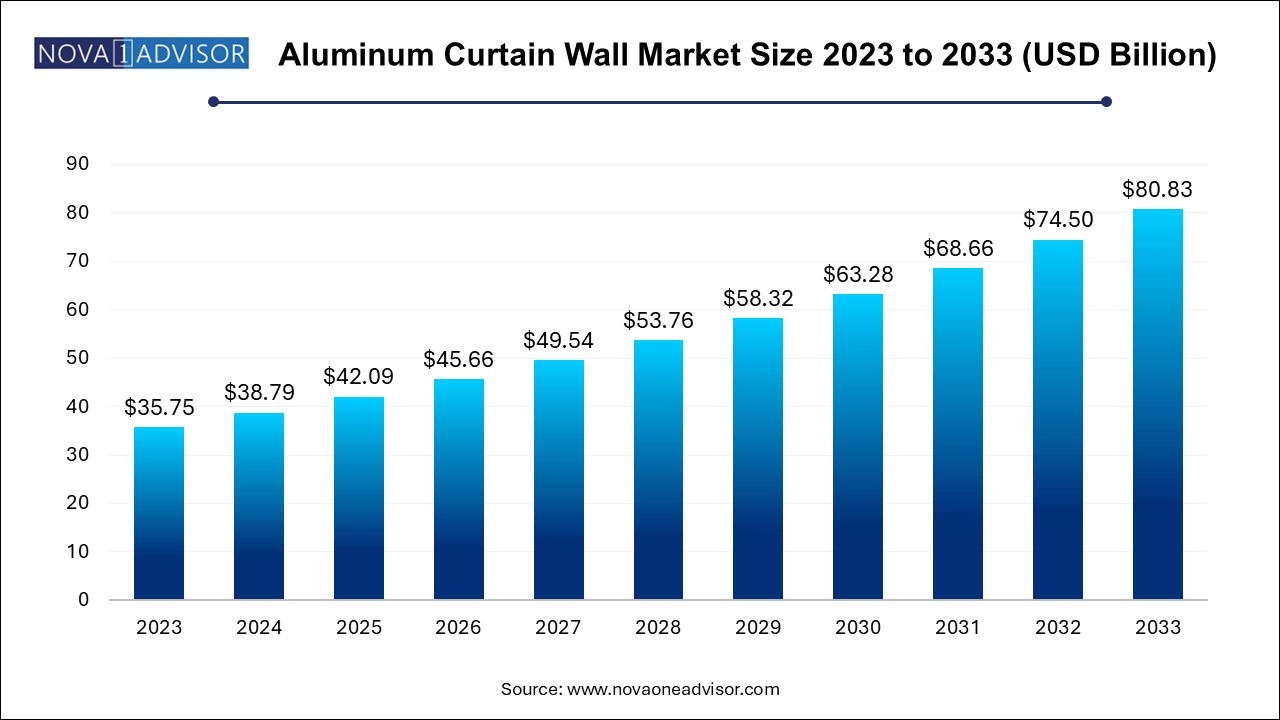

The global aluminum curtain wall market size was exhibited at USD 35.75 billion in 2023 and is projected to hit around USD 80.83 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 38.79 Billion |

| Market Size by 2033 | USD 80.83 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Type, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Alumil; Aluplex; ALUTECH; EFCO, LLC; Enclos Corp.;GUTMANN Group; HansenGroup; heroal; HUECK System GmbH & Co. KG; Josef Gartner GmbH; Kalwall; Kawneer Company, Inc.; National Enclosure Company; Ponzio; Purso; RAICO Bautechnik GmbH; Reynaers; SAPA; Schüco India; Skansa |

The growing emphasis on energy efficiency and sustainable building practices drives market growth. Aluminum curtain walls offer superior insulation properties, reducing the need for artificial heating and cooling, which helps buildings meet stringent energy efficiency standards. As green building certifications such as LEED and BREEAM gain prominence, aluminum curtain walls are becoming more common, particularly in commercial and high-rise residential structures.

Another factor contributing to the demand is the rapid urbanization and development of infrastructure in emerging economies. Countries in Asia-Pacific, the Middle East, and Africa are witnessing a construction boom, with numerous skyscrapers and large commercial projects underway. Aluminum curtain walls are favored in these projects due to their lightweight nature and durability. The material allows for more creative and modern architectural designs, which are highly sought after in urban landscapes.

Furthermore, technological advancements in manufacturing and installing aluminum curtain walls have made them more accessible and cost-effective. Innovations in aluminum processing and developing high-performance glazing systems have improved these curtain walls' structural capabilities and energy efficiency. This has led to the broader adoption of aluminum curtain walls in new constructions and renovation projects across various regions.

Lastly, the increasing awareness of aluminum's long-term benefits, such as its recyclability and low maintenance requirements, encourages builders and developers to choose aluminum curtain walls over traditional materials. As sustainability becomes a core focus in the construction industry, the demand for aluminum curtain walls is expected to continue growing globally.

The commercial segment held the largest market revenue share of 72.4% in 2023. The growing emphasis on energy-efficient and aesthetically appealing building designs in the commercial sector drives the segment growth. Aluminum curtain walls are favored for their lightweight, durable, and low-maintenance properties, making them ideal for large-scale commercial projects like office buildings, shopping malls, and hotels. Additionally, the increasing trend toward high-rise commercial buildings, particularly in urban areas, drives the demand for aluminum curtain walls as they offer enhanced structural support and flexibility in design

The residential segment is projected to grow significantly over the forecast period. Homeowners and developers are increasingly seeking modern architectural designs emphasizing sleek and contemporary exteriors, which aluminum curtain walls provide. These walls also improve energy efficiency by enhancing insulation and reducing thermal bridging, which is crucial in meeting stringent energy regulations. Additionally, aluminum's corrosion resistance and low maintenance requirements make it a cost-effective and long-lasting option for residential buildings. As urbanization continues and more high-rise residential projects emerge, the adoption of aluminum curtain walls in this segment is expected to grow.

The unitized segment held the largest market revenue share in 2023. Unitized curtain walls are pre-fabricated and assembled in controlled factory environments, ensuring high precision and quality. This method significantly reduces installation time on-site, as large sections can be quickly erected, minimizing labor costs and reducing project timelines. Additionally, unitized systems offer superior thermal insulation and weatherproofing, which are increasingly important in modern, energy-efficient building designs. As urbanization and the construction of high-rise buildings continue to grow globally, unitized aluminum curtain walls' efficiency and performance benefits are driving their rising demand in the market.

The stick-built segment is projected to grow significantly over the forecast period. Stick-built curtain walls allow for on-site assembly, which is advantageous for irregular shapes or custom specifications, unlike unitized systems. This method also provides cost-effectiveness for small to medium-sized projects, reducing the need for extensive prefabrication. The stick-built system offers better control over the installation process, enabling adjustments during construction to accommodate unforeseen challenges. As a result, it is favored for projects that require a high degree of customization and precision, driving its growing demand in the market.

The North American market is projected to witness significant growth in the coming year. As urbanization accelerates and cities expand, there is a rising need for modern, energy-efficient buildings, driving the adoption of aluminum curtain walls. These walls are favored for their durability, low maintenance, and ability to support large glass panels that contribute to natural lighting and energy efficiency. Additionally, the push for green building certifications like LEED (Leadership in Energy and Environmental Design) in the U.S. and Canada has further propelled the use of aluminum curtain walls, which contribute to sustainable construction practices.

U.S. Aluminum Curtain Wall Market Insights

The U.S. market held the largest market revenue share regionally in 2023. The rapid growth of urban areas in the U.S. has resulted in a higher demand for aluminum curtain walls due to the need for more commercial and residential structures. The material's ability to support large glass panels while offering flexibility in design also makes it a preferred choice among architects and builders, contributing to its increasing demand.

Europe Aluminum Curtain Wall Market Insights

Europe aluminum curtain wall market is projected to grow significantly over the forecast period. European regulations, particularly the Energy Performance of Buildings Directive (EPBD), are driving the adoption of materials that contribute to better insulation and reduced energy consumption in buildings. Additionally, the growing trend towards modern architectural designs emphasizing large glass facades is fueling demand, as aluminum curtain walls offer the flexibility required for such constructions. The increasing investments in commercial real estate and infrastructure projects across key European cities also contribute to this demand.

The UK market is anticipated to witness a significant growth over the coming years. The UK construction industry has seen a surge in developing high-rise commercial and residential buildings, particularly in urban areas like London and Manchester. Additionally, the push for energy-efficient buildings in the UK, driven by stringent government regulations and the growing emphasis on sustainability, has led to a preference for aluminum curtain walls. These systems offer superior thermal insulation and can be integrated with energy-saving technologies, making them a preferred choice for environmentally conscious construction projects.

Asia Pacific Aluminum Curtain Wall Market Insights

Asia Pacific market held the largest market revenue share of 48.2% in 2023. Rapid urbanization and the ongoing construction boom in countries such as China and India drive market growth. These regions are experiencing significant growth in high-rise buildings, commercial complexes, and infrastructure projects, all requiring durable and aesthetically pleasing building facades. Additionally, government initiatives promoting sustainable construction practices further boost the adoption of aluminum curtain walls as they contribute to building energy conservation.

India market is projected to grow rapidly in the coming years. The rapid urbanization and growth in the construction of commercial and residential buildings drive the demand for aluminum curtain walls. The Indian government's focus on infrastructure development, including the Smart Cities Mission and affordable housing projects, has accelerated the adoption of modern building technologies such as aluminum curtain walls, which offer energy efficiency and durability.

Latin America Aluminum Curtain Wall Market Insights

The Latin American market is projected to grow significantly over the forecast. As cities across Latin America experience growth, there is a rising need for modern buildings that offer energy efficiency and durability, which aluminum curtain walls provide. Additionally, governments and private developers in countries such as Brazil, Mexico, and Argentina are increasingly adopting sustainable construction practices, where aluminum curtain walls play a key role due to their recyclability and low environmental impact. This trend is further supported by the growing emphasis on green building certifications in the region, which encourages using materials such as aluminum that contribute to energy-efficient building designs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global aluminum curtain wall market

Aluminum Curtain Wall Market Application

Aluminum Curtain Wall Market Type

Aluminum Curtain Wall Market Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Aluminum Curtain Wall Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.4. Aluminum Curtain Wall Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Aluminum Curtain Wall Market: Application Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Aluminum Curtain Wall Market: Application Movement Analysis, USD Million, 2024 & 2033

4.3. Commercial

4.3.1. Commercial Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4. Residential

4.4.1. Residential Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 5. Aluminum Curtain Wall Market: Type Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Aluminum Curtain Wall Market: Type Movement Analysis, USD Million, 2024 & 2033

5.3. Stick-built

5.3.1. Stick-built Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.4. Semi-unitized

5.4.1. Semi-unitized Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.5. Unitized

5.5.1. Unitized Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 6. Aluminum Curtain Wall Market: Regional Estimates & Trend Analysis

6.1. Aluminum Curtain Wall Market Share, By Region, 2024 & 2033, USD Million,

6.2. North America

6.2.1. North America Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.2.2. U. S.

6.2.2.1. U. S. Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.2.3. Canada

6.2.3.1. Canada Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3. Europe

6.3.1. Europe Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.2. Russia

6.3.2.1. Russia Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.3. Turkey

6.3.3.1. Turkey Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.4. Poland

6.3.4.1. Poland Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.5. UK

6.3.5.1. UK Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.6. Germany

6.3.6.1. Germany Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.7. France

6.3.7.1. France Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.8. Spain

6.3.8.1. Spain Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4. Asia Pacific

6.4.1. Asia Pacific Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.2. China

6.4.2.1. China Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.3. India

6.4.3.1. India Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.4. Japan

6.4.4.1. Japan Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.5. Taiwan

6.4.5.1. Taiwan Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.6. Thailand

6.4.6.1. Thailand Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.7. Malaysia

6.4.7.1. Malaysia Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.8. Singapore

6.4.8.1. Singapore Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.9. Indonesia

6.4.9.1. Indonesia Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.10. Australia

6.4.10.1. Australia Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5. Latin America

6.5.1. Latin America Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.2. Brazil

6.5.2.1. Brazil Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.3. Mexico

6.5.3.1. Mexico Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6. Middle East and Africa

6.6.1. Middle East and Africa Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6.2. Saudi Arabia

6.6.2.1. Saudi Arabia Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6.3. UAE

6.6.3.1. UAE Aluminum Curtain Wall Market Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis by Key Market Participants

7.2. Company Categorization

7.3. Company Heat Map Analysis

7.4. Company Profiles

7.4.1. Alumil

7.4.1.1. Participant’s Overview

7.4.1.2. Financial Performance

7.4.1.3. Product Benchmarking

7.4.1.4. Recent Developments/ Strategic Initiatives

7.4.2. Aluplex

7.4.2.1. Participant’s Overview

7.4.2.2. Financial Performance

7.4.2.3. Product Benchmarking

7.4.2.4. Recent Developments/ Strategic Initiatives

7.4.3. ALUTECH

7.4.3.1. Participant’s Overview

7.4.3.2. Financial Performance

7.4.3.3. Product Benchmarking

7.4.3.4. Recent Developments/ Strategic Initiatives

7.4.4. EFCO, LLC

7.4.4.1. Participant’s Overview

7.4.4.2. Financial Performance

7.4.4.3. Product Benchmarking

7.4.4.4. Recent Developments/ Strategic Initiatives

7.4.5. Enclos Corp.

7.4.5.1. Participant’s Overview

7.4.5.2. Financial Performance

7.4.5.3. Product Benchmarking

7.4.5.4. Recent Developments/ Strategic Initiatives

7.4.6. GUTMANN Group

7.4.6.1. Participant’s Overview

7.4.6.2. Financial Performance

7.4.6.3. Product Benchmarking

7.4.6.4. Recent Developments/ Strategic Initiatives

7.4.7. HansenGroup

7.4.7.1. Participant’s Overview

7.4.7.2. Financial Performance

7.4.7.3. Product Benchmarking

7.4.7.4. Recent Developments/ Strategic Initiatives

7.4.8. heroal

7.4.8.1. Participant’s Overview

7.4.8.2. Financial Performance

7.4.8.3. Product Benchmarking

7.4.8.4. Recent Developments/ Strategic Initiatives

7.4.9. HUECK System GmbH & Co. KG

7.4.9.1. Participant’s Overview

7.4.9.2. Financial Performance

7.4.9.3. Product Benchmarking

7.4.9.4. Recent Developments/ Strategic Initiatives

7.4.10. Josef Gartner GmbH

7.4.10.1. Participant’s Overview

7.4.10.2. Financial Performance

7.4.10.3. Product Benchmarking

7.4.10.4. Recent Developments/ Strategic Initiatives

7.4.11. Kalwall

7.4.11.1. Participant’s Overview

7.4.11.2. Financial Performance

7.4.11.3. Product Benchmarking

7.4.11.4. Recent Developments/ Strategic Initiatives

7.4.12. Kawneer Company, Inc.

7.4.12.1. Participant’s Overview

7.4.12.2. Financial Performance

7.4.12.3. Product Benchmarking

7.4.12.4. Recent Developments/ Strategic Initiatives

7.4.13. National Enclosure Company

7.4.13.1. Participant’s Overview

7.4.13.2. Financial Performance

7.4.13.3. Product Benchmarking

7.4.13.4. Recent Developments/ Strategic Initiatives

7.4.14. Ponzio

7.4.14.1. Participant’s Overview

7.4.14.2. Financial Performance

7.4.14.3. Product Benchmarking

7.4.14.4. Recent Developments/ Strategic Initiatives

7.4.15. Purso

7.4.15.1. Participant’s Overview

7.4.15.2. Financial Performance

7.4.15.3. Product Benchmarking

7.4.15.4. Recent Developments/ Strategic Initiatives

7.4.16. RAICO Bautechnik GmbH

7.4.16.1. Participant’s Overview

7.4.16.2. Financial Performance

7.4.16.3. Product Benchmarking

7.4.16.4. Recent Developments/ Strategic Initiatives

7.4.17. Reynaers

7.4.17.1. Participant’s Overview

7.4.17.2. Financial Performance

7.4.17.3. Product Benchmarking

7.4.17.4. Recent Developments/ Strategic Initiatives

7.4.18. SAPA

7.4.18.1. Participant’s Overview

7.4.18.2. Financial Performance

7.4.18.3. Product Benchmarking

7.4.18.4. Recent Developments/ Strategic Initiatives

7.4.19. Schüco India

7.4.19.1. Participant’s Overview

7.4.19.2. Financial Performance

7.4.19.3. Product Benchmarking

7.4.19.4. Recent Developments/ Strategic Initiatives

7.4.20. Skansa

7.4.20.1. Participant’s Overview

7.4.20.2. Financial Performance

7.4.20.3. Product Benchmarking

7.4.20.4. Recent Developments/ Strategic Initiatives