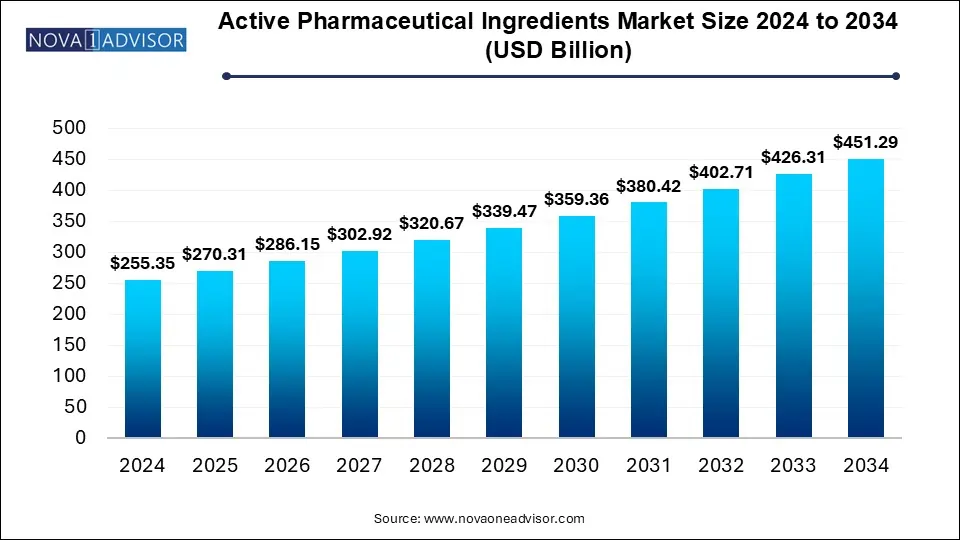

The active pharmaceutical ingredients market size was exhibited at USD 255.35 billion in 2024 and is projected to hit around USD 451.29 billion by 2034, growing at a CAGR of 5.86% during the forecast period 2025 to 2034.

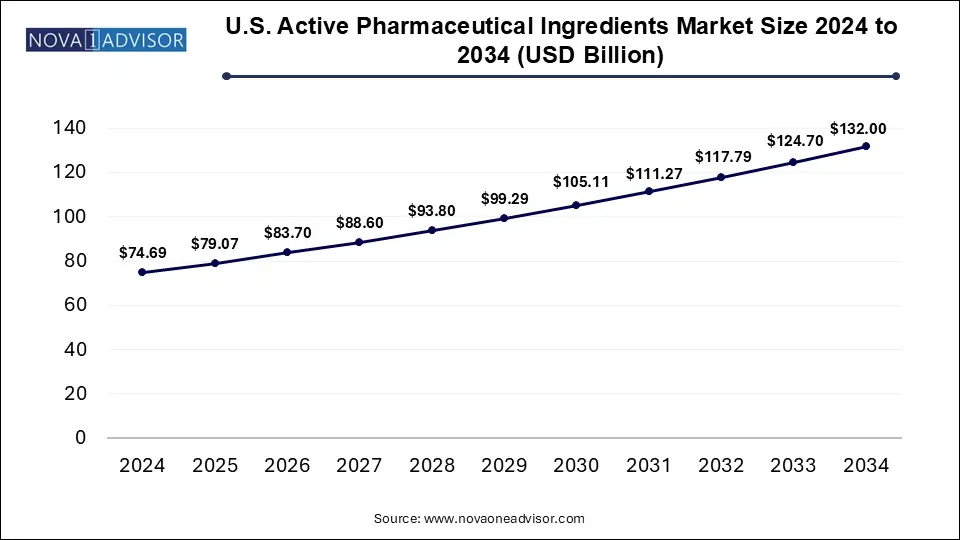

The U.S. active pharmaceutical ingredients market size was valued at USD 74.69 billion in 2024 and is expected to reach around USD 132.0 billion by 2034, growing at a CAGR of 5.31% from 2025 to 2034.

In 2024, North America led the active pharmaceutical ingredients (API) market, securing the largest revenue share of 39.0%. This growth is attributed to the increasing prevalence of chronic diseases, including cardiovascular and genetic disorders, alongside advancements in drug development research. The presence of major industry players like AbbVie Inc., Curia, Pfizer Inc. (Pfizer Center One), Viatris Inc., and Fresenius Kabi AG has further fueled market expansion. For example, in February 2022, Viatris obtained FDA approval for Generic Restasis, a cyclosporine ophthalmic emulsion used to treat dry eye disease. The region benefits from high-value manufacturing sectors specializing in complex and highly potent APIs, gene therapies, and biologics, fostering consistent market growth. Additionally, the expansion of innovators and contract development and manufacturing organizations (CDMOs) in the region is creating enhanced opportunities for API production and commercialization.

U.S. Active Pharmaceutical Ingredients Market Trends

The U.S. accounted for a substantial share of the North American API market in 2024, propelled by its strong pharmaceutical manufacturing industry and rising demand for both generic and innovative APIs. The country has witnessed significant advancements in biotechnology, particularly in monoclonal antibodies, recombinant proteins, and vaccines. Additionally, the increasing incidence of chronic illnesses such as cancer, cardiovascular diseases, and diabetes has further escalated the demand for APIs. The U.S. continues to maintain its leadership position in the region through state-of-the-art API production, regulatory backing, and an expanding biopharmaceutical sector.

Europe Active Pharmaceutical Ingredients Market Trends

Europe’s API market is witnessing substantial growth, driven by the rising demand for high-quality APIs across both innovative and generic pharmaceutical applications. The region's stringent regulatory environment, which enforces high production standards, has significantly contributed to market expansion. Additionally, the growing incidence of chronic illnesses such as cardiovascular and oncology-related diseases has fueled API demand. Europe's leadership in biotechnology has propelled the development of biotech APIs, including monoclonal antibodies, therapeutic enzymes, and vaccines. The increasing focus on biosimilars and outsourcing to contract manufacturing organizations (CMOs) is further accelerating market expansion.

UK API Market Trends

The API market in the UK is poised for significant growth over the forecast period, driven by advancements in healthcare infrastructure and increasing demand for both innovative and generic APIs. The growing prevalence of chronic diseases, particularly cardiovascular and oncology-related conditions, is boosting API consumption. Moreover, advancements in biotechnology and biologics production, coupled with favorable government policies, are fostering market expansion. The rising emphasis on biosimilars and the increasing role of CMOs are also expected to contribute to the UK’s API market growth.

Germany API Market Trends

Germany’s API market is expanding rapidly, supported by its well-established pharmaceutical manufacturing capabilities and stringent regulatory framework. The rising demand for both generic and innovative APIs, along with advancements in biotechnology, is driving market growth. Additionally, the increasing prevalence of chronic diseases and the growing adoption of biosimilars are further enhancing Germany’s market potential.

Asia Pacific Active Pharmaceutical Ingredients Market Trends

Asia Pacific is projected to experience the highest compound annual growth rate (CAGR) in the API market during the forecast period. The region has become a major hub for API production, with high export rates from key countries. China is the largest API producer, manufacturing over 1,600 types of chemical APIs. The region is also witnessing increasing investments from global pharmaceutical companies, further supporting its growth. Initiatives to boost domestic manufacturing facilities are playing a crucial role in market expansion. For instance, in November 2022, Aurobindo Pharma announced plans to complete its Penicillin G plant under the Production Linked Incentive (PLI) scheme by 2024. With an investment of USD 2,000 million, this initiative aims to enhance API manufacturing capacity to 15,000 tons annually.

China API Market Trends

China’s API market is set to grow at an impressive CAGR during the forecast period, driven by a rapidly expanding pharmaceutical sector and increasing domestic demand for both generic and innovative APIs. Government-backed healthcare reforms and substantial investments in biotechnology are further boosting market expansion. Additionally, the growing prevalence of chronic diseases and a heightened focus on quality standards in API production are solidifying China’s position as a key player in the global API industry.

Latin America Active Pharmaceutical Ingredients Market Trends

Latin America’s API market is advancing steadily, fueled by rising investments in healthcare and a growing demand for both generic and innovative APIs. The increasing prevalence of chronic illnesses and the establishment of supportive regulatory frameworks are contributing to market development, positioning the region as an emerging hub for pharmaceutical production and innovation.

Middle East & Africa Active Pharmaceutical Ingredients Market Trends

The API market in the Middle East & Africa (MEA) is expanding due to increased healthcare investments and a growing emphasis on improving medical infrastructure. The rising demand for both generic and innovative APIs is driven by the increasing prevalence of chronic diseases in the region. Additionally, regulatory support and collaborations with global pharmaceutical companies are enhancing market prospects. MEA is gradually emerging as a significant player in the API industry, focusing on strengthening local production capabilities.

Saudi Arabia API Market Trends

Saudi Arabia’s API market growth is largely influenced by government initiatives aimed at enhancing the domestic pharmaceutical sector. Significant investments in healthcare infrastructure and efforts to reduce reliance on imported APIs are creating a conducive environment for local API production. Furthermore, the rising incidence of chronic diseases and the increasing demand for both generic and innovative APIs are contributing to the country's market expansion, positioning Saudi Arabia as a key player in the MEA pharmaceutical landscape.

| Report Coverage | Details |

| Market Size in 2025 | USD 270.31 Billion |

| Market Size by 2034 | USD 451.29 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.86% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type of Synthesis, Type of Manufacturer, Type, Application, Type of Drug, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd.; Teva Pharmaceutical Industries Ltd.; Cipla Inc.; AbbVie Inc.; Aurobindo Pharma; Sandoz International GmbH (Novartis AG); Viatris Inc.; Fresenius Kabi AG; STADA Arzneimittel AG |

In 2024, the synthetic segment dominated the market, accounting for the highest revenue share of 72.08%. The primary factor driving growth in the synthetic API market is the strong demand for generic drugs, which significantly contributes to the revenue of companies engaged in synthetic and chemical API manufacturing. This has created significant opportunities for Contract Development and Manufacturing Organizations (CDMOs) operating in this sector. The growing trend of outsourcing has further strengthened the synthetic API market, as pharmaceutical companies aim to enhance profitability by reducing production costs. For instance, in October 2023, Cambrex completed a $38 million expansion of its small molecule API manufacturing facility, doubling its operational size and increasing its capacity to cater to evolving customer demands.

The biotech API segment is anticipated to experience the highest compound annual growth rate (CAGR) during the forecast period, driven by rising investments in biopharmaceutical and biotechnology industries. These investments are facilitating the development of innovative molecules designed to treat conditions like cancer. Major pharmaceutical players are prioritizing biotech APIs due to their strong revenue potential and high profitability. For example, in May 2023, OLON Group entered the Antibody Drug Conjugate (ADC) API market by establishing a new production facility in Italy, investing €22 million (approximately $23.13 million) to meet containment level OEB6 production standards.

In terms of type, the innovative APIs segment held the highest market share at 64.20% in 2024. This growth can be attributed to increasing financial support and regulatory policies favoring research and development in this domain. Several novel drugs are in the pipeline due to extensive research, with many expected to be launched soon. Additionally, growing regulatory backing for new drug approvals is likely to boost market expansion, reflecting an increased governmental emphasis on healthcare and the pharmaceutical sector.

The generic APIs segment is projected to grow at the fastest CAGR over the forecast period. The upcoming expiration of patents for numerous branded drugs presents significant opportunities for the expansion of the generic API market. Post-pandemic, the pharmaceutical industry is facing a patent cliff, with nearly 200 molecules set to lose exclusivity by 2030 and over 100 biosimilars in development as of 2023. This shift is expected to drive demand for generic APIs, particularly in the oncology segment, where more than 60 molecules associated with high-value APIs are nearing patent expiration.

The cardiology segment emerged as the market leader in 2024, holding the largest revenue share of 22.14%, fueled by the increasing global incidence of cardiovascular diseases (CVDs). According to the World Heart Report 2023, more than 500 million people worldwide are affected by CVDs, contributing to approximately 20.5 million deaths in 2021—nearly one-third of total global fatalities, up from a previous estimate of 121 million deaths due to cardiovascular conditions. CVD remains a critical public health concern, driving extensive API research in this area. Key APIs include Simvastatin, a statin-class cholesterol-lowering drug for dyslipidemia, and Rosuvastatin calcium, a cardiovascular treatment API manufactured by AstraZeneca.

The oncology segment is expected to register the highest CAGR during the forecast period, primarily due to the rising prevalence of cancer worldwide. Collaboration between pharmaceutical firms, research institutions, and regulatory agencies is accelerating drug development, ensuring patient safety, and fostering innovation. For instance, in March 2023, Pfizer Inc. and Seagen Inc. announced a merger agreement, with Pfizer acquiring Seagen, a biotechnology company specializing in cutting-edge cancer treatments. The deal, valued at $43 billion, involves a cash transaction of $229 per Seagen share.

By manufacturer type, the captive APIs segment held the largest revenue share of 51.40% in 2024. A growing number of pharmaceutical companies are investing in overcoming production challenges by developing novel chemical synthesis methods for in-house API manufacturing. This approach reduces costs and minimizes contamination risks. Advancements in protein synthesis and artificial intelligence are also expected to optimize production by enhancing process control. Furthermore, leading pharmaceutical companies are increasingly favoring in-house API manufacturing over outsourcing. For instance, in September 2021, AstraZeneca committed $360 million to expand its API manufacturing facility in Ireland, supporting the commercialization of its innovative products. Such strategic investments are projected to drive further growth in this segment.

The merchant APIs segment is anticipated to record the highest CAGR in the coming years. A key trend in the pharmaceutical industry is the rising preference for contract manufacturing and outsourcing API production. Given the high costs of captive API manufacturing, many pharmaceutical firms are opting for outsourcing solutions to cut expenses. Merchant APIs offer a cost-effective alternative by eliminating the need for significant capital investments in advanced equipment and infrastructure. In response to the evolving post-pandemic landscape, industry leaders are ramping up production capacity to maintain a competitive edge. For instance, in May 2023, Millipore Sigma announced a $69 million expansion of its U.S. facility, effectively doubling its production capacity for highly potent active pharmaceutical ingredients (HPAPIs). This facility will focus on commercial-scale manufacturing of antibody-drug conjugates (ADCs).

The prescription drug segment held the dominant revenue share of 80.0% in 2024. Physician recommendations significantly influence demand for prescription medications. While the usage of proton pump inhibitors (PPIs) for treating heartburn has stabilized due to associated side effects, demand for Histamine-2 Receptor Antagonists (H2RAs) has also been impacted. The oncology sector continues to rely heavily on prescription drugs, as cancer treatments often involve chemotherapy, targeted therapies, immunotherapy, and hormonal treatments. Moreover, biologic drugs are witnessing increased adoption. The success of new targeted therapies has driven a surge in prescriptions for these treatments, with major pharmaceutical companies focusing on introducing innovative, precision-targeted therapies.

The over-the-counter (OTC) drug segment is projected to grow at a rapid CAGR over the forecast period. The accessibility of OTC products makes them highly responsive to shifts in consumer behavior. A notable trend is the transition away from traditional antacids for heartburn management, with an increasing preference for gut health solutions such as probiotics. This shift is creating new growth opportunities for preventive health products, including nutraceuticals, dietary supplements, and probiotics, while tempering demand for conventional OTC medications.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the active pharmaceutical ingredients market

By Type of Synthesis

By Type of Manufacturer

By Type

By Application

By Type of Drug

By Regional