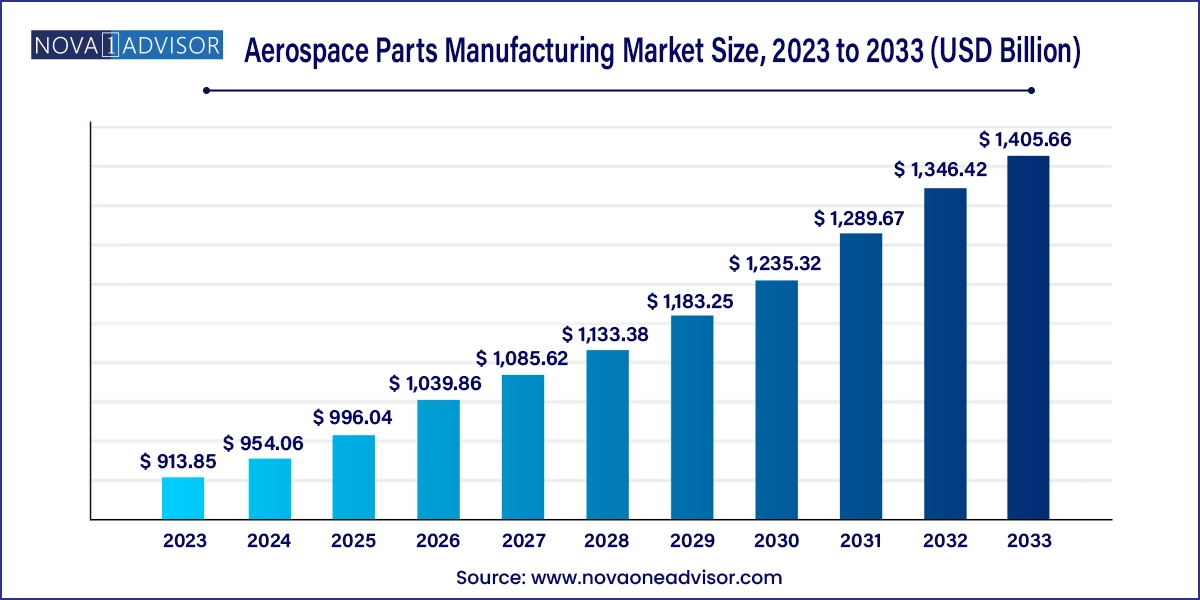

The global aerospace parts manufacturing market size was exhibited at USD 913.85 billion in 2023 and is projected to hit around USD 1,405.66 billion by 2033, growing at a CAGR of 4.4% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 954.06 Billion |

| Market Size by 2033 | USD 1,405.66 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Middle East & Africa, Central & South America |

| Key Companies Profiled | JAMCO Corporation, Intrex Aerospace, Rolls Royce plc, CAMAR Aircraft Parts Company, Safran Group, Woodward, Inc., Engineered Propulsion System, Eaton Corporation plc, Aequs, Aero Engineering & Manufacturing Co., GE Aviation, Lycoming Engines, Pratt & Whitney, Superior Air Parts Inc., MTU Aero Engines AG, Honeywell International, Inc., Collins Aerospace, Composite Technology Research Malaysia Sdn. Bhd., Mitsubishi Heavy Industries Ltd., Kawasaki Heavy Industries Ltd., Subaru Corporation, IHI Corporation, Lufthansa Technik AG, Diel Aviation Holding GmbH, Elektro-Metall Export GmbH, Liebherr International AG, Hexcel Corporation, DuCommun Incorporated, Rockwell Collins, Spirit Aerosystems, Inc., Panasonic Avionics Corporation, Zodiac Aerospace, Thales S.A., Dassault Systems SE, Parker-Hannifin Corporation, Chemetall GmbH, Premium AEROTECH GmbH, Daher Group, FACC AG, Triumph Group, Curtiss-Wright Corporation, Stelia Aerospace, Magellan Aerospace, Bridgestone Corporation |

The market is growing on account of the rising passenger traffic, especially in Asia Pacific and Middle East & Africa, and is expected to drive the demand and production of aerospace parts, over the coming years. Moreover, increasing demand for lightweight and fuel-efficient aircraft to reduce greenhouse gas (GHG) emissions is positively influencing the industry demand.

Expansion in air passenger and air freight volume worldwide against the backdrop of economic growth in emerging countries and considerable developments in commercial aerospace are expected to drive industry growth. An increase in air travel and transport is presumed to propel the demand for manufacturing of aerospace parts that are used in aircraft. This growing demand for transportation is expected to stimulate aircraft production, which, in turn, is expected to result in an extension of contracts between aerospace parts suppliers and aircraft manufacturing companies. In addition, increased defense spending to reduce operational costs and improve the efficiency of aircraft is anticipated to create opportunities for innovation, which is expected to boost technological advancements in the industry.

Aircraft are durable assets and typically remain in service for two or three decades. As the cost to retain and operate the aircraft exceeds the profits generated, they must be replaced. New-generation aircraft and aerospace parts provide improved range and payload capability, thus enabling better fuel efficiency, significant cost savings, and profit margins compared to older aircraft. The annual replacement rate in the airline industry is approximately 3%. Fleet replacement provides a strong base for long-term demand for the manufacturing of new aerospace parts since it is much needed for fleet expansion, which contributes to market development.

The U.S. market dominates the global industry owing to the presence of established companies, such as Boeing, United Technologies, and Lockheed Martin. An increased passenger transportation is expected to drive the manufacturing of aerospace parts in the U.S. Moreover, rising demand for aerospace parts sourced from the U.S. including wings, fasteners, and fuselages on account of assurance of airworthiness strong legacy, and technological ability to produce high-quality products, is expected to drive market growth over the forecast period.

Based on product, aircraft manufacturing accounted for the largest revenue share of over 51% in 2023. This segment includes manufacturing and assembly of a complete aircraft, including the aerostructure. Aero-structure mainly comprises fuselage, door pairings, wings, and airframe. This segment also includes developing and making aircraft prototypes; aircraft conversion that includes significant modifications to aircraft, and complete aircraft overhaul and rebuilding. Aircraft manufacturing consists of the building and assembly of civil aircraft, such as large commercial aircraft, business jets, and regional aircraft.

This segment is led by Boeing, which also manufactures freighters for logistic air supply. Equipment, safety, and support segment is expected to register the fastest CAGR from 2024 to 2030. The equipment, system, and support segment comprises various parts including landing gear, opening and closing doors, air management system, actuation & control system, and others. The overall weight of an aircraft is a crucial factor in determining the efficiency and design of the equipment, system, and other support systems. The reduced weight has a significant impact on the overall performance of an aircraft.

Avionics segment is expected to register a significant CAGR from 2024 to 2030. Advanced avionics are generally used to incorporate screens allowing pictures of the flight routes as well as necessary flight instrument data. Avionics are designed to increase the safety and utility of aircraft and aerospace parts. It encompasses electronic aircraft systems, such as fly-by-wire or fly-by-light flight controls, system monitoring, anti-collision systems, and pilot interface systems including communication, flight management systems, navigation, and weather forecast. Avionics demand generally follows the overall aerospace manufacturing industry and is expected to grow in line with increasing demand for aircraft.

Based on end-use, commercial segment dominated the market with highest revenue share in 2023 in manufacturing of aerospace parts. Commercial aircraft segment is also expected to remain the fastest growing segment from 2024 to 2030. This is on account of rise in passenger and freight traffic around worldwide. With improved trade relations globally, there is a surge in demand for cargo services, which is expected to contribute to growth of the commercial aircraft parts market.

Commercial aircraft market is characterized by presence of a limited number of manufacturing companies owing to the associated financial risks and technological requirements. Manufacturing engines for commercial aircraft entail highest risk, thereby constricting number of manufacturing companies competing in the market. Boeing and Airbus are significant commercial aircraft manufacturing companies, together accounts for majority of the overall revenue share.

Business and general aviation aircraft comprises light planes that are used for private leisure flying, personal transportation, corporate travel, and short-haul commercial transportation, such as air taxis and commuter airliners, with low takeoff weights. Growing demand for business aircraft can be attributed to its benefits such as increased mobility, enhanced productivity, and improved efficiency. Business aircraft is anticipated to boost productivity, as air travel requires less time compared to other modes of travel. This is expected to drive the demand for business aircraft along with market for aerospace parts over the forecast period.

Military aircrafts are used to move troops and materials such as tanks, automotive vehicles, and helicopters. With modifications, they also serve as tankers for in-flight refueling. Military transporters have special features compared to commercial freight aircraft, which includes short-takeoff-and-landing capability, loading ramps, airdrop capability, and paratroop doors.

North America industry for aerospace parts manufacturing dominated the regional market with largest revenue share of 51.7% in 2023. North American economy is extremely favorable for aircraft manufacturing owing to increased number of aging fleets in the region. Replacement of this aging aircraft is contributed to the lower operating efficiency and revenue requirements for the operating airlines. Moreover, increase in per capita income is expected to boost the number of airway passengers, thereby boosting regional demand for aircraft and its parts.

Asia Pacific accounted for a significant share in 2023. This is due to growing development in aviation industry in Asia Pacific driven by economic growth of Japan, China and other countries. There is a rapid rise in international air travel along with growing demand for international cargo which is expected to trigger regional demand for MRO activities, thereby boosting demand for aerospace parts.

Growth of the European aerospace and defense industry is expected to surpass that of aerospace industry in the U.S. over the forecast period, owing to a slight increase in defense spending by some European countries, such as Russia, Italy. The industry has experienced improved performance against the backdrop of economic slowdown and uncertainties in recent years. However, European industry is highly concentrated in nature on account of the major players accounting for a significant revenue share.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global aerospace parts manufacturing market

Product

End-use

Regional