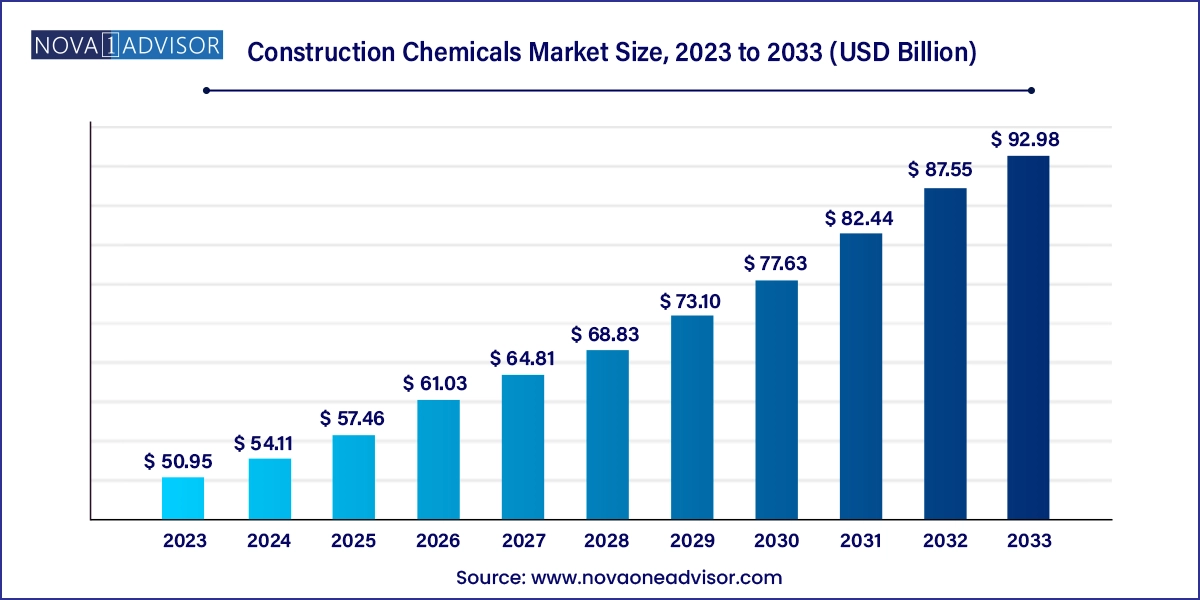

The construction chemicals market size was exhibited at USD 50.95 billion in 2023 and is projected to hit around USD 92.98 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 54.11 Billion |

| Market Size by 2033 | USD 92.98 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Germany; Italy; France; U.K.; China; India; Japan; South Korea; Brazil |

| Key Companies Profiled | Sika AG; Chembond Chemicals Ltd.; RPM International Inc.; Cera-Chem Private Limited.; MAPEI Corporation; Fosroc International Ltd.; Bostik; Inc.; H.B. Fuller; Henkel AG & Company; BASF SE; The Dow Chemical Company; Pidilite industries |

Growing infrastructural developments and rising demand, especially from Asia Pacific region, will propel the market growth in the coming years. The global market is expected to witness considerable growth on account of rising building and construction and other infrastructure activities. Furthermore, rapid urbanization in many developing regions would also boost market expansion over the forecast period. As the industry is highly affected by several regulations, major companies have been focusing on R&D activities to develop new bio-based products. The fluctuation of prices and supply of raw materials is likely to hinder market development. However, a growing number of residential and non-residential buildings and construction activities across the globe will drive the product demand over the forecast period.

Asia Pacific region was the largest consumer for construction chemicals globally. China and India are the major countries in this region accounting for more than 50% of the overall market size. The growth of this market is directly associated with the development of the construction industry. Thus, growing spending on infrastructure development is expected to drive the global market. The infrastructure spending in Europe is expected to grow at around 3% annually reaching USD 508 billion by 2033. This will also have a positive impact on market expansion.

The infrastructure spending in Latin America is expected to cross USD 550 billion by 2033. Countries such as Brazil, Chile, and Columbia account for most of the investments in this region. North America has always remained as the key region for the infrastructure industry. Infrastructure investments in the U.S. are expected to surpass USD 100 billion by 2023, while Canada will reach USD 16 billion in the same year.

The concrete admixture was the largest product segment with a share of 64.7% in 2023. Cement is the major binding material used in the construction industry. Concrete is created by mixing cement with crushed rocks (aggregate), sand, and water. Concrete admixtures are added to the concrete to obtain better finish and strength. Admixtures are basically used for reducing water content in concrete and enhance the durability. The major admixture types used are lingo-based admixtures, Sulfonated Naphthalene Formaldehyde (SNF), and Sulfonated Melamine Formaldehyde (SMF). Among these types, lingo-based admixtures were the first to be used in concrete.

Construction adhesives are expected to witness lucrative growth during the forecast period. They are made of high-quality materials. They enhance the durability and bonding span of adhesives. Adhesives are created using cement, epoxy, and polymer formulation. Cement-based adhesives are largely used in floor and wall tiles. They compose of water-resistant cement and polymer-modified cement, which is useful in internal and external applications. Epoxy adhesives are cold-curing adhesives, which are resistant to water, oil, alkalis, and many other solvents.

Protective coatings are used widely in new constructions and repair works. Protective coatings offer resistance from oil, acids, solvents, and other fuels. Epoxy, urethane, polyester, polyurea, are some of the major chemicals used in protective coatings. The protective coating products include water-borne, solvent-borne, and solvent-less coatings for floors, walls, and structural steel.

Construction chemicals are widely used in non-residential and infrastructure sectors, accounting for over 67.0% of the global volume in 2023. Non-residential & infrastructure are generally used in sealing purposes such as joints and cracks. In addition, the sealants are also used in proofing purposes to prevent the building from moisture, dust, and heat. Sealants are widely used in different commercial and residential applications.

Upcoming projects such as Panama Canal expansion is expected to foster the segment growth over the forecast period. Expansion of ultramodern offices and workspaces along with rapid urbanization and enhanced lifestyles has led to market growth.

The positive outlook towards housing sectors in emerging markets including China, India, South Africa, and Turkey along with Middle East countries is expected to fuel the market growth in the near future. Rising demand for single-family housing projects coupled with growing spending capacity of consumers in developing markets including Nigeria, Mozambique, and Zimbabwe would propel construction chemicals demand over the coming years.

Asia Pacific was the largest regional market for construction chemicals owing to the rapid expansion of the construction sector over the past few years. North America and Europe are relatively mature markets and are characterized by new product development and high preference for bio-based chemicals. Asia Pacific is expected to witness substantial growth over the forecast period on account of increasing investments in infrastructure development coupled with rising consumer disposable income levels.

The economies of South East Asian countries such as Indonesia, Philippines, and Malaysia are experiencing rapid economic growth, which is likely to have a positive impact on the construction industry. These countries are witnessing a strong demand for infrastructure projects, which, in turn, will fuel the demand for construction chemicals in Asia Pacific, thereby driving the regional market.

In Europe, the construction chemicals are driven by the growth of the construction industry. Western European countries, such as the U.K., Germany, the Netherlands, Germany, France, and others, are expected to have moderate growth during the forecast period. Economic policies and political policies in these countries are further expected to have a strong impact on the growth of the construction chemicals market.

Key construction chemical manufacturers include Sika AG, Chembond Chemicals Ltd., RPM International Inc., Cera-Chem Private Limited., MAPEI Corporation, Fosroc International Ltd., Bostik, Inc., H.B. Fuller, Henkel AG & Company, BASF SE, The Dow Chemical Company, and Pidilite industries among others.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the construction chemicals market

Product

End-use

Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Construction Chemicals Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million), (Volume in Kilotons)

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.4. Construction Chemicals Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Construction Chemicals Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Construction Chemicals Market: Product Movement Analysis, Volume in Kilotons, 2024 & 2033 (USD Million)

4.3. Admixture

4.3.1. Admixture Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

4.4. Adhesive

4.4.1. Adhesive Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

4.5. Sealants

4.5.1. Sealants Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

4.6. Coatings

4.6.1. Coatings Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

Chapter 5. Construction Chemicals Market: Application Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Construction Chemicals Market: Application Movement Analysis, Volume in Kilotons, 2024 & 2033 (USD Million)

5.3. Residential

5.3.1. Residential Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

5.4. Non-residential

5.4.1. Non-residential Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

Chapter 6. Construction Chemicals Market: Regional Estimates & Trend Analysis

6.1. Construction Chemicals Market Share, By Region, 2024 & 2033, Volume in Kilotons, USD Million,

6.2. North America

6.2.1. North America Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.2.2. U. S.

6.2.2.1. U. S. Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.2.3. Canada

6.2.3.1. Canada Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.3. Europe

6.3.1. Europe Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.3.2. UK

6.3.2.1. UK Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.3.3. Germany

6.3.3.1. Germany Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.3.4. France

6.3.4.1. France Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.3.5. Italy

6.3.5.1. Italy Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.3.6. Spain

6.3.6.1. Spain Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.4. Asia Pacific

6.4.1. Asia Pacific Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.4.2. China

6.4.2.1. China Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.4.3. India

6.4.3.1. India Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.4.4. Japan

6.4.4.1. Japan Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.4.5. Australia

6.4.5.1. Australia Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.4.6. Vietnam

6.4.6.1. Vietnam Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.4.7. Thailand

6.4.7.1. Thailand Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.4.8. Indonesia

6.4.8.1. Indonesia Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.4.9. Malaysia

6.4.9.1. Malaysia Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.5. Latin America

6.5.1. Latin America Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.5.2. Brazil

6.5.2.1. Brazil Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.5.3. Argentina

6.5.3.1. Argentina Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.5.4. Mexico

6.5.4.1. Mexico Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.6. Middle East and Africa

6.6.1. Middle East and Africa Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.6.2. Saudi Arabia

6.6.2.1. Saudi Arabia Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.6.3. UAE

6.6.3.1. UAE Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.6.4. Oman

6.6.4.1. Oman Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.6.5. Kuwait

6.6.5.1. Kuwait Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

6.6.6. Qatar

6.6.7. Qatar Construction Chemicals Market Estimates and Forecasts, 2021 - 2033 (USD Million), (Volume in Kilotons)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis by Key Market Participants

7.2. Company Categorization

7.3. Company Heat Map Analysis

7.4. Company Profiles

7.4.1. JSW

7.4.1.1. Participant’s Overview

7.4.1.2. Financial Performance

7.4.1.3. Product Benchmarking

7.4.1.4. Recent Developments/ Strategic Initiatives

7.4.2. MAPEI S.p.A.

7.4.2.1. Participant’s Overview

7.4.2.2. Financial Performance

7.4.2.3. Product Benchmarking

7.4.2.4. Recent Developments/ Strategic Initiatives

7.4.3. Sika AG

7.4.3.1. Participant’s Overview

7.4.3.2. Financial Performance

7.4.3.3. Product Benchmarking

7.4.3.4. Recent Developments/ Strategic Initiatives

7.4.4. Ashland

7.4.4.1. Participant’s Overview

7.4.4.2. Financial Performance

7.4.4.3. Product Benchmarking

7.4.4.4. Recent Developments/ Strategic Initiatives

7.4.5. 3M

7.4.5.1. Participant’s Overview

7.4.5.2. Financial Performance

7.4.5.3. Product Benchmarking

7.4.5.4. Recent Developments/ Strategic Initiatives

7.4.6. Arkema

7.4.6.1. Participant’s Overview

7.4.6.2. Financial Performance

7.4.6.3. Product Benchmarking

7.4.6.4. Recent Developments/ Strategic Initiatives

7.4.7. Evonik Industries

7.4.7.1. Participant’s Overview

7.4.7.2. Financial Performance

7.4.7.3. Product Benchmarking

7.4.7.4. Recent Developments/ Strategic Initiatives

7.4.8. Henkel AG & Co. KGaA

7.4.8.1. Participant’s Overview

7.4.8.2. Financial Performance

7.4.8.3. Product Benchmarking

7.4.8.4. Recent Developments/ Strategic Initiatives

7.4.9. Dow

7.4.9.1. Participant’s Overview

7.4.9.2. Financial Performance

7.4.9.3. Product Benchmarking

7.4.9.4. Recent Developments/ Strategic Initiatives

7.4.10. Thermax Limited.

7.4.10.1. Participant’s Overview

7.4.10.2. Financial Performance

7.4.10.3. Product Benchmarking

7.4.10.4. Recent Developments