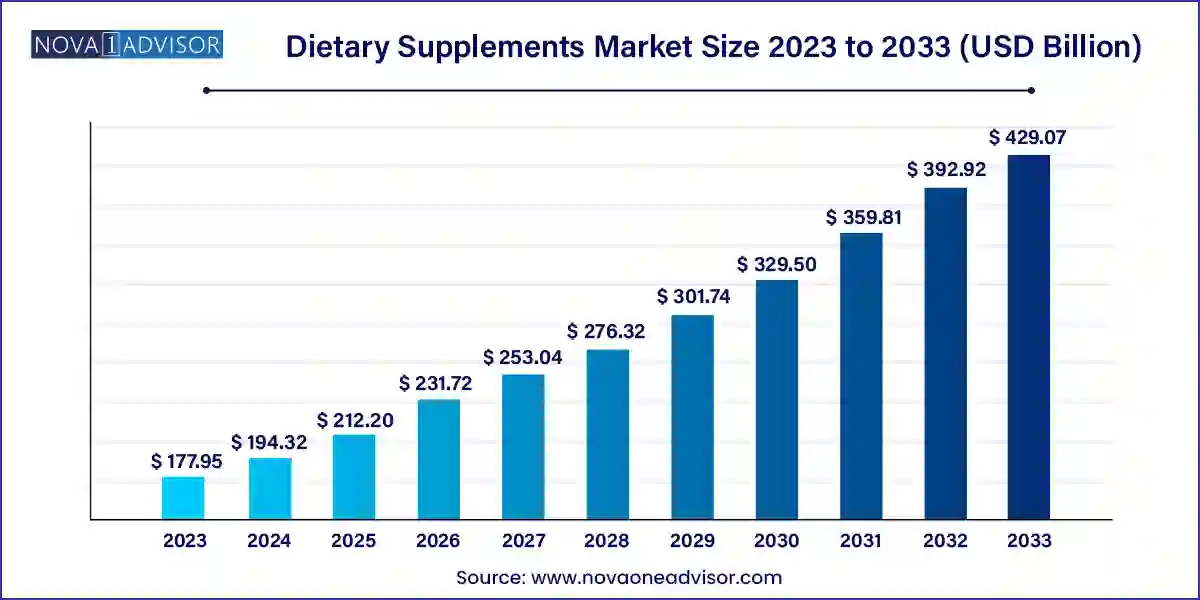

The dietary supplements market size was exhibited at USD 177.95 billion in 2023 and is projected to hit around USD 429.07 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2024 to 2033.

The global dietary supplements market has transformed dramatically over the last decade, emerging as one of the most dynamic segments within the broader health and wellness industry. Fueled by growing consumer awareness about nutrition, preventive healthcare, and chronic disease management, dietary supplements have transitioned from niche products to mainstream daily essentials. These products, which include vitamins, minerals, botanicals, amino acids, probiotics, and more, are formulated to bridge nutritional gaps, enhance physical and mental well-being, and support medical therapies.

The rise of the wellness-conscious consumer, particularly in urban environments, has driven demand for personalized nutrition solutions. Aging populations, increased life expectancy, and the burden of non-communicable diseases have reinforced the importance of supplementation. In emerging markets, rising disposable incomes and the Westernization of diets have also played significant roles in adoption. Moreover, the COVID-19 pandemic in 2020 acted as a catalyst, accelerating market growth as immunity-boosting supplements saw a dramatic rise in consumption across demographics.

With scientific advancements, product diversification, and the expansion of e-commerce, the dietary supplements market is evolving rapidly. Consumers now demand clean-label, plant-based, allergen-free, and sustainable options, prompting manufacturers to innovate and reformulate. Strategic partnerships, mergers, and regulatory changes are further shaping the competitive landscape. As we progress into the next decade, the market shows promising growth potential with an increased focus on personalized nutrition and technological integration.

Personalized Nutrition and DNA-Based Supplements: Companies are leveraging genomics and AI to tailor supplements based on individual health profiles, DNA, and microbiome analysis.

Clean Label and Plant-Based Alternatives: Consumers are seeking vegan, organic, gluten-free, and non-GMO supplement options, pushing brands to reformulate using natural ingredients.

E-commerce and D2C Boom: Online channels, especially direct-to-consumer platforms, are witnessing exponential growth, providing convenience, subscription models, and real-time consultation services.

Functional Gummies and Novel Formats: Traditional tablets and capsules are giving way to gummies, soft chews, oral strips, and effervescent powders that improve palatability and adherence.

Focus on Mental Health and Cognitive Wellness: With rising stress levels, supplements targeting anxiety, sleep disorders, and cognitive enhancement are gaining traction, especially among millennials and professionals.

Immunity and Gut Health Convergence: Post-pandemic, the synergy between immune health and gut microbiome balance has led to increased consumption of probiotics, prebiotics, and postbiotics.

Tech-Enabled Diagnostics and Supplement Integration: Wearables and health tracking devices are being integrated with supplement recommendations to offer real-time, data-driven nutrition support.

Men's and Women's Health Focus: Tailored supplements for menopause, prenatal care, sexual health, and hormonal balance are becoming more specialized and gender-specific.

| Report Coverage | Details |

| Market Size in 2024 | USD 194.32 Billion |

| Market Size by 2033 | USD 429.07 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Ingredient, Form, Application, End user, Type, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

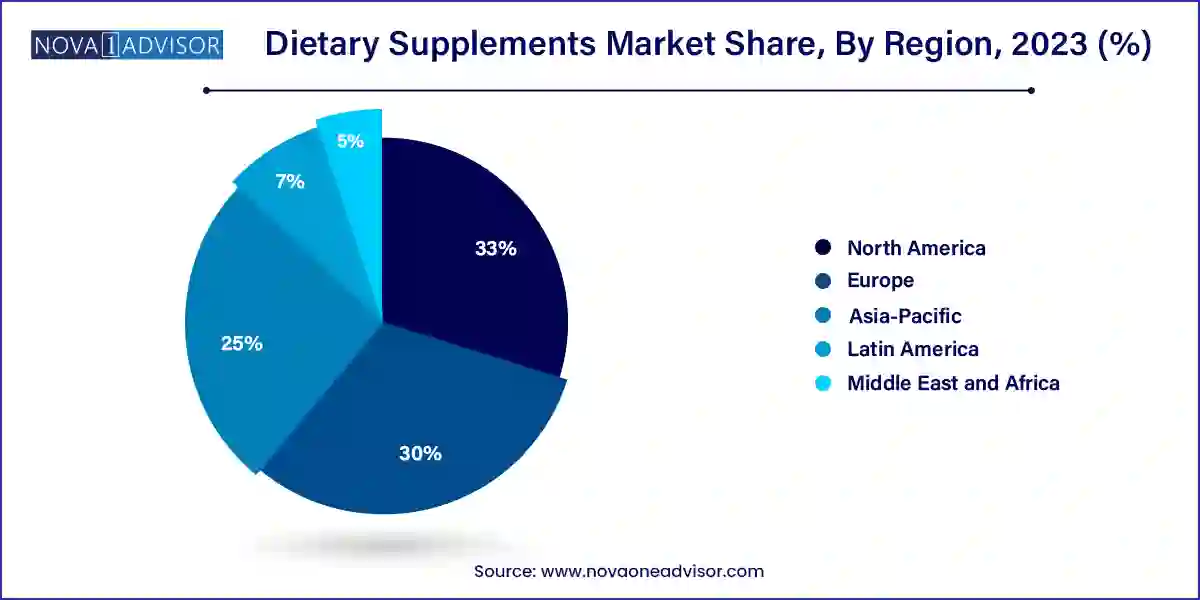

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Key Companies Profiled | Amway Corp., Abbott, Bayer AG, Glanbia plc, Pfizer Inc., Archer Daniels Midland, NU SKIN, GlaxoSmithKline plc., Herbalife Nutrition Ltd., Nature's Sunshine Products, Inc., XanGo, LLC, RBK Nutraceuticals Pty Ltd, American Health, DuPont de Nemours, Inc., Good Health New Zealand, Nature's Bounty, NOW Foods |

A key driver accelerating the dietary supplements market is the rising global awareness around preventive healthcare. Consumers are shifting from reactive to proactive health management, focusing on disease prevention rather than treatment. This shift is particularly visible in aging populations concerned with bone density, cardiac health, and cognitive function, as well as young adults adopting supplements for fitness, energy, and stress management.

Chronic lifestyle diseases such as obesity, diabetes, and cardiovascular conditions have become more prevalent, prompting consumers to complement diets with scientifically-backed supplements. Government-led awareness campaigns and public health recommendations have also fueled this trend. The success of this driver is evidenced by the increased retail shelf space for functional foods and nutraceuticals in pharmacies and supermarkets globally.

A significant restraint in the dietary supplements market is the absence of harmonized global regulations and inconsistent quality control measures. Unlike pharmaceutical drugs, which undergo rigorous testing and approval, dietary supplements often fall into a regulatory grey area. This ambiguity leads to variations in product efficacy, safety, labeling, and claims across countries.

For instance, a supplement considered safe and effective in the U.S. may require different formulations or may even be banned in the EU or Japan. Furthermore, cases of contamination, mislabeling, or the inclusion of unapproved substances have damaged consumer trust. The lack of mandatory clinical trials for many supplements also makes it difficult for healthcare providers to recommend them confidently. Until global frameworks for evaluation and approval are standardized, market expansion may face regulatory bottlenecks and consumer skepticism.

A promising opportunity lies in the rapid expansion of dietary supplements across emerging economies, particularly in Asia-Pacific, Latin America, and Africa. As urbanization accelerates and middle-class incomes rise, consumers in these regions are becoming more health-conscious. Moreover, traditional herbal medicine is gaining validation through scientific research, creating bridges between conventional and modern supplementation.

Additionally, there's a strong growth opportunity in demographic-specific product development. For example, tailored supplements for infants, pregnant women, post-menopausal women, or the geriatric population are increasingly in demand. By combining demographic intelligence with cultural dietary needs, companies can develop hyper-targeted products that resonate with specific consumer groups. This opens doors for innovation, brand loyalty, and long-term engagement in untapped markets.

Vitamins dominated the ingredient segment due to their wide applicability across all age groups and health goals. Vitamin D, B-complex, Vitamin C, and multivitamins are consumed for general wellness, immunity boosting, and bone health. During the COVID-19 pandemic, Vitamin C and D witnessed an unprecedented spike in demand, driven by their reported roles in immune system support. These supplements are affordable, easily available, and well-understood by consumers, making them a cornerstone of daily nutrition regimens globally.

Probiotics are the fastest-growing segment, largely due to the growing evidence linking gut microbiota with multiple health outcomes including mental well-being, immunity, and metabolic regulation. Functional foods containing probiotics are gaining traction alongside capsule-based formats. The Asia-Pacific region, particularly Japan and South Korea, has been a key driver in this segment, with fermented foods and beverages forming a cultural foundation. With rising consumer interest in holistic health and digestion, probiotics are projected to witness double-digit growth.

Tablets currently dominate the form segment, accounting for a substantial share owing to their stability, long shelf life, and easy production. Tablets are often cost-effective and can incorporate a wide variety of ingredients in a compact form. They are also the preferred form in clinical or prescription-based supplement use. Many consumers trust tablets due to their pharmaceutical-like appeal and consistent dosage.

Gummies are the fastest-growing form, especially among millennials, children, and individuals who experience difficulty swallowing pills. Gummy supplements are not only palatable but are also viewed as fun and less medicinal. Multivitamin and melatonin gummies have been particularly successful. This format is also being extended to include botanicals and omega fatty acids. With brands introducing sugar-free and vegan options, gummies are poised to revolutionize supplement adherence.

General Health remains the leading application segment, encompassing supplements that support daily wellness, energy, and nutritional balance. Multivitamins, omega-3s, and adaptogenic herbs are commonly used in this category. As consumers seek to maintain vitality in increasingly stressful urban lifestyles, this broad-spectrum segment continues to attract strong demand across all demographics.

Immunity is the fastest-growing application, particularly since the global pandemic raised public concern about immune resilience. Products containing Vitamin C, zinc, echinacea, elderberry, and probiotics have been flying off shelves. Even post-pandemic, immunity remains a top concern, especially with the rise in viral and lifestyle diseases. Brands are combining traditional immune boosters with cutting-edge science to create innovative blends that continue to capture attention.

Adults constitute the dominant end-user group, forming the backbone of the market. This segment includes young professionals, fitness enthusiasts, and individuals managing health conditions like cholesterol, blood pressure, or mental stress. With widespread access to information and disposable income, adults are more likely to self-prescribe and experiment with supplements to enhance performance, appearance, and immunity.

Pregnant women and geriatric populations are the fastest-growing segments, driven by their specific nutritional needs. Prenatal supplements rich in folic acid, iron, DHA, and calcium are in high demand due to increasing awareness of maternal health. Similarly, aging populations are seeking solutions for joint support, bone density, cognitive health, and cardiovascular wellness. Customized packs and medical recommendations are helping drive consumption in these categories.

Over-the-counter (OTC) supplements dominate due to their wide accessibility, affordability, and consumer-friendly nature. Available in pharmacies, supermarkets, and online platforms, OTC supplements cater to general wellness and are largely self-administered. This market is also more receptive to innovation in flavors, packaging, and branding.

Prescribed supplements are growing rapidly, particularly in clinical nutrition and therapeutic support areas like prenatal health, post-surgery recovery, and chronic disease management. As doctors become more open to integrative healthcare models, prescriptions for omega-3s, B12, and vitamin D are increasing in clinical settings. Regulatory approvals for nutraceuticals as adjunct therapies are further boosting this segment.

Offline channels dominate the distribution channel, especially through pharmacies/drugstores and hypermarkets/supermarkets. These outlets benefit from consumer trust, availability of consultation, and immediate product access. Pharmacists often recommend supplements, making them a key influence point for consumer decisions.

Online channels are the fastest-growing, spurred by convenience, home delivery, bulk purchasing options, and personalization features. The rise of health-focused e-commerce sites and mobile apps enables consumers to read reviews, consult nutritionists, and receive subscription-based services. Direct-to-consumer brands are leveraging influencer marketing and AI-based diagnostics to engage younger tech-savvy buyers.

North America continues to dominate the dietary supplements market, driven by a confluence of high consumer awareness, developed healthcare infrastructure, and strong distribution networks. The U.S. leads in terms of both consumption and innovation, with a mature regulatory framework under the FDA’s Dietary Supplement Health and Education Act (DSHEA). The presence of global giants like Amway, Herbalife, and GNC further strengthens market dynamics. Additionally, digital health trends and fitness culture have led to increased uptake of supplements among urban professionals and aging populations. Subscription models and health tech integration make this market sophisticated and highly competitive.

Asia-Pacific is the fastest-growing regional market, reflecting changing lifestyles, rising middle-class wealth, and increasing awareness of nutritional wellness. Countries like China and India are experiencing rapid urbanization, leading to dietary shifts and higher prevalence of micronutrient deficiencies. Local players are tapping into traditional medicinal knowledge such as Ayurveda and Traditional Chinese Medicine (TCM) to create hybrid supplements that resonate culturally. Japan and South Korea are leading innovation with probiotics and beauty-from-within products. Government initiatives for malnutrition reduction and women’s health are further propelling demand.

January 2025: Nestlé Health Science acquired a majority stake in Orgain, a plant-based protein supplement company, to strengthen its portfolio in clean-label nutrition.

November 2024: Herbalife launched a new line of immunity-boosting gummies in North America and Europe, including formulations with elderberry, zinc, and vitamin C.

August 2024: GNC partnered with Amazon to offer AI-powered personalized supplement recommendations through voice and chatbot interfaces.

June 2024: Amway India announced the launch of Nutrilite Traditional Herbs range, blending Ayurveda with modern extraction technologies.

April 2024: Pharmavite invested $100 million to expand its gummy production facility in Ohio, reflecting surging demand for alternative supplement formats.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the dietary supplements market

Ingredient

Form

Application

End User

Type

Distribution Channel

Regional