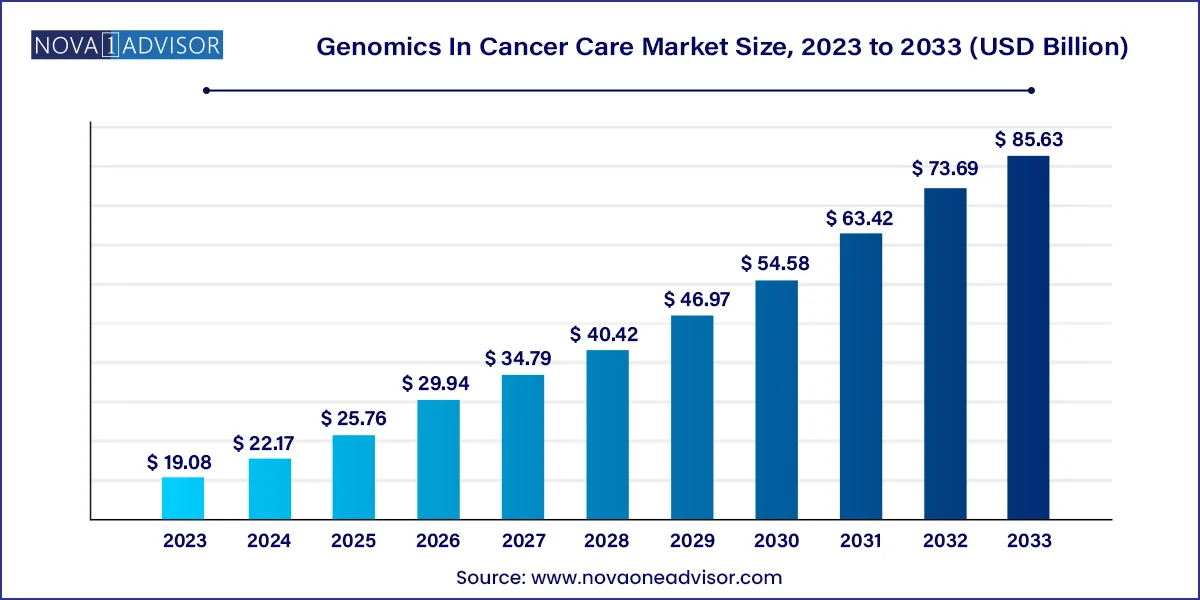

The global genomics in cancer care market size was valued at USD 19.08 billion in 2023 and is anticipated to reach around USD 85.63 billion by 2033, growing at a CAGR of 16.2% from 2024 to 2033

The integration of genomics into cancer care has fundamentally reshaped oncology, paving the way for more precise, targeted, and effective diagnostic and therapeutic strategies. Genomics in cancer care refers to the study of an individual’s genetic material (DNA, RNA) to understand cancer susceptibility, onset, progression, and response to treatment. Through next-generation sequencing (NGS), polymerase chain reaction (PCR), microarrays, and other molecular biology techniques, genomic technologies provide deep insights into the mutations and molecular signatures driving tumor growth.

The global burden of cancer is staggering, with an estimated 20 million new cancer cases and over 10 million deaths worldwide in 2023 alone. Traditional, one-size-fits-all treatment approaches often result in suboptimal outcomes and unnecessary toxicity. Genomics, however, enables the identification of specific genetic mutations (e.g., BRCA1/BRCA2, KRAS, EGFR) that guide clinicians in selecting therapies that are more likely to be effective—marking a shift toward precision oncology.

The growth of the genomics in cancer care market is fueled by advances in sequencing technology, increasing public and private investments in cancer genomics research, and the rising popularity of personalized medicine. Academic and research institutions are forging partnerships with biotech companies to translate genomic discoveries into actionable diagnostics and therapies. The commercialization of liquid biopsy tools, tumor profiling kits, and AI-enabled bioinformatics platforms further adds momentum to this rapidly evolving market.

Governments across various regions are also supporting genomics initiatives. For example, the U.S. Cancer Moonshot Program and the UK’s 100,000 Genomes Project have significantly accelerated cancer genomics research and clinical application. Furthermore, the expanding role of genomics in early diagnosis, prognosis, drug resistance prediction, and therapeutic monitoring is expected to propel the market over the next decade.

Rise of Liquid Biopsy Technologies: Non-invasive genomic profiling from blood samples is transforming cancer diagnostics and monitoring.

Shift Toward Personalized Oncology: Genomics is driving individualized treatment plans based on patient-specific mutations and tumor biology.

AI and Bioinformatics Integration: Machine learning algorithms are increasingly used to interpret complex genomic data, enabling faster and more accurate decision-making.

Multi-Omics Approaches: Combining genomics with transcriptomics, proteomics, and metabolomics for a holistic understanding of cancer is gaining traction.

Clinical Trials Based on Genomic Stratification: Pharmaceutical companies are designing targeted drug trials using genomically stratified patient cohorts.

Consumer Genomics for Cancer Risk Assessment: Direct-to-consumer testing services are expanding to include hereditary cancer screening panels.

Expansion in Home-Based Genetic Testing: At-home genomic testing kits are making genetic insights more accessible, especially in early screening.

Global Genomic Databases: Public and private genomic repositories are being built to facilitate comparative cancer genomics and identify new targets.

| Report Attribute | Details |

| Market Size in 2024 | USD 19.08 Billion |

| Market Size by 2033 | USD 85.63 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 16.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, Technology, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd, Beckman Coulter, Inc., Illumina Inc., Abbott, Cancer Genetics Inc., Bio-Rad Laboratories, Inc, PacBio, GE Healthcare, Quest Diagnostics Incorporated, PerkinElmer, Luminex. |

Rising Prevalence of Cancer and Demand for Precision Oncology

One of the most powerful drivers of the genomics in cancer care market is the surging prevalence of cancer worldwide and the concurrent demand for more accurate, targeted treatments. Traditional cancer therapies—such as chemotherapy and radiation—often lack specificity, leading to unnecessary toxicity and limited effectiveness in genetically heterogeneous tumors. Genomics addresses this gap by decoding the mutational landscape of individual tumors and identifying driver mutations.

For instance, in non-small cell lung cancer (NSCLC), the identification of EGFR and ALK mutations has enabled the use of targeted therapies such as osimertinib and crizotinib, significantly improving survival rates. Similarly, in breast cancer, HER2-positive patients benefit from targeted biologics like trastuzumab. These success stories have created immense clinical and commercial interest in expanding genomic diagnostics and companion therapeutics across more cancer types.

High Cost and Complex Reimbursement Frameworks

Despite its revolutionary promise, genomics in cancer care faces significant challenges related to cost and reimbursement. High-throughput genomic platforms, including next-generation sequencing and microarrays, often require substantial upfront investment and operational expertise. The cost of whole-genome or whole-exome sequencing, although decreasing over time, remains prohibitive for many healthcare systems and patients, particularly in low- and middle-income countries.

Additionally, reimbursement for genomic testing remains inconsistent. In many jurisdictions, payers still categorize genetic tests as investigational, limiting coverage. This lack of standardized reimbursement policies creates uncertainty among healthcare providers and inhibits large-scale adoption, especially in routine clinical workflows. Until payers establish robust frameworks that account for long-term cost savings through precision medicine, the growth of this market will remain somewhat constrained.

Expansion of Genomics in Early Detection and Cancer Screening

One of the most promising opportunities lies in the expansion of genomics-based tools for early detection and screening. Traditionally, many cancers are diagnosed at advanced stages, leading to poor prognosis and limited treatment options. Genomics offers a way to detect cancer-specific genetic and epigenetic changes long before clinical symptoms arise. Liquid biopsies, for example, can detect circulating tumor DNA (ctDNA) or RNA in blood samples, enabling early-stage diagnosis of cancers such as lung, colorectal, and pancreatic.

Companies like GRAIL, with its multi-cancer early detection test Galleri, are pioneering this frontier. Such technologies have the potential to shift cancer care from reactive to proactive, saving lives and reducing healthcare costs. Moreover, incorporating genomic screening into routine health assessments for high-risk populations—such as those with a family history of cancer—can lead to widespread adoption and market expansion.

Consumables dominated the market in 2023 and are expected to maintain their lead throughout the forecast period. Consumables, including reagents, kits, and library preparation tools, are essential components of genomic workflows. Their recurring nature, as opposed to instruments which are capital-intensive one-time investments, ensures steady revenue generation. Increasing frequency of genomic testing, especially in diagnostics and clinical trials, further drives the demand for consumables. For example, cancer diagnostic panels require continuous usage of reagents for mutation detection and biomarker analysis. The introduction of specialized kits for different types of cancers is also bolstering market growth in this segment.

Services, however, are the fastest-growing segment. With many healthcare institutions lacking in-house genomic capabilities, there is a rising demand for outsourced services such as bioinformatics analysis, sequencing as a service, and genomic consulting. Companies like Foundation Medicine and Guardant Health are capitalizing on this trend by offering end-to-end genomic profiling services. Moreover, advancements in cloud-based platforms are making it easier to share and interpret genomic data globally. As personalized medicine gains traction, the reliance on expert genomic service providers is expected to surge, making this a lucrative segment over the next decade.

Diagnostics currently dominate the market. Genomic diagnostics have become indispensable in identifying cancer mutations, classifying tumor subtypes, and guiding treatment decisions. Technologies such as next-generation sequencing (NGS) panels and PCR-based assays are routinely used to detect oncogenic mutations in solid and hematological cancers. For example, BRCA gene testing is vital in assessing breast and ovarian cancer risk, while KRAS and BRAF mutations are commonly screened in colorectal cancer. The rising incidence of cancer, coupled with a growing emphasis on early detection, has cemented diagnostics as the leading application segment.

Personalized Medicine is the fastest-growing application. With the surge in targeted therapies, understanding an individual’s genetic profile is more critical than ever. Personalized medicine involves customizing treatment regimens based on genomic data, leading to more effective and safer outcomes. The FDA's approval of companion diagnostics has facilitated this approach, where specific drugs are only prescribed if certain genetic mutations are present. As awareness spreads and genomic literacy improves among clinicians, personalized medicine is expected to witness exponential growth, especially in high-burden cancer regions.

Genome Sequencing led the technology segment in 2024. Genome sequencing, particularly next-generation sequencing, is at the heart of cancer genomics. It allows comprehensive profiling of cancer genomes to detect single nucleotide variants, copy number variations, and structural alterations. Whole genome and whole exome sequencing are increasingly used in both research and clinical settings. Companies like Illumina, Thermo Fisher, and BGI dominate this space, offering scalable solutions for large-scale sequencing projects.

Nucleic Acid Extraction and Purification is the fastest-growing technology. This process is a critical preparatory step for most genomic applications. With rising throughput in sequencing platforms and increased demand for sample quality, innovations in automated and high-efficiency extraction kits are driving growth. Furthermore, advances in microfluidics and magnetic bead-based technologies are enhancing sample integrity, enabling their use even with minute or degraded specimens. This makes the technology especially useful in liquid biopsies and pediatric cancer testing, areas poised for expansion.

North America dominates the Genomics in Cancer Care Market, holding the largest market share in 2023. The region benefits from a robust healthcare infrastructure, widespread adoption of advanced technologies, and high healthcare spending. The United States, in particular, has been a pioneer in integrating genomics into clinical oncology. Major players like Illumina, Thermo Fisher Scientific, and Foundation Medicine are headquartered in the U.S., contributing to the region's dominance. Additionally, favorable government policies, such as the Precision Medicine Initiative and funding from the National Cancer Institute (NCI), have accelerated genomic research and implementation in cancer care.

Asia-Pacific is the fastest-growing region. Rapid economic development, increasing cancer prevalence, and rising awareness about genomic testing are propelling market growth. Countries such as China, India, Japan, and South Korea are heavily investing in healthcare modernization and genomic R&D. For instance, China's 13th Five-Year Plan emphasized precision medicine as a national priority. Similarly, India's National Biotechnology Development Strategy promotes genome sequencing and translational research. These initiatives, coupled with partnerships between local companies and global biotech firms, are expected to drive significant growth in the Asia-Pacific market over the forecast period.

March 2025: Illumina announced the launch of its next-generation sequencing system, NovaSeq X, designed to offer faster and more cost-effective whole-genome sequencing solutions tailored for oncology research.

February 2025: Thermo Fisher Scientific entered a strategic collaboration with Cancer Research UK to develop and deploy cancer-specific genomic panels for personalized medicine.

January 2025: Guardant Health received FDA approval for its Guardant360 TissueNext test, a tissue-based companion diagnostic for identifying advanced solid tumor biomarkers.

December 2024: Roche launched a new AI-powered genomic interpretation platform in partnership with Flatiron Health to support clinical decision-making in oncology.

November 2024: Agilent Technologies expanded its NGS reagent manufacturing facility in California to meet rising demand for cancer genomics products globally.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Genomics In Cancer Care market.

By Product

By Application

By Technology

By Region