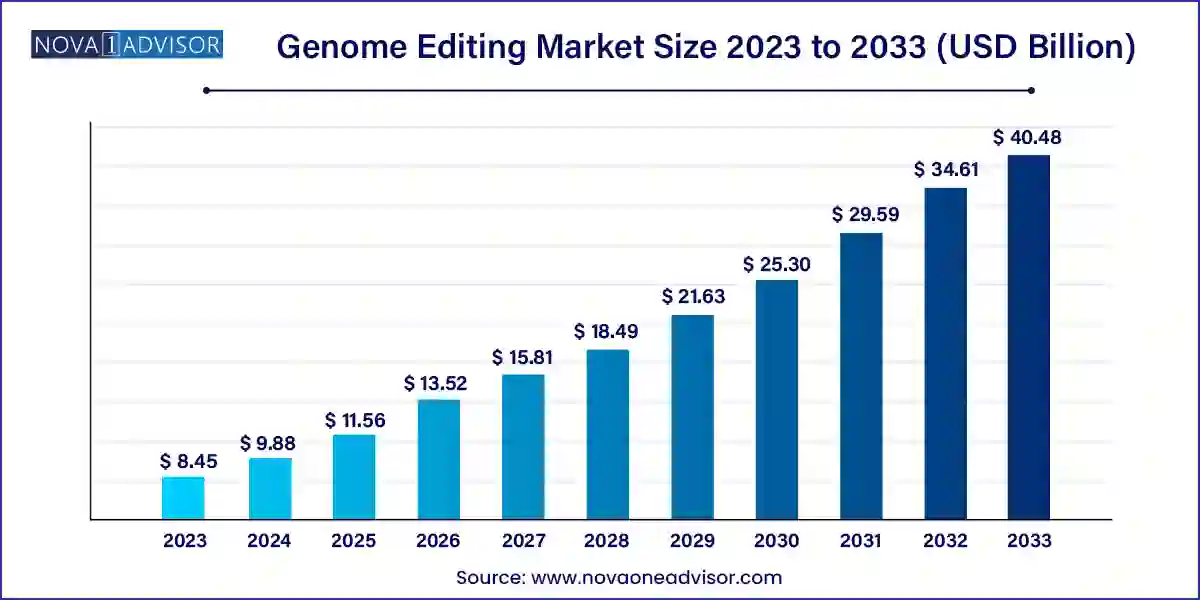

The global genome editing market size was valued at USD 8.45 billion in 2023 and is anticipated to reach around USD 40.48 billion by 2033, growing at a CAGR of 16.96% from 2024 to 2033.

Key Takeaways:

Report Scope of The Genome Editing Market

| Report Coverage | Details |

| Market Size in 2024 | USD 9.88 Billion |

| Market Size by 2033 | USD 40.48 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 16.96% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, delivery method, application, mode, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Merck KGaA; Cibus Inc.; Recombinetics; Sangamo Therapeutics; Editas Medicine; Precision BioSciences; CRISPR Therapeutics; Intellia Therapeutics Inc.; Caribou Biosciences, Inc; Cellectis S.A.; AstraZeneca; Takara Bio Inc.; Horizon Discovery Ltd. (Revvity, Inc.); Danaher Corporation; Transposagen Biopharmaceuticals, Inc.; Genscript Biotech Corp; New England Biolabs; OriGene Technologies, Inc.; bluebird bio, Inc.; Lonza; Thermo Fisher Scientific, Inc.. |

This growth can be attributed to the success in preclinical models driving the demand for genome editing therapeutics, rising competition among market participants for business development, technological advancements in gene editing technologies, and rising adoption in agricultural biotechnology.

The COVID-19 pandemic significantly impacted the market, causing disruptions in several aspects, including clinical trial disruptions, supply chain challenges, and stringent regulations. Manufacturing & supply chains were also affected by lockdown measures, travel restrictions, and reduced workforce, leading to delays in the production & distribution of gene therapy products. Despite these challenges, companies in the genome editing market have adjusted to the new normal by implementing adaptive measures and are expected to recover from the impact of COVID-19.

The pandemic accelerated R&D activities in gene alteration technologies, specifically in response to the urgent need for effective treatments and vaccines for COVID-19. For example, researchers at Nanyang Technological University developed the VaNGuard (Variant Nucleotide Guard) diagnostic test in March 2021, which detected SARS-CoV-2 strains with mutations. This advancement is anticipated to leverage the utilization of CRISPR genome editing technology.

The rapid evolution of CRISPR-based tools has significantly led to the market expansion. The emergence of innovative genome editing tools, which allow easier manipulation of genomic DNA, has brought in a new phase in therapeutic development and disease detection. Consequently, service providers now have a profitable opportunity to tap previously unexplored areas in this field. Moreover, increasing government funding, growing production of genetically modified crops, and rising number of genomics projects are expected to drive market growth.

Many companies are entering into licensing agreements with technology developers to strengthen their market presence, while key players are engaged in strategic initiatives like acquisitions and partnerships to expand their global presence. For instance, in February 2024, Precision BioSciences granted Caribou Biosciences a non-exclusive, global license to use its patented technology for targeted insertion of exogenous antigen binding receptors into the TRAC gene locus of human T cells. This agreement includes upfront payment, royalties on product sales, and potential milestone payments.

Gene editing technology-Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)-is projected to be the burgeoning technology in biotechnology. CRISPR harnesses bacterial immune system to either knock genes out or insert new genes. Due to their time-consuming, ineffective, and labor-intensive nature, traditional genome editing methods are only partially capable of keeping pace with the rapidly evolving genome modification era. Additionally, the technology also provides transformative results in various fields, such as plant, animal, & cell line genetic engineering and drug development & monitoring. The technology has the potential to investigate different gene combinations, control gene expression, and find the role of individual DNA bases.

Crop genetics has been significantly impacted by advancements in genomics and related technologies. Genomes and transcriptomes can now be sequenced for many crops. Major benefits of gene manipulation tools in agricultural sectors include the development of Genetically Modified (GM) plants/crops that have various advanced features, such as increased crop productivity. They also help conserve biodiversity, reduce agricultural eco-footprint, mitigate climate change, and aid in alleviating poverty & hunger.

Technology Insights

The CRISPR/Cas9 segment held the largest market share of 43.89% of the global revenue in 2023. This can be attributed to high precision & efficiency, high versatility & adaptability to different experimental designs, and cost-effectiveness with relatively low expense associated. In addition, with the growing number of applications, the demand for CRISPR is anticipated to grow over the forecast period. The clinical applications of CRISPR have been widely accepted. This is evident from the increasing number of ongoing clinical trials using gene-editing techniques for the treatment of a wide range of diseases such as AIDS, cancer, and genetic diseases. In addition to human health, this technology is witnessing increasing usage in agriculture and animal breeding applications.

The ZFN segment is expected to witness a substantial CAGR of 16.56% over the forecast period. Zinc Finger Nuclease (ZFN) is a widely used technology in the field of genome editing. It is a kind of engineered nuclease that facilitates targeted modifications in DNA strands. ZFNs or homing endonucleases have been successfully used to target HBV, HIV, human papillomavirus, herpes simplex virus type, and human T-cell leukemia virus types, as these are susceptible to transcriptional suppression and gene disruption by ZFNs. Moreover, lower off-target activity does aid in gaining the approval for ZFNs as therapies. As a result, the technique is anticipated to hold immense economic potential for developing gene therapies in the coming years.

Delivery Method Insights

The ex-vivo segment dominated the market with a share of 51.65% in 2023. This dominance can be attributed to the ease of control in DNA modification provided along with the precise regulation of strength and duration of nuclease expression to minimize off-target editing and maximize efficiency. Ex-vivo products such as CAR-T technology for oncology blood treatment are observed to be prioritized in the therapeutic molecular scissors pipeline.

The in-vivo segment is projected to witness the fastest growth at a CAGR of 19.94% from 2024 to 2033. Many specialized cell types cannot be removed from the patient and maintained alive outside the body for the duration of the treatment or cannot be effectively returned to the patient after treatment (e.g., heart muscle cells, specialized neuronal cells). Therefore, the development of several in-vivo genome editing techniques is expected to drive market growth in the near future.

Application Insights

The genetic engineering segment held the largest market share in 2023. The segment is further categorized into cell line engineering, animal genetic engineering, plant genetic engineering, and others. The use of gene therapy for developing novel molecules for the treatment of diseases such as lymphoma, sickle cell, and infectious diseases is anticipated to boost the adoption toward the end of the forecast period.

The clinical applications segment is expected to grow at a significant CAGR of 13.19% over the forecast period. Clinical applications of genome editing include diagnostics and therapy development. The demand for such applications is primarily driven by their potential to address genetic diseases. Genome editing offers the prospect of precise and personalized treatments tailored to an individual's genetic makeup, which helps in advancing therapeutic development. Furthermore, advancements in genome editing technologies, coupled with an increase in understanding of the genetic basis of diseases, have fueled interest in the development of novel diagnostic tools, thereby driving the segment.

Mode Insights

The contract segment dominated the market in 2023 due to the high extent of outsourcing activities in the genomics space driven by the lower costs and greater flexibility in operations offered by such activities as compared to in-house development. The segment is projected to witness further growth because of the increasing strategic activities undertaken by outsourcing service providers. For instance, in December 2022, a CRO named Crown Bioscience, Inc. collaborated with ERS Genomics Limited to gain access to ERS’ CRISPR/Cas9 patent portfolio and strengthen its market presence in the gene editing space. Such initiatives are expected to boost the outsourcing opportunities in the genome editing domain and can positively impact market growth.

The in-house segment is expected to witness lucrative growth over the forecast period due to the ownership of supply channels, better troubleshooting abilities, and enhanced potential for future in-house scale-up activities. Hence, companies such as Precision BioSciences maintain internal manufacturing facilities compliant with current Good Manufacturing Practices (cGMP) to produce genome-edited products, including allogeneic CAR T cell therapies. These factors are anticipated to drive the revenue growth for the segment over the forecast period.

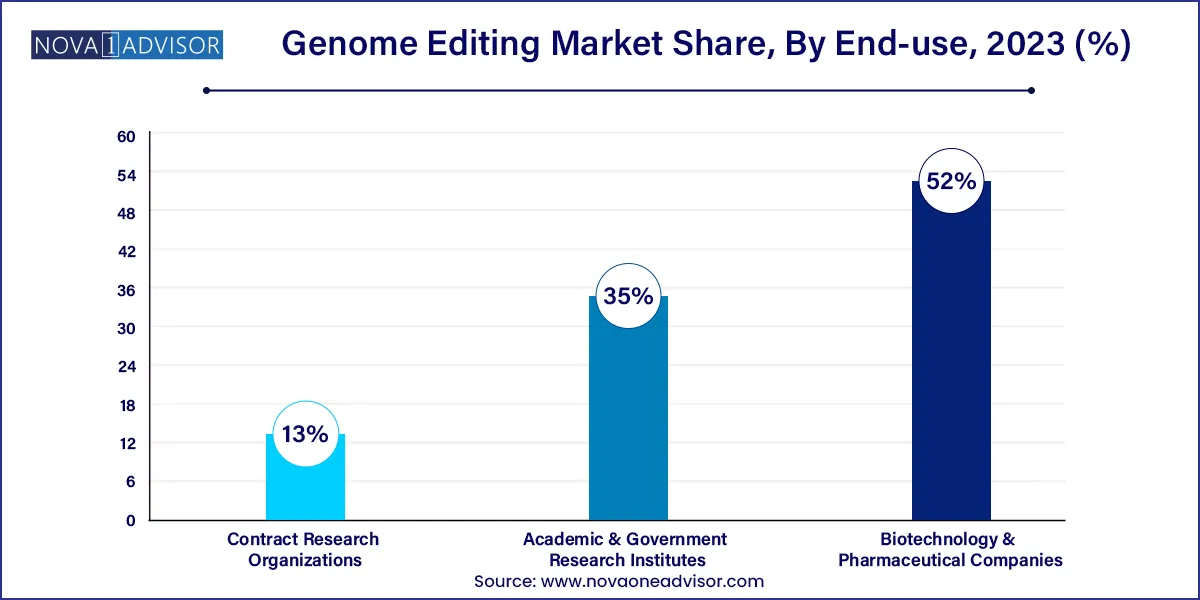

End-use Insights

The biotechnology and pharmaceutical companies segment accounted for the largest market share of 52% in 2023. The presence of a growing number of research activities for novel therapeutic development is the major factor contributing to revenue generation. Moreover, global pharmaceutical companies are collaborating with emerging companies to develop novel technologies. Increased research development efforts for novel treatments are the main factor fueling revenue growth. With rapid advancements in DNA engineering technology such as the introduction of the CRISPR/Cas9 system, the process of creating knockout/knock-in transgenic in microorganisms, plants, and animals, including humans, has become very simple, easy, efficient, accurate, and less time-consuming.

The academic and research institutions segment is expected to grow at the fastest CAGR of 19.22% over the forecast period due to the increasing usage of genome editing technology in academic settings such as college campuses. Several organizations are developing lessons for high school and college students to better understand gene editing techniques.

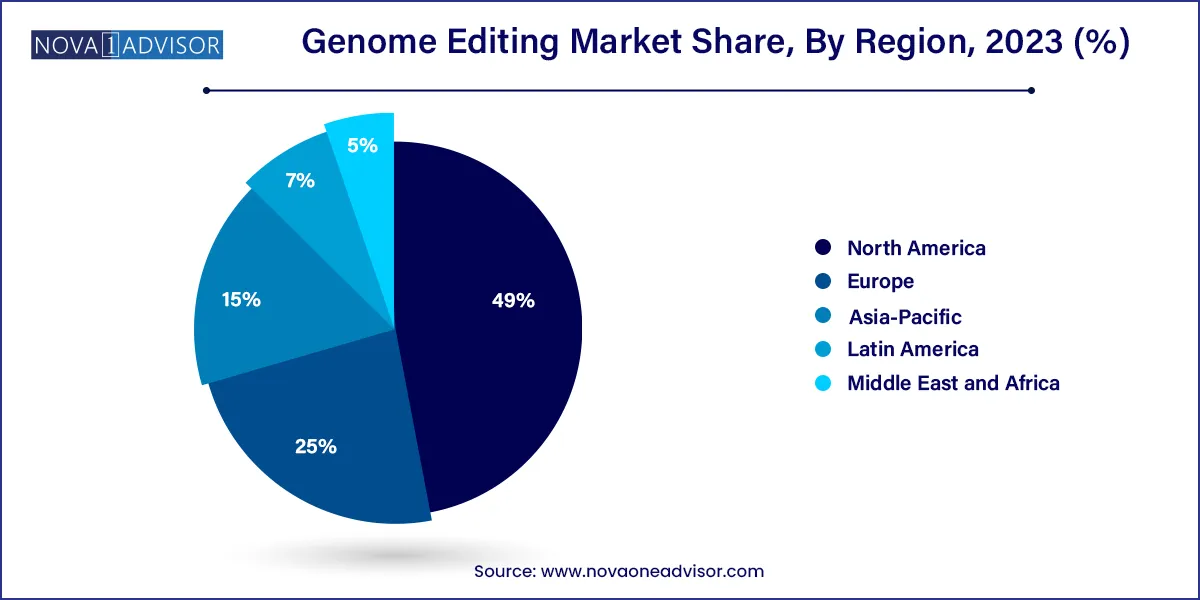

Regional Insights

North America dominated the market and accounted for a 49% share in 2023 owing to the growing investments in the R&D of gene editing technologies. Due to the presence of several biotechnology and pharmaceutical companies working on developing genome editing technologies, the region is projected to maintain its dominance over the projected period.

Further, with increased government funding and support for scientific R&D, the U.S. held the largest market share for genome editing technology in North America. The presence of major players such as Editas Pharmaceuticals, Thermo Fisher Scientific, and CRISPR Therapeutics is also anticipated to fuel market expansion in this region, as is the increasing investment in genomic research.

U.S. Genome Editing Market Trends

The presence of robust research infrastructure, a rise in genetically modified crops, and an increase in the prevalence of genetic diseases are some of the major factors boosting the U.S. genome editing market’s growth. Moreover, in the U.S., genetic diseases such as cystic fibrosis are prevalent. On the other hand, a rise in the number of patent approvals for U.S.-based companies has also accelerated the adoption of genome editing tools in the country, leading to positive market growth. Further, with increased government funding and support for scientific R&D, the U.S. held the largest market share for genome editing technology in North America.

Europe Genome Editing Market Trends

The genome editing market in Europe was identified as lucrative. This is attributed to the adoption of new rules related to genome editing by European countries creating an opportunity for the market.

The UK genome editing market presents several potential opportunities that favor an increase in the usage of advanced genome editing tools. Numerous efforts undertaken by UK-based genome editing companies and funding initiatives supported by private & public entities drive the UK market’s growth. In September 2021, the UK’S Department for Environment, Food and Rural Affairs (Defra) declared that by the end of 2021, researchers who wanted to conduct field trials of gene-edited plants will no longer be required to submit risk assessments.

The genome editing market in France growth is driven by the rising prevalence of hereditary diseases, such as hemophilia and metabolic disorders. To cure such disorders, several researchers are using genome editing technologies. Furthermore, France is undertaking several efforts to drive innovation in plant genetics, thereby boosting market growth in the country. Some of the 28 leading private and public research organizations involved in plant breeding, plant science, and connected technologies formed the Plant Alliance.

The Germany genome editing market generated significant revenue in Europe in 2023, which can be attributed to the presence of developed global companies, such as Merck KGaA & QIAGEN, which offer genome editing and related products. The collaboration and partnership models among key players strengthen their market presence in the country as well as at a global level, hence, driving the revenue in the country.

Asia Pacific Genome Editing Market Trends

Asia Pacific is anticipated to witness the fastest growth at a CAGR of 18.75% from 2024 to 2033. The regional market growth is expected to be driven by the increasing demand for gene editing technologies and the rising prevalence of genetic disorders and diseases across countries like India and Australia. Moreover, the domestic companies providing gene editing products and services are attracting investments and funding. For instance, in April 2021, GenScript launched Research-Grade Lentiviral Vector Packaging Service for drug discovery, cell line development, and gene editing.

The China genome editing market is growth is driven by the local presence of key market players, such as GenScript. The company is taking initiatives to promote genome engineering services such as CRISPR services and gene services. The China market for genome editing is ready for growth due to the Chinese government's increasing focus on precision medicine and the presence of major players such as BGI, and Hebei Senlang Biotechnology.

The genome editing market in Japan is characterized by an increasing number of Japanese companies that are acquiring licenses to the CRISPR-Cas9 technology, potentially driving market growth. In addition, an increasing prevalence of genetic diseases and diabetics coupled with growing genomic research initiatives is expected to drive the market in Japan. In Japan, around 13.5% of the total population either has type 2 diabetes or impaired glucose tolerance.

The India genome editing market is expected grow in the near future. India possesses a high growth potential due to the high competency and intense demand for genome editing technology to improve agriculture productivity suitably. In the country, the Department of Biotechnology’s (DBT) National Agri-Food Biotechnology Institute is utilizing CRISPR genome editing technology to modify bananas. Moreover, ongoing research projects related to CRISPR/Cas9 by Indian researchers and scientists are expected to drive the market growth.

Middle East And Africa Genome Editing Market Trends

The genome editing market in Middle East and Africa is projected to grow in the forthcoming years. The increasing applications of biotechnology in healthcare are contributing to the expansion of the market in this region.

The Saudi Arabia genome editing market is characterized by several ongoing research projects related to CRISPR genome editing technology which are expected to boost the market growth over the forecast period. The rising adoption of CRISPR technology for enhancing the immune system of plants is expected to drive market growth in the coming years.

The genome editing market in Kuwait is expected to witness rapid growth in the coming decade due to the increasing investment in scientific R&D, both by the government and private sector, which drives innovation in genetic technologies. This investment creates opportunities to develop new and improved genome editing tools and techniques.

Recent Developments

Some of the prominent players in the Genome editing market include:

Key Genome Editing Companies:

The following are the leading companies in the genome editing market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global genome editing market.

By Technology

By Delivery Method

By Application

By Mode

By End-use

By Region