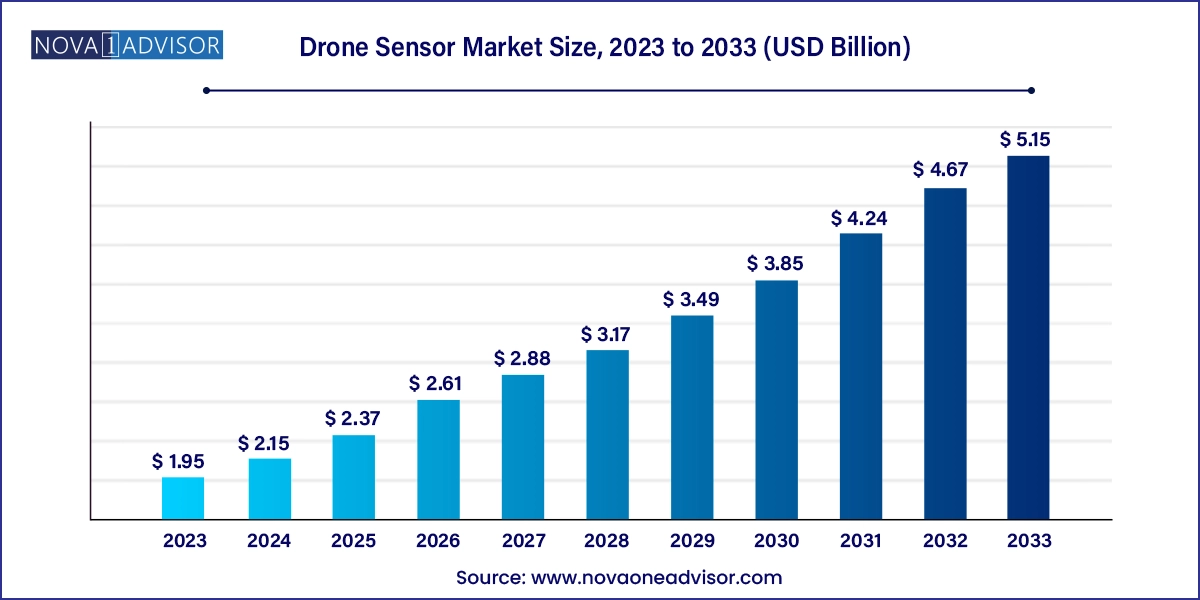

The drone sensor market size was exhibited at USD 1.95 billion in 2023 and is projected to hit around USD 5.15 billion by 2033, growing at a CAGR of 10.2% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.15 Billion |

| Market Size by 2033 | USD 5.15 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Sensor Type, Platform Type, Application, Technology, End user, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

| Key Companies Profiled | ams-OSRAM AG; Bosch Sensortec GmbH; InvenSense; KVH Industries, Inc.; LeddarTech Holdings Inc.; RTX; Sentera; Sony Semiconductor Solutions Group; Sparton; TE Connectivity; Teledyne FLIR LLC; Trimble Inc. |

The rising demand for high-resolution drones with advanced capabilities is significantly impacting the market. As industries seek enhanced data collection capabilities, sensors that offer improved accuracy, reliability, and real-time data processing are becoming essential. This trend is particularly evident in sectors like agriculture, where precision farming techniques require detailed aerial data for optimizing crop yields and resource utilization.

Consequently, manufacturers are investing in the development of sophisticated sensors that can meet these growing needs, incorporating features such as multispectral imaging and hyperspectral sensing. The integration of advanced technologies, such as artificial intelligence and machine learning, is further enhancing the capabilities of drone sensors, enabling them to analyze data more efficiently and make informed decisions.

The increasing demand for precision agriculture is driving the adoption of drone sensors equipped with specialized imaging technologies. Farmers are leveraging drones to monitor crop health, assess soil conditions, detect pests and diseases, and optimize resource usage, all of which require advanced sensing capabilities. This trend not only enhances agricultural productivity but also promotes sustainable farming practices by reducing waste and minimizing environmental impact. As a result, the market for drone sensors tailored for agricultural applications is expected to expand rapidly, with a focus on developing sensors that can capture multispectral and thermal data to provide a comprehensive view of crop conditions. The integration of AI and machine learning algorithms is enabling drones to identify patterns, predict crop yields, and make data-driven decisions to optimize farming practices.

The growing adoption of drones in security and surveillance applications is another key trend shaping the market. Organizations are increasingly utilizing drones equipped with high-definition cameras, thermal imaging sensors, and radar systems for monitoring and reconnaissance purposes. This shift is driven by the need for enhanced security measures in both urban and rural settings, as well as the growing demand for efficient and cost-effective surveillance solutions. Consequently, the demand for sophisticated sensors that can operate in various conditions, including low light and adverse weather, is on the rise. The integration of AI and machine learning algorithms is enabling drones to detect and track suspicious activities, identify potential threats, and alert authorities in real-time. This trend is expected to continue as the demand for advanced security solutions increases across various sectors, including law enforcement, border patrol, and critical infrastructure protection.

One of the key trends in the drone sensor market is the rapid expansion of drones in the commercial sector. Businesses are increasingly adopting drone technology for tasks such as aerial photography, infrastructure inspection, and environmental monitoring. This growth is driven by the need for cost-effective and efficient solutions in various industries. As commercial applications continue to evolve, the demand for advanced sensors that can support these functions is expected to rise significantly.

The image sensor segment dominated the market in 2023 with a share of around 32%. The integration of AI and ML with image sensors is transforming drones into intelligent machines capable of making real-time decisions. These technologies allow drones to analyze images as they are captured, identify objects, track movements, and even predict behavior. This capability is crucial for applications in surveillance, where drones need to autonomously follow targets or monitor large areas. AI-powered image sensors are also being used in search and rescue missions, where quick identification of people or hazards can save lives. The combination of AI and advanced image sensors is setting the stage for a new era of autonomous drone operations across various sectors.

The inertial sensor segment is estimated to have a significant CAGR from 2024 to 2033. Continuous advancements in sensor technology are enhancing the performance and capabilities of inertial sensors. Improved algorithms and data fusion techniques are enabling more accurate and reliable navigation solutions, further propelling market growth. The development of miniaturized and low-power inertial sensors is also contributing to the integration of these technologies into smaller and more versatile drones. As manufacturers continue to push the boundaries of sensor performance, the inertial sensor segment is expected to benefit from increased adoption and integration into drone platforms. These advancements are crucial for expanding the operational capabilities of drones and addressing the evolving needs of various industries.

The Vertical Take-Off and Landing (VTOL) segment held the largest revenue share in 2023, VTOL drones demand sophisticated navigation and control systems due to their dual flight modes. Sensors like IMUs, GPS, and barometers are becoming more advanced to ensure precise transitions between vertical and horizontal flight. This precision is crucial for maintaining stability, especially in challenging environments. The trend towards enhanced navigation systems is enabling VTOL drones to safely perform complex missions in various industries.

The hybrid segment is estimated to register the fastest CAGR from 2024 to 2033. Hybrid drones are increasingly being equipped with a diverse range of sensors, including Lidar, multispectral, and thermal imaging, to enhance their multi-mission capabilities. These advanced sensor suites enable hybrid drones to gather detailed data for applications like precision agriculture, environmental monitoring, and infrastructure inspection. The trend towards sensor integration is making hybrid drones more capable and efficient, allowing them to perform complex tasks with greater accuracy. This capability is particularly valuable in industries that require high-quality data collection over large and diverse areas.

The navigation segment held the largest revenue share in 2023. The integration of multiple sensors, including inertial measurement units (IMUs), magnetometers, and barometers, is becoming standard practice to create more robust navigation systems. Sensor fusion combines data from these different sensors to provide more accurate and reliable navigation, especially in GPS-denied environments. This trend is particularly important for drones operating indoors, underground, or in areas with weak satellite signals. By leveraging sensor fusion, drones can maintain stable and precise navigation even in complex or obstructed environments, expanding their operational capabilities.

The data acquisition segment is estimated to register the fastest CAGR from 2024 to 2033. The demand for high-resolution sensors is rising as industries seek more detailed and accurate data from drones. These sensors, including high-definition cameras, Lidar, and multispectral sensors, are critical for applications such as precision agriculture, environmental monitoring, and infrastructure inspection. The trend towards higher resolution data acquisition is driven by the need for more precise and actionable insights. As a result, drone manufacturers are increasingly integrating advanced sensors to meet these demands, allowing for more detailed analysis and decision-making.

The remotely operated segment held the highest revenue share in 2023. The remotely operated segment is experiencing increased demand for surveillance and security applications, particularly in urban areas and critical infrastructure. Organizations are utilizing drones for real-time monitoring and threat detection, which enhances situational awareness and response capabilities. This trend is driven by the need for improved security measures in both public and private sectors. As concerns over safety and security grow, the adoption of remotely operated drones for surveillance purposes is expected to rise.

The fully autonomous segment is estimated to register the fastest CAGR from 2024 to 2033. Fully autonomous drones are increasingly relying on advanced AI algorithms for real-time navigation and decision-making. These systems process data from various sensors, such as cameras, Lidar, and radar, to navigate complex environments and make autonomous decisions during flight. The trend towards AI integration is enhancing the capabilities of fully autonomous drones, allowing them to perform tasks such as obstacle avoidance, route optimization, and dynamic mission planning without human input. This is particularly important in industries like logistics, where efficiency and reliability are critical.

The military segment held the highest revenue share in 2023. There is a notable trend towards the adoption of autonomous and semi-autonomous drones in military operations. These systems can execute missions with minimal human intervention, reducing risks to personnel and increasing mission success rates. The development of sophisticated algorithms for navigation, target recognition, and obstacle avoidance is driving this trend. As militaries seek to enhance operational efficiency and reduce costs, the demand for autonomous drone systems is expected to rise significantly.

The consumer segment is estimated to register the fastest CAGR from 2024 to 2033. One of the primary growth drivers for the consumer segment is the increasing demand for aerial photography and videography. Drones equipped with high-resolution image sensors and stabilization technology are becoming popular tools for capturing stunning visuals from unique perspectives. This trend is particularly evident among social media influencers, content creators, and hobbyists who seek to enhance their photography and videography skills. As more individuals recognize the creative potential of drones, the demand for consumer-grade drones with advanced imaging capabilities is expected to rise.

The drone sensor market in North America accounted for a revenue share of nearly 40% in 2023. In North America, the market is significantly propelled by the rising use of drones in military and defense applications, as well as in precision agriculture, where advanced sensor technologies are essential for optimizing productivity and operational efficiency.

U.S. Drone Sensor Market Trends

The drone sensor market in the U.S. is anticipated to grow at a CAGR of around 8% from 2024 to 2033. The U.S. market is experiencing steady growth, driven by the increasing adoption of drones in commercial and industrial applications. Advancements in sensor technology, such as high-resolution cameras and Lidar, are enhancing the capabilities of drones, making them more effective for tasks like infrastructure inspection, agriculture, and emergency response.

Europe Drone Sensor Market Trends

The drone sensor market in Europe accounted for a notable revenue share in 2023. The market growth is supported by advancements in regulatory frameworks that aim to ensure safe and compliant drone operations. This includes developing standards for sensor accuracy and data security to meet stringent European regulations. As regulations evolve, they are facilitating the broader adoption of drones across various sectors.

Asia Pacific Drone Sensor Market Trends

The drone sensor market in Asia Pacific is anticipated to grow at the fastest CAGR of over 11% from 2024 to 2033. The Asia Pacific region is seeing a surge in investments in smart city initiatives, with drones playing a crucial role in urban planning and infrastructure management. Advanced sensors are being utilized for tasks such as traffic monitoring, infrastructure inspection, and environmental data collection, supporting the development of more efficient and sustainable urban environments.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the drone sensor market

Sensor Type

Platform Type

Application

Technology

End User

Regional