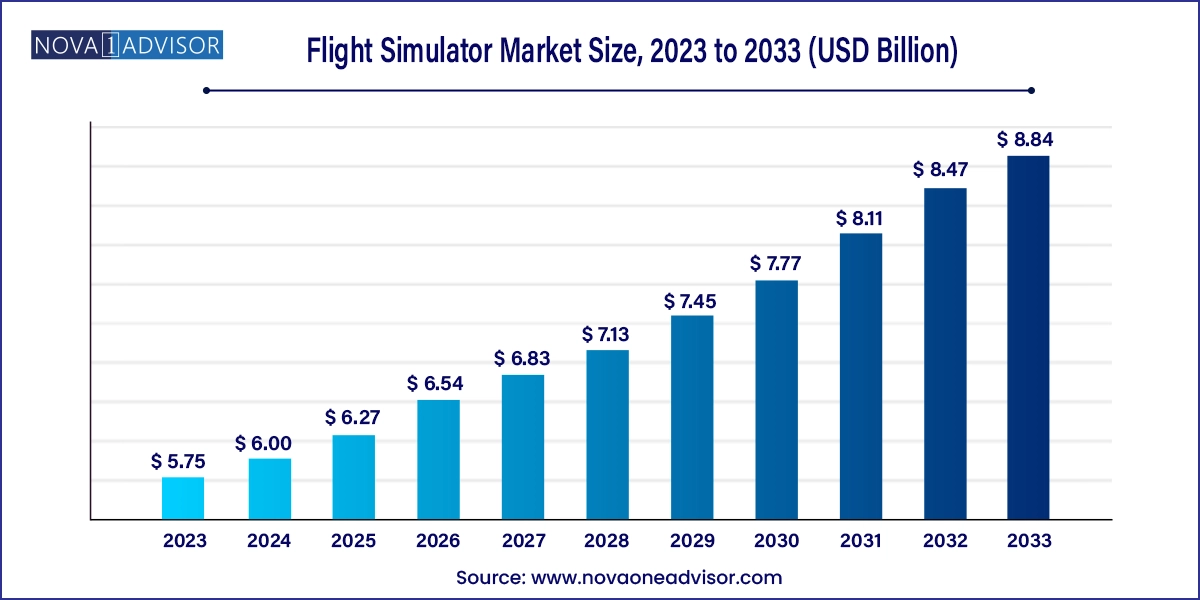

The global flight simulator market size was exhibited at USD 5.75 billion in 2023 and is projected to hit around USD 8.84 billion by 2033, growing at a CAGR of 4.4% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.00 Billion |

| Market Size by 2033 | USD 8.84 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Leonardo S.p.A.; Boeing; CAE Inc.; AIRBUS; The DiSTI Corporation; Fidelity Technologies Corporation; Havelsan Air Electronic Industry; Kratos Defense & Security Solutions, Inc.; L3Harris Technologies, Inc.; Lockheed Martin Corporation; Meggitt PLC; Collins Aerospace; Saab AB; Teledyne Brown Engineering; Thales; VirTra, Inc. |

The benefits offered by flight simulator devices include mission-critical training programs that ensure effective aircraft operation, low operational costs, and visual systems. These benefits offer near real-world experience and are anticipated to create new growth avenues for market growth over the next few years. Rising demand for better and more effective pilot training is anticipated to catapult growth. The growing importance of aircraft safety and the need for substantial training is anticipated to spur demand over the forecast period.

The need for flight handling and safety operations, such as situational awareness and skill competency, promotes industry growth. The industry is witnessing unprecedented R&D efforts in aerospace technology and technological advancements, resulting in the development of highly advanced flight simulators. These products offer high efficiency and can save fuel costs. Additionally, advancements in computing technology have significantly resulted in the incorporation of better visual and motion systems for enhanced fidelity and smoothness, which is also anticipated to drive the market flight simulators market over the forecast period.

High manufacturing costs coupled with ongoing operation and maintenance costs are some of the factors expected to hamper product demand. Additionally, flight simulators' limited physical environment and behavioral challenges may negatively impact the market over the forecast period. However, the rising concerns over pilot training costs, fluctuating fuel prices, and cost-saving on basic aircraft maintenance and repair favorably impact the industry growth. The development of realistic aircraft flying simulation systems with overhead and ECAM displays using aircraft system logic has significantly resulted in the high adoption of these devices.

The flight simulators are built to replicate the actual aircraft's cockpit and cabin. The dashboard of the flight simulator is fixed with motion and visual systems to create realistic environments for the pilots. It allows the pilots to feel the movement in the aircraft precisely, and the visual systems help them to work out the approach procedures at the airports. The visual systems are designed to offer the pilots a satellite-quality 180-degree view.

Technological advancements resulting in the development of highly advanced flight simulator is expected to drive market growth. Lockheed Martin Corporation offers a flight simulator named Prepar3D, which can recreate the cityscape and night flying illustrations. They have kept it as an open source for private users and software developers to create new applications and environments, thus ensuring the constant evolution of the program. Additionally, advancements in computing technology have significantly resulted in better visual systems offering near-real-world experience, which are likely to drive industry growth over the forecast period.

The rapidly increasing civil aviation industry and escalating government funding to the defense aviation sector worldwide are expected to increase flight simulator demand significantly over the next eight years. Further, rising passenger air travel elevates demand for trained pilots, which positively impacts the flight simulator adoption. Additionally, the development of realistic aircraft system logic with overhead and ECAM displays has significantly resulted in the high adoption of flight simulators.

Rising demand for air travel is expected to propel the global flight simulator market growth over the forecast period. The need to effectively replicate real flying training using motion and visual systems has resulted in the evolution of sophisticated flight simulators in the market. An increase in government spending and growing security concerns, particularly in the military sector, is expected to escalate growth significantly.

The growing importance of aircraft safety and the need for substantial flight training and simulation is anticipated to spur demand over the coming years. Stringent government norms and regulations pertaining to passenger safety are further expected to elevate product demand. The need for flight handling and safety operations, such as situational awareness and flight skill competency, are expected to fuel industry growth. Additionally, increasing demand for better and more effective pilot training is anticipated to catapult growth.

Technological advancements resulting in the development of highly advanced flight simulator is expected to drive market growth. R&D efforts in aerospace technology coupled with performance evaluation of pilots are likely to stimulate market growth over the next few years. The high efficiency of simulation technology and the ability to save fuel costs are expected to serve as key drivers for the market.

The development of simulators for Unmanned Aerial Vehicles (UAVs) is expected to offer alternative opportunities for the global market. Advancements in computing technology have significantly resulted in better visual systems offering near real-world experience, which are expected to drive industry growth over the next seven years.

The FFS segment accounted for over 92.0% of the market share in 2023. FFS refers to high-technical flight simulators that offer high fidelity and reliability. FFS accurately stimulates the aircraft and the environment in which it operates. These devices create motion, sound, visuals, and all other aircraft operations to create a realistic training environment, which ensures thorough training for the pilots.

The FTD segment is expected to expand significantly during the forecast period. FTDs are training modules with limited visual display. The primary purpose of these devices is to train where all indicators and switches are on the deck. These devices are extensively used for their low purchase cost and operations. Furthermore, the use of UAV drones has increased the need for the training of drone pilots, which, in turn, is projected to drive market growth.

Based on application, the market for flight simulators has been segregated into military, Defense, and civil. The civil segment held the highest market share of 69.2% in 2023. Military and defense include simulators for training and mission rehearsals for armed forces. Further, live, virtual, and constructive training offered by flight simulators enables armed forces pilots to perform better in real-world tasks or missions, resulting in increased product installation.

Manufacturers have realized the importance of improving Aircraft Simulation Technology (AST) to offer a realistic aircraft system. Therefore, they focus on mergers and acquisitions for greater financial, technical, marketing, manufacturing, and distribution resources. For example, Textron, L-3 Communications, and Lockheed Martin have acquired commercial aircraft simulator competitors to reduce their overall exposure to defense markets and seek growth in civil aviation.

The military & defense sector is expected to expand at the fastest CAGR of 4.4% during the forecast period due to the advanced technology, realistic training environments, and cost-effectiveness. Flight simulators provide a safe and controlled training environment for pilots to practice various scenarios and emergency procedures, improving their skills and operational readiness. The complexity of modern military aircraft and the need for extensive training drive the demand for highly immersive simulators. Moreover, simulators help reduce costs associated with live training and contribute to sustainability efforts.

North America emerged as a key market for flight simulators, accounting for a significant global revenue share in 2023. This is attributable to early technology adoption by manufacturers and consumers. In addition, stringent regulations enforced by the Federal Aviation Administration (FAA) and Federal Aviation Regulations, including Sec. 61.64 for using flight simulators for training purposes, further spur regional growth. Further, advanced military and commercial infrastructure availability is also expected to bolster the market growth for flight simulators in this region.

Europe accounted for the highest revenue share of 31.8% in 2023. This is attributed to the growing demand for flight simulation products for pilot training. Also, the growing emphasis of the European aviation industry on safety and rigorous pilot training is further boosting market growth in the region.

The Asia Pacific is estimated to exhibit high growth over the forecast period owing to increasing demand for these devices, particularly in developing countries such as India and China. The growth in the Asia Pacific region is accredited to the high demand for air travel concerning increased trade and tourism. North America is likely to witness slow growth, primarily due to the apprehensions regarding air safety and strict air safety standards enforced by the FAA in the U.S.

The pandemic hit the aviation industry hard due to restrictions imposed on air travel. The Canadian flight simulator company CAE Inc. reported a decline of 35.8% in the profit from flight simulators during the first quarter of 2020. However, by the end of the second quarter of 2020, the sales of commercial flight simulators experienced an uptick, with demand generated from cargo airlines and carriers. Additionally, civil aviation travel witnessed a substantial growth of approximately 60% across the U.S., Europe, and Latin American regions during the first quarter of 2023.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global flight simulator market

Product

Application

Regional