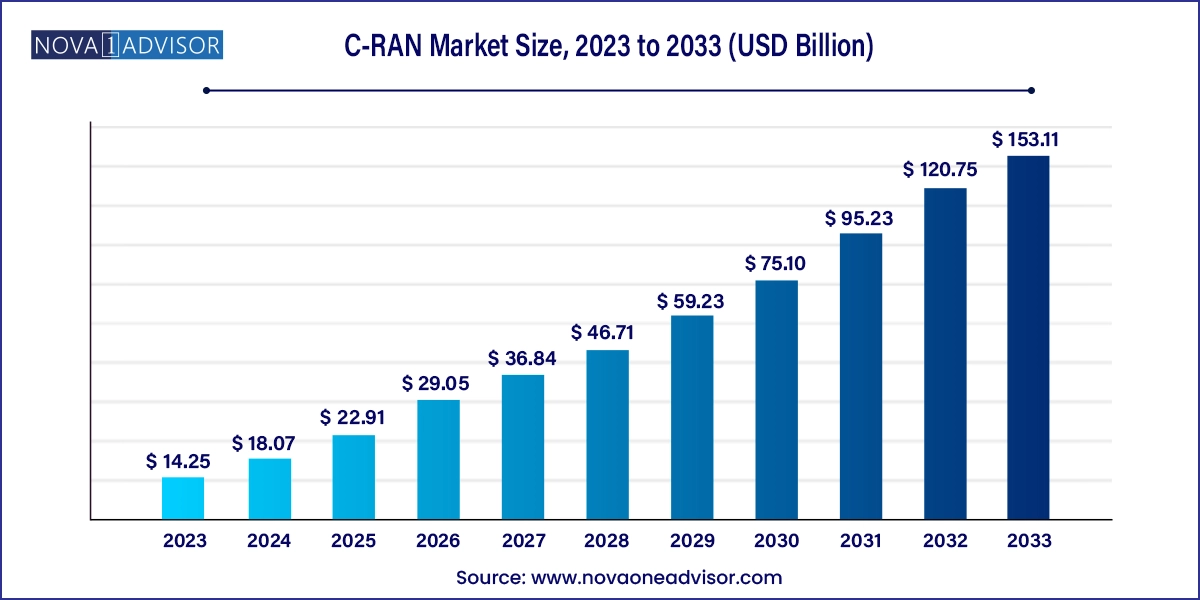

The global C-RAN market size was exhibited at USD 14.25 billion in 2023 and is projected to hit around USD 153.11 billion by 2033, growing at a CAGR of 26.8% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 18.07 Billion |

| Market Size by 2033 | USD 153.11 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 26.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Architecture Type, Component, Network Type, Deployment Model, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; South America; Middle East & Africa |

| Key Companies Profiled | Altiostar Networks; ASOCS Ltd; Cisco Systems, Inc.; Telefonaktiebolaget LM Ericsson; Fujitsu Limited; Huawei Technologies Co., Ltd; Intel Corporation; HRMavenir Systems, Inc.; NEC Corporation; Samsung Electronics Co., Ltd.; Nokia Corporation; ZTE Corporation |

The rising adoption of smart devices and the availability of limited spectrum is anticipated to drive the demand for C-RAN (Cloud Radio Access Network) market. As C-RAN centralizes operational resources, which can be allocated on a priority basis to various processes, as per the requirements. Additionally, the rising cost of energy consumption is expected to drive the demand for C-RAN as it can help network providers cut operational costs.

Moreover, the trend of centralized resource and functionality pools is expected to drive market growth. As the baseband unit is situated at a central location and the remote radio units are exclusively deployed at the cell site which allows operators better deployment and cost benefits per cell site. Moreover, the increase in sophisticated network protocols is expected to create lucrative opportunities in the C-RAN market. For instance, C-RAN enables multi-connection support for optical fiber, millimeter wave, and cellular protocols.

The growing use of 5G connectivity has become one of the most popular trends in the global C-RAN market. The advent of 5G is expected to increase the load on the current infrastructure and network performance model. The C-RAN architecture uses a small cell model, which is an efficient mode to tackle 5G standards. Therefore, the growing 5G testing measures in countries such as China, South Korea, the U.S., and Japan are expected to further the growth of the cloud radio network access market.

Furthermore, the growth in connectivity data as a result of high 4G and 5G smartphone penetration is anticipated to push operators to use C-RAN. Similarly, there are a growing number of electronic gadgets with connected functionality due to the prominence of Internet of Things (IoT). Also, the trend of always-online and high data-consuming applications is increasing the stress on operator systems. Telecom providers thus prefer C-RAN for network quality consistency and efficiency.

On the other hand, the requirement for high bandwidth in the fronthaul link is witnessed as a major challenge that is anticipated to hinder the cloud radio access network market growth over the forecast period. The fronthaul requires 10 times more bandwidth capacity as compared to the backhaul used in LTE channels. This could be achieved with a fiber optical cable; however, its deployment cost is very high that might prove as an overhead for mobile network providers. In addition, CPRI fronthaul cannot be deployed easily like backhaul due to which the capacity requirement grows with the rise in the number of users.

The centralized RAN segment accounted for the largest market share of around 60% in 2023. The segment growth can be attributed to technological advancements enabled for optical, wireless, and IT communication systems. For instance, it uses the updated CPRI standard, dense wavelength division multiplexing, and mmWave to enable the relay of baseband signal over long ranges. Additionally, the segment growth is due to its application for deployment at a large scale with multi-radio protocol support.

The virtualized/cloud RAN segment is expected to record the highest CAGR of around 28% over the forecast period. The segment growth is accredited to the rise in the adoption of software-defined networking and network functions virtualization (NFV) technology by the wireless telecom industry. The virtualization of the radio access network is anticipated to facilitate the preparation of the carrier for 5G network helping to boost the bandwidth requirements. For instance, a 5G base station can virtually enhance both the capacity and efficiency of a system by drawing from a group of baseband units.

The infrastructure segment accounted for the largest market share of over 49% in 2023. This growth in the market share of the segment can be credited to the rapid adoption of radio technology and facilities to meet the needs of 5G network. The benefits of power cost reduction and energy efficiency by the C-RAN infrastructure component is expected to attract more end-users. Moreover, the infrastructure segment is significantly important for C-RAN to handle various protocols and establish connection with base stations and end-users.

The software segment is projected to expand at a significant CAGR of around 27% during the forecast period. The segment growth is attributed to the increasing demand for NFV solutions for radio access network visualization in deployment projects. Furthermore, the segment is also expected to grow due to the demand for custom processes for large and small carrier companies. Also, the trend of enterprises developing their exclusive software based on the ever-changing networking market is expected to drive market growth.

The LTE and 5G segment accounted for the largest market share of around 88% in 2023 and is expected to witness the fastest CAGR of 28.1% over the forecast period. The dominance of the segment can be credited to the massive growth in data traffic and significantly high power consumption by current network architecture. As LTE and 5G are high speed and low latency networks, they are more efficient for C-RAN operations. Moreover, the growing presence of 5G networks around the world is anticipated to be one of the major trends for the segment growth.

The 3G network type segment is expected to face challenges over the forecast period. The 3G network type was popular in demand before LTE and 5G networks were launched. Moreover, the segment had widespread presence in developing regions that made it favorable for use in C-RAN. However, the prominence of LTE and the growing adoption of 5G in developed regions is expected to impact 3G network type negatively.

The outdoor segment accounted for the largest market share of around 81% in 2023. The massive deployment of C-RAN architecture in the outdoor environment provides better coverage and reach in areas that include urban markets, stadiums, and other such facilities. Moreover, the trend of 5G in developing countries is expected to drive market growth as telecom operators install new mobile towers in strategic outdoor locations. In addition, outdoor deployment is in trend as it can handle peak traffic loads for long hours while maintaining infrastructural stability.

The indoor segment is expected to grow at a notable CAGR of around 31% over the forecast period. The deployment of indoor small cells that are mini base stations for C-RAN architecture are in trend as they offer better service to the end-users in high-density and high-value locations such as private places, offices, homes, among other enclosed locations. The trend of data security in indoor deployment is anticipated to positively influence the market. For instance, indoor deployments are common in embassies, government offices, and court buildings that handle and exchange sensitive data.

Asia Pacific accounted for the largest market share of around 32% in 2023. Factors such as rising development of C-RAN infrastructure as a step towards deploying 5G to countries such as China, Japan, and South Korea are expected to grow the market. Favorable government initiatives and polices are also anticipated to have a positive influence on the regional market. For instance, in October 2023, the Indian government’s ‘Make in India’ policy resulted in the push for 5G in India.

North America is expected to hold the second largest market share of around 29.5% in 2023, and is estimated to maintain its position throughout the forecast period. The early adoption of 5G in U.S. is expected to be the reason for the regional market growth. The deployment of 5G technology is continuously supported by the increasing influx of technological development in the region. Moreover, many key players in the market operate in North America, helping to increase the region’s market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global C-RAN market

Architecture Type

Component

Network Type

Deployment Model

Regional

Chapter 1 Methodology and Scope

1.1 Market Segmentation & Scope

1.2 Market Definitions

1.3 Information Procurement

1.3.1 Information analysis

1.3.2 Market formulation & data visualization

1.3.3 Data validation & publishing

1.4 Research Scope and Assumptions

1.4.1 List to data sources

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Industry Outlook

3.1 Market Lineage Outlook

3.2 Industry Value Chain Analysis

3.3 Market Dynamics

3.3.1 Market driver analysis

3.3.1.1 Need for an energy - efficient and cost - effective network architecture

3.3.1.2 Emergence of the 5G network

3.3.2 Market challenge analysis

3.3.2.1 Requirement for a high capacity fronthaul

3.4 Industry Opportunities & Challenges

3.5 Industry Analysis Tools

3.5.1 PORTER’s Analysis

3.5.2 Macroeconomic Analysis

Chapter 4 C - RAN Market Architecture Type Outlook

4.1 C - RAN Market Share By Architecture Type, 2021 - 2033 (USD Million)

4.2 Architecture Type Movement Analysis & Market Share, 2024 & 2033

4.3 C - RAN Market Estimates & Forecast, By Architecture Type (USD Million)

4.3.1 Centralized - RAN

4.3.2 Virtualized/Cloud RAN

Chapter 5 C - RAN Market Component Outlook

5.1 C - RAN Market Share By Component, 2021 - 2033 (USD Million)

5.2 Component Movement Analysis & Market Share, 2024 & 2033

5.3 C - RAN Market Estimates & Forecast, By Component (USD Million)

5.3.1 Infrastructure

5.3.1.1 Remote Radio Units

5.3.1.2 Baseband Units

5.3.1.3 Fronthaul

5.3.2 Software

5.3.3 Services

5.3.3.1 Consulting

5.3.3.2 Design and Deployment

5.3.3.3 Maintenance and Support

5.3.3.4 Others

Chapter 6 C - RAN Market Network Type Outlook

6.1 C - RAN Market Share By Network Type, 2021 - 2033 (USD Million)

6.2 Network Type Movement Analysis & Market Share, 2024 & 2033

6.3 C - RAN Market Estimates & Forecast, By Network Type (USD Million)

6.3.1 3G

6.3.2 LTE & 5G

Chapter 7 C - RAN Market Deployment Model Outlook

7.1 C - RAN Market Share By Deployment Model, 2021 - 2033 (USD Million)

7.2 Deployment Model Movement Analysis & Market Share, 2024 & 2033

7.3 C - RAN Market Estimates & Forecast, By Deployment Model (USD Million)

7.3.1 Indoor

7.3.2 Outdoor

Chapter 8 C - RAN Market Regional Outlook

8.1 C - RAN Market Share By Region, 2024 & 2033

8.2 North America

8.2.1 North America C - RAN market, 2021 - 2033

8.2.2 U.S.

8.2.2.1 U.S. C - RAN market, 2021 - 2033 (USD Million)

8.2.3 Canada

8.2.3.1 Canada C - RAN market, 2021 - 2033 (USD Million)

8.2.4 Mexico

8.2.4.1 Canada C - RAN market, 2021 - 2033 (USD Million)

8.3 Europe

8.3.1 Europe C - RAN market, 2021 - 2033

8.3.2 U.K.

8.3.2.1 U.K. C - RAN market, 2021 - 2033 (USD Million)

8.3.3 Germany

8.3.3.1 Germany C - RAN market, 2021 - 2033 (USD Million)

8.3.4 Italy

8.3.4.1 Italy C - RAN market, 2021 - 2033 (USD Million)

8.3.5 France

8.3.5.1 France C - RAN market, 2021 - 2033 (USD Million)

8.4 Asia Pacific

8.4.1 Asia Pacific C - RAN market, 2021 - 2033

8.4.2 China

8.4.2.1 China C - RAN market, 2021 - 2033 (USD Million)

8.4.3 Japan

8.4.3.1 Japan C - RAN market, 2021 - 2033 (USD Million)

8.4.4 South Korea

8.4.4.1 South Korea C - RAN market, 2021 - 2033 (USD Million)

8.4.5 India

8.4.5.1 India C - RAN market, 2021 - 2033 (USD Million)

8.5 South America

8.5.1 South America C - RAN market, 2021 - 2033

8.5.2 Brazil

8.5.2.1 Brazil C - RAN market, 2021 - 2033 (USD Million)

8.5.3 Argentina

8.5.3.1 Argentina C - RAN market, 2021 - 2033 (USD Million)

8.6 MEA

8.6.1 MEA C - RAN market, 2021 - 2033

8.6.2 Saudi Arabia

8.6.2.1 Saudi Arabia C - RAN market, 2021 - 2033 (USD Million)

8.6.3 South Africa

8.6.3.1 South Africa C - RAN market, 2021 - 2033 (USD Million)

Chapter 9 Competitive Landscape

9.1 Key Market Participants

9.1.1 Altiostar Networks

9.1.2 ASOCS Ltd.

9.1.3 Cisco Systems, Inc.

9.1.4 Telefonaktiebolaget LM Ericsson.

9.1.5 Fujitsu Limtied

9.1.6 Huawei Technologies Co., Ltd.

9.1.7 Intel Corporation

9.1.8 HRMavenir Systems, Inc

9.1.9 NEC Corporation

9.1.10 Samsung Electronics Co., Ltd.

9.1.11 Nokia Corporation

9.1.12 ZTE Corporation

9.2 Recent Developments & Impact Analysis, By Key Market Participants

9.3 Company Categorization

9.4 Participant’s Overview

9.5 Financial Performance

9.6 Product Benchmarking

9.7 Company Heat Map Analysis

9.8 Company Market Share Analysis, 2022

9.9 Strategy Mapping

9.9.1 Expansion

9.9.2 Mergers & acquisitions

9.9.3 Collaborations

9.9.4 New product launches

9.9.5 Research & development