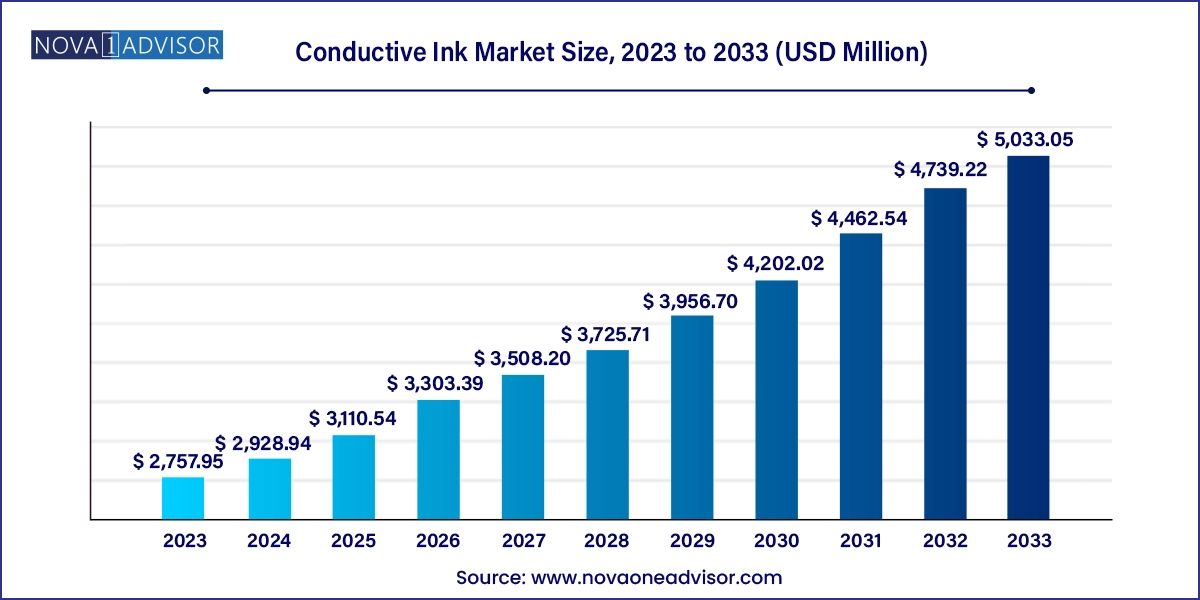

The conductive ink market size was exhibited at USD 2,757.95 million in 2023 and is projected to hit around USD 5,033.05 million by 2033, growing at a CAGR of 6.2% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2,928.94 Million |

| Market Size by 2033 | USD 5,033.05 Million |

| Growth Rate From 2024 to 2033 | CAGR of 6.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; U.K.; Germany; France; China; India; Japan; Brazil |

| Key Companies Profiled | DuPont; Vorbeck Materials Corp.; Applied Nanotech Holdings, Inc.; Sun Chemical Corporation; PPG Industries, Inc.; Creative Materials, Inc.; Poly-Ink; Henkel Ag & Co. KgaA; PChem Associates, Inc.; Johnson Matthey Colour Technologies; Fujikura Ltd.; Heraeus Holding; Nagase America Corporation; Engineered Materials Systems; Epoxies; Etc; Voxel8; Methode Electronics; Novacentrix; Johnson Matthey |

Growth in the market can be attributed to several critical factors such as strong demand from the end-use industries. Possesses certain inherent advantages such as better electrical conductivity and strong resistance to oxidation. Conductive silver ink products find use in markets such as medical devices, consumer electronics, and alternative energy solutions. The products also find applications in polymer thick-film circuitry, EMI, and RFI shielding of polyimide flexible circuits, membrane switches, and coatings for tantalum capacitors. The inks are used on various substrates such as Mylar, Kapton, Polycarbonate, Glass, Polyester, Polyimide, Teflon and Silicone Surfaces, and ITO-coated Surfaces.

Conductive copper ink is used for photonic curing in consumer electronics, radio-frequency identification, membrane touch switch, and antenna applications. The inks are cost-effective in comparison to conductive silver ink. Conductive polymers are used in spin coatings and slot dies coatings. Carbon nanotube ink is used for inkjet printing. In terms of application, the market for conductive ink has been bifurcated into photovoltaic, membrane switches, displays, automotive, smart packaging, biosensors, printed circuits, and other applications. Other applications include batteries, electromagnetic interference, and fuel cells. The conductive inks help in conducting electricity in a printed object.

The photovoltaic application has witnessed a positive trend in the recent past and the trend is projected to continue in the near future. Conductive inks are used in photovoltaic cells, which look similar to solar panels and help in producing steam or hot water. Although the changes in government policies in 2016 in the U.S., China, India, and the U.K. for the surplus PV module installation have slowed the photovoltaic growth rate, conductive inks still hold a major share in the market. The regional market has been segmented into North America, Europe, Asia Pacific, Central and South America, and the Middle East and Africa. The Asia Pacific accounted for more than 58% of the total conductive inks market in 2023 in terms of revenue.

The region is expected to witness a similar trend followed by Europe and North America over the next eight years. Countries such as China and Japan accounted for a significant share of the market. Application segments such as batteries, sensors, and automobiles are presumed to record the highest growth over the forecast period in the regional market. Rapid technological advancements in the electronics and automobile sectors in the Asia Pacific region are anticipated to fuel the growth of the market for conductive ink.

The conductive silver ink product segment led the market and accounted for more than 21.0% revenue share in 2023. Major conductive ink products include conductive silver ink, conductive copper ink, conductive polymers, carbon nanotube ink, dielectric inks, and carbon/graphene ink. The conductive silver ink segment is estimated to dominate the market for conductive ink during the forecast period. The segment is estimated to gain market share from more than 22.0% in 2023 to 24.0% by 2033. The increasing prominence of the product in industries such as printed electronics and flexible electronics is likely to act as a key catalyst for segment growth in the coming years.

Developments in product configuration, by enabling the use of nanomaterials, have contributed to making conductive silver inks highly popular in various industries. In recent years, the increasing use of printed electronics in expensive metals, such as gold and platinum, has led to the growing use of silver inks in the electronics industry. Conductive silver inks have gained the confidence of investors owing to their unique characteristics. The conductive silver ink segment is thus anticipated to dominate the market over the forecast period.

The photovoltaic application segment led the market for conductive ink and accounted for more than 23.0% revenue share in 2023. The market, on the basis of application, is classified into photovoltaic, membrane switches, displays, automotive, smart packaging, biosensors, printed circuit boards, and others. The smart packaging segment dominated the application sector in 2023. The segment is expected to show the fastest growth rate, ascending with a CAGR of 7.0% from 2023 to 2033 and holding a market share of over 7% by 2033.

Conductive inks are used in the fabrication of photovoltaic textiles. The rising prominence of clean energy is likely to push the growth of the photovoltaic segment over the forecast period. The globally rising electrical demand is likely to be the key propellant of solar plants. Countries such as China, India, and the U.S. are projected to generate robust demand for the photovoltaic segment. The solar energy installation in India grew by nearly 89% from 2019 to 2020. Thus, owing to the demand for clean energy, the market for conductive inks is projected to witness a robust growth rate over the forecast period.

The Asia Pacific led the market for conductive ink and accounted for more than 60.0% of revenue share in 2023. The Asia Pacific dominated the market over recent years ahead of Europe and North America. Market shares of developed markets such as North America and Europe are anticipated to decrease owing to application saturation. Developing markets such as the Asia Pacific, and Middle East & Africa are projected to experience brisk growth in areas such as Photovoltaic, Membrane switches, Displays, Automotive, Smart packaging, Biosensors, Printed circuit boards, Other applications. Robust demand for these applications is projected to fuel the regional market.

Rapid urbanization, increasing disposable incomes, and improved government balance sheets resulting in increased infrastructure spending are some of the major contributors to the growth of the market for conductive ink in Asia pacific. The government has entered into numerous Public-private Partnerships (PPPs) to develop the electronics and automobile industries in the country. Also, its concentrated efforts to provide affordable modern electronics are driving the market in the Asia Pacific.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the conductive ink market

Product

Application

Regional

Chapter 1 Methodology and Scope

1.1 Research methodology

1.2 Research Scope & Assumptions

1.3 List of data sources

Chapter 2 Executive Summary

2.1 Conductive Ink - Industry Summary & Key Buying Criteria, 2021 - 2030

2.2 Global Conductive ink market estimates & forecasts, 2021 - 2033

2.2.1 Global Conductive ink market estimates & forecasts by region, 2021 - 2033

2.2.2 Global Conductive ink market estimates & forecasts by product, 2021 - 2033

2.2.3 Global Conductive ink market estimates & forecasts by application, 2021 - 2033

Chapter 3 Conductive Ink Market Industry Outlook

3.1 Conductive ink market segmentation

3.2 Conductive ink market size and growth prospects, 2021 - 2033

3.3 Conductive ink value chain analysis

3.3.1 Vendor landscape

3.4 Raw material trends

3.5 Regulatory framework

3.6 Conductive ink market dynamics

3.6.1 Market driver analysis

3.6.1.1 Increasing demand for efficiency & miniaturization

3.6.1.2 Emerging applications to drive conductive ink market growth

3.6.2 Market restraint analysis

3.6.2.1 Volatility of silver price & lack of technical awareness and challenges

3.7 Key opportunities - prioritized

3.8 Industry Analysis - Porter’s

3.9 Conductive ink market PESTEL analysis, 2014

Chapter 4 Conductive Ink Market Product Outlook

4.1 Global Conductive ink market share by product, 2021 & 2033

4.2 Conductive silver ink

4.2.1 Conductive silver ink Conductive ink market estimates & forecasts, 2021 - 2033

4.2.2 Conductive silver ink Conductive ink market estimates & forecasts by region, 2021 - 2033

4.2.3 Conductive silver ink Conductive ink market estimates & forecasts by region, 2021 - 2033

4.3 Conductive copper ink

4.3.1 Conductive copper ink Conductive ink market estimates & forecasts, 2021 - 2033

4.3.2 Conductive copper ink Conductive ink market estimates & forecasts by region, 2021 - 2033

4.3.3 Conductive copper ink Conductive ink market estimates & forecasts by region, 2021 - 2033

4.4 Conductive polymers

4.4.1 Conductive polymers Conductive ink market estimates & forecasts, 2021 - 2033

4.4.2 Conductive polymers Conductive ink market estimates & forecasts by region, 2021 - 2033

4.4.3 Conductive polymers Conductive ink market estimates & forecasts by region, 2021 - 2033

4.5 Carbon nanotube ink

4.5.1 Carbon nanotube ink Conductive ink market estimates & forecasts, 2021 - 2033

4.5.2 Carbon nanotube ink market estimates & forecasts by region, 2021 - 2033

4.5.3 Carbon nanotube ink Conductive ink market estimates & forecasts by region, 2021 - 2033

4.6 Dielectric inks

4.6.1 Dielectric inks Conductive ink market estimates & forecasts, 2021 - 2033

4.6.2 Dielectric inks Conductive ink market estimates & forecasts by region, 2021 - 2033

4.6.3 Dielectric inks Conductive ink market estimates & forecasts by region, 2021 - 2033

4.7 Carbon/Graphene ink

4.7.1 Carbon/Graphene ink Conductive ink market estimates & forecasts, 2021 - 2033

4.7.2 Carbon/Graphene ink Conductive ink market estimates & forecasts by region, 2021 - 2033

4.7.3 Carbon/Graphene ink Conductive ink market estimates & forecasts by region, 2021 - 2033

4.8 Others

4.8.1 Others Conductive ink market estimates & forecasts, 2021 - 2033

4.8.2 Others Conductive ink market estimates & forecasts by region, 2021 - 2033

4.8.3 Others Conductive ink market estimates & forecasts by region, 2021 - 2033

Chapter 5 Conductive Ink Market Application Outlook

5.1 Global Conductive ink market share by application, 2021 - 2033

5.2 Photovoltaic

5.2.1 Conductive ink market estimates & forecasts from Photovoltaic, 2021 - 2033

5.2.2 Conductive ink market estimates & forecasts from Photovoltaic by region, 2021 - 2033

5.3 Membrane switches

5.3.1 Conductive ink market estimates & forecasts from Membrane switches, 2021 - 2033

5.3.2 Conductive ink market estimates & forecasts from Membrane switches by region, 2021 - 2033

5.4 Displays

5.4.1 Conductive ink market estimates & forecasts from Displays, 2021 - 2033

5.4.2 Conductive ink market estimates & forecasts from Displays by region, 2021 - 2033

5.5 Automotive

5.5.1 Conductive ink market estimates & forecasts from Automotive, 2021 - 2033

5.5.2 Conductive ink market estimates & forecasts from Automotive by region, 2021 - 2033

5.6 Smart packaging

5.6.1 Conductive ink market estimates & forecasts from Smart packaging, 2021 - 2033

5.6.2 Conductive ink market estimates & forecasts from Smart packaging by region, 2021 - 2033

5.7 Biosensors

5.7.1 Conductive ink market estimates & forecasts from Biosensors, 2021 - 2033

5.7.2 Conductive ink market estimates & forecasts from Biosensors by region, 2021 - 2033

5.8 Printed circuit boards

5.8.1 Conductive ink market estimates & forecasts from Printed circuit boards, 2021 - 2033

5.8.2 Conductive ink market estimates & forecasts from Printed circuit boards by region, 2021 - 2033

5.9 Other application

5.9.1 Conductive ink market estimates & forecasts from Other application, 2021 - 2033

5.9.2 Conductive ink market estimates & forecasts from Other application by region, 2021 - 2033

Chapter 6 Conductive Ink Market Regional Outlook

6.1 Global Conductive ink market share by region, 2021 & 2033

6.2 North America

6.2.1 North America Conductive ink market estimates and forecast, 2021 - 2033

6.2.2 North America Conductive ink market estimates and forecast, by product 2021 - 2033

6.2.3 North America Conductive ink market estimates and forecast, by application 2021 - 2033

6.2.4 U.S.

6.2.4.1 U.S. Conductive ink market estimates and forecast, 2021 - 2033

6.2.4.2 U.S. Conductive ink market estimates and forecast, by product 2021 - 2033

6.2.4.3 U.S. Conductive ink market estimates and forecast, by application 2021 - 2033

6.3 Europe

6.3.1 Europe Conductive ink market estimates and forecast, 2021 - 2033

6.3.2 Europe Conductive ink market estimates and forecast, by product 2021 - 2033

6.3.3 Europe Conductive ink market estimates and forecast, by application 2021 - 2033

6.3.4 Germany

6.3.4.1 Germany Conductive ink market estimates and forecast, 2021 - 2033

6.3.4.2 Germany Conductive ink market estimates and forecast, by product 2021 - 2033

6.3.4.3 Germany Conductive ink market estimates and forecast, by application 2021 - 2033

6.3.5 U.K.

6.3.5.1 U.K. Conductive ink market estimates and forecast, 2021 - 2033

6.3.5.2 U.K. Conductive ink market estimates and forecast, by product 2021 - 2033

6.3.5.3 U.K. Conductive ink market estimates and forecast, by application 2021 - 2033

6.3.6. France

6.3.6.1 France Conductive ink market estimates and forecast, 2021 - 2033

6.3.6.2 France Conductive ink market estimates and forecast, by product 2021 - 2033

6.3.6.3 France Conductive ink market estimates and forecast, by application 2021 - 2033

6.4 Asia Pacific

6.4.1 Asia Pacific Conductive ink market estimates and forecast, 2021 - 2033

6.4.2 Asia Pacific Conductive ink market estimates and forecast, by product 2021 - 2033

6.4.3 Asia Pacific Conductive ink market estimates and forecast, by application 2021 - 2033

6.4.4 China

6.4.4.1 China Conductive ink market estimates and forecast, 2021 - 2033

6.4.4.2 China Conductive ink market estimates and forecast, by product 2021 - 2033

6.4.4.3 China Conductive ink market estimates and forecast, by application 2021 - 2033

6.4.5 India

6.4.5.1 India Conductive ink market estimates and forecast, 2021 - 2033

6.4.5.2 India Conductive ink market estimates and forecast, by product 2021 - 2033

6.4.5.3 India Conductive ink market estimates and forecast, by application 2021 - 2033

6.4.6. Japan

6.4.6.1 Japan Conductive ink market estimates and forecast, 2021 - 2033

6.4.6.2 Japan Conductive ink market estimates and forecast, by product 2021 - 2033

6.4.6.3 Japan Conductive ink market estimates and forecast, by application 2021 - 2033

6.5 Middle East & Africa (MEA)

6.5.1 MEA Conductive ink market estimates and forecast, 2021 - 2033

6.5.2 MEA Conductive ink market estimates and forecast, by product 2021 - 2033

6.5.3 MEA Conductive ink market estimates and forecast, by application 2021 - 2033

6.6 Central & South America (CSA)

6.6.1 CSA Conductive ink market estimates and forecast, 2021 - 2033

6.6.2 CSA Conductive ink market estimates and forecast, by product 2021 - 2033

6.6.3 CSA Conductive ink market estimates and forecast, by application 2021 - 2033

6.6.4 Brazil

6.6.4.1 Brazil Conductive ink market estimates and forecast, 2021 - 2033

6.6.4.2 Brazil Conductive ink market estimates and forecast, by product 2021 - 2033

6.6.4.3 Brazil Conductive ink market estimates and forecast, by application 2021 - 2033

Chapter 7 Competitive Landscape

7.1 DuPont

7.1.1 Company Overview

7.1.2 Financial Performance

7.1.3 Product Benchmarking

7.1.4 Strategic Initiatives

7.2 Vorbeck Materials Corp.

7.2.1 Company Overview

7.2.2 Financial Performance

7.2.3 Product Benchmarking

7.2.4 Strategic Initiatives

7.3 Applied Nanotech Holdings, Inc.

7.3.1 Company Overview

7.3.2 Financial Performance

7.3.3 Product Benchmarking

7.4 Sun Chemical Corporation

7.4.1 Company Overview

7.4.2 Financial Performance

7.4.3 Product Benchmarking

7.5 PPG Industries, Inc.

7.5.1 Company Overview

7.5.2 Financial Performance

7.5.3 Product Benchmarking

7.5.4 Strategic Initiatives

7.6 Creative Materials, Inc.

7.6.1 Company Overview

7.6.2 Financial Performance

7.6.3 Product Benchmarking

7.6.4 Strategic Initiatives

7.7 Poly-Ink

7.7.1 Company Overview

7.7.2 Financial Performance

7.7.3 Product Benchmarking

7.8 Henkel Ag & Co. KgaA

7.8.1 Company Overview

7.8.2 Financial Performance

7.8.3 Product Benchmarking

7.8.4 Strategic Initiatives

7.9 PChem Associates, Inc.

7.9.1 Company Overview

7.9.2 Financial Performance

7.9.3 Product Benchmarking

7.10 Johnson Matthey Colour Technologies

7.10.1 Company Overview

7.10.2 Financial Performance

7.10.3 Product Benchmarking

7.11 Fujikura Ltd.

7.11.1 Company Overview

7.11.2 Financial Performance

7.11.3 Product Benchmarking

7.11.4 Strategic Initiatives

7.12 Heraeus Holding

7.12.1 Company Overview

7.12.2 Financial Performance

7.12.3 Product Benchmarking

7.12.4 Strategic Initiatives

7.13 Nagase America Corporation

7.13.1 Company Overview

7.13.2 Financial Performance

7.13.3 Product Benchmarking

7.13.4 Strategic Initiatives

7.14 Engineered Materials Systems

7.14.1 Company Overview

7.14.2 Financial Performance

7.14.3 Product Benchmarking

7.14.4 Strategic Initiatives

7.15 Epoxies, Etc

7.15.1 Company Overview

7.15.2 Financial Performance

7.15.3 Product Benchmarking

7.15.4 Strategic Initiatives

7.16 Voxel8

7.16.1 Company Overview

7.16.2 Financial Performance

7.16.3 Product Benchmarking

7.16.4 Strategic Initiatives

7.17 Methode Electronics

7.17.1 Company Overview

7.17.2 Financial Performance

7.17.3 Product Benchmarking

7.17.4 Strategic Initiatives

7.18 Novacentrix

7.18.1 Company Overview

7.18.2 Financial Performance

7.18.3 Product Benchmarking

7.18.4 Strategic Initiatives

7.19 Johnson Matthey

7.19.1 Company Overview

7.19.2 Financial Performance

7.19.3 Product Benchmarking

7.19.4 Strategic Initiatives