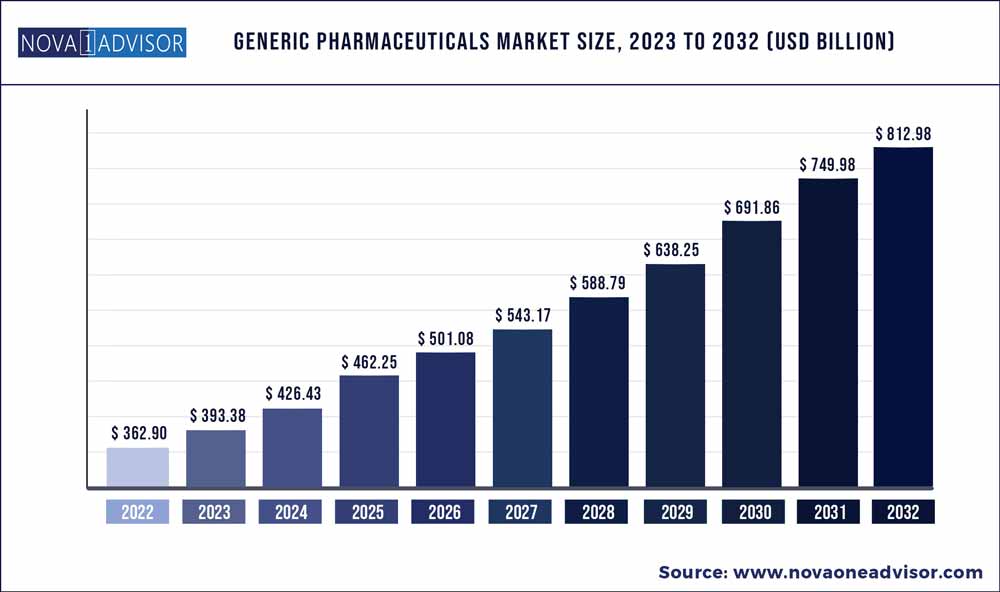

The global generic pharmaceuticals market size was exhibited at USD 362.9 billion in 2022 and is projected to hit around USD 812.98 billion by 2032, growing at a CAGR of 8.4% during the forecast period 2023 to 2032.

Key Pointers:

Generic Pharmaceuticals Market Report Scope

|

Report Coverage |

Details |

|

Market Size in 2023 |

USD 393.38 Billion |

|

Market Size by 2032 |

USD 812.98 Billion |

|

Growth Rate from 2023 to 2032 |

CAGR of 8.4% |

|

Base year |

2022 |

|

Forecast period |

2023 to 2032 |

|

Segments covered |

Type, Application, Product, Route of administration, Distribution channel |

|

Regional scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

|

Key companies profiled |

Teva Pharmaceutical Industries Ltd.; Viatris Inc. Novartis AG; Sun Pharmaceutical Industries Ltd.; LUPIN, AbbVie Inc. (Allergan); AstraZeneca; Sawai Pharmaceutical Co., Ltd.; Hikma Pharmaceuticals PLC; Dr. Reddy’s Laboratories Ltd.; Cipla Inc.; Sanofi; Aurobindo Pharma; Endo International plc. |

The growth of the generic pharmaceuticals market is largely attributable to the expiry of product patents which clears the way for generic drugs and biosimilar manufacturers to launch products in the market. For instance, in July 2020, Teva Pharmaceutical Industries Ltd. entered into a joint venture with Takeda Pharmaceutical Company Limited aimed to manufacture and commercialize specialty assets, complex generic drugs, and other pipeline opportunities. This joint venture was anticipated to drive the generic pharmaceuticals market.

Furthermore, increasing government initiatives to promote generic drug products for reducing the overall healthcare expenditure on pharmaceuticals and the patent expiry of major products. For instance, the Therapeutic Goods Administration (TGA) Australia aims to offer affordable, efficient, high-quality, and accessible generic drugs to citizens for their treatment. In support of generic drugs, the TGA has been trying to reduce regulatory and reimbursement burdens such as changing the landscape of generic drugs and reducing barriers through international collaboration with manufacturers to launch their generic drugs in the market. Such initiatives of the Australian government open new avenues in the market.

In the U.S., every year millions of Americans use a generic drug for their treatment, hence, generic drugs remain the best bargain in the health care insurance programs, and given the recent enactment of healthcare reform legislation such as the introduction of the Patient Protection and Affordable Health Care Act. P.L. 111-148. Under this act, prescription drug coverage is mandated by the government as part of these new health insurance plans. The introduction of such policies may improve the quality and efficiency of healthcare, thereby, driving market growth.

The rising disease burden of infectious & non-infectious diseases coupled with the increasing geriatric population which is prone to chronic diseases such as diabetes, and hypertension, among others, may positively affect the market growth. According to an article published, in September 2022, around 17.9 million general population suffer from cardiovascular diseases (CVD) every year worldwide. Diseases including TB, diabetes, cardiovascular diseases, and HIV were among the major causes of death. The increasing incidence and prevalence of these diseases is expected to drive the market.

Some of the prominent players in the Generic Pharmaceuticals Market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Generic Pharmaceuticals market.

By Type

By Application

By Product

By Route of Administration

By Distribution Channel

By Region