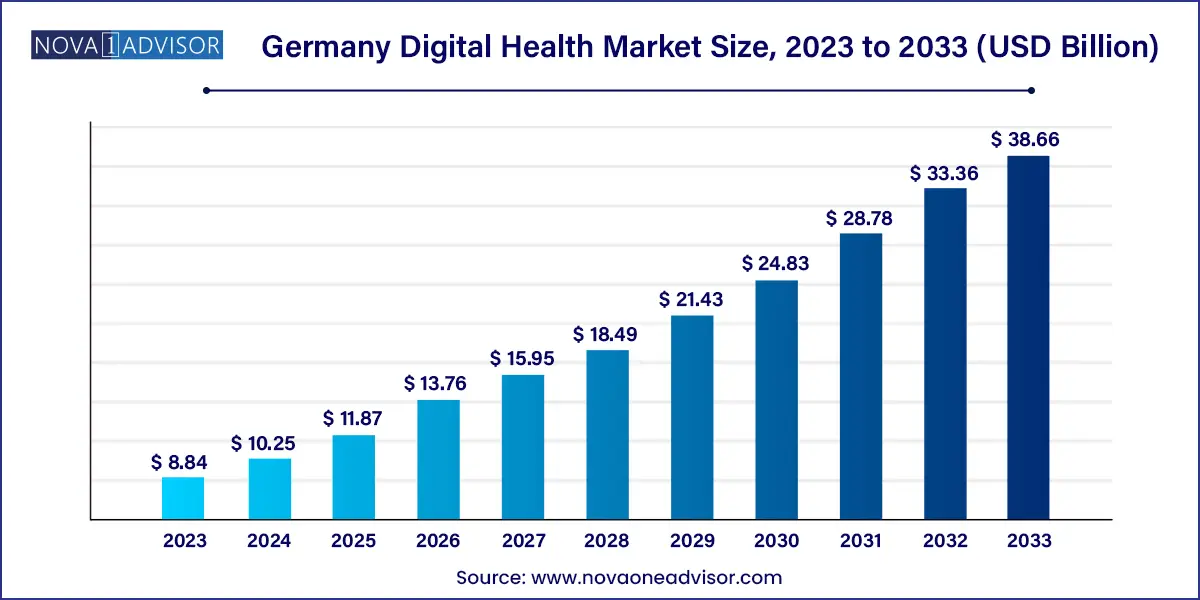

The germany digital health market size was estimated at USD 8.84 billion in 2023 and is projected to hit around USD 38.66 billion by 2033, registering a CAGR of 15.9% during the forecast period from 2024 to 2033.

The Germany digital health market has evolved into one of the most dynamic sectors within the country’s broader healthcare and technology landscape. Known for its robust infrastructure, a well-regulated public health system, and technological leadership, Germany is poised to be a European leader in digital healthcare transformation. Digital health in this context encompasses a wide array of solutions including telehealth, mobile health (mHealth), healthcare analytics, and digital health systems such as electronic health records (EHRs) and e-prescribing systems.

Government initiatives, such as the Digital Healthcare Act (DVG) and the eHealth Act, have catalyzed the integration of digital technologies into mainstream healthcare. These regulations not only provide legal frameworks but also enable physicians to prescribe digital apps, reimbursed by statutory health insurance, creating a unique reimbursement model rarely seen elsewhere in Europe.

Digital health adoption in Germany is further accelerated by the increasing burden of chronic diseases, an aging population, and the demand for accessible and efficient healthcare delivery models. According to estimates, over 15 million Germans are aged 67 and above, requiring constant monitoring and chronic disease management—conditions that digital solutions are well-positioned to support.

Furthermore, Germany’s growing startup ecosystem in health tech, along with investments by global giants like Siemens Healthineers and SAP Health, contribute to the maturity and future scalability of the digital health industry. Whether it’s using remote medication management for senior citizens in Bavaria or applying healthcare analytics in Berlin hospitals to predict patient outcomes, Germany is reshaping how healthcare is delivered and experienced.

The rising adoption of digital healthcare services such as telemedicine, remote monitoring, and electronic health record systems, among many others is anticipated to drive the market growth. The rise in challenges faced by the healthcare industry including the increasing prevalence of chronic diseases, the rapidly aging population, and the shortage of medical professionals in Germany, are some of the major factors anticipated to accelerate the demand for digital health. Germany's e-health infrastructure has been expanding, emphasizing technological supply and demand, patient acceptance, and utilization of online healthcare solutions.

The Digital Care Act (DVG) in Germany provides prescription access to online health applications, paving the way for their widespread adoption and reimbursement. A "Fast Track" process has been established to ensure that all 73 million Germans with public health insurance (90%) have access to online health applications to integrate them into the statutory health system. Rising healthcare costs have been a problem for Germany and many other developed countries that support the adoption of digital health to manage costs. In 2019, the World Health Organization (WHO) reported that Germany's healthcare expenditure accounted for roughly 11.7% of the country's GDP.

Telemedicine provides remote medical care and other related health services using information and communication technologies. Over 200 telemedicine projects are operating in Germany at present, with many more arising in the last few years. Deutsche Telemedizinportal, a component of the eHealth Initiative established by the Federal Ministry of Health, offers comprehensive information about completed and ongoing projects. The initiative aims to open the door for significant applications beyond the project stage and into routine care.

The rapidly increasing population in Germany is contributing to an increased prevalence of chronic diseases and a higher demand for healthcare services. Online health technologies can assist in managing and monitoring chronic conditions effectively. According to a report by the German Federal Statistical Office, the percentage of the population 65 and older is expected to rise from 21% in 2015 to almost 33% by 2060.

During the COVID-19 pandemic, Germany benefited from digital health infrastructure. The country has advanced significantly in using digital health solutions for doctors and patients, allowing for accurate resource allocation and effective crisis management. Over 90% of general practitioners use e-health solutions. In 2021, 61% of outpatient physicians provided digital services to their patients, primarily through telemedicine (37%), online booking (21%), and others. The 2.7 million teleconsultations in 2020 were surpassed by 3.5 million in 2021, a 29% increase, owing to the offered benefits.

Legal Reimbursement of Digital Health Apps (DiGAs): Germany is pioneering the legal prescription and reimbursement of digital apps under public health insurance, setting a regulatory benchmark in Europe.

Teleconsultation in Rural Healthcare: Telehealth is gaining traction in rural areas to bridge the gap in specialist availability, particularly for dermatology, psychiatry, and cardiology.

Wearable Health Technology Adoption: German consumers are increasingly using wearables such as pulse oximeters, glucose monitors, and actigraphs, often integrated with their personal health records.

Artificial Intelligence in Healthcare Analytics: Hospitals are adopting AI-powered platforms for diagnostics, patient flow management, and risk prediction for chronic diseases.

Digital Twin Integration in Hospitals: Emerging trends include the use of digital twins for patient modeling, particularly in cardiovascular and diabetic care.

Start-up-Healthcare Ecosystem Collaborations: German health tech startups are increasingly collaborating with public hospitals and insurance providers for pilot implementations.

| Report Attribute | Details |

| Market Size in 2024 | USD 10.25 Billion |

| Market Size by 2033 | USD 38.66 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, component, application, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Siemens Healthineers; IBM Corporation; Allscripts Healthcare Solutions Inc; Cerner Corporation; GE Healthcare; Abbott; Olympus Corporation; Resideo Technologies; Cisco; Telefonica S.A; Softserve; Computer Programs and Systems, Inc; Vocera Communications; CISCO Systems, Inc; Apple Inc; McKesson Corporation; Epic Systems Corporation; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd; Orange; Qualcomm Technologies, Inc; and CompuGroup Medical. |

A central driving force behind the growth of Germany’s digital health market is the government’s proactive stance on regulation and reimbursement. With laws such as the Digital Healthcare Act (Digitale-Versorgung-Gesetz) and the Digital Health Applications Ordinance, Germany became the first country to allow reimbursement for prescribed digital health applications (DiGAs). This move legitimized digital therapeutics and incentivized both developers and healthcare providers to invest in the space.

For example, if a German citizen is diagnosed with anxiety, a general practitioner can prescribe a CBT-based (Cognitive Behavioral Therapy) digital app approved by the BfArM (Federal Institute for Drugs and Medical Devices), which the insurance will cover. This seamless integration of digital tools into standard care workflows is unmatched globally and fosters accelerated digital adoption across all demographic profiles.

Despite significant progress, Germany’s strict data privacy laws, particularly under the GDPR, pose challenges to the digital health sector. Healthcare providers and digital health startups must comply with stringent guidelines, which often slow down innovation cycles, delay product launches, and require considerable investment in security infrastructure.

Additionally, interoperability remains a hurdle. Although electronic patient records (ePA) are gaining momentum, many digital platforms still face issues integrating seamlessly with hospital information systems and legacy EHRs. The lack of standardized APIs and a unified framework for data exchange limits the real-time utility of digital solutions and restricts broader ecosystem collaboration.

Germany faces an increasing burden of chronic diseases such as diabetes, obesity, and cardiovascular disorders, with an aging population that often finds frequent clinic visits challenging. This opens up a significant opportunity for scaling remote chronic disease management solutions.

For instance, a senior living alone in Leipzig with Type 2 diabetes could benefit from a continuous glucose monitor integrated with an mHealth platform, coupled with a remote medication management system. These platforms can generate alerts for caregivers and doctors when values are abnormal, triggering timely interventions. Insurance reimbursement for such integrated solutions will make them attractive to a wide user base. Startups and established tech firms focusing on post-acute care, remote monitoring, and behavior modification can capitalize on this growing demand.

Tele-healthcare dominated the German digital health market in 2024, due to its wide-scale utility across both urban and rural populations. Within tele-healthcare, video consultations and remote medication management experienced heightened adoption during and post-COVID-19. German insurers now routinely reimburse virtual visits for dermatology, mental health, and general consultations. Tele-care services like remote medication tracking systems are being deployed in geriatric care, where timely intake is critical for health outcomes. Activity monitoring solutions also gained ground among rehabilitation centers and elderly care facilities.

Conversely, mHealth is emerging as the fastest growing segment, thanks to the widespread penetration of smartphones and wearables. Wearables such as sleep apnea monitors, neurological monitors, and BP monitors are being integrated with AI platforms to predict patient conditions. Fitness and medical apps are popular among millennials and Gen Z, who prioritize proactive health tracking. A surge in health app prescriptions under DiGA further underscores the segment’s growth. Germany’s partnership with private mobile operators and device vendors to promote health monitoring is expected to boost this segment exponentially over the next few years.

Services accounted for the dominant share of the digital health market in Germany, primarily because healthcare is increasingly becoming experience- and outcome-driven. Services include remote diagnostics, virtual nursing, AI-powered decision support, and chronic care management. Hospitals, especially university clinics like Charité in Berlin, are outsourcing these services to digital health platforms, allowing scalable patient management and optimization of care delivery.

At the same time, software is projected to witness the fastest growth, especially solutions designed for clinical analytics, EHR integration, and care coordination. SaaS-based health applications are being rapidly adopted by small and mid-sized practices. Additionally, startups are increasingly building modular, cloud-based platforms that can plug into legacy hospital IT systems — a flexible architecture that's highly appealing in Germany's complex healthcare IT environment.

Diabetes emerged as the most dominant application area, with over 8 million people in Germany affected by the condition. Remote monitoring tools, insulin management platforms, and diet tracking apps are now commonplace for diabetic patients. Companies like mySugr have developed app-based tools that integrate with glucometers and physician dashboards, enabling real-time care management. National reimbursement programs covering diabetes apps have further amplified adoption.

Meanwhile, obesity management is the fastest growing application, driven by rising lifestyle-induced conditions and consumer focus on preventive health. The proliferation of fitness apps, combined with AI-powered dietary recommendation platforms, has led to a cultural shift where tech is actively used for weight loss. Wearables that measure caloric expenditure, track activity levels, and suggest workouts are seeing widespread consumer engagement, especially among the younger population.

Patients were the largest end-user group in the German digital health market, driven by consumer-facing platforms that offer personalized care and self-monitoring capabilities. Tools that allow patients to control and share their data, manage appointments, and track recovery paths are especially popular. Direct-to-consumer digital therapeutics are becoming commonplace, and growing patient awareness of healthcare apps and services has accelerated this trend.

On the other hand, providers are the fastest growing end-users, especially after COVID-19, which compelled healthcare institutions to digitalize operations. Providers are embracing AI for imaging diagnostics, chatbots for appointment scheduling, and EHR-integrated dashboards for patient monitoring. Hospitals in North Rhine-Westphalia and Bavaria have launched innovation hubs to train staff and test new digital care models, underscoring the accelerating pace of adoption among providers.

North Rhine-Westphalia dominated the digital health market in Germany, benefiting from its high population density, developed infrastructure, and concentration of major hospitals and academic medical centers. Cities like Cologne, Düsseldorf, and Essen have witnessed widespread adoption of teleconsultation services and hospital-grade remote monitoring platforms. Moreover, innovation funding from state government and partnerships with local tech companies have contributed to the region’s leadership in digital health.

Baden-Württemberg is projected to be the fastest growing region, with a thriving startup ecosystem in cities like Stuttgart and Heidelberg. The region is home to many medical device manufacturers and digital health innovators. Recent partnerships between university hospitals and digital health startups to implement AI-based diagnostics and predictive analytics have made Baden-Württemberg a hotspot for investment. Government grants for digital infrastructure and health innovation parks further accelerate growth prospects.

March 2025 – Ada Health, a Berlin-based digital health startup, announced a €30 million investment round to expand its AI-powered symptom assessment platform across German public hospitals.

January 2025 – Siemens Healthineers launched a new digital twin model for heart failure patients in collaboration with the German Center for Cardiovascular Research, allowing for personalized treatment simulations.

November 2024 – CompuGroup Medical introduced a new EHR software update enabling faster integration with mHealth wearables and DiGA-approved apps, expanding interoperability options for clinics.

August 2024 – TeleClinic, a leading telemedicine provider, partnered with BARMER (one of Germany’s largest insurers) to offer round-the-clock video consultations for mental health services across the country.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Germany Digital Health market.

By Technology

By Component

By Application

By End-use