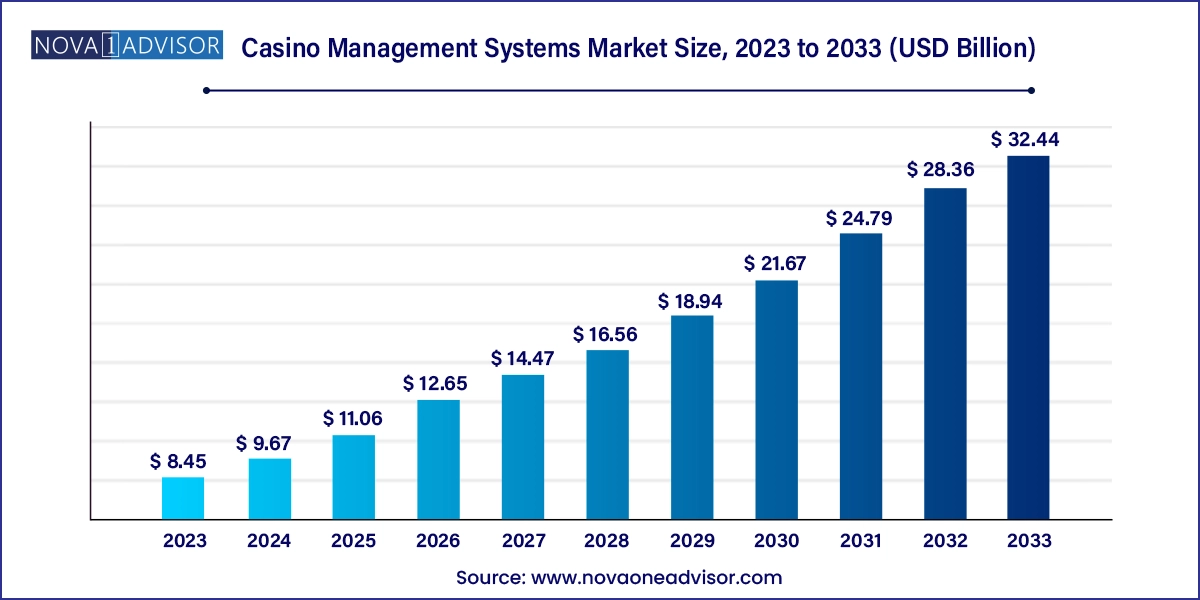

The global casino management systems market size was exhibited at USD 8.45 billion in 2023 and is projected to hit around USD 32.44 billion by 2033, growing at a CAGR of 14.4% during the forecast period 2024 to 2033.

The global Casino Management Systems (CMS) market is rapidly evolving as digitalization and data-centric decision-making become critical to casino operations. Casino Management Systems refer to integrated software platforms that manage various functions within a casino, including player tracking, accounting, security, and promotions. These systems help operators optimize revenue, enhance customer experience, and ensure regulatory compliance across gaming and non-gaming areas.

With the gambling industry growing across developed and emerging economies alike, casinos are now focused on improving operational efficiency, customer personalization, and fraud prevention. This is where CMS solutions play a pivotal role. Traditionally used in large casino resorts, CMS platforms are now expanding into small and mid-sized venues due to affordability and cloud-based deployment models.

The global CMS market is being reshaped by technological advancements such as artificial intelligence (AI), machine learning (ML), biometric authentication, and blockchain integration. Vendors are building unified platforms that connect slot machines, table games, customer service, and surveillance under one digital umbrella.

For instance, Konami’s SYNKROS system, highlighted at the NIGA 2025 trade show in Anaheim, showcases real-time player tracking, multi-property loyalty features, and robust mobile integration. Similarly, IGT and Aristocrat are investing in modular CMS that allow casinos to upgrade selectively, minimizing disruption while maximizing scalability.

Adoption of AI-Powered Player Behavior Analytics: Casinos are using AI to monitor player preferences, predict churn, and personalize promotional campaigns.

Integration of Mobile and Contactless Features: Touchless check-in, mobile wallet integration, and app-based player loyalty are on the rise, especially post-pandemic.

Rise of Cloud-Based CMS Deployment: Cloud-based systems are gaining traction for their lower capital costs, easy updates, and remote accessibility.

Enhanced Biometric and Facial Recognition Tools: To bolster security and ensure age verification, casinos are incorporating biometric technology into surveillance and access control.

Omnichannel Experience and Loyalty Integration: Casinos are unifying land-based and online loyalty programs, enabling seamless customer journeys across platforms.

Modular and Customizable CMS Offerings: Vendors now provide CMS modules for individual applications like marketing, accounting, or property management, which can be scaled up over time.

Data Privacy and Compliance Enhancements: Stricter regulations are pushing vendors to integrate robust compliance modules and audit trails within CMS.

Emergence of IoT and Smart Devices: Sensors and IoT devices connected to CMS are being used to monitor gaming floors, track maintenance, and personalize experiences in real time.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.67 Billion |

| Market Size by 2033 | USD 32.44 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 14.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

IGT.; Konami Gaming, Inc.; Light & Wonder, Inc. LGS; Honeywell International, Inc.; Aristocrat; Next Level Security Systems, Inc. |

A major driver of the CMS market is the increasing need for real-time data collection and insights to drive operational decisions. Casinos generate vast amounts of transactional and behavioral data every second from player movements and slot machine usage to drink service requests and surveillance logs.

Advanced CMS platforms enable real-time analytics across these data streams, helping operators make agile decisions on staffing, machine placement, marketing offers, and fraud alerts. For example, a CMS can instantly flag unusual betting patterns that may indicate card counting or machine tampering. In parallel, marketing teams use real-time dashboards to launch tailored offers to high-value players still on the floor.

This real-time responsiveness not only boosts revenues but also enhances player satisfaction and operational efficiency, which are critical in highly competitive gaming destinations like Las Vegas or Macau.

While CMS offers substantial long-term ROI, the initial cost of deployment and integration remains a barrier particularly for small and mid-sized operators. Building a comprehensive CMS often requires significant investment in hardware (servers, terminals, surveillance equipment), software licenses, staff training, and downtime during migration.

Moreover, integrating CMS with legacy systems and third-party tools such as hotel booking engines, CRM platforms, and financial software is often complex. Compatibility issues, data silos, and the need for custom APIs can delay deployment and increase costs. This creates hesitation among conservative or budget-constrained casino operators.

Despite the availability of modular and cloud-based options, the perception of CMS as a capital-heavy investment continues to hinder faster adoption in emerging markets and independent casinos.

The liberalization of gambling laws in emerging markets presents a lucrative opportunity for CMS vendors. Governments across Latin America, Southeast Asia, and parts of Africa are increasingly legalizing casinos to boost tourism and tax revenue.

As these markets open, there is a demand for CMS that can support multilingual interfaces, currency conversion, local compliance, and mobile-first environments. Vendors who offer plug-and-play solutions with fast localization capabilities are well-positioned to capture this growth.

For example, the Philippines and Vietnam have seen a surge in integrated casino resorts, prompting a need for full-stack CMS platforms. Similarly, Brazil is in the process of approving new casinos, which could unlock a billion-dollar market opportunity. Vendors entering these markets early with localized offerings will enjoy a first-mover advantage.

Accounting & Cash Management dominated the application segment due to its critical role in financial integrity and compliance. Casinos deal with high volumes of cash and digital transactions, and any discrepancy can lead to regulatory penalties or loss of license. Modern CMS platforms automate accounting, audit trails, tax reporting, and real-time cash flow tracking, reducing manual errors and fraud. The integration of AI further enhances reconciliation and predictive budgeting. Casinos also benefit from accurate, real-time dashboards that help in understanding revenue sources, optimizing machine placements, and minimizing revenue leakages.

Player Tracking is the fastest-growing segment as operators increasingly seek to deliver personalized gaming experiences. Advanced tracking systems allow casinos to record and analyze every touchpoint—from time spent on machines to spending habits and preferred games. Using this data, casinos can offer targeted promotions, dynamic loyalty rewards, and exclusive experiences. For example, VIP players may receive real-time alerts about available high-stakes tables or exclusive concierge services. This level of personalization not only improves retention but also boosts average customer value, especially in competitive markets.

Security & Surveillance dominated in traditional casino environments where regulatory oversight and high-volume cash handling demand robust monitoring. CMS modules now support integration with AI-enhanced surveillance cameras, facial recognition, and behavior analysis tools. This enables early detection of criminal behavior, cheating, or internal theft. Surveillance systems are often linked with access control and staff movement tracking, providing holistic security management.

Marketing & Promotions is growing rapidly with the increasing focus on customer retention. CMS platforms now power dynamic, AI-driven promotions that respond to real-time player behavior. For example, if a player hits a certain milestone or seems to be winding down, the system might automatically trigger an incentive such as a free buffet voucher or extended play credits. These personalized promotions result in higher engagement and encourage return visits.

North America dominates the Casino Management Systems market, led by the United States and Canada, where a mature and highly regulated gaming ecosystem exists. The U.S., particularly Las Vegas and Atlantic City, hosts some of the world’s most advanced casinos that invest heavily in technology. Operators like MGM Resorts and Caesars Entertainment use integrated CMS platforms that span gaming, hospitality, and entertainment. Furthermore, North America is home to key vendors like IGT, Konami Gaming, and Aristocrat, who continuously innovate and test new features with regional clients before expanding globally.

The region’s robust regulatory framework necessitates meticulous record-keeping and compliance features within CMS. Moreover, North American casinos are early adopters of advanced technologies such as AI, 5G, and facial recognition, setting benchmarks for global adoption. Regular trade shows and conferences, like G2E Las Vegas, foster vendor-operator collaboration and accelerate deployment of cutting-edge CMS solutions.

Asia Pacific is the fastest-growing region, fueled by massive tourism influx and government-backed casino development projects. Macau, the world’s largest gaming hub by revenue, leads the region, followed by the Philippines, Singapore, and Malaysia. With Japan and Thailand moving toward legalization, the market is poised for exponential growth.

Asia’s gaming culture is characterized by high-spending VIPs and loyalty-centric behavior, making CMS a critical tool for targeting and retaining premium clientele. Operators are investing in multi-property systems that unify gaming and non-gaming services across resorts. For instance, a guest’s casino play, hotel stay, and shopping history are integrated to offer customized benefits. The integration of digital payments, prevalent in China and Korea, also necessitates real-time CMS support for financial compliance and reporting.

March 2025 – Konami Gaming announced its participation at the NIGA 2025 trade show in Anaheim, showcasing the latest upgrades to its SYNKROS CMS platform. These include enhanced real-time reporting, mobile-first features, and AI-based analytics tailored for tribal gaming enterprises.

February 2025 – Light & Wonder, formerly known as Scientific Games, introduced modular updates to its CMS suite, emphasizing scalability and personalized marketing modules. These updates aim to support both single-venue casinos and multi-property resorts across the Americas and Asia.

April 2025 – IGT launched a blockchain-based loyalty integration within its CMS, aiming to create a transparent and tamper-proof rewards ecosystem. The new system is being piloted in selected Las Vegas casinos.

January 2025 – Aristocrat Technologies enhanced its Oasis CMS with facial recognition and multi-lingual support, targeting the Asia Pacific market. The upgrade supports regional expansion and better compliance with international AML (Anti-Money Laundering) standards.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global casino management systems market

Application

Regional