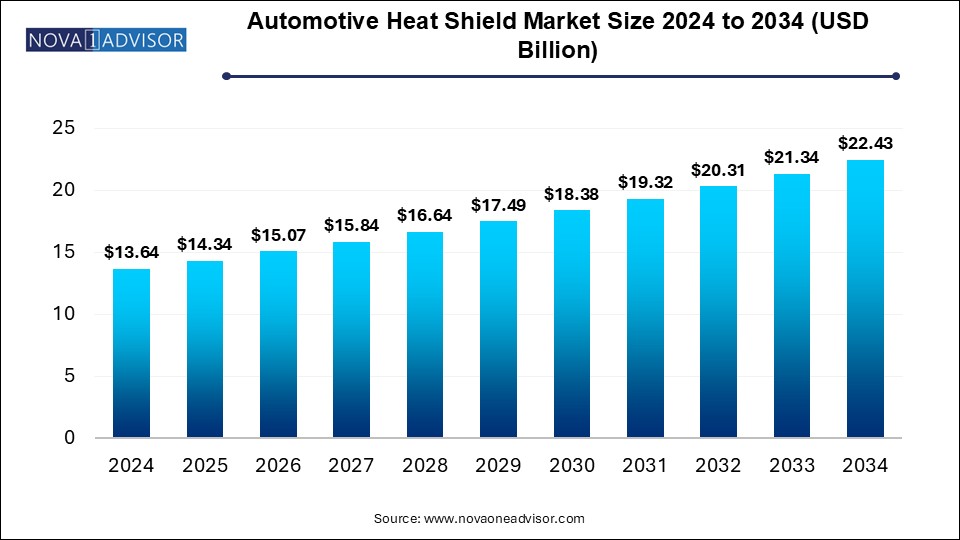

The automotive heat shield market size was exhibited at USD 13.64 billion in 2024 and is projected to hit around USD 22.43 billion by 2034, growing at a CAGR of 5.1% during the forecast period 2025 to 2034.

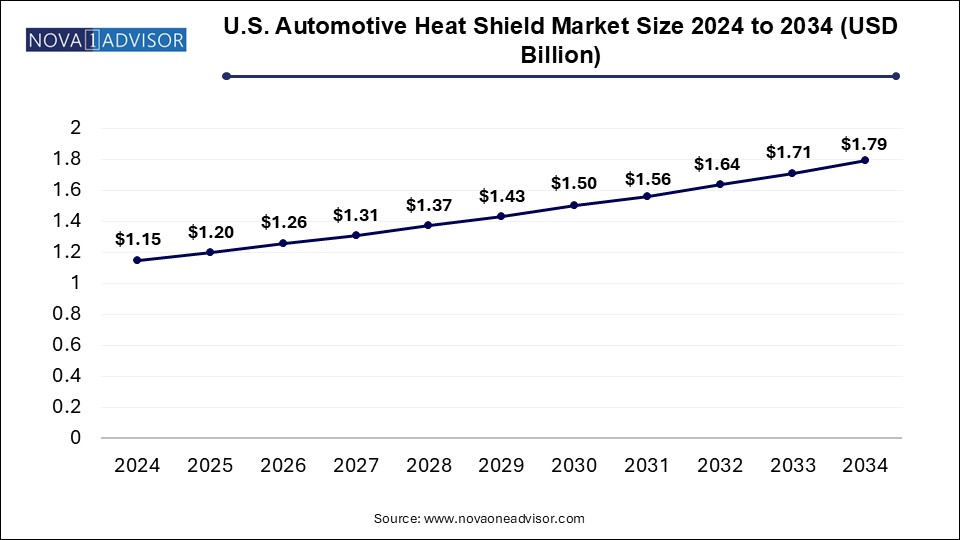

The U.S. automotive heat shield market size was valued at USD 1.15 billion in 2024 and is expected to reach around USD 1.79 billion by 2034, growing at a CAGR of 4.1% from 2025 to 2034.

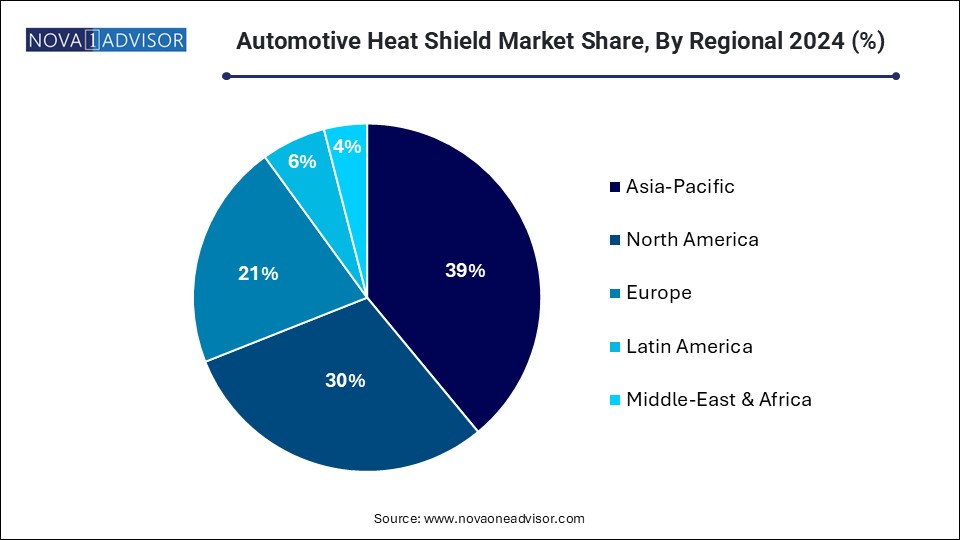

Asia Pacific led the market, accounting for 39.0% of global revenue in 2024. The region's automotive heat shield market is experiencing substantial growth, driven by the rapid expansion of the automotive sector in key countries such as China, India, and Japan. This surge in demand is fueled by increasing production and sales of passenger and commercial vehicles, necessitating high-performance heat shields to safeguard components from extreme heat generated by engines and exhaust systems. As automakers in Asia Pacific prioritize fuel efficiency and vehicle performance, effective thermal management becomes increasingly essential.

China Automotive Heat Shield Market Trends

China dominates the global automotive heat shield market, with rapid growth in both domestic and export vehicle production. As vehicle manufacturing continues to expand, there is a rising demand for heat shields to protect crucial components from excessive engine and exhaust heat. Additionally, the increasing adoption of electric vehicles (EVs) and hybrid models in China has further driven the need for advanced thermal management solutions.

Central & South America Automotive Heat Shield Market Trends

The automotive heat shield market in Central & South America is projected to experience notable growth over the forecast period. With an increasing focus on reducing emissions and enhancing fuel efficiency, demand for heat shields that optimize vehicle performance is on the rise. By managing exhaust heat, these components contribute to improved engine efficiency and a lower carbon footprint. Moreover, the enforcement of stricter emission regulations and fuel economy standards in countries like Brazil is accelerating the adoption of heat shields in vehicles to ensure regulatory compliance.

North America Automotive Heat Shield Market Trends

The North American automotive heat shield market is expanding due to the increasing production of electric and hybrid vehicles. These vehicles operate at elevated temperatures due to high-powered batteries and advanced electric drivetrains, necessitating the use of heat shields to protect critical components. The shift toward electrification in the automotive industry, driven by both consumer demand and government policies, is directly influencing the need for advanced heat shields capable of withstanding higher heat levels in EVs and hybrid vehicles.

In the U.S., stringent government regulations mandate lower vehicle emissions and enhanced safety measures. Agencies such as the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) enforce policies requiring automakers to minimize their environmental impact. Heat shields play a vital role in safeguarding sensitive vehicle components from extreme temperatures and emissions, thereby increasing demand for advanced thermal protection solutions to comply with these regulations.

Europe Automotive Heat Shield Market Trends

Europe's automotive heat shield market is advancing due to a rising preference for lightweight materials and innovations in heat shield technologies. These components must not only endure high temperatures but also contribute to vehicle weight reduction, a key factor in improving fuel efficiency. The growing adoption of lightweight materials such as aluminum, advanced composites, and ceramic coatings in heat shield manufacturing is gaining traction. These developments are particularly crucial as the popularity of electric and hybrid vehicles increases, necessitating superior thermal management solutions in the European market.

| Report Coverage | Details |

| Market Size in 2025 | USD 14.34 Billion |

| Market Size by 2034 | USD 22.43 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Application, Material, Vehicle Type, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | DuPont; Dana Limited.; Zircotec Ltd; Morgan Advanced Materials; Autoneum; ElringKlinger AG; Lydall, Inc.; Tenneco Inc.; CARCOUSTICS; UGN Inc. |

In 2024, the metallic segment held an 86.0% share of total revenue, driven by its superior heat resistance and durability compared to non-metallic alternatives. Commonly made from aluminum or steel, metallic heat shields provide excellent thermal conductivity and can endure the high-temperature conditions prevalent in automotive engines and exhaust systems. Their robust nature extends product longevity, minimizing replacement needs, which is particularly appealing to manufacturers seeking to reduce maintenance costs and enhance vehicle durability.

The non-metallic segment is projected to grow at the highest CAGR of 5.5% during the forecast period. This growth is fueled by the rising demand for lightweight materials in vehicle production. Automakers are increasingly focusing on fuel efficiency improvements and emission reductions, further driving the adoption of non-metallic heat shields.

The engine compartment contributed 78.0% of the revenue share in 2024, propelled by the increasing need for enhanced vehicle performance and superior thermal management. As automotive manufacturers push for greater engine efficiency and power output, engines generate more heat, requiring efficient heat shields to safeguard sensitive components and optimize performance.

The turbocharger segment is expected to expand at the fastest CAGR of 6.2% over the forecast period. Turbochargers enhance engine efficiency by compressing air, enabling smaller engines to deliver greater power. However, this process generates significant heat, necessitating high-quality heat shields to protect nearby components from thermal damage and ensure reliable performance. With the growing incorporation of turbochargers across various vehicle models, the demand for efficient heat shields continues to rise.

The passenger car segment accounted for 31.0% of total revenue in 2024, driven by increasing consumer demand for enhanced vehicle comfort and cabin temperature control. Heat shields play a crucial role in preventing engine and exhaust heat from affecting the cabin, improving the overall driving experience. As buyers prioritize comfort and safety, automakers are incorporating advanced thermal insulation technologies to isolate heat from high-temperature zones, leading to widespread adoption of heat shields in both premium and economy-class passenger vehicles.

The HCV (Heavy Commercial Vehicle) segment is expected to witness substantial growth, with a projected CAGR of 4.8% over the forecast period. This growth is attributed to increasing regulatory measures aimed at reducing emissions, alongside advancements in engine technology. As governments enforce stricter standards to curb exhaust emissions, there is a growing demand for heat shields that effectively regulate engine and exhaust system temperatures in HCVs.

The single-shell segment held a dominant 59.0% share of the revenue in 2024, driven by its cost-effectiveness and simple design, making it a preferred choice for vehicle manufacturers. This segment offers adequate thermal protection for various automotive components, especially where moderate heat insulation is required. Additionally, the increasing focus on lightweight materials for better fuel efficiency supports the demand for single-shell heat shields, as they are generally lighter than multi-layer alternatives. Their ease of installation and low maintenance needs further enhance their appeal to automakers looking to streamline production costs and improve assembly efficiency.

The sandwich segment is anticipated to register the fastest CAGR of 5.9% over the forecast period. The rising preference for sandwich heat shields stems from their superior durability and ability to perform effectively in extreme conditions. Designed to withstand high temperatures and harsh environments, these heat shields provide long-term protection for critical vehicle components such as exhaust systems, turbochargers, and engine parts.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Automotive Heat Shield Market

By Product

By Application

By Material

By Vehicle Type

By Regional