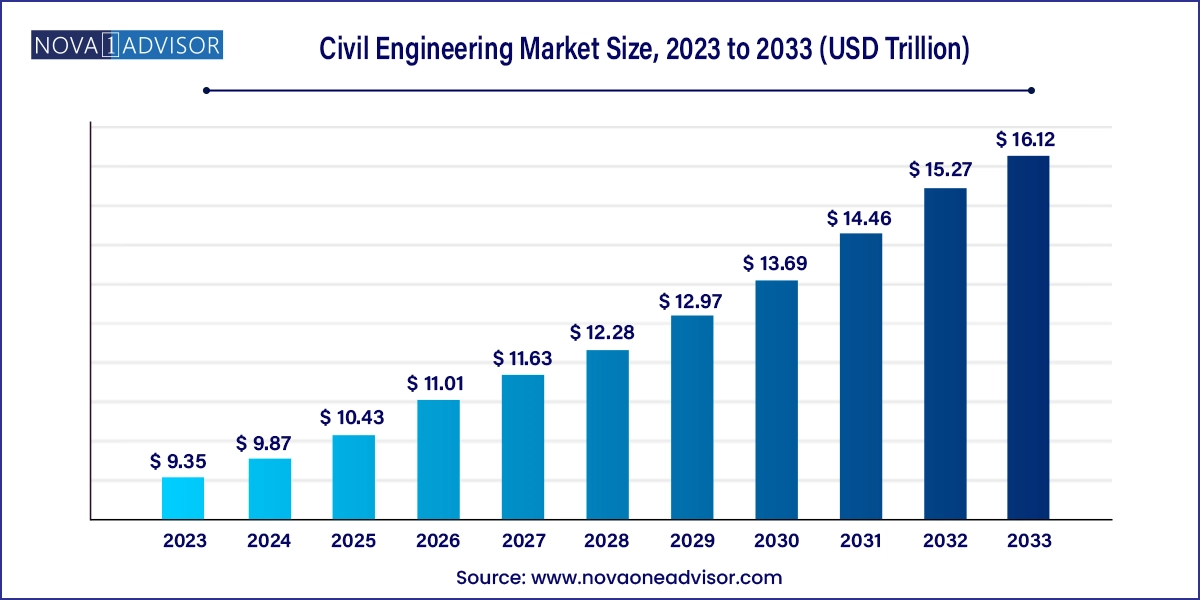

The global civil engineering market size was exhibited at USD 9.35 trillion in 2023 and is projected to hit around USD 16.12 trillion by 2033, growing at a CAGR of 5.6% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.87 Trillion |

| Market Size by 2033 | USD 16.12 Trillion |

| Growth Rate From 2024 to 2033 | CAGR of 5.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Application, Customers, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Key Companies Profiled | AECOM; Amec Foster Wheeler plc; United States Army Corps of Engineers; SNC-Lavalin; Jacobs; Galfar Engineering & Contracting SAOG (Galfar); Fluor Corporation.; HDR Inc.; Tetra Tech Inc.; Stantec Inc. |

This growth is attributed to an increase in the number of infrastructure and capital projects. Additionally, increasing disposable income in emerging economies is anticipated to drive the infrastructure segment’ growth over the forecast period, thereby propelling the growth of civil engineering services in the construction industry.

Civil engineering services in North America are led by the U.S. owing to the presence of an extensively developed manufacturing industry, government initiatives to develop social infrastructure, and increased demand from the residential sector. A rising number of construction and refurbishment activities in key sectors, such as offices, educational institutes, hotels, restaurants, transport buildings, and online retail warehousing, is anticipated to fuel the growth of civil engineering within North America. In addition, the growing residential sector on account of the increasing immigration is projected to promote industry growth.

The abundant availability of raw material suppliers is expected to affect the buying power of consumers. Markets with oversupply are likely to export raw materials to import-oriented regions in order to reduce buying power. On the other hand, suppliers in import-orient shall have a larger say in pricing, thus increasing the bargaining power of suppliers.

The housing and construction industry is cyclical and can witness unforeseen fluctuations in construction activities. Such fluctuations can adversely affect product demand down the construction industry value chain. The world economy faced a severe downturn in the past years that affected developed and developing countries. This, in turn, led to a reduction in economic activities and investments in the construction sector, impacting civil engineering services worldwide.

Increasing infrastructural activities in emerging economies and a rise in refurbishment projects in developed economies are factors expected to contribute to civil engineering demand. The construction industry in Asia Pacific has been developing rapidly in recent years. The industry has witnessed numerous technological advancements and the proliferation of unique architectural designs.

Construction services was the largest segment and accounted for a global revenue share of 27.4% in 2023. Increasing demand for various rail structures, tunnels, bridges, and other civil works on account of growing population and traffic issues across the globe is anticipated to propel the civil engineering market growth.

Demand for planning & design services is projected to grow over the forecast period owing to the presence of multiple well-established global civil engineering companies in the industry. Planning & design is an essential part of any construction project, which ensures proper integration of design and construction process.

The maintenance service segment is anticipated to witness the fastest CAGR of 6.6% over the forecast period, as it is an essential part of civil engineering to prolong life cycle of a structure and avoid losses. It includes a number of tasks from cleaning and repairing to replacements. An increasing number of maintenance and redevelopment projects across the globe is anticipated to promote service growth in civil engineering.

Other services include renovation activities, retrofitting, reconstruction, and alterations made to existing structures. Increasing renovation activities owing to the rising need to prolong the life of a building structure is expected to aid the growth of civil engineering. Rising installations of energy-efficient products are anticipated to further drive the market growth.

The real estate segment accounted for a global revenue share of 40.7% in 2023 and is expected to witness significant growth over the forecast period. The rising purchasing power and consumer confidence are fueling the recovery of housing construction including both new constructions as well as renovation. This is expected to result in overall industry growth for civil engineering.

The infrastructure segment is estimated to register the fastest CAGR of 6.7% from 2024 to 2033. Increasing public and private investments in infrastructure project development including railways, roads, airports, waterways, and others are projected to drive segment growth over the forecast period. In addition, a rising inclination towards the design and development of flexible infrastructure is expected to propel the infrastructure application growth.

The industrial application segment is expected to witness a significant CAGR of 6.3% over the forecast period. Increasing manufacturing activities coupled with rising demand for industrial infrastructure including R&D, manufacturing, processing facilities as well as warehouses are expected to result in rising demand for civil engineering services across the globe.

Market players involved in engineering, design, and construction of industrial facilities offer a broad range of services to manufacturing companies, oil & gas industry, energy & power, aviation, and several other industries for development and maintenance, thereby driving the industry growth for civil engineering over the forecast period.

The government was the largest customer segment and accounted the global revenue share of 41.3% in 2023. Favorable government policies for the development of railways and road infrastructure, as well as renovation of public infrastructure buildings and their maintenance, are projected to benefit the segment growth.

Rising public spending on housing projects with increasing investments in new construction and renovation is expected to have a major impact on the market for civil engineering across the globe. In addition, rising investments from public sector in the non-residential segment suggest several government programs and policies supporting the development of non-residential construction.

Private sector, including construction contractors, individuals, and real estate developers, is also a major customer of civil engineering services. Increasing investment by private companies in construction activities including housing projects and the development of healthcare centers & new schools indicates the rising demand for civil engineering services from private institutions.

Major infrastructure projects rely on both public and private funds. Projects, which are conducted jointly between public and private companies encourage the private sector to engage in high-budget infrastructure projects. Therefore, it is expected to propel the demand for civil engineering during the forecast period.

The demand outlook for North America civil engineering market is favorable, with public and private investments focusing on longer-term infrastructures such as new manufacturing plants. In addition, industrial sector in North America is also expected to benefit from the new policy reforms. This is expected to boost the industrial construction in the region, thereby driving the demand for civil engineering services over the forecast period.

U.S. Civil Engineering Market Trends

The U.S. accounted for the largest revenue market share in 2023, with a slow recovery in residential and commercial constructions. However, declining infrastructure investment poses a major concern to the country's construction sector. The U.S. has failed to address its deficiency in infrastructure through measures like the construction of roads, bridges, airports, and waterways mainly because of the lack of funding.

The civil engineering market in Mexico is witnessing growth due to implementation of national development plan by Mexico government which is known asNational Infrastructure Program (PNI) to boost infrastructural growth in the country as a strategic move to increase productivity and improve competitive market of construction industry. PNI is anticipated to reduce regional differences across the country and increase overall standard of living in Mexico, resulting in an ascending market for civil engineering.

Asia Pacific Civil Engineering Market Trends

Asia Pacific held a revenue share of 33.7% of the global market in 2023. The region is expected to observe the most extreme development rate over the conjecture time frame. While many organizations are situated in the U.S., Asia Pacific has seen a substantial rise in the expansion of the civil engineering sector. Organizations based out of the U.S. are setting up businesses in nations like India & China that offer tax breaks and decreased assembling costs.

The civil engineering market in China has bounced back from the effects of the COVID-19 pandemic, supported by ongoing industrialization and urbanization projects in the country. Additionally, resurgence in foreign investment funding for infrastructural development, and increasing disposable incomes of the population is expected to further boost the market growth.

The India civil engineering market is anticipated to grow at a rapid pace over the forecast period owing to government initiatives such as “Make in India”. Furthermore, positive development in the regional economic conditions is likely to lead to the growth of residential and commercial construction projects, which in turn is conducive to market growth.

Europe Civil Engineering Market Trends

The civil engineering market in Europe is expected to grow during the forecast period. The construction sector is a major contributor to the overall GDP in almost all European countries. In addition, positive signs in public and private debt are contributing to the growth of the construction industry, which, in turn, is expected to contribute favorably to market growth.

The civil engineering market in Germany is one of the biggest consumers of civil engineering in Europe for the year 2023. The construction sector is witnessing a boom due to various government initiatives in the form of tax incentives related to real estate. These advantages and are anticipated to benefit the civil engineering industry in Germany.

Middle East & Africa Civil Engineering Market Trends

The construction industry in Middle East & Africa is expected to witness a rebound growth over the forecast period owing to the expansion of oil production and increase in private investments. Moreover, a rise in investment by the governments of Saudi Arabia, the UAE, and Qatar in construction projects in order to boost economic growth in their respective countries is expected to drive the construction industry, thereby augmenting the demand for civil engineering services.

The Saudi Arabia civil engineering market is experiencing boom due toongoing infrastructuralprojects initiated by the Government of Saudi Arabia such as National Investment Strategy. In October 2021, Kingdom of Saudi Arabia declared KSA Vision 2030 goals that includes renewable energy, manufacturing, logistics and transportation, healthcare, and digital infrastructure are among major industries covered by National Investment Strategy of the country.

In January 2024, an AECOM-led joint venture called Vermont Corridor Partners (VCP) led the Vermont Transit Corridor Planning and Environmental Study. The study recommends a multi-faceted BRT and rail improvement plan along Vermont Avenue, LA Metro's second-busiest transit corridor running from Hollywood Boulevard to 120th Street. This joint venture will be aimed at the planning, design, and implementation, with mobility access, equity, and community priorities at the forefront.

In December 2023, Jacobs partnered with a non-profit organization Bridges to Prosperity in order to construct a suspended footbridge over a river for the safety and convenience of the surrounding communities. The team worked on every stage of the project, from filling the abutment with rock and concrete to creating approach ramps hoisting cables and setting the sag, assembling and launching swings over cables, decking, hand installation of fencing, and painting towers.

In December 2023, Fluor Corporation was contracted by Dow to construct the world's first Net-Zero Scope 1 and Net-Zero Scope 2 Integrated Ethylene Cracker and Derivatives Complex in Fort Saskatchewan Alberta, Canada. Dow’s current manufacturing facilities are being expanded and refurbished as part of the overall program.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global civil engineering market

Services

Application

Customers

Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Information Analysis

1.3.2. Market Formulation & Data Visualization

1.3.3. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List To Data Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Civil Engineering Market Variables, Trends & Scope

3.1. Market Lineage/Ancillary Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends Analysis

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.1.1. Growing Global Construction Spending

3.5.1.2. Growth in Transport Infrastructure

3.5.2. Market Restraint Analysis

3.5.2.1. Fluctuating Economic Cycles

3.5.3. Industry Opportunities

3.5.4. Market Challenges Analysis

3.6. Porter’s Five Forces Analysis

3.7. PESTLE, by SWOT Analysis

3.8. Market Disruption Analysis

Chapter 4. Civil Engineering Market: Services Estimates & Trend Analysis

4.1. Key Takeaways

4.2. Services Movement Analysis & Market Share, 2024 & 2033

4.3. Civil Engineering Market Estimates & Forecast, by Services, 2021 - 2033 (USD Trillion)

4.3.1. Planning & Design

4.3.1.1. Civil Engineering Market Estimates & Forecast, by Planning & Design, 2021 - 2033 (USD Trillion)

4.3.2. Construction

4.3.2.1. Civil Engineering Market Estimates & Forecast, by Construction, 2021 - 2033 (USD Trillion)

4.3.3. Maintenance

4.3.3.1. Civil Engineering Market Estimates & Forecast, by Maintenance, 2021 - 2033 (USD Trillion)

4.3.4. Other Services

4.3.4.1. Civil Engineering Market Estimates & Forecast, by Other Services, 2021 - 2033 (USD Trillion)

Chapter 5. Civil Engineering Market: Application Estimates & Trend Analysis

5.1. Key Takeaways

5.2. Application Movement Analysis & Market Share, 2024 & 2033

5.3. Civil Engineering Market Estimates & Forecast, by Application, 2021 - 2033 (USD Trillion)

5.3.1. Real Estate

5.3.1.1. Civil Engineering Market Estimates & Forecast, in Real Estate, 2021 - 2033 (USD Trillion)

5.3.2. Infrastructure

5.3.2.1. Civil Engineering Market Estimates & Forecast, in Infrastructure, 2021 - 2033 (USD Trillion)

5.3.3. Industrial

5.3.3.1. Civil Engineering Market Estimates & Forecast, in Industrial, 2021 - 2033 (USD Trillion)

Chapter 6. Civil Engineering Market: Customer Estimates & Trend Analysis

6.1. Key Takeaways

6.2. Customer Movement Analysis & Market Share, 2024 & 2033

6.3. Civil Engineering Market Estimates & Forecast, by Customer, 2021 - 2033 (USD Trillion)

6.3.1. Government

6.3.1.1. Civil Engineering Market Estimates & Forecast, for Government, 2021 - 2033 (USD Trillion)

6.3.2. Private

6.3.2.1. Civil Engineering Market Estimates & Forecast, for Private, 2021 - 2033 (USD Trillion)

6.3.3. Others

6.3.3.1. Civil Engineering Market Estimates & Forecast, for Others, 2021 - 2033 (USD Trillion)

Chapter 7. Civil Engineering Market: Region Estimates & Trend Analysis

7.1. Key Takeaways

7.2. Regional Market Share Analysis, 2023 - 2030

7.3. North America

7.3.1. North America Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.3.2. North America Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.3.3. North America Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.3.4. North America Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.3.5. U.S.

7.3.5.1. U.S. Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.3.5.2. U.S. Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.3.5.3. U.S. Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.3.5.4. U.S. Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.3.6. Canada

7.3.6.1. Canada Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.3.6.2. Canada Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.3.6.3. Canada Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.3.6.4. Canada Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.3.7. Mexico

7.3.7.1. Mexico Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.3.7.2. Mexico Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.3.7.3. Mexico Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.3.7.4. Mexico Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.4. Europe

7.4.1. Europe Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.4.2. Europe Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.4.3. Europe Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.4.4. Europe Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.4.5. UK

7.4.5.1. UK Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.4.5.2. UK Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.4.5.3. UK Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.4.5.4. UK Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.4.6. Germany

7.4.6.1. Germany Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.4.6.2. Germany Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.4.6.3. Germany Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.4.6.4. Germany Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.4.7. France

7.4.7.1. France Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.4.7.2. France Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.4.7.3. France Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.4.7.4. France Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.5. Asia Pacific

7.5.1. Asia Pacific Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.5.2. Asia Pacific Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.5.3. Asia Pacific Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.5.4. Asia Pacific Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.5.5. China

7.5.5.1. China Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.5.5.2. China Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.5.5.3. China Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.5.5.4. China Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.5.6. India

7.5.6.1. India Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.5.6.2. India Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.5.6.3. India Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.5.6.4. India Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.5.7. Australia

7.5.7.1. Australia Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.5.7.2. Australia Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.5.7.3. Australia Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.5.7.4. Australia Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.5.8. Indonesia

7.5.8.1. Indonesia Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.5.8.2. Indonesia Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.5.8.3. Indonesia Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.5.8.4. Indonesia Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.6. Central & South America

7.6.1. Central & South America Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.6.2. Central & South America Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.6.3. Central & South America Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.6.4. Central & South America Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.6.5. Brazil

7.6.5.1. Brazil Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.6.5.2. Brazil Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.6.5.3. Brazil Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.6.5.4. Brazil Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.7. Middle East & Africa

7.7.1. Middle East & Africa Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.7.2. Middle East & Africa Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.7.3. Middle East & Africa Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.7.4. Middle East & Africa Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.7.5. Saudi Arabia

7.7.5.1. Saudi Arabia Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.7.5.2. Saudi Arabia Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.7.5.3. Saudi Arabia Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.7.5.4. Saudi Arabia Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.7.6. UAE

7.7.6.1. UAE Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.7.6.2. UAE Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.7.6.3. UAE Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.7.6.4. UAE Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

7.7.7. Qatar

7.7.7.1. Qatar Civil Engineering Market Estimates & Forecasts, 2021 - 2033 (USD Trillion)

7.7.7.2. Qatar Civil Engineering Market Estimates & Forecasts, by Services, 2021 - 2033 (USD Trillion)

7.7.7.3. Qatar Civil Engineering Market Estimates & Forecasts, by Application, 2021 - 2033 (USD Trillion)

7.7.7.4. Qatar Civil Engineering Market Estimates & Forecasts, by Customer, 2021 - 2033 (USD Trillion)

Chapter 8. Civil Engineering Market - Supplier Intelligence

8.1. Kraljic Matrix

8.2. Engagement Model

8.3. Negotiation Strategies

8.4. Sourcing Best Practices

8.5. Vendor Selection Criteria

8.6. List of Raw Material Suppliers

Chapter 9. Civil Engineering Market - Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company Categorization

9.3. Company Market Position Analysis, 2024

9.4. Company Heat Map Analysis

9.5. Strategy Mapping, 2024

9.6. Market Entry Strategies

9.7. Company Profiles

9.7.1. AECOM

9.7.1.1. Participant’s overview

9.7.1.2. Financial performance

9.7.1.3. Product benchmarking

9.7.1.4. Recent developments

9.7.2. Amec Foster Wheeler plc

9.7.2.1. Participant’s overview

9.7.2.2. Financial performance

9.7.2.3. Product benchmarking

9.7.2.4. Recent developments

9.7.3. United States Army Corps of Engineers

9.7.3.1. Participant’s overview

9.7.3.2. Financial performance

9.7.3.3. Product benchmarking

9.7.3.4. Recent developments

9.7.4. SNC Lavalin

9.7.4.1. Participant’s overview

9.7.4.2. Financial performance

9.7.4.3. Product benchmarking

9.7.4.4. Recent developments

9.7.5. Jacobs Engineering Group, Inc.

9.7.5.1. Company overview

9.7.5.2. Financial performance

9.7.5.3. Product benchmarking

9.7.5.4. Strategic initiatives

9.7.6. Galfar Engineering & Contracting SAOG

9.7.6.1. Company overview

9.7.6.2. Financial performance

9.7.6.3. Product benchmarking

9.7.6.4. Strategic initiatives

9.7.7. Fluor Corporation

9.7.7.1. Company overview

9.7.7.2. Financial performance

9.7.7.3. Product benchmarking

9.7.7.4. Strategic initiatives

9.7.8. HDR, Inc.

9.7.8.1. Company overview

9.7.8.2. Financial performance

9.7.8.3. Product benchmarking

9.7.8.4. Strategic initiatives

9.7.9. Tetra Tech, Inc.

9.7.9.1. Company overview

9.7.9.2. Financial performance

9.7.9.3. Product benchmarking

9.7.9.4. Strategic initiatives

9.7.10. Stantec, Inc.

9.7.10.1. Participant’s overview

9.7.10.2. Financial performance

9.7.10.3. Product benchmarking

9.7.10.4. Recent developments