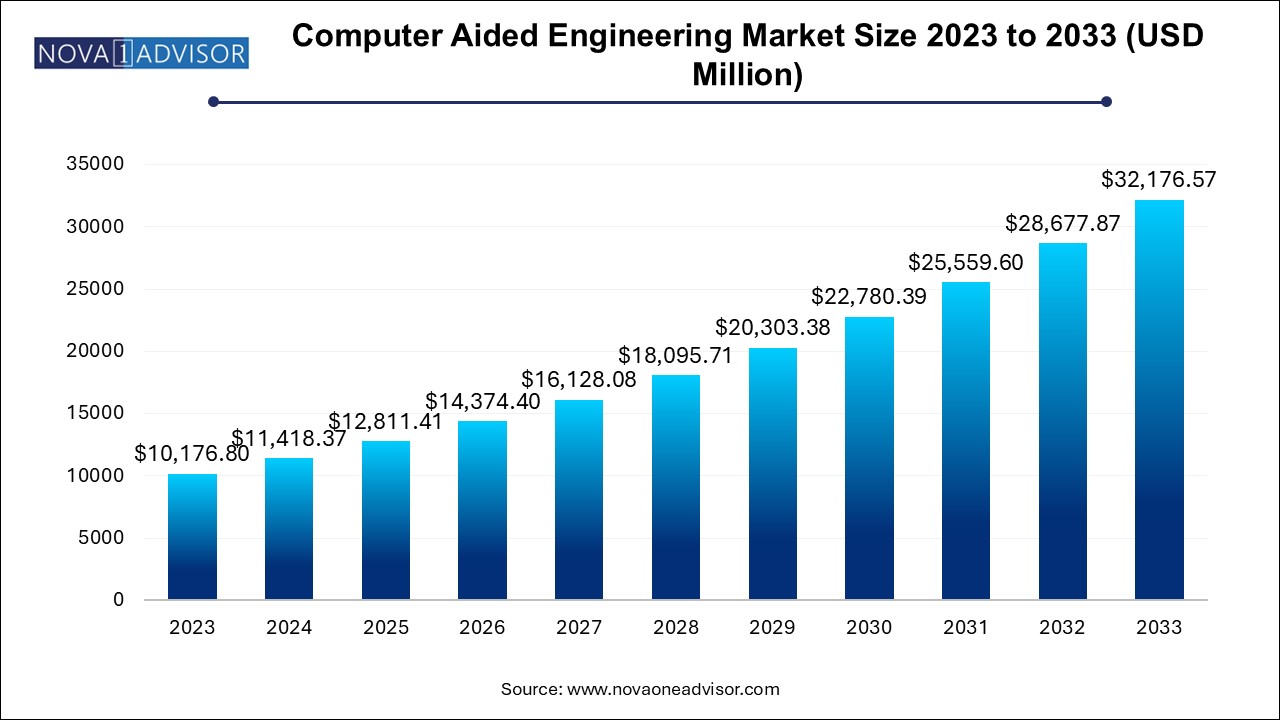

The global computer aided engineering market size was exhibited at USD 10176.8 million in 2023 and is projected to hit around USD 32176.57 million by 2033, growing at a CAGR of 12.2% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 11418.37 Million |

| Market Size by 2033 | USD 32176.57 Million |

| Growth Rate From 2024 to 2033 | CAGR of 12.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Component, Deployment Model, End-use Industry, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; South America; MEA |

| Key Companies Profiled | ANSYS, Inc.,Altair Engineering, Autodesk, Inc., Bentley Systems, Inc., Dassault Systemes, ESI Group, Exa Corporation, Mentor Graphics Corporation (A subsidiary of Siemens AG), Hexagon AB, Siemens |

owing to the increased outsourcing of manufacturing processes to emerging economies such as China, India, and Russia, among others. The computer aided engineering (CAE) market is poised for unprecedented growth during the forecast period, as integrated software solutions eliminate the need for multiple prototypes and product recall concerns. As a result, the cost associated with prototyping and product recall strategy is highly reduced. Moreover, the increasing use of CFD software for analyzing temperature in battery modules and extending battery life & performance is anticipated to drive the market growth.

The market all over the globe is witnessing a drastic shift from on-premise computing to cloud-based computing. Cloud computing reduces costs related to hardware acquisition and software licensing, installation, and support. This is further expected to increase the use of the CAE software. Additionally, companies are adopting the Hyper-Converged Infrastructure (HCI) platform for building a private cloud that enables advanced computation and storage services.

Customers are increasingly quantifying their software contributions. As a result, companies are willing to pay high license fees for the software that supports low-value processes. They are developing alternating pricing and delivering models, alike Software as a Service (SaaS) pricing models, enabling customers to opt for a pay-as-you-go subscription plan. However, the new pricing model is expected to affect the software providers’ cash flow, revenue recognition, and finance.

The market for value added resellers (VAR) is expected to have significant growth over the projected period. VARs will help in reducing the gap between the end-users and suppliers. VARs receive certifications and training from suppliers to increase their credibility. As a result, the growth of VARs is expected to have a positive effect on the growth of the computer aided engineering market over the forecast period.

Based on component, the market is segmented into software and services. The software segment accounted the major market share in 2023 and is anticipated to continue its dominance in the coming years. The segment growth can be attributed to benefits such as data safety, reliability, and uninterrupted testing. The software optimizes the engineering tasks and are majorly used to examine the robustness and performance of the components and assemblies.

Based on software types, the industry is segmented into Finite Element Analysis (FEA), Computational Fluid Dynamics (CFD), multibody dynamics, and optimization & simulation. In 2023, the FEA segment accounted for a market share of more than 51% and is anticipated to dominate the market over the forecast. FEA is a computational analysis methodology that helps in determining the strength of a product with respect to the loading. FEA simulates real components to analyze problems pertaining to heat transfer, structural analysis, electromagnetic potential, and mass transport.

Computational fluid dynamics involves qualitative prediction of fluid flow using mathematical modeling and software tools. CFD is used in analyzing turbulence, flow, and pressure distribution of gasses & liquids and their interaction with different structures. The industry players are aiming at developing application-specific software for customized process functions. Furthermore, the multibody dynamic analysis is of two types: Inverse dynamics and forward dynamics. Forward dynamics analysis is the movement of individual components by the application of external forces. Inverse dynamics involves the analysis of forces to move the system in a specific way.

The service segment is expected to register the highest CAGR over the forecast period. The growth of the segment can be attributed to the growing awareness of virtually enabled processes used for product development among companies and governments. Services such as design and consulting, implementation, and maintenance are gaining popularity among various enterprises.

In 2023 the on-premise segment held a market share exceeding 63% in the global market and is expected to exhibit a CAGR of nearly 10.5% from 2023 to 2030. The software industry is a fast-paced industry and timely development and introduction of products to the market are vital to a firm’s success. Companies are obtaining new software technologies through mergers & acquisitions. Based on deployment models, the industry is segmented into on-premise and cloud. Cloud computing offers easy access to data, vast space for data storage, and security. Moreover, cloud-based CAE, offered as a Software-as-a-Service (SaaS), renders application-specific solutions to the CAE users. Hence, the cloud-based deployment model is expected to portray a high growth rate during the projected period.

Cloud-based deployment enables faster distribution, minimal maintenance, reduction in cost, and increase in scalability. Although the on-premise software implementation increased the software deployment cost along with up-gradation costs, the on-premise software installation held a significant share in the market in 2023. This high share of on-premise segment can be attributed to its early adoption. Additionally, deployment of software at the client’s site is considered a more convenient option by several companies where the data confidentiality issues persist. For similar reasons, the on-premise segment is expected to hold the majority share during the forecast period

Based on end-use, the industry is segmented into defense & aerospace, automotive, electronics, medical devices, industrial equipment, and others. In 2023, the automotive industry held the largest market share of more than 29% in the global market and expected to exhibit a significant CAGR from 2024 to 2033. In the automotive segment, the utilization of Computer-Aided Engineering (CAE) software brings significant value by enabling engineers to analyze and optimize heat dissipation techniques, such as cooling, ventilation, and aerodynamics. This enhances the overall design and performance of vehicles. Moreover, CAE software plays a pivotal role in Computer-Aided Engineering (CAE) drawing and Computer-Aided Engineering (CAE) design, empowering engineers to simulate and refine designs before physical prototypes are produced.

In the defense and aerospace industry, the application of CAE software is expected to experience substantial growth during the forecast period. This growth can be attributed to the increasing adoption of CAE software for crucial tasks, including structural analysis, computational fluid dynamics (CFD), and electromagnetic analysis. These capabilities are vital for the development of advanced defense and aerospace systems. By integrating CAE software, organizations in these sectors can ensure accurate engineering calculations and simulations, resulting in enhanced product performance, reliability, and safety.

The defense and aerospace end-use is expected to witness the highest growth rate over the forecast period, owing to the increasing use of CAE software. The growing government spending in the defense & aerospace segment, for modernizing anti-terror equipment and mitigating security lapses, is anticipated to increase the growth of the segment. Further, the growing concerns about security & surveillance, in public places, are likely to influence the segment demand.

Additionally, advanced technologies such as Color Noise Reduction (CNR) for truer colors, Backside Illumination (BSI) for high sensitivity, and High Dynamic Range (HDR) for smooth and crisp video, are anticipated to provide opportunities for electronics segment growth. The medical imaging market is gaining traction in the market owing to its efficiency in diagnosing complex medical conditions. The rising prevalence of critical and chronic diseases, such as cardiovascular diseases & cancer, and increasing awareness of early diagnosis are the key factors driving the demand for imaging systems in healthcare facilities.

In 2023, North America dominated the CAE market with a market share of more than 33.0% and is expected to continue its dominance over the forecast period owing to the presence of bio-diverse cultures and increasing automation in the manufacturing sector. The rising concerns about greenhouse gas emissions and the evolving battery technologies are anticipated to spur the North American regional market. Additionally, rapid penetration of IoT and increasing expenses for defense are a few factors influencing the North America regional market share.

The APAC regional market is expected to witness exponential growth over the forecast period with a CAGR of 13.4%. This growth can be attributed to the rising government investments for developing the manufacturing sector and expanding the capacity of renewable energy generation. The growing automation of industrial equipment is likely to drive the industry demand.

U.K. CAE market

The CAE Market in the U.K.accounted for a revenue share of 20.96% in the European market. The growth can be attributed to the strong automotive and aerospace industries driving demand for advanced simulation and design tools.

France CAE Market

The CAE Market in Franceaccounted for a revenue share of 16.13% in the European market. The revenue share can be attributed to the government support for technological innovation and digitalization boosting CAE market growth.

Germany CAE market

The CAE Market in Germanyaccounted for a revenue share of 28%. The revenue share can be attributed to the dominant automotive manufacturing sector utilizing CAE for product design, testing, and optimization.

China CAE market

The CAE market in Chinaaccounted for a revenue share of more than 16% in the Asia Pacific market. The revenue share can be attributed to the rapid industrialization and manufacturing expansion leading to increased demand for CAE in various sectors.

India CAE market

The CAE market in Indiaaccounted for a revenue share of more than 10% in the Asia Pacific market. The revenue share can be attributed to the shift towards digital engineering and simulation-driven design accelerating the adoption of CAE technologies.

Japan CAE market

The growth of the CAE market in Japan can be attributed to the emphasis on precision engineering and high-quality manufacturing boosting the demand for CAE solutions.

Kingdom of Saudi Arabia (KSA) CAE market

The growth of CAE market in KSA can be attributed to the Investments in infrastructure and industrial projects, and diversification efforts towards technology-driven industries.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global computer aided engineering market

Component

Deployment Model

End-use

Regional