a significant rate over the forecast period, driven by their suitability for comprehensive genetic analysis and diagnosis of complex genetic disorders. As disease genetics understanding advances, demand for this approach is likely to increase, driven by its ability to provide detailed insights into genetic complexities.

Predesigned gene panels dominated the market and accounted for revenue share of 66.19% in 2023, driven by their widespread adoption among clinicians due to their research-backed design and understanding of genetic predispositions to various disorders. Predesigned panels offer comprehensive genetic analysis, whereas customized panels are typically used for rare disorder diagnosis or specialized research. The increasing global incidence of genetic disorders and cancer is fueling demand for these well-researched predesigned gene panels, enabling timely diagnosis and personalized treatment approaches.

Customized gene panels are expected to register substantial growth over the forecast period. Customized gene panels excel at analyzing specific gene pathways, particularly useful for researching illnesses affecting particular pathways. They identify individual variations, enabling diagnosis, outcome prediction, patient management, and genetic counseling for inherited disorders. Technologies such as Ion AmpliSeq use ultrahigh multiplex PCR to amplify targeted regions with high sensitivity.

Cancer risk assessment accounted for the largest market share of 54.29% in 2023. The increasing global cancer incidence and the advantages of gene panels, including their minimally invasive nature, are driving demand. As a result, gene panels are being used to replace multiple tests for cancer screening, particularly in populations with hereditary risk factors, allowing for the identification of genetic risk factors for various cancer types.

The diagnosis of congenital diseases is expected be the fastest-growing market application with a 20.4% CAGR over the forecast period. The rising prevalence of these conditions will drive growth, as early diagnosis enables timely prognosis and therapeutic intervention to improve quality of life. Growing understanding of heredity and increased genetic screening needs are also propelling adoption in hospitals and diagnostic labs.

The academic & research institutes segment had the highest revenue share in 2023, accounting for 42.14% of the total revenue. This is attributed to the growing global incidence of genetic disorders and cancer, which has led to increased research and development activities in this field. Universities and genetic research institutions are driving advancements in genomic technologies and discovering new applications for gene panels.

The pharmaceutical & biotechnology companies segment is projected to witness the most lucrative growth rate of 22.8% between 2024 and 2033. This is driven by increasing demand for gene panels to support cancer therapy development and the growing understanding of genetic disease mechanisms, leading to increased R&D investments and adoption of gene panels for personalized treatments.

North America gene panel market dominated the global gene panel market with a share of 36.17% in 2023. The research on cancer and inherited rare diseases in the region has witnessed a significant surge, accompanied by a notable increase in the number of NGS-based and clinical applications. Moreover, the presence of leading NGS providers in this region, coupled with the growing government support for genomics research, has further propelled advancements in this field.

U.S. Gene Panel Market Trends

The gene panel market in the U.S. dominated the North America gene panel market with a share of 71.7% in 2023 due to comprehensive studies conducted in multiple research facilities, jointly sponsored by academic institutions, pharmaceutical companies, and the National Cancer Institute, facilitating widespread adoption and growth.

Europe Gene Panel Market Trends

Europe gene panel market was identified as a profitable region in the industry, driven by supportive government policies, regulations, and incentives that promote the adoption of gene panel technology, such as subsidies for renewable energy initiatives and carbon pricing mechanisms, which contribute to market growth.

The gene panel market in the UK is impacted by the British government’s demonstration of a resolute dedication to the progression of genomic healthcare and research. Notably, the NHS in England has become the pioneer in providing whole genome sequencing as a standard component of routine care, making it the first healthcare service globally to do so.

Asia Pacific Gene Panel Market Trends

Asia Pacific gene panel market is projected to register the fastest CAGR of 19.6% over the forecast period, driven by increasing healthcare expenditure, technological advancements, and growing demand for genetic testing. The region is witnessing increased adoption for applications like cancer risk assessment, congenital disease diagnosis, and pharmacogenomics, fueled by expanding healthcare infrastructure, awareness, and rising incidence of genetic disorders and cancer.

The gene panel market in China is expected to grow rapidly in the coming years due to the growing demand of genetic screening. Genetic panels have become a popular choice for genetic screening due to their ability to efficiently and affordably screen for multiple genetic mutations at once.

Key market players are competing on product innovation, pricing, and strategic partnerships. The competitive landscape in the industry is dynamic, with constant new product launches and geographic expansions to maintain market positions.

GenScript offers clients the opportunity to verify the effectiveness of antibodies in their specific application prior to proceeding with the sequencing of desired clones for recombinant antibody production.

Illumina aims to utilize cutting-edge technologies in order to analyze genetic variation and function, enabling studies that were previously unimaginable. It provides adaptable and scalable solutions to cater to the customers' requirements.

Gene Panel Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Gene Panel market.

By Product & Services

By Technique

By Design

By Application

By End Use

By Region