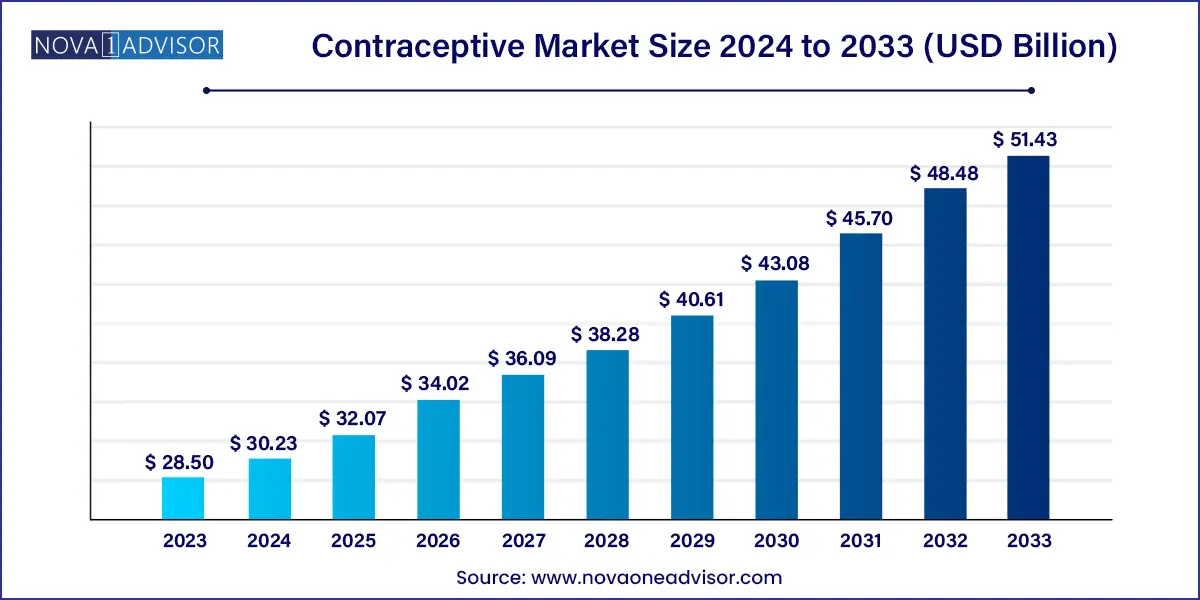

The global contraceptive market size was exhibited at USD 28.50 billion in 2023 and is projected to hit around USD 51.43 billion by 2033, growing at a CAGR of 6.08% during the forecast period of 2024 to 2033.

Key Takeaways:

Contraceptive Market: Overview

The contraceptive market plays a pivotal role in reproductive health and family planning by providing a range of options to prevent unintended pregnancies. This comprehensive overview examines key aspects of the contraceptive market, including market size, growth drivers, challenges, and emerging trends.

Contraceptive Market Growth

The growth of the contraceptive market is fueled by several key factors. Firstly, increasing awareness about family planning and reproductive health has led to greater acceptance and adoption of contraceptives among sexually active individuals worldwide. As individuals become more informed about their reproductive options, the demand for contraceptives continues to rise. Additionally, advancements in contraceptive technology have resulted in the development of more effective and user-friendly contraceptive methods, expanding the range of options available to consumers. Furthermore, government initiatives and public health campaigns aimed at promoting contraceptive use, particularly in low-income and underserved communities, have contributed to increased accessibility and affordability of contraceptives. Overall, these growth factors collectively drive the contraceptive market towards a positive trajectory, supporting reproductive health and family planning efforts globally.

Contraceptive Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 28.50 Billion |

| Market Size by 2033 | USD 51.43 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.08% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Bayer AG; China Resources Zizhu Pharmaceutical Co., Ltd. (CR Zizhu); Cupid Ltd.; Helm AG; Church & Dwight; Organon Group Of Companies; Pfizer Inc.; Viatris (Mylan); Abbvie, Inc.; Afaxys, Inc.; Agile Therapeutics; Janssen Pharmaceuticals, Inc.; Veru, Inc. |

Contraceptive Market Dynamics

In the contraceptive market, two significant dynamics shape the industry landscape. Firstly, changing social norms and attitudes towards family planning have a profound impact on market dynamics. As societal views evolve to embrace reproductive rights and gender equality, there is a growing acceptance of contraceptive use as a means of empowering individuals to make informed choices about their reproductive health. This shift in attitudes drives increased demand for contraceptives and fosters innovation in product development and marketing strategies to cater to diverse consumer preferences.

Secondly, regulatory landscape and government policies play a crucial role in shaping market dynamics. Regulatory agencies oversee the approval, marketing, and distribution of contraceptives, imposing standards to ensure safety, efficacy, and quality. Changes in regulatory requirements, such as product registration processes or labeling guidelines, can significantly impact market access and competitiveness for manufacturers. Moreover, government policies related to healthcare financing, reimbursement, and family planning initiatives influence market demand and accessibility of contraceptives, particularly in underserved regions. Navigating the complex regulatory environment requires strategic compliance efforts and proactive engagement with regulatory authorities to navigate market dynamics effectively.

Contraceptive Market Restraint

In the contraceptive market, two significant restraints stand out prominently. Firstly, cultural and religious barriers to contraceptive use pose a considerable obstacle to market growth. In many regions, societal norms and religious beliefs may discourage or prohibit the use of contraceptives, particularly among certain demographic groups. These cultural barriers can limit awareness, acceptance, and access to contraceptives, leading to lower adoption rates and market penetration. Overcoming cultural and religious barriers requires targeted education and awareness campaigns, as well as sensitivity to local customs and beliefs to promote reproductive health choices effectively.

Secondly, concerns about potential side effects and health risks associated with certain contraceptive methods serve as a significant restraint on market expansion. While contraceptives are generally safe and effective, some individuals may have reservations about using hormonal contraceptives due to perceived risks or adverse reactions. Additionally, misinformation or misconceptions about contraceptive methods may lead to reluctance or hesitancy among potential users. Addressing these concerns requires transparent communication, comprehensive education, and personalized counseling to help individuals make informed decisions about their contraceptive options. Furthermore, ongoing research and development efforts to improve the safety and tolerability of contraceptives can help alleviate concerns and enhance consumer confidence in the market.

Contraceptive Market Opportunity

In the contraceptive market, two significant opportunities emerge prominently. Firstly, the increasing focus on male contraceptives presents a promising opportunity for market expansion. While most contraceptive methods are targeted towards women, there is a growing demand for male-centric contraceptive options. Innovations in male contraceptives, such as male hormonal contraceptives or non-hormonal methods like reversible inhibition of sperm under guidance (RISUG), offer potential alternatives for couples seeking shared responsibility in family planning. Addressing this unmet need for male contraceptives can diversify the market and attract new consumer segments, driving growth and innovation in the industry.

Secondly, the rise of digital health technologies and telemedicine presents a significant opportunity for market players to enhance accessibility and convenience of contraceptives. Digital platforms offer solutions for virtual consultations, prescription services, and delivery of contraceptive products, overcoming barriers such as geographical distance or stigma associated with seeking reproductive health services in person. By leveraging digital health solutions, contraceptive providers can reach broader audiences, particularly younger generations accustomed to digital platforms, and streamline the delivery of contraceptive care. Investing in digital health infrastructure and partnerships with telemedicine providers can unlock new avenues for growth and improve patient access to contraceptives in the evolving healthcare landscape.

Contraceptive Market Challenges

In the contraceptive market, two significant challenges pose notable obstacles to growth. Firstly, inadequate access to contraceptives in underserved regions remains a critical challenge. Despite efforts to improve contraceptive availability and distribution, disparities persist in access to reproductive health services, particularly in low-income and rural areas. Limited healthcare infrastructure, lack of trained healthcare providers, and cultural barriers to contraceptive use contribute to unequal access and utilization rates. Addressing this challenge requires targeted interventions, such as expanding healthcare infrastructure, increasing education and awareness programs, and implementing innovative delivery models to reach marginalized populations effectively.

Secondly, affordability and cost barriers hinder contraceptive access for many individuals. While contraceptives are essential for reproductive health and family planning, out-of-pocket expenses can be prohibitive, especially for low-income households. Inadequate healthcare coverage and limited reimbursement for contraceptives in some regions further exacerbate affordability issues. High upfront costs for long-acting reversible contraceptives (LARCs) or contraceptive implants may deter individuals from choosing these highly effective methods. Overcoming affordability barriers requires collaborative efforts from policymakers, healthcare providers, and manufacturers to develop cost-effective solutions, such as subsidized pricing schemes, generic alternatives, or innovative financing mechanisms, to ensure equitable access to contraceptives for all individuals, regardless of socioeconomic status.

Segments Insights:

Product Insights

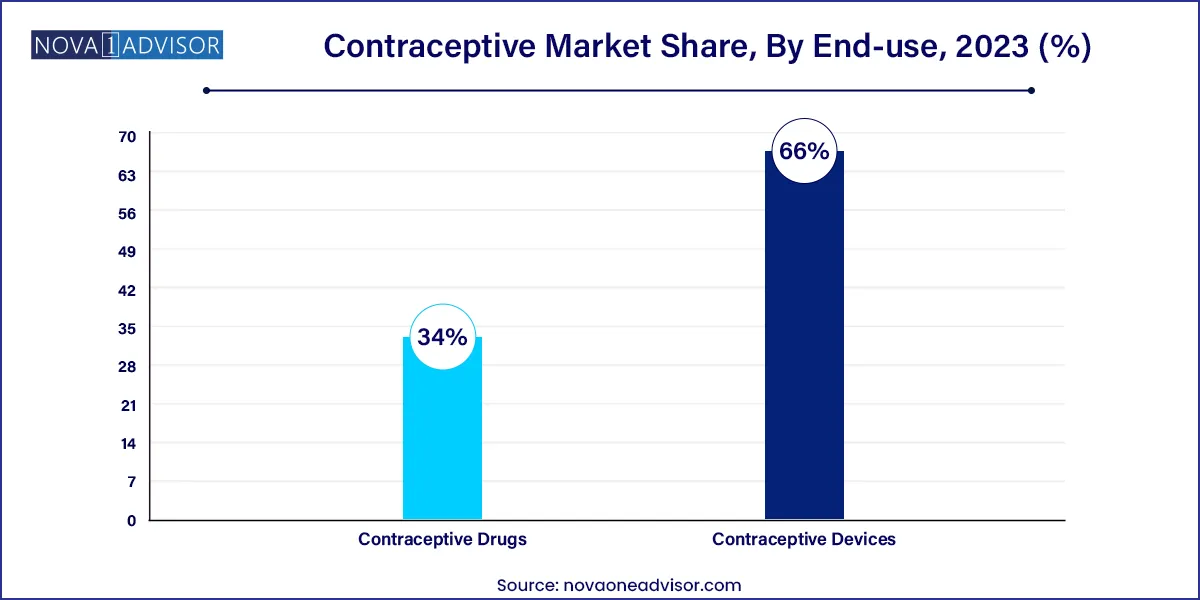

Based on products, the global industry has been segmented into contraceptive drugs and contraceptive devices. The contraceptive devices segment dominated the industry with the largest revenue share of more than 66.0% in 2023 and is expected to witness the highest growth with a CAGR of 7.12% over the forecast period. This is attributed to an increase in the awareness level of STDs and the efficiency of condoms to prevent infections, including HIV. In a recent study, subdermal implants have been identified to have an immense potential to meet the requirement of women for family planning. The contraceptive device segment is further sub-segmented into condoms, subdermal implants, IUDs, vaginal rings, and diaphragms.

The condoms segment held the largest share in 2023 owing to the rising demand in the regions of Europe and the Asia Pacific. The growth can also be attributed to the demand from the public sector source. According to the Family Planning Report 2023 report, around 378.1 million units of condoms were supplied by the Department of Health & Family Welfare in India. The contraceptive drugs segment is expected to witness lucrative growth during the forecast period. The segment is further sub-segmented into contraceptive pills, patches, and injectables. The contraceptive pill segment held the largest share of the segment in 2023.

The growth is attributed to the increased procurement volumes by public-sector organizations. As per the Family Planning 2023 report by Clinton Health Access Initiative, the market volumes for contraceptive pills including combined hormonal contraceptive and progestin-only pills accounted for around 201 million FP2020 market volumes. These pills are more affordable compared to contraceptive devices. As per the article published in The Lancet, around 14.8% of the total contraceptive prevalence in 2019 was attributed to contraceptive pills.

Regional Insights

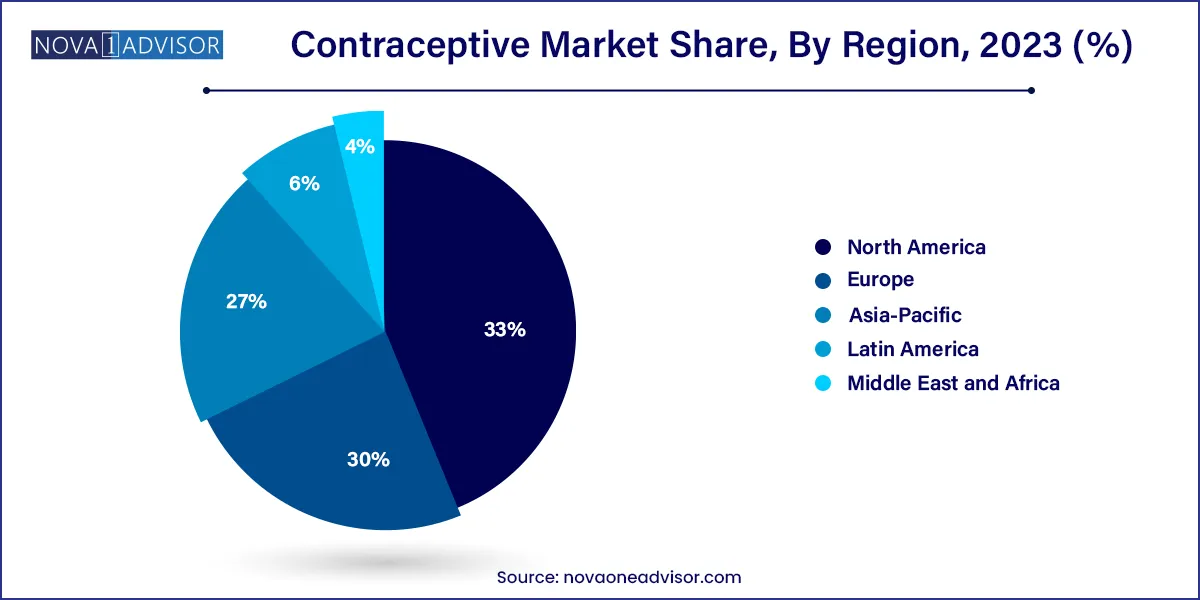

North America dominated the global industry in 2023 with the maximum revenue share of more than 33.0% and is expected to maintain its position throughout the forecast period owing to the high incidence of abortion, rising population of women within the age group of 15-44 years, and high patient awareness levels in the region. The launch of generic and low-cost drugs and devices has also led to an increase in the demand for contraceptives by teenagers. In April 2023, Reckitt Benckiser launched a new condom category, Durex Intense. Asia Pacific is projected to witness the fastest CAGR during the forecast period.

The growth can be attributed to the rising number of government initiatives, growing demand for population control, and a decrease in the unintended pregnancy rate. According to the Center for Reproductive Rights, around 53.8 million unintended pregnancies occur every year in Asia, and around 65% of those are abortion cases. The contraception prevalence rate among married adolescents in Asia is around 41%. Europe held a significant market share in 2023 due to suitable reimbursement scenarios for the use of contraceptives.

According to the Center for Reproductive Rights, Access to Contraceptives in European Union Report, in Germany, IUDs, emergency contraception, and hormonal contraceptives with a prescription are covered under the mandatory health insurance scheme for females under the age of 18. There is a 10% co-payment for women aged 18 to 19 years of age with a capped value of 10 euros per prescription. Contraceptives are covered under the scheme for women aged 20 years and above when intended for other reasons apart from the prevention of pregnanc

Some of the prominent players in the contraceptive market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global contraceptive market.

Product

By Region