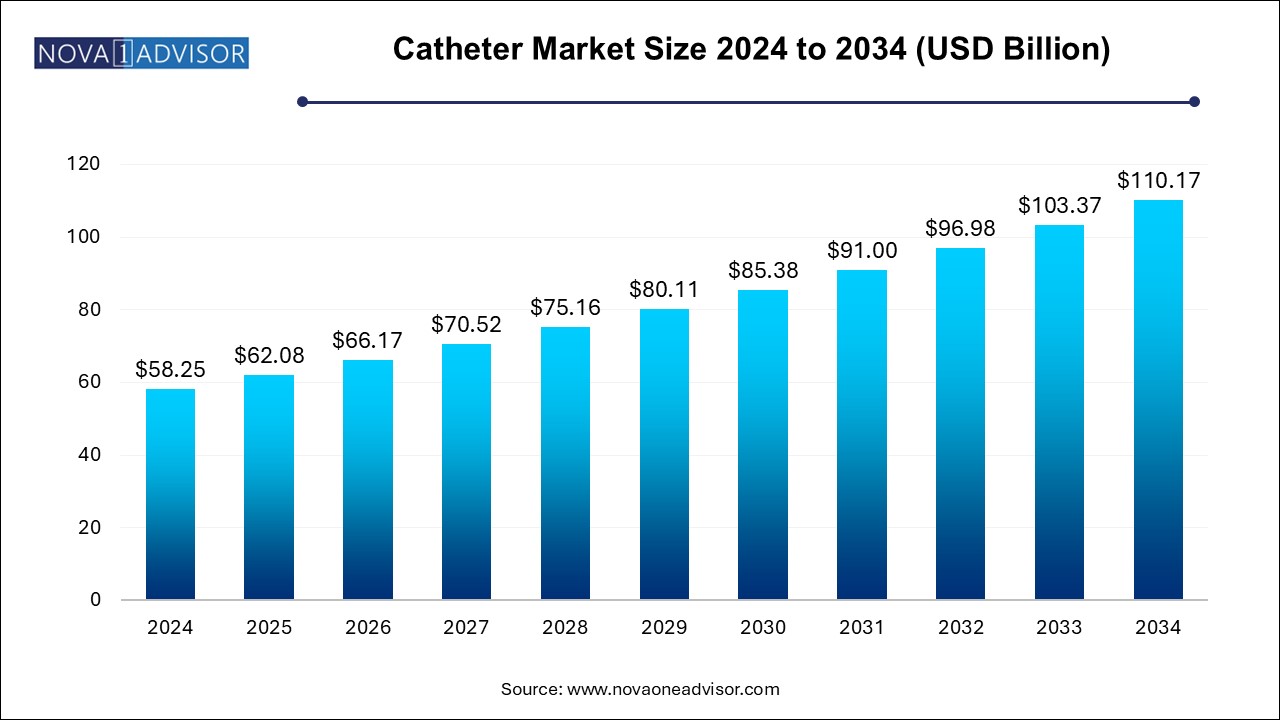

The catheter market size was exhibited at USD 58.25 billion in 2024 and is projected to hit around USD 110.17 billion by 2034, growing at a CAGR of 6.58% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 62.08 Billion |

| Market Size by 2034 | USD 110.17 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 6.58% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

| Key Companies Profiled | Hollister Incorporated; Medtronic; Boston Scientific Corporation; Edward Lifesciences; Smith Medical Inc.; Teleflex Incorporated; ConvaTec Group Plc |

The increasing cases of chronic disorders such as neurological, cardiovascular, and urological disorders requiring hospitalization boosts the expansion of the market. For instance, as per the reports published by the National Library of Medicine in 2023, approximately around 15% of the global population suffer from neurological disorders, which causes physical and cognitive disabilities.

According to the WHO, over 200 million individuals worldwide are affected by various urological disorders. In the U.S., urological disorders impact nearly 25 million people, with women constituting 80% of this population. With the increasing prevalence of conditions such as urinary retention, UI, benign prostatic hyperplasia, and neurogenic bladder dysfunction, there has been a growing demand for catheterization for short-term or long-term management of these ailments. Furthermore, the market is anticipated to experience growth in the forecast period due to a surge in midscale catheter manufacturers competing for a larger market share.

Major market players use advanced materials, such as polyurethanes/polycarbonates, to manufacture catheters. Carbothane, resistant to chemicals such as iodine, hydrogen peroxide, or alcohol is used to make catheters to increase their longevity. For instance, MAHURKAR Chronic Carbothane catheter, manufactured by Medtronic, is easy to insert with a single technique and ensuring top-notch resistance to kinks. This catheter provides impressive flow rates with minimal pressure on both arterial and venous systems.

Moreover, catheters made of Durathane offer resistance and strength. For example, the DuraFlow 2 chronic hemodialysis catheter, offered by AngioDynamics, is made of Durathane, which offers advantages of both silicone and polyurethane. This catheter material offers strength and is resistant to a variety of commonly used site care agents. Thus, the use of advanced materials to manufacture catheters is increasing their demand among end users.

The increasing awareness of controlling catheter-related bloodstream infections (CRBSI) among the people will contribute to a greater demand for catheters in the coming forecast period. A significant factor leading to catheter-related bloodstream infections (CRBSI) is the lack of proper care and maintenance for these devices. Healthcare professionals are preferring the use of catheters that pose minimal infection risks due to their increased awareness and emphasis on infection control. For instance, in May 2023, BD introduced a convenient prefilled flush syringe for customers. This innovative BD PosiFlush SafeScrub syringe is designed to enhance patient care by expediting the flushing and disinfection of IV catheters during clinical procedures. Ensuring the cleanliness and disinfection of catheters is crucial in preventing CRBSIs. As a result, healthcare professionals are becoming more aware of the significance outlined in infection prevention guidelines, enhancing the need for the proper flushing, and disinfecting of catheters.

Moreover, treatment of Peripheral Artery Disease (PAD) is usually followed by a minimally invasive procedure that involves the use of catheters to clear the blocked arteries. Growing preference for angioplasty over conventional surgeries has resulted in a rise in the demand for this procedure among patients. As peripheral angioplasty is a minimally invasive procedure and offers better outcomes, it has gained significant popularity over the past decade. The growing demand for minimally invasive procedures can also be attributed to the recent technological innovations, for instance, use of antimicrobial coating and miniaturized catheters to prevent the risk of restenosis. These procedures have higher adoption rates and are becoming standard techniques in general surgery due to the use of advanced technologies and innovative coated catheters available in the market. Thus, the growing preference for minimally invasive surgeries is expected to drive the growth of the catheters market during the forecast period.

Cardiovascular catheter segment led the market and accounted for 27.99% of the total revenue share in 2024. Rising prevalence of cardiovascular disorders and increasing demand for interventional cardiac procedures, coupled with growing adoption of cardiac catheters, are expected to boost the growth of the market for cardiovascular catheters during the forecast period. For instance, according to data released by the American College of Cardiology in July 2023, around 200 million individuals globally, and over 12 million people in the U.S., are dealing with peripheral artery disease (PAD). The increasing demand for these catheters can be attributed to the increasing incidence of cardiac conditions such as coronary artery disease, congenital heart problems, and cardiac arrhythmia. As the occurrence of these conditions rises, there is an increased need for diagnostic and interventional procedures, with cardiovascular catheters playing a pivotal role in performing minimal invasive procedures.

Specialty catheters segment is projected to witness the highest growth rate over the forecast period owing to the increasing demand for minimally invasive procedures, coupled with rising prevalence of target diseases, Moreover, increasing regulatory approvals are likely to contribute to segment growth. For instance, in February 2022, Teleflex Incorporated received U.S. FDA approval for its specialty catheters used for crossing Chronic Total Occlusion (CTO) that occur during Percutaneous Coronary Intervention (PCI). Specialty catheters are equipped with features such as smoother surfaces, reduced friction, and materials that minimize irritation. This customization enhances patient satisfaction and compliance, particularly in cases where long-term catheterization is necessary.

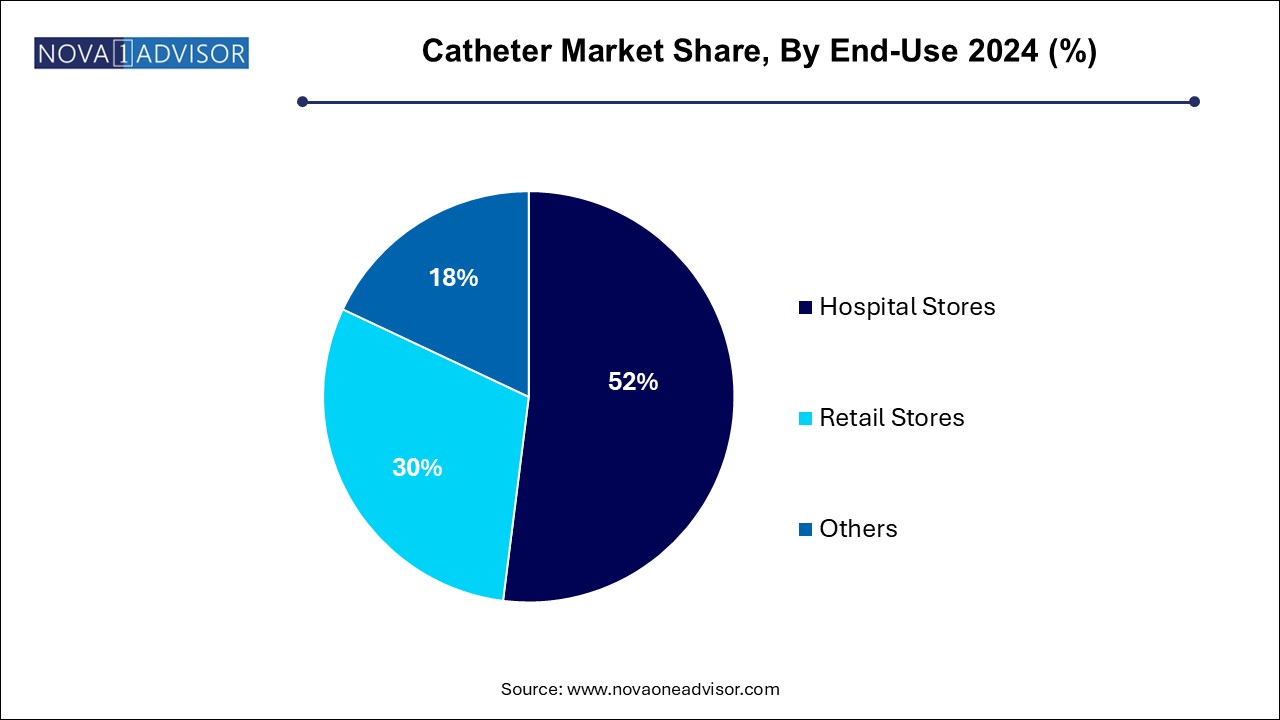

Hospital stores segment dominated the market with the largest revenue share in 2024. Hospital stores are situated in the hospital premises where it stores and dispenses a wide range of catheters required for the surgical and minimal invasive procedures. Unlike regular pharmacies catering to outpatients, hospital stores prioritize the needs of patients admitted to the hospital. These cater to specific and often rare medical conditions, requiring precise storage and handling protocols.

Moreover, due to the critical nature of their function, hospital stores operate under strict regulations. These regulations govern everything from storage conditions and dispensing procedures to personnel qualifications and record-keeping practices. This stringent framework ensures patient safety and medication accuracy. Additionally, modern hospital stores leverage cutting-edge technology to streamline operations and optimize medication management. Automated dispensing systems, electronic prescribing platforms, and advanced inventory tracking software are just a few examples. These technologies minimize errors, improve efficiency, and enhance patient care. Time is often of the essence in healthcare, and hospital stores ensure immediate access to the needed catheters. This reduces delays in treatment and potentially improves patient outcomes. These factors boost the demand for catheters in the hospital stores, driving the market growth.

The retail stores segment is projected to witness the highest growth rate over the forecast period. This is attributed to the availability of various e-commerce platforms which sell catheters. These platforms offer convenient, choice-filled, and often cost-effective way to purchase the catheters. For instance, the e-commerce sites that offer warranty, discounts, and prompt customer service for catheters are Shopcatheters, Allegro Medical Supplies Inc., and Amazon. This has a positive impact on the sales of the products through these sales channels. Thus, supporting the segment growth during the forecast period.

North America accounted for 31.72% of the global market in 2024 and is expected to continue its dominance over the forecast period. This can be ascribed to various factors, including the growing incidence of chronic illnesses and an aging population, as well as the favorable impact of major manufacturers like Teleflex Incorporated, Medtronic, and Boston Scientific Corporation enhancing regional growth. The market for catheters in North America has expanded due to favorable government regulations, rising public awareness, a large number of highly competent health care providers, and the presence of prominent healthcare facilities.

The demand for catheters may be positively impacted by greater patient and healthcare community understanding of the importance of early identification and treatment for chronic illnesses. The Centers for Medicare & Medicaid Services (CMS), for instance, predicted that in 2022, health spending in the U.S. will be 7.5% of GDP. It was predicted to cross $1 trillion in 2023. In addition, high disposable income in developed economies & skilled professionals are some factors responsible for the large share of the market of the country.

Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the presence of large population suffering from kidney & cardiovascular diseases, improvement in medical facilities, and availability of insurance policies. Increased surgical volume, growing government partnerships, and a developing medical device portfolio all contribute to regional growth. Additionally, an increase in government initiatives contributes to market developments in the region.

For instance, in July 2022, the Asia Pacific Society of Infection Control introduced the APSIC guide on the prevention of catheter-linked UI infections. The program focuses on offering practical recommendations provided in a brief format to help healthcare facilities in Asia Pacific maintain high standards of infection prevention & management. Its primary objective was to guide the management and care of patients with a urinary catheter. Moreover, the presence of a large patient pool and the growing need for technologically advanced & cost-efficient healthcare solutions are expected to present significant regional growth opportunities in the market.

Indian market is anticipated to grow at a CAGR of 7.7% over the forecast period. The key factors estimated to drive the Indian market are adoption of new technology in catheter manufacturing, growing disease variation and prevalence, and increasing research and development for enhancing the product portfolio.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the catheter market

Product Type

End Use

Region

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Catheter Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Ancillary Market Outlook

3.2. Increasing number of clinical trials

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Increasing Incidence of Chronic Disorders

3.3.1.2. Increasing Awareness of Controlling Catheter-Related Bloodstream Infections (CRBSI)

3.3.1.3. Growing Use of Advanced Materials in Catheters

3.3.2. Market Restraint Analysis

3.3.2.1. Stringent Regulations for Novel Product Launch

3.3.2.2. Risk and Complications Associated with the Catheters

3.3.3. Market Opportunities Analysis

3.3.3.1. Growing Preference for Minimally Invasive Procedures

3.3.4. Market Challenge Analysis

3.3.4.1. High Cost of Products

3.4. Catheter Market Analysis Tools

3.4.1. Industry Analysis - Porter’s

3.4.1.1. Bargaining power of suppliers

3.4.1.2. Bargaining power of buyers

3.4.1.3. Threat of substitutes

3.4.1.4. Threat of new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political & Legal Landscape

3.4.2.2. Economic and Social Landscape

3.4.2.3. Technological landscape

Chapter 4. Catheter Market: Product Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Catheter Market: Product Type Movement Analysis & Market Share, 2024 & 2033

4.3. Cardiovascular Catheters

4.3.1. Cardiovascular Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.1.1. Electrophysiology Catheters

4.3.1.1.1. Electrophysiology Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.1.2. PTCA Balloon Catheters

4.3.1.2.1. PTCA Balloon Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.1.3. IVUS Catheters

4.3.1.3.1. IVUS Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.1.4. PTA Balloon Catheters

4.3.1.4.1. PTA Balloon Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4. Urology Catheters

4.4.1. Urology Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.1.1. Hemodialysis Catheters

4.4.1.1.1. Hemodialysis Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.1.2. Peritoneal Catheters

4.4.1.2.1. Peritoneal Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.1.3. Foley Catheters

4.4.1.3.1. Foley Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.1.4. Intermittent Catheters

4.4.1.4.1. Intermittent Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.1.5. External Catheters

4.4.1.5.1. External Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.5. Intravenous Catheters

4.5.1. Intravenous Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.5.1.1. Peripheral Catheters

4.5.1.1.1. Peripheral Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.5.1.2. Midline Peripheral Catheters

4.5.1.2.1. Midline Peripheral Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.5.1.3. Central Venous Catheters

4.5.1.3.1. Central Venous Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.6. Neurovascular Catheters

4.6.1. Neurovascular Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.7. Specialty Catheters

4.7.1. Specialty Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.7.1.1. Wound/Surgical Catheters

4.7.1.1.1. Wound/Surgical Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.7.1.2. Oximetry Catheters

4.7.1.2.1. Oximetry Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.7.1.3. Thermodilution Catheters

4.7.1.3.1. Thermodilution Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.7.1.4. IUI Catheters

4.7.1.4.1. IUI Catheters Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 5. Catheter Market: End-Use Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Catheter Market: End-Use Movement Analysis & Market Share, 2024 & 2033

5.3. Hospital Stores

5.3.1. Hospital Stores Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.4. Retail Stores

5.4.1. Retail Stores Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.5. Others

5.5.1. Others Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 6. Catheter Market: Regional Estimates & Trend Analysis

6.1. Regional Outlook

6.2. Catheter Market: Regional Movement Analysis & Market Share, 2024 & 2033

6.3. North America

6.3.1. North America Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.2. U.S.

6.3.2.1. Key Country Dynamics

6.3.2.2. Competitive Scenario

6.3.2.3. Regulatory Scenario

6.3.2.4. Reimbursement Scenario

6.3.2.5. U.S. Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.3. Canada

6.3.3.1. Key Country Dynamics

6.3.3.2. Competitive Scenario

6.3.3.3. Regulatory Scenario

6.3.3.4. Reimbursement Scenario

6.3.3.5. Canada Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4. Europe

6.4.1. Europe Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.2. UK

6.4.2.1. Key Country Dynamics

6.4.2.2. Competitive Scenario

6.4.2.3. Regulatory Scenario

6.4.2.4. Reimbursement Scenario

6.4.2.5. UK Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.3. Germany

6.4.3.1. Key Country Dynamics

6.4.3.2. Competitive Scenario

6.4.3.3. Regulatory Scenario

6.4.3.4. Reimbursement Scenario

6.4.3.5. Germany Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.4. France

6.4.4.1. Key Country Dynamics

6.4.4.2. Competitive Scenario

6.4.4.3. Regulatory Scenario

6.4.4.4. Reimbursement Scenario

6.4.4.5. France Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.5. Italy

6.4.5.1. Key Country Dynamics

6.4.5.2. Competitive Scenario

6.4.5.3. Regulatory Scenario

6.4.5.4. Reimbursement Scenario

6.4.5.5. Italy Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.6. Spain

6.4.6.1. Key Country Dynamics

6.4.6.2. Competitive Scenario

6.4.6.3. Regulatory Scenario

6.4.6.4. Reimbursement Scenario

6.4.6.5. Spain Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.7. Denmark

6.4.7.1. Key Country Dynamics

6.4.7.2. Competitive Scenario

6.4.7.3. Regulatory Scenario

6.4.7.4. Reimbursement Scenario

6.4.7.5. Denmark Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.8. Sweden

6.4.8.1. Key Country Dynamics

6.4.8.2. Competitive Scenario

6.4.8.3. Regulatory Scenario

6.4.8.4. Reimbursement Scenario

6.4.8.5. Sweden Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.9. Norway

6.4.9.1. Key Country Dynamics

6.4.9.2. Competitive Scenario

6.4.9.3. Regulatory Scenario

6.4.9.4. Reimbursement Scenario

6.4.9.5. Norway Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5. Asia Pacific

6.5.1. Asia Pacific Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.2. Japan

6.5.2.1. Key Country Dynamics

6.5.2.2. Competitive Scenario

6.5.2.3. Regulatory Scenario

6.5.2.4. Reimbursement Scenario

6.5.2.5. Japan Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.3. China

6.5.3.1. Key Country Dynamics

6.5.3.2. Competitive Scenario

6.5.3.3. Regulatory Scenario

6.5.3.4. Reimbursement Scenario

6.5.3.5. China Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.4. India

6.5.4.1. Key Country Dynamics

6.5.4.2. Competitive Scenario

6.5.4.3. Regulatory Scenario

6.5.4.4. Reimbursement Scenario

6.5.4.5. India Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.5. South Korea

6.5.5.1. Key Country Dynamics

6.5.5.2. Competitive Scenario

6.5.5.3. Regulatory Scenario

6.5.5.4. Reimbursement Scenario

6.5.5.5. South Korea Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.6. Australia

6.5.6.1. Key Country Dynamics

6.5.6.2. Competitive Scenario

6.5.6.3. Regulatory Scenario

6.5.6.4. Reimbursement Scenario

6.5.6.5. Australia Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.7. Thailand

6.5.7.1. Key Country Dynamics

6.5.7.2. Competitive Scenario

6.5.7.3. Regulatory Scenario

6.5.7.4. Reimbursement Scenario

6.5.7.5. Thailand Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6. Latin America

6.6.1. Latin America Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6.2. Brazil

6.6.2.1. Key Country Dynamics

6.6.2.2. Competitive Scenario

6.6.2.3. Regulatory Scenario

6.6.2.4. Reimbursement Scenario

6.6.2.5. Brazil Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6.3. Mexico

6.6.3.1. Key Country Dynamics

6.6.3.2. Competitive Scenario

6.6.3.3. Regulatory Scenario

6.6.3.4. Reimbursement Scenario

6.6.3.5. Mexico Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6.4. Argentina

6.6.4.1. Key Country Dynamics

6.6.4.2. Competitive Scenario

6.6.4.3. Regulatory Scenario

6.6.4.4. Reimbursement Scenario

6.6.4.5. Argentina Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.7. Middle East & Africa

6.7.1. Middle East & Africa Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.7.2. South Africa

6.7.2.1. Key Country Dynamics

6.7.2.2. Competitive Scenario

6.7.2.3. Regulatory Scenario

6.7.2.4. Reimbursement Scenario

6.7.2.5. South Africa Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.7.3. Saudi Arabia

6.7.3.1. Key Country Dynamics

6.7.3.2. Competitive Scenario

6.7.3.3. Regulatory Scenario

6.7.3.4. Reimbursement Scenario

6.7.3.5. Saudi Arabia Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.7.4. UAE

6.7.4.1. Key Country Dynamics

6.7.4.2. Competitive Scenario

6.7.4.3. Regulatory Scenario

6.7.4.4. Reimbursement Scenario

6.7.4.5. UAE Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.7.5. Kuwait

6.7.5.1. Key Country Dynamics

6.7.5.2. Competitive Scenario

6.7.5.3. Regulatory Scenario

6.7.5.4. Reimbursement Scenario

6.7.5.5. Kuwait Catheter Market Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 7. Competitive Landscape

7.1. Market Participant Categorization

7.2. Key Company Profiles

7.2.1. Boston Scientific Corporation

7.2.1.1. Company Overview

7.2.1.2. Financial Performance

7.2.1.3. Service Benchmarking

7.2.1.4. Strategic Initiatives

7.2.2. Teleflex Incorporated

7.2.2.1. Company Overview

7.2.2.2. Financial Performance

7.2.2.3. Service Benchmarking

7.2.2.4. Strategic Initiatives

7.2.3. Medtronic

7.2.3.1. Company Overview

7.2.3.2. Financial Performance

7.2.3.3. Service Benchmarking

7.2.3.4. Strategic Initiatives

7.2.4. Hollister Incorporated

7.2.4.1. Company Overview

7.2.4.2. Financial Performance

7.2.4.3. Service Benchmarking

7.2.4.4. Strategic Initiatives

7.2.5. Edward Lifesciences

7.2.5.1. Company Overview

7.2.5.2. Financial Performance

7.2.5.3. Service Benchmarking

7.2.5.4. Strategic Initiatives

7.2.6. Smith Medical Inc.

7.2.6.1. Company Overview

7.2.6.2. Financial Performance

7.2.6.3. Service Benchmarking

7.2.6.4. Strategic Initiatives

7.2.7. ConvaTec Group Plc

7.2.7.1. Company Overview

7.2.7.2. Financial Performance

7.2.7.3. Service Benchmarking

7.2.7.4. Strategic Initiatives

7.2.8. Cure Medical LLC

7.2.8.1. Company Overview

7.2.8.2. Financial Performance

7.2.8.3. Service Benchmarking

7.2.8.4. Strategic Initiatives

7.3. Heat Map Analysis/ Company Market Position Analysis

7.4. Estimated Company Market Share Analysis, 2022

7.5. List of Other Key Market Players